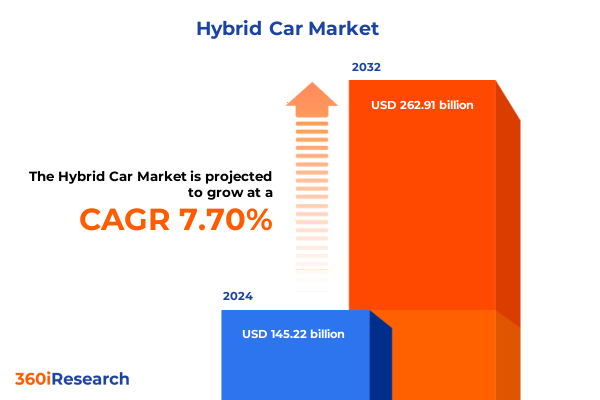

The Hybrid Car Market size was estimated at USD 155.44 billion in 2025 and expected to reach USD 166.37 billion in 2026, at a CAGR of 7.79% to reach USD 262.91 billion by 2032.

Discover the Evolving Hybrid Car Market Dynamics and Strategic Opportunities Shaping Worldwide Automotive Innovation and Adoption

The hybrid car market stands at the intersection of environmental responsibility and automotive innovation, redefining how consumers and corporations approach vehicle ownership. As global concerns about climate change intensify, hybrid technology has emerged as a pragmatic bridge between traditional internal combustion engines and fully electric vehicles. Automakers are leveraging advances in battery chemistry, powertrain efficiency, and digital connectivity to deliver hybrid models that meet evolving regulatory standards and consumer expectations.

Moreover, consumer sentiment is increasingly favoring hybrid solutions as surveys indicate a growing desire for a balanced approach to fuel economy and reduced emissions. In the United States, intent to purchase a hybrid electric or plug-in hybrid vehicle has risen by five percentage points year-over-year, reaching 26 percent of surveyed consumers who are seeking a “best of both worlds” solution to manage fuel costs and environmental impact. Consequently, industry stakeholders must stay attuned to these shifting preferences to align product portfolios with emerging market demand.

Uncover the Transformative Shifts Driving the Hybrid Car Revolution Amidst Regulatory Technological and Consumer Preference Changes Globally

In recent years, transformative shifts have reshaped the hybrid car landscape, driven by a combination of regulatory mandates, technological breakthroughs, and changing consumer behaviors. Governments across major markets have introduced stricter emission targets, compelling automakers to accelerate the integration of hybrid powertrains into their lineups. In Europe, for instance, CO₂ targets under the European Union’s new framework have spurred a wave of plug-in hybrid introductions to avoid fines approaching ten billion euros for non-compliance. At the same time, China’s extension of auto trade-in subsidies is projected to bolster its EV and plug-in hybrid market, reinforcing its position as the world’s largest electric mobility player.

Simultaneously, technology advancements in energy density and electric motor efficiency are enabling hybrids to deliver longer electric-only driving ranges and reduced lifecycle costs. According to the IEA, the number of electric models, including plug-in hybrids, will outpace conventional models in certain segments by 2030, underlining the rapid convergence of hybrid and electric mobility. Therefore, automakers and suppliers are collaborating more closely on battery innovations and lightweight materials to refine hybrid system performance, driving a new era of automotive engineering excellence.

Examine the Far-Reaching Consequences of 2025 United States Automotive Tariffs on Hybrid Vehicle Supply Chains Costs and Market Dynamics

The United States’ imposition of a 25 percent tariff on automotive imports effective April 2, 2025, has reverberated across global hybrid vehicle supply chains, altering cost structures and production strategies. Initially introduced to protect domestic manufacturing, these tariffs have heightened input expenses for automakers importing vehicles and components from Canada, Mexico, and the European Union. As a result, production costs for certain hybrid models increased by several thousand dollars per unit, creating margin pressures for both premium and mass-market brands.

Consequently, notable global players have reported significant financial impacts. Kia Corporation disclosed a $570 million hit in its second quarter due to these tariffs, contributing to a 24 percent year-on-year decline in operating profit and underscoring the vulnerability of import-reliant manufacturing strategies. Meanwhile, Volkswagen has proposed shifting production of select Audi models to U.S. facilities to mitigate tariff exposures after absorbing approximately $1.3 billion in costs during the first half of the year.

In response to industry outcry, an executive order was signed to prevent the stacking of automotive levies on top of steel and aluminum tariffs, offering temporary relief for vehicles assembled domestically and parts manufacturing reshoring initiatives. However, the adjustment provides only partial mitigation, leaving automakers to navigate an environment of ongoing policy uncertainty and elevated compliance considerations.

