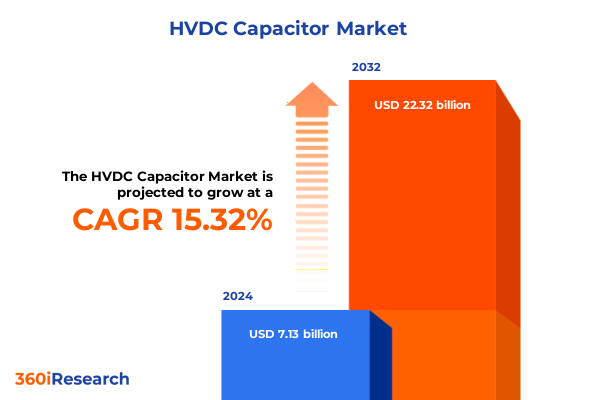

The HVDC Capacitor Market size was estimated at USD 8.15 billion in 2025 and expected to reach USD 9.32 billion in 2026, at a CAGR of 15.47% to reach USD 22.32 billion by 2032.

Unveiling the Crucial Role of High-Voltage Direct Current Capacitors in Modern Energy Infrastructure Transformation and Reliability Enhancement Across Global Power Transmission Networks

High-Voltage Direct Current (HVDC) capacitors are pivotal components in the modern electrical grid, serving as the backbone for efficient power transmission across vast distances. Their ability to smooth voltage ripples and filter harmonics is essential for converter stations, transmission systems, and interfaces with renewable energy sources. In recent years, grid operators and power utilities have intensified their focus on HVDC technology as a means to meet growing demand for reliable, high-capacity energy delivery while mitigating losses inherent to alternating current systems.

As global energy priorities shift toward decarbonization and the integration of intermittent renewable sources, the role of HVDC capacitors has become increasingly strategic. Beyond traditional converter stations and distribution systems, these capacitors enable seamless connections with battery storage, solar farms, and offshore wind installations. Consequently, an in-depth understanding of capacitor design, material innovations, and application environments is no longer a niche interest but a critical requirement for stakeholders seeking to future-proof infrastructure investments. This report lays the groundwork for assessing the present challenges and opportunities in the HVDC capacitor domain, providing a solid foundation for informed decision-making.

Examining the Emerging Technological and Market Shifts Driving Revolutionary Changes in the High-Voltage Direct Current Capacitor Landscape Across Diverse Energy Sectors

The landscape of HVDC capacitors is undergoing a paradigm shift fueled by technological breakthroughs and evolving market demands. At the core of this transformation is the rise of voltage source converters equipped with advanced modular multilevel architectures. These designs not only reduce losses and enhance voltage stability but also open new pathways for retrofit applications in existing grids. Simultaneously, additive manufacturing techniques and novel dielectric materials are driving down component size while improving thermal handling and service life, ushering in a new era of compact, high-performance capacitor banks.

Alongside technological innovation, industry dynamics are being reshaped by the acceleration of cross-sector collaborations and open innovation platforms. Equipment manufacturers, research institutions, and utility consortia are pooling resources to streamline standardization and shorten product development cycles. As a result, market participants are rapidly adopting best practices for digital condition monitoring, predictive maintenance, and integrated energy management systems. These transformative shifts are redefining competitive advantage and setting the stage for more resilient, adaptive, and sustainable HVDC installations.

Assessing the Far-Reaching Effects of Recent United States Tariff Implementations in 2025 on the Dynamics of the High-Voltage Direct Current Capacitor Supply Chain and Manufacturing

In early 2025, the United States government implemented a series of tariffs targeting imported electrical components, including high-voltage capacitors sourced from key overseas suppliers. These measures, intended to bolster domestic manufacturing and safeguard critical supply chains, have introduced both challenges and opportunities for industry stakeholders. On one hand, higher import duties have led to a recalibration of procurement strategies, with many end users proactively seeking alternative sources or negotiating longer-term contracts to mitigate cost volatility. On the other hand, this policy environment has incentivized local production investments, spurring partnerships between capacitor manufacturers and U.S.-based manufacturers of precision dielectric materials.

The cumulative impact of these tariffs has unfolded unevenly across the value chain. Converter module assemblers and turnkey project integrators have absorbed a portion of the cost increases through supply chain optimization and design standardization. Meanwhile, utilities and industrial end users are exploring inventory hedging and collaborative purchasing consortia to maintain project economics. Over time, the tariffs have reinforced a strategic pivot toward regional sourcing, underpinning circular supply-chain initiatives and fostering greater resilience against future trade disruptions. Stakeholders must now navigate this new terrain by balancing cost management with high-availability requirements for critical grid assets.

