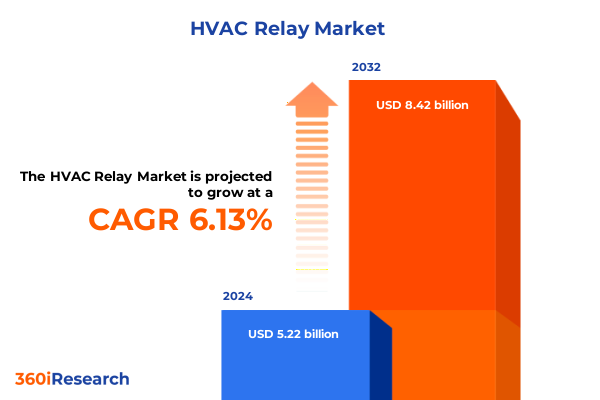

The HVAC Relay Market size was estimated at USD 5.50 billion in 2025 and expected to reach USD 5.79 billion in 2026, at a CAGR of 6.26% to reach USD 8.42 billion by 2032.

Establishing a Comprehensive Overview of HVAC Relay Market Evolution to Inform Strategic Decision Making

The HVAC relay market sits at the convergence of traditional mechanical systems and cutting-edge electronic control technologies. In recent years, demand has surged as building owners and facility managers seek to optimize energy efficiency, improve system reliability, and reduce maintenance overhead. Relays, acting as critical interfaces between control signals and high-power HVAC equipment, have evolved from simple electromechanical switches to sophisticated solid state devices that offer enhanced precision and durability. Consequently, stakeholders across the value chain-from component suppliers to OEMs and aftermarket service providers-must navigate a dynamic landscape characterized by rapid technological advancements and shifting regulatory frameworks.

Against this backdrop, this executive summary provides an authoritative overview designed to guide strategic decision-making. It highlights the drivers reshaping the industry, the challenges that could impede growth, and the segments offering the greatest opportunities. By synthesizing insights across multiple dimensions-type, application, installation, contact configuration, coil voltage, and form factor-this report equips leaders with the context needed to align product portfolios, refine market entry strategies, and strengthen competitive positioning. Ultimately, the intention is to facilitate proactive planning and foster innovation that will define the next generation of HVAC relay solutions.

Examining the Convergence of Smart Building Automation and Energy Efficiency Mandates Redefining HVAC Relay Innovation

The HVAC relay market is undergoing transformative shifts driven by technological breakthroughs and changing stakeholder expectations. On one hand, the proliferation of smart building frameworks has elevated the role of relays, as these components integrate into networked control systems to enable real-time monitoring and adaptive feedback. This transformation is introducing hybrid relay designs that combine electromechanical robustness with digital intelligence, thereby bridging legacy infrastructure and advanced automation platforms.

Simultaneously, sustainability mandates and energy conservation standards are compelling manufacturers to pursue innovations that minimize power consumption and extend product lifespan. As a result, solid state relays are gaining traction due to their low leakage currents and rapid switching capabilities. Moreover, cloud-based analytics and remote diagnostics are redefining maintenance paradigms, fostering service models centered on predictive upkeep rather than reactive repair. These developments highlight a profound shift from commodity component sales toward value-added service offerings that deepen customer relationships and enhance total lifecycle value.

Analyzing How 2025 Tariff Policies Have Stimulated Regionalized Supply Chains While Driving Cost Optimization in Relay Manufacturing

United States tariffs enacted in early 2025 have introduced a significant inflection point for global HVAC relay supply chains. By imposing levies on certain imported electronic components, policymakers aimed to bolster domestic manufacturing and protect strategic industries. While this approach has stimulated local production in select areas, it has concurrently elevated input costs for OEMs reliant on cost-effective imports. Consequently, manufacturers are reevaluating sourcing strategies, with some shifting production to tariff-exempt jurisdictions or localizing assembly operations to mitigate financial impact.

In parallel, tariff-induced cost pressures have amplified incentives for relay designers to optimize material usage and refine manufacturing processes. These efforts have accelerated adoption of advanced stamping techniques and novel polymer composites, reducing both weight and unit cost. Over time, these initiatives are expected to realign the competitive landscape, favoring players nimble enough to adapt production footprints swiftly while maintaining stringent quality and certification standards. In essence, the tariff environment is catalyzing a transition toward more regionalized, agile supply chains that balance cost, compliance, and customer service requirements.

Uncovering Critical Segmentation Factors That Reveal Distinct Demand Patterns Across Type Application and Form Factor Criteria

Understanding market segmentation is essential for identifying niche opportunities and tailoring product strategies effectively. Based on type, electromechanical relays continue to hold ground due to their reliability and field-proven performance, whereas solid state relays are gaining momentum in applications demanding rapid switching and minimal wear. Hybrid relays are emerging as a bridge between these two extremes, offering a compelling mix of durability and electronic control, while reed relays remain prized for their compact size and high-speed operation.