Gain In-Depth Segmentation Insights Revealing How Vehicle Type Powertrain Configurations and End-User Preferences Shape Hybrid Car Market Dynamics

The hybrid car market can be deconstructed through distinct segmentation lenses, each revealing nuanced demand drivers. When viewed through the prism of vehicle type, commercial fleets are gravitating toward hybrid vans and light trucks for their balance of load capacity and fuel efficiency, while passenger cars-spanning hatchbacks, sedans, and SUVs-are commanding sustained interest among individual buyers seeking versatile daily drivers. This segmentation underscores the importance of tailoring hybrid configurations to varied weight classes and usage cycles.

Alternatively, analyzing the marketplace by powertrain type reveals differentiated adoption curves. Full hybrids, which autonomously switch between combustion engines and electric motors, appeal to cost-conscious consumers prioritizing efficiency without reliance on charging infrastructure. Mild hybrids, offering electric assistance during acceleration and engine start-stop functions, capture a niche of buyers seeking incremental environmental gains at modest premiums. Plug-in hybrids, delivering extended electric-only ranges for urban commuters and corporate fleets, are emerging as a bridge solution for regions with nascent charging networks.

Finally, end-user segmentation highlights divergent purchase rationales. Fleet operators value total cost of ownership reductions and brand reliability when integrating hybrids into service rotations. Conversely, individual consumers weigh lifestyle factors, such as commuting distances and home charging capabilities, alongside environmental ethics and potential incentives. Recognizing the interplay of these segmentation dimensions is critical for effectively positioning hybrid models in an increasingly complex marketplace.

This comprehensive research report categorizes the Hybrid Car market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Powertrain Type

- End User

Explore Key Regional Insights Highlighting How Market Drivers Vary Across Americas Europe Middle East Africa and Asia Pacific Hybrid Adoption Landscapes

Regional dynamics exert a pronounced influence on hybrid vehicle adoption, with each geocentric cluster cultivating unique conditions. In the Americas, supportive incentives and an expanding public charging network are accelerating uptake, particularly in urban corridors of Canada and select U.S. states with zero-emission mandates. Rising fuel prices and tightening corporate emission targets are prompting both commercial and individual buyers to explore hybrid alternatives more aggressively than ever before.

Across Europe, the Middle East, and Africa, regulatory environments remain the primary catalyst for hybrid integration. Stricter CO₂ thresholds in the European Union have driven automakers to intensify plug-in hybrid rollouts, while Middle Eastern markets leverage hybrid technology to navigate extreme climates and reduce oil dependency. African regions present a more nascent hybrid landscape, where infrastructural constraints coexist with emerging middle-class demand for affordable fuel-efficient vehicles.

Meanwhile, in the Asia-Pacific domain, national policies and consumer preferences shape a diverse tapestry of growth patterns. Japan and South Korea, as pioneers of hybrid technology, continue to lead with mature hybrid portfolios, whereas China’s aggressive subsidy programs are fuelling robust expansion of plug-in hybrid and full electric models. Australia and Southeast Asian markets are witnessing gradual adoption, influenced by evolving fuel standards and the rollout of targeted incentives.

This comprehensive research report examines key regions that drive the evolution of the Hybrid Car market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyze Competitive Landscapes with Key Company Insights Demonstrating How Leading Automakers Are Innovating Hybrid Technology and Market Strategies

Leading automakers are advancing hybrid innovations and refining strategies to solidify market positions. Toyota, the trailblazer in hybrid powertrains, achieved record-breaking electrified vehicle sales in its North American operations by expanding production capacity and launching its first domestic battery plant in North Carolina to alleviate supply chain bottlenecks. Toyota’s disciplined investments and broad model lineup across hatchback and SUV segments reinforce its role as a technology leader.

Other global players are deploying targeted tactics to navigate cost pressures and localize production. Volkswagen’s proposed U.S. assembly initiative for imported Audi models demonstrates a strategic shift toward geographically balanced manufacturing to neutralize tariff impacts. Similarly, Ford and General Motors are integrating mild hybrid systems across popular light-truck platforms to meet corporate average fuel economy requirements while leveraging existing gasoline engine infrastructures.

Emerging competitors are also intensifying focus. Kia’s introduction of the Carnival hybrid SUV illustrates an effort to capture premium crossover demand, despite encountering a substantial tariff-induced profit hit in Q2. Meanwhile, Hyundai and Honda continue to optimize their full hybrid and plug-in hybrid offerings, adapting powertrain calibrations and value propositions to resonate with environmentally conscious consumers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hybrid Car market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AUDI AG

- BYD Europe B.V.

