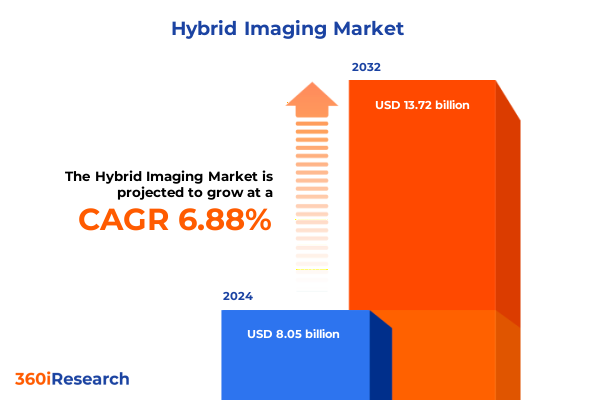

The Hybrid Imaging Market size was estimated at USD 8.60 billion in 2025 and expected to reach USD 9.19 billion in 2026, at a CAGR of 6.90% to reach USD 13.72 billion by 2032.

Unveiling the Transformative Potential of Hybrid Imaging Technologies to Drive Next-Generation Diagnostic Precision, Enhanced Patient Care, and Clinical Innovation Globally

Hybrid imaging represents a paradigm shift in diagnostic medical imaging, seamlessly combining anatomical and functional modalities to deliver a richer, more nuanced understanding of disease processes. By integrating technologies such as PET, CT, and MRI into unified platforms, clinicians can visualize metabolic activity against precise anatomical backdrops, significantly improving diagnostic accuracy, staging of disease, and treatment response assessments. This convergence of technologies not only enhances clinical workflows by reducing the need for multiple separate scans but also supports more personalized patient pathways by providing consolidated data in a single session.

As healthcare systems worldwide grapple with increasing demand for rapid, precise diagnostics, hybrid imaging emerges as a cornerstone of next-generation clinical practice. Technological improvements in detector sensitivity, image reconstruction algorithms, and radiotracer specificity have catalyzed broader adoption, while evolving reimbursement policies in key regions have facilitated capital investment. Consequently, hybrid imaging is transitioning from niche research applications to mainstream clinical use, offering decision-makers a compelling value proposition rooted in improved patient outcomes, operational efficiencies, and potential cost savings over longitudinal treatment journeys.

Exploring the Technological, Regulatory, and Clinical Shifts Driven by AI Integration, Advanced Radiotracers, and Policy Trends Reshaping the Hybrid Imaging Landscape

The hybrid imaging landscape is undergoing transformative shifts propelled by breakthroughs in artificial intelligence, the emergence of novel radiopharmaceuticals, and evolving regulatory frameworks that encourage cross-modality innovation. Advanced AI-driven image reconstruction and analysis tools are streamlining post-processing workflows, enabling real-time quantification of functional parameters and anomaly detection with higher sensitivity. Simultaneously, the development of targeted radiotracers for oncology, neurology, and cardiology is expanding the clinical utility of hybrid systems, paving the way for earlier detection of pathologies and refined therapy monitoring.

Moreover, regulatory agencies in major markets have begun to issue tailored guidelines for hybrid devices, accelerating approval timelines for integrated scanners and companion diagnostics. This policy evolution, coupled with strategic partnerships between imaging system manufacturers and radiopharmaceutical developers, is fostering a more collaborative ecosystem. As a result, healthcare providers are gaining access to turnkey solutions that combine high-performance hardware, sophisticated software, and specialized tracers, ultimately reshaping diagnostic pathways and setting new standards for precision medicine.

Assessing the Far-Reaching Effects of 2025 United States Tariffs on Hybrid Imaging Equipment Supply Chains, Manufacturing Costs, and Innovation Trajectories

In 2025, the United States implemented targeted tariffs on imported high-precision imaging components, including advanced detectors, gantry assemblies, and specialized semiconductors essential for hybrid scanners. These measures, aimed at bolstering domestic manufacturing, have cascading effects throughout the supply chain. Equipment manufacturers face increased input costs, which in turn influence pricing strategies and capital expenditure decisions for healthcare providers. As a result, procurement cycles have lengthened, with many institutions deferring upgrades or opting for refurbished systems to manage budgets effectively.

Conversely, the tariff environment has catalyzed a surge in local innovation, as domestic suppliers scramble to scale production of critical components. Start-ups and established original equipment manufacturers are investing in advanced fabrication facilities, leveraging government incentives to reduce dependency on overseas supply. While the near-term pressure on device costs may slow adoption in cost-sensitive segments, the mid-term outlook suggests a more resilient, diversified supply network fortified by regional manufacturing hubs and strategic alliances.

