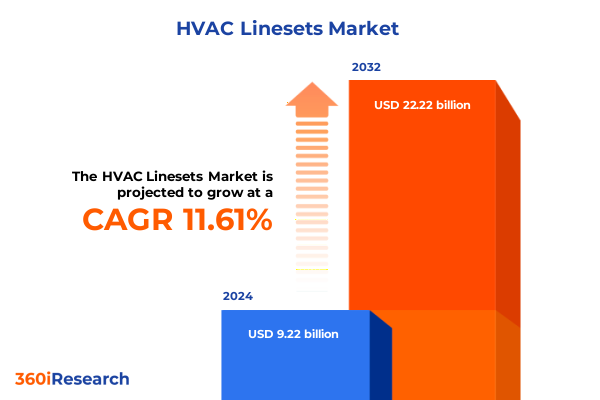

The HVAC Linesets Market size was estimated at USD 10.19 billion in 2025 and expected to reach USD 11.26 billion in 2026, at a CAGR of 11.78% to reach USD 22.22 billion by 2032.

Unveiling the foundational forces shaping the HVAC linesets market landscape and setting the stage for strategic decision-making and industry leadership

The HVAC linesets market is foundational to modern heating, ventilation, and air conditioning systems, acting as the critical conduit for refrigerant and efficiency across residential, commercial, and industrial applications. As energy efficiency regulations tighten and sustainability becomes a core business imperative, linesets have evolved from simple tubing systems into highly specialized assemblies integrated with advanced insulation and material technologies. This executive summary introduces the essential drivers, market dynamics, and stakeholder considerations that frame the strategic landscape of HVAC linesets today.

Initially intended to facilitate seamless thermal transfer, linesets now accommodate higher pressures, advanced refrigerants with lower global warming potential, and digital monitoring capabilities. The push for net-zero carbon targets and retrofitting legacy systems underscores the growing complexity and importance of lineset selection. Consequently, manufacturers and end users alike must navigate a landscape defined by material innovation, insulation performance, and geopolitical influences. This introduction sets the stage for a deeper exploration of transformative shifts, tariff impacts, segmentation insights, regional nuances, leading company strategies, and actionable recommendations.

By unpacking these dimensions, decision-makers will gain clarity on emerging trends, competitive innovations, and risk mitigation tactics. Subsequent sections provide a structured narrative that illuminates how technological advancements, policy shifts, and regional demand drivers intersect to shape market trajectories. A clear understanding of these foundational elements will empower stakeholders to chart a resilient, future-ready course in an increasingly dynamic HVAC ecosystem.

Examining the transformative technological, regulatory, and sustainability-driven shifts redefining HVAC linesets and unlocking new opportunities for innovation

In recent years, the HVAC linesets sector has experienced a profound realignment driven by technological breakthroughs, shifting regulatory regimes, and heightened sustainability expectations. Innovations in materials science have yielded new foam and aerogel-based insulations that dramatically reduce thermal losses, while digital sensors embedded within linesets enable real-time monitoring of refrigerant flow and system performance. These capabilities underpin a shift toward predictive maintenance models, allowing service providers to preempt downtime and optimize energy usage across diverse installations.

Regulatory frameworks have further accelerated the pace of change. Tighter building codes now mandate lower heat transfer coefficients, compelling manufacturers to integrate multi-layer insulation and corrosion-resistant alloys into standard product lines. Environmental directives on refrigerant global warming potential have catalyzed the adoption of alternative lineset configurations optimized for low-GWP refrigerants, fostering a competitive atmosphere where R&D investment is paramount.

Moreover, the convergence of IoT platforms with centralized building management systems is redefining value propositions for both OEMs and end users. As intelligent linesets become essential components of smart building ecosystems, partnerships between insulation specialists, tubing suppliers, and software providers have proliferated. This collaborative innovation model is unlocking new revenue streams through premium service contracts and data-driven efficiency improvements. Collectively, these transformative shifts are forging a more resilient, efficient, and sustainable HVAC linesets market poised for long-term growth.