From an application perspective, the commercial sector prioritizes reliability and integration with building management systems, driving demand for relays with advanced diagnostic capabilities. Industrial customers, on the other hand, focus on ruggedness and high cycle counts to withstand harsh environments, creating preference for relays with reinforced contact materials and encapsulation. Residential installations require cost-effective, user-friendly options that blend discreet design with ease of installation, satisfying both retrofit and new construction markets.

Installation patterns are bifurcated between aftermarket solutions, which emphasize compatibility and rapid deployment, and original equipment manufacturer channels, where custom specifications and volume production yield economies of scale. In terms of contact configuration, double pole double throw relays are sought for systems requiring isolated switching paths, whereas single pole double throw and single pole single throw variants are employed where simpler circuit control suffices. Coil voltage segmentation further informs design choices: high voltage relays cater to heavy-duty equipment in commercial and industrial settings, while low voltage models are ubiquitous in residential and light commercial applications. Finally, form factor delineates options between DIN rail mount devices that streamline panel installations, panel mount units offering flexibility in control cabinets, and PCB mount relays enabling compact, board-level integration.

This comprehensive research report categorizes the HVAC Relay market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Installation

- Contact Configuration

- Coil Voltage

- Form Factor

- Application

Highlighting Divergent Regional Drivers and Regulatory Forces Shaping HVAC Relay Demand across the Americas EMEA and Asia-Pacific

Regional dynamics play a pivotal role in shaping the HVAC relay market through diverse regulatory frameworks and infrastructure development trends. In the Americas, energy efficiency regulations and incentive programs have spurred retrofits and new constructions alike, elevating demand for intelligent relay solutions that integrate seamlessly with smart grid architectures. Moreover, a robust aftermarket ecosystem has flourished, driven by facility operators seeking rapid component replacement and system upgrades to extend equipment lifespan.

Across Europe, the Middle East, and Africa, stringent eco-design directives and building codes have prioritized low-power consumption and recyclability, prompting manufacturers to innovate materials and optimize relay designs for circularity. Meanwhile, emerging markets in the Middle East have accelerated construction growth, fostering demand for high-capacity relays that can operate reliably under extreme temperature conditions. In Africa, infrastructure modernization efforts are steadily increasing adoption of modular control systems, with relays playing a foundational role in scalable installations.

In the Asia-Pacific region, rapid urbanization and expansion of industrial capacity have fueled both OEM and aftermarket sales. Governments across the region are introducing stringent emissions and energy standards that align with global sustainability goals, encouraging adoption of advanced control components. As a result, local production hubs have expanded, supported by favorable trade agreements and investment incentives, positioning Asia-Pacific as both a significant demand center and a key manufacturing base for HVAC relay components.

This comprehensive research report examines key regions that drive the evolution of the HVAC Relay market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Emerging Challengers Whose Strategic Alliances and Innovations Are Redefining Market Leadership Dynamics

The HVAC relay market is populated by a spectrum of influential companies, each contributing unique strengths across product innovation, manufacturing scale, and global reach. Legacy electromechanical specialists have invested heavily in modernization, integrating digital diagnostics and materials science to reinforce their competitive standing. At the same time, emerging electronics-focused enterprises are leveraging semiconductor expertise to accelerate the proliferation of solid state relays featuring advanced thermal management and miniaturization.

Partnerships and strategic alliances have become increasingly prevalent as market leaders aim to complement core competencies and expedite time to market. Collaborative ventures between component manufacturers and systems integrators are facilitating end-to-end solutions that encompass hardware, firmware, and predictive maintenance services. Moreover, acquisitions of niche relay designers by larger conglomerates are reshaping the competitive hierarchy, driving portfolio diversification and creating synergies in R&D.

Across geographies, regional champions have fortified their positions through localized production and distribution networks, enabling rapid fulfillment and tailored aftersales support. These companies are investing in digital platforms to enhance customer engagement, deploy remote diagnostics, and streamline order management. Collectively, these strategic maneuvers underscore the importance of agility, innovation, and customer-centricity in maintaining market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the HVAC Relay market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- American Zettler, Inc.

- Coto Technology, Inc.

- Deltrol Controls

- Eaton Corporation plc

- Finder S.p.A.

- Fuji Electric Co., Ltd.

- Honeywell International Inc.

- Hongfa Technology Co., Ltd.

- Johnson Controls International plc

- Mitsubishi Electric Corporation

- Omron Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Sensata Technologies, Inc.

- Siemens AG

- Song Chuan Precision Machinery Co., Ltd.

- Struthers-Dunn, Inc.

- TE Connectivity Ltd.