Uncovering Critical Insights from Technology, Sales Channel, Application, and End-User Segmentation to Illuminate Opportunities in Hybrid Imaging

The hybrid imaging market is best understood through a multifaceted segmentation framework that illuminates nuanced performance characteristics and growth pathways. Within the domain of technology type, PET-CT scanners continue to dominate high-throughput oncology workflows, leveraging robust detector arrays and refined attenuation correction algorithms. By contrast, PET-MRI systems are gaining traction in neurology and small-anatomy applications, where superior soft-tissue contrast and advanced functional mapping deliver unparalleled insights for epilepsy evaluation and neurodegenerative disease monitoring. Meanwhile, SPECT-CT remains an indispensable option in cardiology, its well-established tracer libraries and cost-efficient operation appealing to diagnostic centers focused on myocardial perfusion and viability studies.

Examining the sales channel dimension reveals that direct sales relationships thrive in mature healthcare markets, where manufacturers and large hospital networks co-develop customized installation and service agreements. In emerging economies, distributors extend reach into secondary and tertiary care facilities, facilitating entry into regions with diverse regulatory and infrastructure landscapes. This dual-channel approach underscores the importance of tailored go-to-market strategies that align with local procurement practices and financing models.

Turning to applications, hybrid imaging’s versatility is on full display. In cardiology, bespoke protocols for myocardial perfusion and viability enable clinicians to differentiate ischemic from hibernating myocardium, guiding revascularization decisions. Infectious disease imaging capitalizes on infection site and inflammation-targeted tracers to unravel complex pathophysiological processes, supporting more precise antimicrobial therapies. Neurology applications, spanning epilepsy and neurodegenerative mapping, rely on combined functional-anatomical insights to pinpoint seizure foci and track disease progression. Oncology continues to be the largest end-use domain, splitting between hematologic malignancies and solid tumors to deliver tailored staging, restaging, and therapy response assessments across diverse tumor types. Finally, end users such as diagnostic centers, hospitals, and research institutes each harness hybrid imaging differently, from high-volume screening in ambulatory clinics to cutting-edge investigational protocols in academic centers, underscoring the technology’s broad applicability across healthcare settings.

This comprehensive research report categorizes the Hybrid Imaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Application

- End User

Revealing Region-Specific Drivers, Challenges, and Growth Catalysts Impacting Hybrid Imaging Adoption Across the Americas, EMEA, and Asia-Pacific

Regional dynamics exert a profound influence on hybrid imaging adoption and evolution, with each geography presenting unique drivers and obstacles. In the Americas, advanced healthcare infrastructure and favorable reimbursement frameworks in the United States and Canada underpin strong capital investment in next-generation PET-CT and PET-MRI systems. Meanwhile, market maturity encourages service providers to differentiate through value-added offerings such as integrated reporting solutions and centralized image repositories that optimize clinical workflows and facilitate multi-site collaborations.

Europe, the Middle East, and Africa embody a tapestry of market nuances. Western Europe, characterized by stringent regulatory oversight and high per-capita healthcare spending, fosters demand for premium hybrid platforms with cutting-edge reconstruction capabilities. In contrast, emerging markets in Eastern Europe, the Gulf Cooperation Council, and North Africa lean on cost-effective SPECT-CT deployments and innovative financing models to expand access to molecular imaging. Cross-border partnerships and pan-regional harmonization of regulatory standards are increasingly central to scaling operations across this diverse territory.

Asia-Pacific stands out for its rapid healthcare modernization and expanding research initiatives. Governments across China, India, Japan, and ASEAN nations are incentivizing the installation of advanced imaging suites to address rising noncommunicable disease burdens. Domestic manufacturers are also ramping up R&D and forging international alliances to enhance local production of hybrid scanners. Consequently, the region is poised to leapfrog in terms of affordability and accessibility, driving widespread adoption across both public hospital networks and private diagnostic chains.

This comprehensive research report examines key regions that drive the evolution of the Hybrid Imaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players’ Strategic Initiatives, Partnerships, and Product Innovations Shaping the Competitive Hybrid Imaging Ecosystem

Leading imaging system vendors are pursuing strategic initiatives that underscore competitive differentiation and collaborative innovation. One major player has launched a next-generation digital PET-CT platform featuring AI-driven reconstruction and ultra-low-dose protocols, positioning itself at the forefront of dose optimization and workflow efficiency. Another global manufacturer has deepened its hybrid PET-MRI portfolio with modular architectures that allow seamless upgrades of magnet strength and software suites, catering to research institutes seeking longitudinal platform continuity.

Additionally, emerging challengers are forging alliances with radiopharmaceutical companies to integrate novel tracers directly into imaging workflows, thereby shortening clinical trial timelines and enhancing diagnostic specificity. Partnerships between hardware providers and software analytics firms are also proliferating, as vendors recognize the value of end-to-end solutions that unify image acquisition, cloud-based processing, and decision support. Through targeted acquisitions, collaborative pilot programs, and flagship installations in leading academic centers, these industry titans and agile newcomers alike are defining the competitive hybrid imaging ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hybrid Imaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bruker Corporation

- Canon Medical Systems Corporation

- Cubresa Inc.

- GE Healthcare Technologies Inc.

- Mediso Medical Imaging Systems Ltd.

- MILabs B.V.