Analyzing the cumulative ramifications of 2025 United States tariffs on HVAC linesets supply chains, material costs, and competitive positioning across industry players

The introduction of new United States tariffs in early 2025 has imposed a cumulative burden on HVAC lineset supply chains, with punitive duties on imported metals and finished assemblies substantially raising input costs. Materials traditionally sourced from global suppliers now carry incremental cost layers, prompting manufacturers to reassess procurement strategies and renegotiate long-term contracts. The impact reverberates through every segment of the value chain, from metal extrusion and insulation fabrication to assembly and distribution.

For manufacturers relying heavily on imported copper and aluminum tubing, the tariffs have exacerbated price volatility, hindering cost forecasting and constraining margins. In response, many producers have accelerated the localization of critical manufacturing processes, establishing new extrusion lines domestically or migrating assembly operations to regions exempt from punitive trade policies. Concurrently, strategic stockpiling of key raw materials prior to tariff enactment has provided temporary relief, albeit at the expense of increased working capital requirements.

End users are beginning to absorb these elevated costs, either through higher project budgets or by extending equipment lifecycles to defer capital expenditures. System integrators are adopting modular procurement approaches to optimize material utilization, while insulation specialists are exploring alternative formulations that reduce dependency on tariffed substrates. Over the long term, these adjustments are likely to yield a more diversified supplier network and renewed emphasis on localized production hubs, ultimately strengthening supply chain resilience in an era of persistent trade uncertainty.

Diving deep into critical segmentation insights that illuminate application, material, end-user, insulation, and distribution channel dynamics shaping market trajectories

In order to appreciate the full complexity of market dynamics, the HVAC linesets arena must be viewed through multiple segmentation lenses that reveal distinct performance requirements and commercial drivers. Based on application, linesets are designed for air conditioning systems that demand precise thermal management, heat pump integrations requiring bidirectional refrigerant flow, and refrigeration units where temperature consistency is critical for food and pharmaceutical storage. Each application niche imposes unique pressure ratings, bend radii, and insulation specifications to optimize system reliability.

Material selection further distinguishes product portfolios, as linesets fabricated from aluminum offer lightweight cost advantages, while copper variants deliver superior thermal conductivity and corrosion resistance. Stainless steel alternatives cater to corrosive or high-pressure environments, trading higher material costs for extended lifecycle performance. These material-driven decisions directly affect fabrication processes, welding techniques, and overall product pricing strategies.

End user segmentation paints another layer of complexity. Commercial installations span hospitality spaces that prioritize guest comfort and noise abatement, office complexes focused on occupant productivity and air quality, and retail environments where aesthetic integration is essential. In industrial settings, food processing facilities require hygienic, sanitized assemblies; manufacturing plants seek durability under heavy workloads; and pharmaceutical operations enforce stringent contamination controls. Residential applications encompass multifamily dwellings that benefit from compact, flexible assemblies and single-family homes where installation access and energy efficiency dominate buying criteria.

Further refinement emerges through insulation segmentation, with aerogel solutions delivered as blankets or rigid boards for high-performance thermal barriers, foam products available as cost-effective phenolic and PU formulations, and rubber-based offerings such as EPDM and NBR optimized for vibration damping and moisture resistance. Meanwhile, distribution channel segmentation highlights the roles of direct-to-consumer channels-both offline trade show networks and online e-commerce platforms-alongside distributors operating through retailers and wholesalers, and original equipment manufacturers that integrate linesets into end-to-end HVAC packages. Taken together, these segmentation insights illuminate the multifaceted decision matrices that industry stakeholders navigate when selecting and deploying HVAC linesets.

This comprehensive research report categorizes the HVAC Linesets market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Insulation

- Application

- End User

- Distribution Channel

Uncovering pivotal regional insights across the Americas, Europe-Middle East-Africa, and Asia-Pacific that influence HVAC linesets demand and strategic priorities

Regional demand for HVAC linesets is shaped by distinct economic, climatic, and regulatory conditions that require tailored go-to-market approaches. In the Americas, a combination of retrofit growth in aging building stock and stringent energy efficiency standards has driven demand for high-performance insulation and low-leakage tubing assemblies. North American market dynamics are influenced by federal and state-level incentives for energy-efficient upgrades, while Latin American infrastructure spend and growing middle-class urbanization are expanding new construction pipelines, driving demand for modular, easily customizable lineset solutions.

