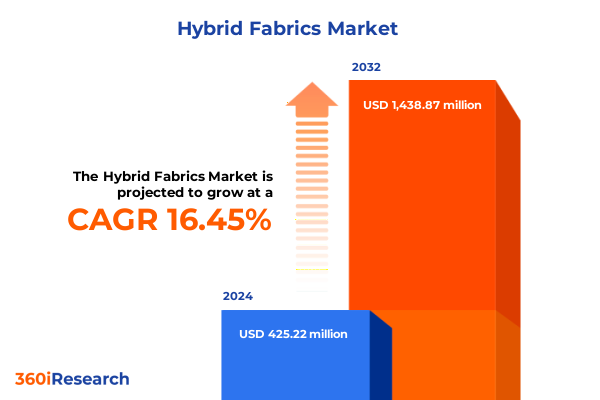

The Hybrid Fabrics Market size was estimated at USD 494.70 million in 2025 and expected to reach USD 576.86 million in 2026, at a CAGR of 16.47% to reach USD 1,438.86 million by 2032.

Unveiling the Rise of Hybrid Fabrics as Multifunctional Solutions Revolutionize Performance and Sustainability Across Key Industries

Hybrid fabrics have emerged as a cornerstone in the evolution of advanced materials, merging diverse fibers and manufacturing techniques to deliver unparalleled performance. These next-generation textiles integrate fibers such as aramid, carbon, glass, nylon, and polyester with innovative processes like braiding, knitting, non-woven production, and weaving. By combining high-strength reinforcements with flexibility and functional coatings, hybrid fabrics are reshaping the capabilities of products across aerospace, automotive, medical, defense, and sports sectors.

As industries increasingly demand materials that offer strength-to-weight advantages and multifunctional attributes, hybrid fabrics stand at the intersection of technological innovation and sustainability. Emerging use cases now include smart garments woven with conductive yarns and non-woven composites that enhance environmental resilience. With ongoing breakthroughs in material science and process engineering, hybrid fabrics are transitioning from niche applications to mainstream adoption, driven by their ability to deliver tailored properties for specific performance requirements.

Navigating Pivotal Transformations as Sustainability, Advanced Composites, and Digital Fabrication Redefine the Global Hybrid Fabrics Landscape

The hybrid fabrics landscape is undergoing transformative shifts propelled by mounting sustainability expectations and advances in composite engineering. In recent years, leading textile designers and material scientists have collaborated to pioneer circular manufacturing methods, integrating bio-based and recycled fibers into hybrid structures without sacrificing technical performance. Meanwhile, additive manufacturing and digital weaving systems are enabling the creation of complex fabric geometries that enhance structural integrity and reduce waste.

Concurrently, the adoption of nanotechnology and surface functionalization techniques has unlocked new possibilities in water repellency, ultraviolet resistance, and antimicrobial properties. These enhancements extend the life cycle of hybrid textiles and reduce the environmental footprint of end products. Furthermore, cross-industry partnerships are fostering the convergence of textile producers, automotive OEMs, and electronics firms, accelerating the development of smart hybrid fabrics with embedded sensors and adaptive thermal regulation. As these trends coalesce, hybrid fabrics are poised to redefine the boundaries of performance materials and meet the exacting standards of tomorrow’s industries.

Assessing the Cumulative Consequences of 2025 US Tariffs on Hybrid Fabric Supply Chains, Cost Structures, and Competitive Dynamics in a Volatile Trade Environment

The 2025 tariff measures imposed by the United States have exerted cumulative pressure on the hybrid fabrics supply chain, elevating costs for producers and users alike. With baseline duties now ranging between 10% and 25% on key inputs such as carbon fiber, glass fiber, and specialized aramids, manufacturers face increased raw material expenses that ripple through production budgets. These higher import levies have prompted many firms to reassess sourcing strategies, shifting volume towards domestic suppliers or alternative low-tariff regions.

Moreover, small and medium enterprises have encountered heightened volatility in logistics and inventory planning as tariff uncertainties lead to stockpiling and price hedging strategies. This environment has had tangible impacts in downstream markets, with textile converters and composite fabricators reporting margin compression and passing part of the cost burden to end users. Consequently, some sectors-particularly non-woven production for medical textiles and high-performance aramid composites for defense-are accelerating investments in local capacity expansion to mitigate external tariff risks. As a result, the tariff landscape is reshaping competitive dynamics, incentivizing consolidation and strategic alliances that can navigate these trade challenges effectively.