Unraveling the Complexity of Market Segmentation Insights Through Application, Converter Technology, End Users, Phase Types, Capacitor Types, and Voltage Ratings

A nuanced perspective on the HVDC capacitor market emerges when examining its segmentation along multiple dimensions. Application environments span converter stations and transmission systems as well as distribution networks, where capacitors ensure voltage stability. Within renewable integration, the integration of battery storage, solar arrays, and wind farms has escalated demand for specialized capacitor designs that accommodate variable power profiles. Concurrently, the converter technology axis distinguishes line commutated converters featuring six-, twelve-, and twenty-four-pulse configurations from voltage source converters, which leverage modular multilevel, three-level, and two-level topologies to optimize energy efficiency and grid compatibility.

End users range from heavy industries-encompassing cement, metals and mining, and oil and gas-to transportation operators, and utilities, both public and private. These diverse sectors impose stringent reliability criteria, prompting capacitor manufacturers to tailor their offerings to specific environmental and operational stressors. Phase type further refines the market, differentiating back-to-back linkages from bipole and monopole transmissions. Type classifications include converter capacitors for voltage smoothing, filter capacitors for harmonic mitigation, and smoothing capacitors for DC link stabilization. Finally, voltage rating choices span high-voltage, extra high-voltage, and ultra high-voltage applications, each demanding precision engineering, bespoke dielectric formulations, and rigorously tested safety margins.

This comprehensive research report categorizes the HVDC Capacitor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Converter Technology

- End User

- Phase Type

- Type

- Voltage Rating

Highlighting Regional Dynamics and Strategic Imperatives in the Americas, Europe Middle East Africa, and Asia-Pacific High-Voltage Direct Current Capacitor Domains

The geographical tapestry of the HVDC capacitor market reveals distinct regional dynamics. In the Americas, utility modernization programs in North America coexist with emerging converter station projects in Latin America, reflecting a dual focus on grid reliability and renewable integration. Regulatory frameworks are evolving to incentivize local content, driving end users to establish long-term partnerships with capacitor suppliers who can demonstrate both technical expertise and a resilient supply chain.

In Europe, the Middle East, and Africa, ambitious cross-border interconnector projects and offshore wind initiatives are catalyzing demand for ultra high-voltage capacitors. Local government incentives and pan-regional grid harmonization efforts have further accelerated capacity expansions, with manufacturers adapting product roadmaps to satisfy rigorous grid code requirements. Asia-Pacific presents another dimension of complexity, characterized by rapid infrastructure rollouts in China and India alongside decarbonization targets in Australia and Southeast Asia. As regional priorities diverge-ranging from industrial electrification to renewable dispatchability-the capacitor market is compelled to deliver versatile solutions at scale.

This comprehensive research report examines key regions that drive the evolution of the HVDC Capacitor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Leaders Shaping the High-Voltage Direct Current Capacitor Sphere Through Innovation Partnerships and Competitive Strategies

Several leading players are shaping the trajectory of the HVDC capacitor landscape through strategic investments and technology partnerships. One global electrical engineering conglomerate has leveraged its extensive R&D facilities to pioneer hybrid dielectric formulations, achieving higher capacitance densities and enhanced thermal resilience. Another incumbent, specializing in power electronics, has collaborated with semiconductor innovators to integrate digital condition monitoring capabilities directly within capacitor modules, enabling real-time diagnostics and life-cycle management.

In parallel, regional champions in Asia and Europe have carved out niches by focusing on localized manufacturing and service networks. These companies have established centers of excellence for material science and accelerated pilot production of ultra high-voltage capacitors. Moreover, several joint ventures between converter station EPC firms and capacitor specialists underscore a trend toward vertically integrated solutions, where end-to-end performance guarantees become a differentiator. Together, these industry leaders are accelerating product roadmaps, driving standards development, and shaping the competitive landscape for years to come.

This comprehensive research report delivers an in-depth overview of the principal market players in the HVDC Capacitor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Alstom S.A.

- API Capacitors Ltd.

- CG Power and Industrial Solutions Limited

- Condis SA

- Eaton Corporation plc

- ELECTRONICON Kondensatoren GmbH

- Fuji Electric Co., Ltd.

- General Electric Company

- HVP High Voltage Products GmbH

- Isofarad Kft.

- KEMET Corporation

- LIFASA

- Maxwell Technologies, Inc.

- Mitsubishi Electric Corporation

- Murata Manufacturing Co., Ltd.

- Samwha Capacitor Group Co., Ltd.

- Schneider Electric SE

- Shanghai Yongming Electronic Co., Ltd.

- Siemens Energy AG

- Sieyuan Electric Co., Ltd.

- TDK Corporation

- Toshiba Energy Systems & Solutions Corporation

- Transgrid Solutions

- Wuxi CRE New Energy Technology Co., Ltd.

