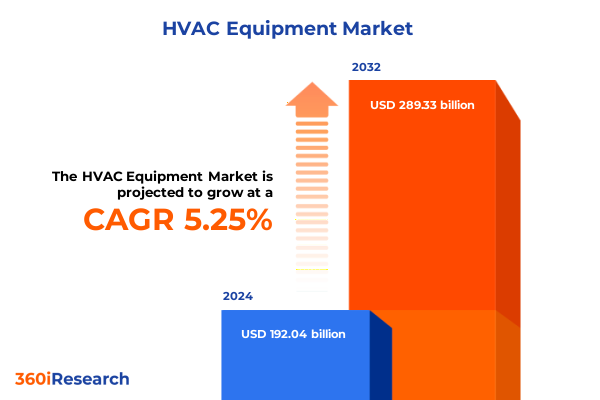

The HVAC Equipment Market size was estimated at USD 201.16 billion in 2025 and expected to reach USD 210.72 billion in 2026, at a CAGR of 5.32% to reach USD 289.33 billion by 2032.

Setting the Stage for a Comprehensive Exploration of Technological Advances and Regulatory Shifts Reshaping the HVAC Equipment Ecosystem

The HVAC equipment landscape is undergoing a profound transformation driven by evolving customer expectations, advancing technology, and intensified emphasis on energy efficiency. As buildings seek to balance occupant comfort with sustainability goals, heating, ventilation, and air conditioning systems have become central to operational strategies across sectors. Market stakeholders must understand not only the traditional performance metrics of heating and cooling equipment but also the expanding role of digital platforms that optimize energy usage and predictive maintenance. From commercial high-rises seeking integrated building management solutions to residential consumers demanding smarter climate control, the industry’s value proposition extends well beyond thermal regulation to encompass data-driven decision-making and lifecycle cost management.

Against this backdrop, regulatory frameworks are tightening globally, incentivizing the shift toward low-carbon refrigerants and higher equipment efficiency ratings. Government programs and building codes increasingly prioritize the reduction of greenhouse gas emissions, encouraging the uptake of advanced heat pump technologies and zero-emission heating alternatives. In parallel, emerging risk profiles such as supply chain disruption and tariff volatility are reshaping procurement strategies and capital expenditure planning. A comprehensive understanding of these converging forces is invaluable for organizations aiming to make strategic investments and maintain competitive differentiation. As stakeholders navigate this dynamic environment, clarity on market trends, segmentation intricacies, and regional drivers will be essential prerequisites for informed decision-making.

Unprecedented Paradigm Shifts Redefining HVAC System Intelligence Efficiency and Integration Across Building Ecosystems

The industry is witnessing a shift from legacy mechanical systems toward highly interconnected, intelligent platforms that autonomously optimize performance. Smart HVAC solutions now leverage sensor networks, machine learning algorithms, and cloud-based analytics to monitor indoor air quality, anticipate maintenance needs, and adjust operations in real time. This digital overlay empowers facility managers to achieve substantial reductions in energy consumption and extend equipment life while delivering enhanced comfort levels.

Concurrently, the decarbonization imperative is accelerating innovation in alternative fuel sources and electrification pathways. Heat pumps are moving center stage as viable replacements for conventional gas and oil furnaces, especially in regions with clean electricity grids. Solar thermal integration and combined heat and power arrangements are also gaining traction, particularly in industrial and large commercial applications where on-site generation and cogeneration systems offer efficiency gains.

Moreover, the democratization of building automation is eroding historical barriers to adoption. Open protocols and interoperable architectures are enabling modular deployments that scale from single-family homes to campus-wide facilities. These advances underscore a broader paradigm shift: HVAC systems are no longer passive infrastructure components but active contributors to broader smart building ecosystems, forging closer alignment between operational technology (OT) and information technology (IT).