Over in Europe, Middle East, and Africa, regulatory rigor around F-gas reductions and building code enhancements has compelled local manufacturers to accelerate product innovation. European Union mandates on refrigerant management have led to the proliferation of linesets engineered for CO2 and R-32 refrigerants, while Middle Eastern commercial projects prioritize systems that withstand high ambient temperatures and saline conditions. African markets, though nascent, are witnessing pilot deployments of containerized cold chain refrigeration supported by durable stainless steel linesets that resist corrosion in humid, coastal regions.

Asia-Pacific remains a hotbed of growth driven by rapid urbanization, expanding manufacturing hubs, and government-backed green building programs. Chinese and Indian domestic manufacturers are scaling extruded aluminum and rubber-insulated linesets to meet surging demand, while Southeast Asian economies are adopting smart building technologies that incorporate sensor-enabled lineset monitoring. Across all these regions, nuanced regulatory frameworks, climate diversity, and infrastructure investment profiles are compelling global players to customize product offerings and forge strategic partnerships with local distribution networks.

This comprehensive research report examines key regions that drive the evolution of the HVAC Linesets market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing essential insights into leading HVAC linesets manufacturers, their competitive strategies, technological advancements, and market positioning dynamics

A landscape characterized by rapid technological evolution and shifting trade policies has elevated the strategic role of leading HVAC linesets manufacturers. Key industry participants are executing differentiated strategies that blend vertical integration with targeted partnerships. Major tubing producers have invested in in-house insulation R&D, developing proprietary aerogel composites that deliver ultra-thin thermal barriers. At the same time, insulation specialists have broadened their metal product portfolios through joint ventures with extrusion plants, creating seamless supply chain synergies.

Global conglomerates are leveraging scale to secure preferential raw material contracts, while nimble regional players focus on agility, custom fabrication, and localized service networks. Several established firms are piloting digital lineset solutions that integrate RFID tracking and performance analytics, enabling channel partners to offer predictive maintenance services. Others are differentiating through sustainability credentials, obtaining third-party certifications for low-carbon manufacturing and circular economy initiatives that reuse end-of-life tubing.

Competitive positioning is further sharpened by strategic acquisitions and collaboration agreements. Some market leaders have acquired specialist foam producers to embed advanced phenolic systems across their standard product lines. Others have aligned with building automation providers to embed digital sensors directly into lineset sheathing. As a result, industry players that master the convergence of materials science, digital transparency, and service-oriented business models are increasingly capturing high-value contracts across commercial and industrial segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the HVAC Linesets market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bosch Thermotechnik GmbH

- Carrier Global Corporation

- Daikin Industries, Ltd.

- Danfoss A/S

- DiversiTech Corporation

- ElvalHalcor Hellenic Copper and Aluminium Industry S.A.

- Emerson Electric Co.

- Hindalco Industries Limited

- Hitachi, Ltd.

- Johnson Controls International plc

- KME Group S.p.A.

- Lennox International Inc.

- LG Electronics Inc.

- Mitsubishi Electric Corporation

- Mueller Industries, Inc.

- Panasonic Corporation

- Parker-Hannifin Corporation

- Trane Technologies plc

- Wieland-Werke AG

Presenting actionable strategic recommendations for industry leaders to navigate evolving HVAC linesets trends, mitigate risks, and capitalize on emerging opportunities

To navigate the dynamic HVAC linesets environment, industry leaders must adopt a multifaceted approach that addresses supply chain stabilization, innovation acceleration, and sustainability imperatives. First, diversifying material sourcing by establishing strategic alliances with upstream metal and insulation suppliers can mitigate the risks associated with trade policy fluctuations. Companies should prioritize long-term off-take agreements and collaborative innovation programs to co-develop next-generation aerogel and foam insulation products that align with stringent thermal performance standards.

Furthermore, organizations should invest in digitalization initiatives that integrate IoT-enabled sensors and analytics platforms into lineset offerings. By providing real-time performance data, manufacturers can differentiate through value-added predictive maintenance services, reduce unplanned downtime for end users, and unlock new recurring revenue streams. To that end, forging partnerships with building management system providers and cloud analytics firms can expedite the deployment of holistic smart infrastructure solutions.