- Honda Motor Company, Ltd.

- Hyundai Motor Company

- Kia Motors Corporation

- Mitsubishi Motors Corporation

- Nissan Motor Corporation

- Renault Group

- Tata Motors Limited

- Toyota Motor Corporation

- Volkswagen Group

- ZF Friedrichshafen AG

Implement Actionable Recommendations for Industry Leaders to Navigate Hybrid Market Complexities Enhance Competitiveness and Capitalize on Emerging Opportunities

To navigate the complexities of the hybrid car market, industry leaders should adopt a multi-pronged approach. Automakers are advised to pursue modular powertrain architectures that enable seamless integration of full, mild, and plug-in hybrid systems across multiple vehicle platforms. This flexibility reduces development costs and accelerates time-to-market.

In addition, investment in regional manufacturing and assembly localization can mitigate tariff exposures and logistical risks. Establishing or expanding production facilities in key demand centers ensures a responsive supply chain, supports local employment, and enhances stakeholder relations. Partnerships with battery and component suppliers should emphasize joint research initiatives to optimize energy density and component durability, further enhancing total cost of ownership metrics.

Moreover, brand strategies must align with end-user priorities. For commercial clientele, tailored leasing and fleet management programs that highlight lifecycle cost savings will catalyze broader adoption. For individual consumers, clear communication of environmental benefits, coupled with accessible financing and home-charging solutions, will address common adoption barriers. Finally, collaboration with policymakers to shape incentive frameworks and charging infrastructure investments will ensure sustainable market expansion.

Understand the Rigorous Research Methodology Underpinning Our Hybrid Car Market Analysis Ensuring Reliability through Comprehensive Data Triangulation

Our analysis is grounded in a rigorous research methodology designed to deliver reliable, unbiased insights. We began with an extensive literature review of primary regulatory documents, industry whitepapers, and publicly available financial statements to establish baseline market contexts. This was followed by structured expert interviews with OEM executives, supply chain specialists, and policy analysts to validate emerging hypotheses and uncover real-world challenges.

Subsequently, we conducted a quantitative survey of fleet operators and individual consumers, capturing perceptions on vehicle attributes, total cost of ownership considerations, and purchase intentions. Data triangulation was achieved by cross-referencing survey findings with secondary industry databases, trade association reports, and customs import-export statistics to ensure representativeness across geographies and segments.

Finally, scenario modelling was applied to evaluate tariff impacts, technology adoption curves, and regulatory developments. This approach allowed us to stress-test market sensitivities and provide actionable recommendations that reflect both current realities and plausible future conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hybrid Car market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hybrid Car Market, by Vehicle Type

- Hybrid Car Market, by Powertrain Type

- Hybrid Car Market, by End User

- Hybrid Car Market, by Region

- Hybrid Car Market, by Group

- Hybrid Car Market, by Country

- United States Hybrid Car Market

- China Hybrid Car Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 795 ]

Synthesize Critical Conclusions from Our Hybrid Car Market Study to Illuminate Future Prospects and Guide Strategic Decision-Making Across the Industry

Having examined technological advances, regulatory pressures, and consumer behaviors, it is clear that the hybrid car market will remain an essential bridge as the automotive industry transitions toward full electrification. Governments and industry stakeholders must continue to collaborate to refine policy frameworks that incentivize low-emission powertrains without stifling innovation.

At the same time, automakers should maintain a balanced portfolio strategy, investing in modular platforms that can swiftly adapt to both hybrid and battery electric powertrains. Supply chain resilience, particularly through localization and strategic partnerships, will deter disruption from trade policy shifts and component scarcities.

Finally, targeted engagement with fleet operators and individual consumers will differentiate successful brands. By addressing specific pain points-whether operational efficiency for fleets or environmental aspirations for private buyers-manufacturers can capture market share and establish long-term loyalty in a rapidly evolving competitive environment.

Engage with Our Associate Director’s Exclusive Offer to Procure the Comprehensive Hybrid Vehicle Market Research Report for Strategic Advantage

For decision-makers seeking a strategic advantage in the hybrid vehicle sector, our comprehensive market research report offers unparalleled insights and actionable intelligence. To access the full breadth of analysis, including detailed segmentation assessments, regional outlooks, and competitive benchmarking, connect with Ketan Rohom, Associate Director, Sales & Marketing. His expertise will guide you through the report’s findings and help tailor a solution aligned with your organization’s growth objectives. Reach out today to schedule a personalized briefing, secure your copy of the report, and position your team at the forefront of the hybrid car market’s next wave of innovation.

- How big is the Hybrid Car Market?

- What is the Hybrid Car Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?