Assessing the Far-Reaching Cumulative Impact of 2025 Tariff Measures on Supply Chains Procurement Strategies and Cost Structures in HVAC

In 2025, a suite of tariff measures aimed at imported HVAC components-spanning steel and aluminum panels, compressor modules, and control electronics-laid the groundwork for substantial procurement cost increases. These measures, triggered by broader trade policy objectives, introduced cumulative duties that gradually compounded the landed cost of units assembled overseas. As a consequence, buyers and original equipment manufacturers reevaluated supply chain footprints, exploring near-shoring and dual-sourcing strategies to mitigate exposure to ongoing trade tensions.

The compounded impact of these duties extended beyond headline unit prices. Extended lead times emerged as suppliers restructured their logistics flows to optimize tariff classification, while smaller manufacturers encountered cash flow challenges due to upfront tariff liabilities. In response, service providers and equipment distributors forged alliances with domestic fabricators to secure tariff-exempt sourcing channels. These collaborative approaches not only alleviated cost pressures but also fostered vertically integrated supply relationships that enhanced quality control and shortened cycle times.

Meanwhile, the higher cost base prompted stakeholders to emphasize total cost of ownership over capital expenditure alone. Facility operators increasingly prioritized modular system architectures and scalable upgrade paths that delayed tariff-laden replacement cycles. The interplay between tariff dynamics and evolving performance expectations underscores the importance of agile procurement frameworks that can pivot rapidly in the face of regulatory shifts and market volatility.

Illuminating Market Nuances through Multi-Dimensional Segmentation Spanning Technology Types Fuel Preferences End Uses and Component Variations

Illuminating the HVAC market requires understanding how technology choices fundamentally alter competitive dynamics. Conventional systems continue to serve core segments where cost sensitivity and proven reliability prevail, whereas smart HVAC solutions capture a growing share of applications demanding predictive maintenance and advanced energy management. The delineation between conventional and smart technology shapes investment priorities, dictates retrofit versus new-build decisions, and informs service models around remote diagnostics and software upgrades.

Fuel preference further segments the landscape, with electric systems expanding their footprint as heat pumps and electric boilers become more efficient and affordable. Gas remains entrenched in regions with extensive pipeline infrastructure, while oil maintains a niche presence in mature residential neighborhoods. Solar-thermal and hybrid fuel configurations appeal to sustainability-minded commercial and industrial clients seeking to hedge against energy price volatility.

End-use segmentation highlights how building function dictates equipment specifications. Residential properties prioritize quiet operation, compact footprints, and remote-enabled thermostats, while commercial environments emphasize zoning flexibility, indoor air quality compliance, and integration with building management systems. Industrial segments impose rigorous performance criteria and often require custom-engineered solutions to handle process heat and specialized ventilation demands.

Component segmentation reveals intricate decision windows. Air conditioning systems span from centralized chillers-available in absorption, centrifugal, and screw variants-to decentralized packaged, rooftop, split, and variable refrigerant flow units. Heating systems range from high-efficiency boilers and furnaces to air- and ground-source heat pumps. Ventilation infrastructure encompasses air handling units, energy recovery ventilators, and exhaust fans, each tailored to meet distinct airflow and heat-exchange requirements.

Product-type distinctions converge with component segmentation in the chiller market, where absorption units excel in co-generation settings and centrifugal and screw chillers dominate large-scale facilities. Packaged, rooftop, split, and VRF configurations cater to diverse application sizes and architectural constraints, providing a spectrum of performance, control granularity, and installation complexity.

This comprehensive research report categorizes the HVAC Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Fuel Type

- End Use

Decoding Regional Dynamics Across Americas Europe Middle East Africa and Asia Pacific to Uncover Unique Drivers and Demand Patterns in HVAC

Across the Americas, heightened regulatory emphasis on carbon reduction and incentive programs for high-efficiency equipment have catalyzed a robust retrofit market. Federal and state tax credits for heat pump deployments, combined with energy performance contracting models, are driving widespread adoption in both institutional and residential sectors. North American manufacturers are also capitalizing on near-shoring trends to streamline distribution networks and accelerate project timelines.