Sustainability commitments must also be woven into strategic roadmaps. Adopting low-GWP refrigerant-compatible designs, securing third-party environmental certifications, and implementing circular economy practices for end-of-life tubing recovery will strengthen brand credibility among environmentally conscious customers. Finally, tailored market entry strategies that consider regional regulatory landscapes and climate-specific requirements will enable companies to capture growth in emerging markets while reinforcing their positions in mature geographies.

Detailing the robust research methodology underpinned by rigorous data collection, stakeholder interviews, and analytical frameworks that validate market intelligence

The research underpinning this executive summary relies on a rigorous, multi-tiered methodology that combines primary stakeholder engagement with comprehensive secondary data analysis. Initial data collection began with in-depth interviews and surveys conducted among a cross-section of HVAC linesets manufacturers, insulation specialists, system integrators, and end users. These qualitative insights provided granular perspectives on material preferences, performance trade-offs, and procurement criteria across varied applications.

To complement primary findings, extensive secondary research was conducted using publicly available technical standards, regulatory publications, and peer-reviewed journals. All data points were triangulated to ensure consistency and validity, with conflicting information subjected to follow-up inquiries and expert panel review sessions. Quantitative analysis of trade flows, patent filings, and manufacturing capacity trends was performed to identify supply chain vulnerabilities and emerging hotspots for material innovation.

Data integrity was further reinforced through ongoing validation efforts. Key assumptions, such as cost drivers, regulatory impacts, and product adoption rates, were stress-tested against real-world case studies and pilot projects. This iterative approach not only verified the robustness of conclusions but also revealed nuanced regional variances and evolving competitive dynamics. Ultimately, this blend of primary, secondary, and analytical rigor ensures that the insights presented are both actionable and reflective of current market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our HVAC Linesets market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- HVAC Linesets Market, by Type

- HVAC Linesets Market, by Insulation

- HVAC Linesets Market, by Application

- HVAC Linesets Market, by End User

- HVAC Linesets Market, by Distribution Channel

- HVAC Linesets Market, by Region

- HVAC Linesets Market, by Group

- HVAC Linesets Market, by Country

- United States HVAC Linesets Market

- China HVAC Linesets Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding insights that synthesize the comprehensive analysis of HVAC linesets market forces and outline the strategic implications for future growth and resilience

Through a comprehensive examination of technological innovations, regulatory pressures, tariff implications, segmentation nuances, regional dynamics, and competitive maneuvering, the strategic landscape of HVAC linesets emerges as both dynamic and opportunity-rich. The convergence of advanced insulation technologies, digital integration, and sustainability mandates is redefining product value propositions and differentiating market leaders from traditional equipment suppliers.

Trade policy disruptions in 2025 have accelerated shifts toward localized manufacturing and diversified supply chains, underscoring the need for agility and collaborative partnerships. Segmentation insights highlight the imperative for application-specific design, while regional analyses reveal that success hinges on tailoring solutions to distinct regulatory and environmental contexts. Leading companies that align material innovation with digital services and sustainability credentials are best positioned to capture high-growth contracts and forge lasting client relationships.

As industry stakeholders prepare for the next wave of regulatory updates and technological breakthroughs, adopting a proactive, integrated strategy will be critical. Firms that embrace digitalization, secure sustainable material sources, and refine go-to-market approaches by region will cultivate resilient value chains capable of withstanding future market fluctuations. Ultimately, the insights distilled in this executive summary provide a strategic roadmap for organizations seeking to navigate the evolving HVAC linesets ecosystem with confidence.

Engage directly with Ketan Rohom to access the full in-depth HVAC linesets market research report and empower your strategic decision-making with expert insights

To explore the full breadth of market dynamics, in-depth analysis, and strategic insights outlined in this executive summary, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise will guide you through tailored solutions, ensuring your organization gains a competitive advantage from comprehensive HVAC linesets market intelligence. By engaging with Ketan, you will access exclusive data, actionable recommendations, and customized research support designed to empower critical decisions. Don’t miss the opportunity to leverage this high-value resource for informed strategy development and sustainable growth initiatives

- How big is the HVAC Linesets Market?

- What is the HVAC Linesets Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?