Revealing In-Depth Segmentation Insights Illuminating How Fiber Types, Technologies, Applications, and Distribution Channels Drive the Hybrid Fabrics Market

The hybrid fabrics market exhibits a nuanced segmentation reflecting the diversity of fiber types and performance requirements. Pure and meta-aramids underpin applications demanding supreme thermal resistance and ballistic protection, while para-aramids deliver enhanced tensile strength for impact mitigation. Carbon fibers are differentiated across high, intermediate, and standard modulus grades, each tailored for stiffness levels and fatigue resistance. Glass fibers, available as E-Glass and S-Glass variants, provide cost-effective reinforcement with dependable durability. Nylon variants such as Nylon 6 and Nylon 6,6 bring elasticity and abrasion resistance, whereas recycled and virgin polyesters contribute moisture management and lightweight performance.

In parallel, production technologies such as 1D and 2D braiding, warp and weft knitting, and advanced non-woven processes (including drylaid, meltblown, and spunbond techniques) enable the generation of fabrics that balance load distribution and formability. Traditional weaving methods-plain, satin, and twill weaves-remain integral for achieving specific drape and tensile characteristics. Application-focused segments range from aerospace interiors to structural components, from casual and sportswear apparel to automotive exterior panels and interior trim, as well as critical military protective apparel and armor systems. Distribution strategies span direct manufacturer channels to OEMs, full-line and specialty distributors, and targeted online B2B and B2C platforms, ensuring market reach across diverse customer bases.

This comprehensive research report categorizes the Hybrid Fabrics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fiber Type

- Technology

- Application

- Distribution Channel

Examining Key Regional Dynamics as Americas, EMEA, and Asia-Pacific Markets Shape Growth Opportunities and Supply Chain Strategies in Hybrid Fabrics

Regional dynamics in the hybrid fabrics arena reveal distinctive growth vectors and innovation hubs. In the Americas, robust demand for lightweight composites in aerospace and defense anchors a mature market characterized by high regulatory standards and well-established supply chains. North American producers are leveraging automation and advanced analytics to optimize production yields and reduce lead times. By contrast, emerging players in Latin America are exploring strategic partnerships to build local processing capabilities.

Europe, Middle East & Africa is defined by its sustainability mandate and the integration of circular economy principles. The European Union’s recent partnerships under the Horizon Europe framework are channeling significant investments into sustainable textile initiatives, promoting biodegradability and recycling pathways for hybrid fabrics. Industry clusters across Germany, France, and the United Kingdom are collaborating on projects that embed digital traceability and green manufacturing at scale. Meanwhile, energy infrastructure expansion in the Middle East and Africa is fostering demand for durable, high-performance composite materials in construction and renewable energy applications.

Asia-Pacific stands as the fastest-growing region, propelled by rapid industrialization, infrastructure investment, and automotive electrification trends. China, Japan, South Korea, and India lead production volumes of carbon, glass, and specialty fibers, bolstered by government incentives for renewable energy projects and advanced manufacturing zones. This concentration of innovation and scale positions Asia-Pacific as a strategic source for hybrid fabrics, shaping global supply and collaborative R&D agendas.

This comprehensive research report examines key regions that drive the evolution of the Hybrid Fabrics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves by Leading Manufacturers and Innovators Driving Collaboration, Product Breakthroughs, and Capacity Expansion in Hybrid Fabrics

Major industry players are driving the hybrid fabrics market forward through targeted innovation and strategic investments. DuPont has notably accelerated its aramid portfolio with the introduction of Kevlar® EXO™, a next-generation fiber platform that delivers enhanced flexibility, ballistic protection, and thermal stability, earning recognition as an Edison Award finalist in 2025. By investing tens of millions in global capacity expansion and automation, DuPont is reinforcing its leadership in life protection and high-performance composite solutions.

Toray Industries continues to shape aerospace and defense landscapes with its TORAYCA™ carbon fibers and Cetex® thermoplastic composites, recently showcasing expanded thermoplastic offerings for urban air mobility platforms at Le Bourget’s 2025 air show. Teijin Limited, Hexcel Corporation, and SGL Group are similarly advancing thermoset and thermoplastic prepregs, leveraging proprietary resin systems to tune stiffness, impact resilience, and processing efficiency across critical applications. Alongside these innovators, several midsize and specialist enterprises are forging partnerships to deliver bespoke hybrid fabric architectures, ensuring agility in addressing niche performance demands and reinforcing competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hybrid Fabrics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A&P Technology, Inc.

- ALPHA COMPOSITION LTD.

- Avient Corporation

- Bally Ribbon Mills

- BGF Industries, Inc.

- COLAN AUSTRALIA

- Composite Envisions LLC

- DOSTKIMYA

- DuPont de Nemours, Inc.

- Entra Korea. Co., Ltd.