In Europe, Middle East, and Africa, the stringency of European Union building codes and refrigerant phase-down schedules is leading to accelerated retirement of legacy systems and rapid uptake of low-global-warming-potential refrigerants. The Middle East’s extreme cooling loads have spurred innovation in high-capacity chillers and thermally efficient envelope solutions, while emerging African markets exhibit burgeoning demand for modular, scalable HVAC solutions that can adapt to power supply variability.

Asia-Pacific’s rapid urbanization and industrial expansion underpin sustained growth across residential, commercial, and manufacturing landscapes. China’s dual emphasis on domestic innovation and renewable integration has produced next-generation smart HVAC products, whereas India’s infrastructure investments and evolving efficiency standards are reshaping procurement paradigms. Meanwhile, ASEAN countries are embracing decentralized micro-grid tie-ins and solar-supported heating systems to balance growth with environmental protection.

This comprehensive research report examines key regions that drive the evolution of the HVAC Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Insiders Championing Digital Innovation Sustainability and Collaborative Ecosystems in HVAC

Major global players are fortifying their market positions through a confluence of digital innovation, sustainability commitments, and strategic alliances. A leading manufacturer known for pioneering the first digital scroll compressor has expanded its portfolio with cloud-native building management platforms that deliver real-time insights and streamline service operations. Another established brand recently acquired a software-as-a-service specialist to embed predictive analytics within its field service ecosystem, illustrating the convergence of equipment and intelligence.

Partnerships between equipment makers and energy service companies are also reshaping value propositions. Joint ventures are delivering outcome-based contracts that guarantee performance metrics such as kilowatt-hour savings or indoor air quality standards. This trend underscores a broader shift from transactional sales toward subscription-style service models, aligning long-term incentives around operational excellence and continuous improvement.

In pursuit of decarbonization goals, several industry leaders have announced net-zero roadmaps that encompass refrigerant selection, renewable energy sourcing for factory operations, and circular economy initiatives such as component reuse programs. These commitments not only address regulatory pressures but also resonate with corporate sustainability agendas and investor expectations. Collectively, these strategic maneuvers illustrate how competitive differentiation in the HVAC equipment arena now hinges on digital prowess, environmental stewardship, and collaborative ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the HVAC Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A. O. Smith Corporation

- Carrier Corporation

- Daikin Industries, Ltd.

- Danfoss A/S

- Emerson Electric Co.

- Fujitsu Limited

- Gree Electric Appliances Inc.

- Haier Group Corporation

- Hitachi Air Conditioning Company

- Honeywell International, Inc.

- Johnson Controls International PLC

- Lennox International, Inc.

- LG Electronics

- Midea Group

- Mitsubishi Electric

- Nortek Global HVAC LLC

- Panasonic Holdings Corporation

- Raytheon Technologies Corporation

- Rheem Manufacturing Company by Paloma Co., Ltd.

- Samsung Electronics Co., Ltd.

- Trane Technologies Company, LLC

- Vaillant Group

- Whirlpool Corporation

- Wolf GmbH

Actionable Strategic Imperatives to Harness Digital Capabilities Mitigate Supply Chain Risks and Elevate Service Models in HVAC

To thrive amidst evolving customer demands and regulatory parameters, industry leaders should prioritize integration of advanced predictive maintenance platforms within their core offerings. By embedding machine learning-driven algorithms directly into control architectures, equipment providers can reduce unplanned downtime and extend asset lifecycles, thereby enhancing total value proposition for end users.

Simultaneously, diversifying manufacturing footprints through a mix of domestic production and strategically located assembly hubs will mitigate tariff exposure and supply chain risk. Organizations should evaluate partnerships with regional fabricators to maintain flexibility in component sourcing, enabling rapid response to policy changes and logistical challenges.

In parallel, companies must deepen their service capabilities by developing subscription-style offerings that guarantee performance outcomes. Structuring contracts around key performance indicators such as energy savings, air quality improvements, or uptime guarantees will foster stronger customer relationships and generate recurring revenue streams. Investment in workforce upskilling-particularly in data analytics, IoT device management, and systems integration-will be critical to support these evolving service models.