- Miltenyi Biotec B.V. & Co. KG

- MR Solutions Ltd.

- Philips Healthcare (Koninklijke Philips N.V.)

- Raycan Technology Co., Ltd.

- Siemens Healthineers AG

- TriFoil Imaging, Inc.

Strategic Imperatives for Industry Leaders to Harness Innovation, Strengthen Supply Resilience, and Drive Sustainable Growth in Hybrid Imaging Markets

To capitalize on the rapid evolution of hybrid imaging, industry leaders should prioritize the development of modular platforms that support incremental technology refreshes without full system replacements. By enabling plug-and-play detector or software module upgrades, vendors can address customer concerns around obsolescence and large capital outlays, while sustaining recurring revenue through service and licensing models.

Moreover, organizations must diversify supply chains through dual sourcing of critical components and strategic stockpiling to mitigate tariff-related disruptions. Building collaborative ecosystems with radiotracer manufacturers and software developers will enhance innovation pipelines, ensuring a steady flow of high-value clinical applications. Engaging early with health authorities and payers to demonstrate clinical and economic benefits will accelerate reimbursement approvals for emerging modalities. Finally, embedding sustainability into product design and manufacturing processes will not only meet evolving ESG mandates but also resonate with health systems striving to reduce environmental footprints, positioning hybrid imaging providers as partners in holistic healthcare transformation.

Detailing the Comprehensive Research Methodology Employing Primary Interviews, Secondary Data Analysis, and Rigorous Validation for Robust Hybrid Imaging Insights

The insights presented in this report derive from a rigorous, multi-tiered research methodology designed to ensure both depth and accuracy. Primary research involved over a hundred structured interviews with a cross-section of stakeholders, including C-level executives at imaging system manufacturers, radiopharmaceutical specialists, hospital administrators, and lead clinicians at academic institutions. These conversations provided real-world perspectives on technology adoption, procurement considerations, and clinical workflow integration.

Complementing these qualitative inputs, extensive secondary research was conducted, encompassing regulatory filings, peer-reviewed journals, conference proceedings, and company technical literature. Quantitative data were triangulated through a combination of bottom-up analyses of installed base metrics and top-down assessments of capital expenditure trends. Finally, all findings underwent a validation phase with independent experts to refine assumptions and ensure the robustness of strategic recommendations. This comprehensive approach underpins the report’s actionable insights and reflects the latest developments in the hybrid imaging landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hybrid Imaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hybrid Imaging Market, by Technology Type

- Hybrid Imaging Market, by Application

- Hybrid Imaging Market, by End User

- Hybrid Imaging Market, by Region

- Hybrid Imaging Market, by Group

- Hybrid Imaging Market, by Country

- United States Hybrid Imaging Market

- China Hybrid Imaging Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Summarizing the Strategic Imperatives, Emerging Trends, and Future Directions Defining the Next Era of Hybrid Imaging Diagnostics and Research

In summary, hybrid imaging stands at the nexus of technological innovation and clinical necessity, offering unparalleled diagnostic precision and operational efficiencies. The convergence of AI-driven reconstruction, targeted radiotracers, and evolving regulatory pathways has catalyzed a new era in which PET-CT, PET-MRI, and SPECT-CT platforms extend beyond traditional boundaries, serving a broad spectrum of cardiology, infectious disease, neurology, and oncology applications.

Despite near-term headwinds from tariff-induced cost pressures and supply-chain realignments, the industry is poised for sustained advancement. Segmentation insights reveal tailored pathways for growth across technology types, sales channels, application domains, and end-user settings, while regional nuances underscore the importance of localized strategies. By aligning with the strategic imperatives outlined here-modular innovation, supply-chain diversification, and collaborative ecosystem building-industry participants can navigate uncertainties and drive transformative impact in patient care and clinical research.

Engage Directly with Ketan Rohom, Associate Director of Sales & Marketing, to Secure the Comprehensive Hybrid Imaging Market Research Report and Accelerate Strategic Insights

Unlock unparalleled insights into the hybrid imaging landscape by accessing the full comprehensive report. Partnering with Ketan Rohom, Associate Director of Sales & Marketing, provides exclusive access to in-depth analysis that goes beyond the executive summary, encompassing proprietary data, detailed competitor benchmarking, and strategic foresight designed to inform both near-term tactics and long-term planning. Engage directly to explore customized extensions, granular market deep dives, and scenario modeling that will equip your leadership team with the actionable intelligence needed to seize emerging opportunities.

Take the next step toward gaining a competitive advantage in the fast-evolving hybrid imaging domain. Reach out to Ketan Rohom to initiate a collaborative consultation that aligns with your organizational goals, whether you seek targeted technology roadmaps, regulatory landscape mapping, or application-specific deployment strategies. By securing the complete market research report, you position your enterprise to navigate regulatory complexities, mitigate supply-chain risks, and capitalize on the most promising segments for growth and innovation.

- How big is the Hybrid Imaging Market?

- What is the Hybrid Imaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?