- G. Angeloni s.r.l

- Gurit Services AG

- HACOTECH GmbH

- Haufler Composites GmbH & Co.KG.

- Hexcel Corporation

- Hyosung Corporation

- Kolon Industries, Inc.

- Microtex Composites S.r.l.

- Owens Corning

- Porcher Industries

- Rock West Composites, Inc.

- SAERTEX GmbH & Co.KG

- SGL Carbon SE

- Solvay S.A.

- Taiwan Electric Insulator Co., Ltd.

- TCR Composites, Inc.

- Teijin Limited

- Textile Products, Inc.

- Toray Industries, Inc.

- VITRULAN HOLDING GMBH

Translating Market Insights into Actionable Recommendations for Industry Leaders to Optimize Operations, Foster Sustainable Innovation, and Strengthen Market Position

Industry leaders seeking to capitalize on hybrid fabrics’ potential should adopt a multifaceted strategic approach. Companies must prioritize supply chain diversification by establishing dual-sourcing agreements and nearshoring critical fiber production to mitigate trade policy risks. Simultaneously, investing in digital manufacturing platforms-such as automated weaving systems and real-time quality analytics-will enhance operational resilience and lower scrap rates.

In parallel, R&D teams should intensify efforts on sustainable material chemistries and recycling processes, aligning with regulatory drivers and investor expectations for circularity. Forming cross-sector alliances with OEMs in automotive, aerospace, and medical domains will accelerate co-development of application-specific hybrid architectures. Moreover, fostering talent through targeted upskilling programs in textile engineering and composite processing will sustain innovation cycles. By integrating these initiatives into a coherent roadmap, industry leaders can harness performance gains, secure competitive differentiation, and navigate evolving market landscapes with confidence.

Detailing Our Rigorous Mixed-Method Research Methodology Combining In-Depth Interviews, Data Triangulation, and Scenario Analysis for Validated Insights

This research employed a rigorous mixed-methodology framework to ensure comprehensive market coverage and analytical rigor. The process began with extensive secondary data collection, reviewing trade publications, technical journals, and regulatory databases to map industry dynamics and identify key players. Concurrently, expert interviews were conducted with product development leaders, supply chain managers, and end-user executives to validate emerging trends and triangulate insights.

Quantitative analysis integrated shipment data, import-export statistics, and patent filings, enabling trend identification across fiber types, technologies, and regions. Qualitative assessments drew on thematic coding of interview transcripts and case studies, capturing nuanced perspectives on innovation drivers and barriers. The findings were further stress-tested through scenario modeling, evaluating potential impacts of trade policy shifts and raw material price fluctuations. This multi-layered approach underpins the credibility of the insights presented and supports data-driven decision-making for stakeholders across the hybrid fabrics ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hybrid Fabrics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hybrid Fabrics Market, by Fiber Type

- Hybrid Fabrics Market, by Technology

- Hybrid Fabrics Market, by Application

- Hybrid Fabrics Market, by Distribution Channel

- Hybrid Fabrics Market, by Region

- Hybrid Fabrics Market, by Group

- Hybrid Fabrics Market, by Country

- United States Hybrid Fabrics Market

- China Hybrid Fabrics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3816 ]

Concluding Reflections on Strategic Imperatives and Future Trajectories for Hybrid Fabrics as Industries Embrace Performance, Sustainability, and Agility

Hybrid fabrics represent a pivotal junction in the evolution of performance materials, offering unparalleled combinations of strength, flexibility, and functionality. As industries grapple with stringent sustainability and performance mandates, the adaptability of hybrid fabric architectures becomes an indispensable asset. From the aerospace sector’s pursuit of lightweight structural components to the medical field’s demand for engineered non-wovens, hybrid textiles are continuously unlocking new application frontiers.

Looking ahead, the convergence of circular economy paradigms, advanced manufacturing technologies, and collaborative innovation networks will define the trajectory of hybrid fabrics. Stakeholders who proactively align their strategies with these imperatives will secure access to high-growth markets and reinforce their competitive edge. Ultimately, the hybrid fabrics domain underscores how material science ingenuity, paired with strategic foresight, can generate transformative value across global industries.

Engage with Ketan Rohom to Secure a Comprehensive Hybrid Fabrics Market Report That Empowers Strategic Precision

For more detailed insights and to explore how hybrid fabrics can transform your strategic roadmap, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through tailored research highlights, competitive intelligence, and actionable strategy frameworks designed to empower your decision-making process. Connect with Ketan to secure your comprehensive market research report and leverage the latest data and analysis for sustainable growth and innovation in the hybrid fabrics industry.

- How big is the Hybrid Fabrics Market?

- What is the Hybrid Fabrics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?