- Toshiba Corporation

Recommending Strategic Priorities for Relay Manufacturers Including Technological Investment and Supply Chain Localization to Drive Growth

Industry participants must adopt a multi-pronged approach to thrive amid intensifying competition and evolving customer demands. First, investing in hybrid relay technologies that blend electromechanical reliability with digital intelligence will address a broad spectrum of application requirements and future-proof product portfolios. By prioritizing modular designs, companies can expedite customization and respond swiftly to customer specifications without incurring significant retooling costs.

Second, enhancing manufacturing agility through regionalized production facilities will mitigate tariff exposure and reduce lead times. This requires a balanced assessment of local assembly capabilities, supply chain risk, and proximity to end markets. In tandem, firms should strengthen partnerships with logistics providers and distributors to ensure resilient delivery networks that adapt to fluctuating demand patterns.

Finally, service differentiation through predictive maintenance and connectivity-enabled offerings will foster deeper customer relationships and recurring revenue streams. By deploying embedded sensors and leveraging cloud analytics, manufacturers can transition from one-off sales to ongoing service contracts, providing clients with continuous performance insights and reducing total cost of ownership. Such a shift will be instrumental in securing long-term competitive advantage.

Detailing a Rigorous Research Framework Combining Secondary Literature Analysis and Expert Interviews for Validated Market Insights

The research underpinning this executive summary integrates comprehensive secondary and primary methodologies to ensure robust, triangulated insights. Initially, a thorough review of published technical papers, patent filings, and industry white papers established a foundational understanding of relay technologies, materials, and design trends. Regulatory databases and official standards documents were consulted to capture evolving compliance requirements across jurisdictions.

Concurrently, primary research involved structured interviews with key stakeholders, including relay designers, OEM procurement managers, and aftermarket service providers. These discussions yielded qualitative perspectives on market dynamics, emerging customer needs, and competitive pressures. Additionally, insights from systems integrators and building management experts illuminated integration challenges and performance expectations in smart building deployments.

Data triangulation ensured alignment between secondary research findings and primary feedback, while iterative collaboration with subject-matter experts validated analytical assumptions. This multifaceted methodology emphasizes transparency and replicability, offering decision-makers a credible basis for strategic planning and investment prioritization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our HVAC Relay market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- HVAC Relay Market, by Type

- HVAC Relay Market, by Installation

- HVAC Relay Market, by Contact Configuration

- HVAC Relay Market, by Coil Voltage

- HVAC Relay Market, by Form Factor

- HVAC Relay Market, by Application

- HVAC Relay Market, by Region

- HVAC Relay Market, by Group

- HVAC Relay Market, by Country

- United States HVAC Relay Market

- China HVAC Relay Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Market Trends and Strategic Imperatives That Will Drive the Future of HVAC Relay Technologies and Industry Collaboration

The HVAC relay market stands at a critical juncture where technology innovation, regulatory imperatives, and shifting customer expectations converge. As legacy electromechanical devices evolve into digitally enabled components, manufacturers face both the challenge and opportunity to redefine value propositions. Success will hinge on the ability to balance robust physical performance with intelligent control features that support predictive maintenance and seamless integration into connected systems.

Regional trade policies and sustainability mandates continue to reshape supply chain strategies and material selection. Companies that proactively adapt through localized manufacturing, process optimization, and material innovation will be best positioned to manage cost pressures and regulatory complexity. Equally important is the capacity to harness market segmentation insights to target applications and customer segments with precision, thereby maximizing return on R&D investments.

In closing, the next phase of growth for the HVAC relay market will be driven by collaborative ecosystems that link hardware expertise, software intelligence, and service excellence. Firms that embrace this integrated approach will lead industry transformation, delivering solutions that meet the evolving demands of modern buildings and industrial facilities.

Unlock Full Access to a Comprehensive HVAC Relay Market Research Report through a Personalized Consultation with Our Associate Director of Sales & Marketing

To capitalize on the strategic insights and detailed analysis provided in this executive summary, it is essential to secure full access to the comprehensive HVAC relay market research report. Ketan Rohom stands ready to guide you through each facet of the study, ensuring you can leverage the data and strategic recommendations to drive growth and innovation in your organization. Engaging directly with the Associate Director, Sales & Marketing at 360iResearch, you will benefit from a personalized consultation that highlights the most pertinent findings and tailors the research to your unique business objectives.

By initiating this conversation, you will gain immediate clarity on report structure, data presentation, and expert commentary tailored to your competitive landscape. This direct engagement not only streamlines the decision-making process but also ensures that you implement the most effective strategies supported by robust evidence. With Ketan’s expertise, you will be positioned to translate market insights into actionable initiatives that enhance operational efficiency and market penetration.

Act now to transform these insights into tangible business value. Reach out to Ketan Rohom to secure your copy of the HVAC relay market research report and embark on a path toward sustained competitive advantage.

- How big is the HVAC Relay Market?

- What is the HVAC Relay Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?