Presenting Actionable Strategic Roadmaps and Best Practices for Industry Leaders to Navigate Challenges and Capitalize on Opportunities in HVDC Capacitor Markets

Industry decision-makers must act decisively to harness emerging opportunities and navigate operational uncertainties. First, establishing strategic alliances with capacitor manufacturers can drive co-development of next-generation dielectric materials, ensuring alignment with evolving grid codes and performance benchmarks. Equally important is diversifying the supplier base to include both global innovators and regional specialists, thereby mitigating geopolitical and logistical risks associated with concentrated sourcing.

Furthermore, embedding digital monitoring and analytics into capacitor assets should be prioritized to shift from reactive maintenance to predictive service models. This proactive approach minimizes downtime and extends asset life, delivering tangible total-cost-of-ownership benefits. Lastly, aligning capacity planning with sustainability objectives-such as circular material flows and end-of-life recycling-will not only satisfy regulatory mandates but also reinforce corporate leadership in environmental stewardship. By adopting these actionable strategies, industry leaders can secure operational resilience, optimize performance, and drive sustainable growth in the HVDC capacitor market.

Detailing the Robust and Systematic Multi-Source Research Methodology Employed to Derive Insights and Validate Findings in the HVDC Capacitor Market Study

This analysis draws upon a rigorous, multi-tiered research framework designed to ensure validity and depth of insights. Primary research involved in-depth interviews with senior engineers, project managers, and procurement specialists across utilities, industrial end users, and equipment manufacturers. These conversations provided firsthand perspectives on evolving technical requirements, procurement hurdles, and innovation priorities. Complementing this, secondary research aggregated technical white papers, industry standards documentation, and composite patent analyses to trace technology trajectories and emerging material advances.

To triangulate data, quantitative inputs-such as component performance metrics and reliability benchmarks-were synthesized with qualitative judgments from an expert advisory panel comprising grid integration consultants and capacitor technologists. A stringent data validation protocol was applied, encompassing cross-verification against publicly disclosed project specifications and regulatory filings. Through iterative review cycles, the methodology ensured that findings reflect both current practices and anticipated directional shifts, offering stakeholders a robust foundation for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our HVDC Capacitor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- HVDC Capacitor Market, by Application

- HVDC Capacitor Market, by Converter Technology

- HVDC Capacitor Market, by End User

- HVDC Capacitor Market, by Phase Type

- HVDC Capacitor Market, by Type

- HVDC Capacitor Market, by Voltage Rating

- HVDC Capacitor Market, by Region

- HVDC Capacitor Market, by Group

- HVDC Capacitor Market, by Country

- United States HVDC Capacitor Market

- China HVDC Capacitor Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Drawing Comprehensive Conclusions on Market Transformations, Strategic Imperatives, and the Future Outlook of High-Voltage Direct Current Capacitor Deployment Worldwide

The confluence of technological innovation, regulatory shifts, and evolving application landscapes underscores the critical importance of HVDC capacitors in modern power systems. From advances in modular multilevel converter compatibility to the recalibrated supply chain dynamics influenced by U.S. tariffs, stakeholders must remain agile in their strategic approaches. By understanding the detailed segmentation-from application environments to voltage rating nuances-organizations can develop targeted strategies that align with specific performance and reliability requirements.

Regionally, the market’s diversity-from grid modernization in the Americas to interconnector accelerations in EMEA and infrastructure expansions in Asia-Pacific-reinforces the need for adaptive planning and localized partnerships. The leadership of key manufacturers in material science, digital integration, and integrated solution delivery sets a benchmark for industry trajectories. Ultimately, proactive adoption of predictive maintenance, co-development models, and sustainable material practices will distinguish industry frontrunners. This report synthesizes these insights, equipping decision-makers with the clarity needed to navigate disruption and capture enduring value in the HVDC capacitor domain.

Engage Directly with Ketan Rohom to Secure In-Depth Market Intelligence and Leverage Expert Analysis in Procuring the Comprehensive HVDC Capacitor Report Today

To delve deeper into the comprehensive analysis and strategic guidance presented in this report, engage with Ketan Rohom, Associate Director, Sales & Marketing. Drawing on years of experience and a proven track record in guiding energy infrastructure stakeholders, Ketan offers personalized support to align the report’s insights with your organization’s objectives. By arranging a consultation, you can explore tailor-made solutions, clarify specific queries, and gain a competitive edge in the rapidly evolving HVDC capacitor arena. Reach out today to secure this indispensable resource and position your enterprise at the forefront of technological advancements and market dynamics.

- How big is the HVDC Capacitor Market?

- What is the HVDC Capacitor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?