Finally, active engagement with regulatory stakeholders and participation in standards-setting bodies will ensure that emerging frameworks reflect both environmental ambitions and operational realities. Proactive advocacy can shape refrigerant phase-down timelines, incentive programs, and efficiency benchmarks in ways that align with organizational strengths and long-term innovation roadmaps.

Outlining Robust Qualitative and Quantitative Research Frameworks Incorporating Stakeholder Interviews Data Analytics and Scenario Planning

This analysis is grounded in a rigorous research framework that begins with extensive primary interviews involving c-suite executives, service technicians, procurement directors, and regulatory experts across multiple geographies. These conversations unveiled firsthand insights into operational challenges, technology adoption barriers, and strategic priorities. Complementing this primary research, secondary sources such as government energy reports, trade association publications, patent filings, and peer-reviewed engineering journals were systematically reviewed to contextualize trends and validate emerging narratives.

Quantitative analysis was conducted on a diverse dataset encompassing historical trade and tariff records, energy consumption metrics, and corporate sustainability disclosures. Cross-referencing these data points enabled the identification of causal relationships between regulatory interventions and market responses. Advanced analytical techniques, including scenario planning and sensitivity analysis, were employed to stress-test assumptions and examine potential outcomes under varying policy trajectories.

The segmentation framework was meticulously constructed to reflect the multifaceted nature of HVAC decision-making, integrating dimensions such as technology sophistication, fuel modality, end-use context, and component specialization. Peer review sessions with industry veterans and academic advisors ensured the integrity and relevance of the categorizations. All findings were further validated through an expert panel workshop, enabling refinement of insights and endorsement of key takeaways.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our HVAC Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- HVAC Equipment Market, by Component

- HVAC Equipment Market, by Technology

- HVAC Equipment Market, by Fuel Type

- HVAC Equipment Market, by End Use

- HVAC Equipment Market, by Region

- HVAC Equipment Market, by Group

- HVAC Equipment Market, by Country

- United States HVAC Equipment Market

- China HVAC Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Insights into a Unified Vision for Strategic Adaptation and Sustainable Excellence in the HVAC Domain

As the HVAC equipment sector navigates an era defined by technological convergence, regulatory stringency, and evolving customer imperatives, the ability to anticipate change and adapt strategies will determine market leadership. Smart system integration, coupled with decarbonization efforts, offers a pathway to elevated performance and sustainable operations. At the same time, tariff dynamics and supply chain realignments underscore the value of procurement agility and regional diversification.

Segmentation analysis reveals that decision-making is influenced by a complex interplay of technology preferences, fuel considerations, and context-specific performance requirements. Regional variations further complicate this mosaic, with each market exhibiting distinct policy drivers, infrastructure constraints, and maturity levels. Industry players must therefore calibrate their product roadmaps and go-to-market approaches to resonate with localized demand signals while preserving global scale efficiencies.

Strategic collaboration-whether through joint ventures, performance-based service arrangements, or participation in standards consortia-will accelerate innovation diffusion and foster resilience. Equally, sustained investment in digital platforms, workforce capabilities, and regulatory engagement will fortify value propositions and secure competitive advantage. Taken together, these insights coalesce into a cohesive vision for an industry in motion, poised to deliver comfort, efficiency, and sustainability across the built environment.

Engaging a Direct Conversation with Ketan Rohom for Tailored Market Insights to Accelerate HVAC Strategic Initiatives

To explore the depths of this comprehensive HVAC equipment market analysis and gain access to exclusive data visualizations, case studies, and detailed regulatory impact assessments, we invite you to engage with Ketan Rohom. As Associate Director of Sales & Marketing, he is primed to understand your specific business challenges and align the report’s insights with your strategic priorities. By connecting with him, you can unlock tailored briefings, priority delivery of supplementary briefings, and bespoke consulting packages that fit your organizational objectives. Seize this opportunity to leverage unparalleled expertise and drive transformative outcomes for your HVAC initiatives.

- How big is the HVAC Equipment Market?

- What is the HVAC Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?