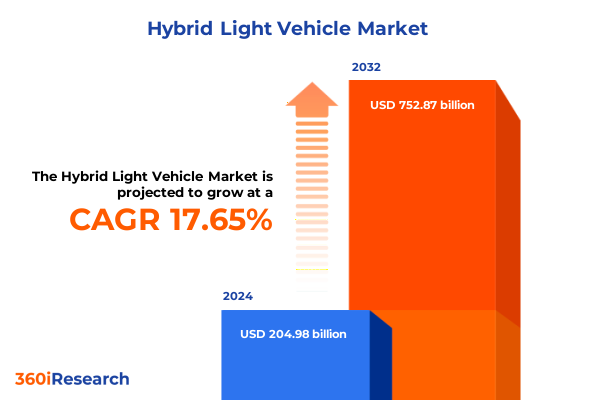

The Hybrid Light Vehicle Market size was estimated at USD 240.57 billion in 2025 and expected to reach USD 281.20 billion in 2026, at a CAGR of 17.70% to reach USD 752.87 billion by 2032.

Unveiling the Strategic Imperatives and Complex Dynamics Driving the Evolution of the Hybrid Light Vehicle Sector

The hybrid light vehicle segment has emerged as a pivotal arena for innovation and sustainability, blending conventional and electrified powertrains to address evolving consumer demands and regulatory requirements. As global environmental imperatives intensify and fuel prices fluctuate, hybrid solutions offer a transitional pathway, mitigating carbon footprints while ensuring operational reliability. This executive summary distills the complex dynamics influencing the hybrid light vehicle ecosystem, synthesizing market drivers, technological developments, and policy catalysts to provide decision-makers with a clear roadmap.

Against a backdrop of shifting geopolitical landscapes, the automotive industry is navigating unprecedented challenges, from sudden tariff impositions to supply chain realignments. In response, hybrid light vehicle manufacturers are accelerating research into advanced battery chemistries, lightweight materials, and energy management systems. This confluence of factors is redefining vehicle design philosophies, prompting a reassessment of production footprints and forging collaborations across the value chain. Consequently, stakeholders must stay attuned to the fast-evolving competitive terrain.

Charting the Electrification Surge and Collaborative Innovations Reshaping the Future of Hybrid Light Vehicles

The automotive landscape is undergoing a profound transformation fueled by the rapid ascent of electrification, intensified by robust policy frameworks and shifting consumer expectations. Manufacturers are recalibrating their portfolios to strike an optimal balance between fully electric and hybrid offerings, responding to both environmental mandates and infrastructure bottlenecks. This evolution is underscored by a surge in battery electric vehicle deliveries, which rose by 47% in the first half of 2025, illustrating OEMs’ commitment to expand electrified lineups and mitigate emissions.

Simultaneously, consumers are embracing hybrid powertrains as a pragmatic choice, benefiting from extended range and reduced emissions without full reliance on charging networks. Data indicates that plug-in hybrid electric vehicles in China increased their electric range by over 20% between 2020 and 2024, reflecting technological advancements in battery capacity and thermal management. Against this complex backdrop, strategic partnerships between automakers, battery suppliers, and technology firms are multiplying, forging end-to-end solutions that enhance performance, lower costs, and support resilience in global supply chains. Moreover, the Inflation Reduction Act’s restructuring of tax incentives is reinforcing local sourcing of battery components, reshaping procurement strategies and nurturing domestic manufacturing clusters.

Examining the Far-Reaching Ramifications of 25% Import Duties on Hybrid Light Vehicle Production and Profitability

In April 2025, the administration implemented a sweeping 25% ad valorem tariff on all imported passenger vehicles and light trucks, a policy expanded to auto components by May, fundamentally altering cost structures across the industry. This abrupt escalation prompted global OEMs and suppliers to accelerate preemptive stockpiling, as evidenced by LG Energy Solution’s strategic procurement ahead of tariff imposition, which bolstered second-quarter profits by facilitating component availability under more favorable fiscal conditions.

The downstream effect has been a marked increase in landed costs, compelling automakers to reassess regional manufacturing footprints. Notably, one major South Korean OEM reported a 570 million dollar hit to second-quarter earnings attributed solely to U.S. tariff duties, even as its U.S. sales climbed 5% from last year due to customer urgency ahead of price increases. Consequently, the industry is witnessing accelerated shifts toward near-shoring and increased utilization of USMCA content exemptions, as manufacturers optimize cross-border logistics and seek to contain margin compression. These dynamics underscore the critical need for agile trade strategies and robust supply chain contingencies.

Unlocking Segment-Specific Technological Demands and Customer Preferences Across Propulsion, Vehicle Type, and End-User Categories

The propulsion landscape is distinguished by distinct market segments, each presenting unique technological imperatives and growth trajectories. Battery electric vehicles dominate the discourse, leveraging lithium-ion and, to a lesser extent, nickel-metal hydride chemistries to deliver zero-emission mobility. Hybrid electric vehicles, combining internal combustion engines with electric assist, continue to resonate in regions with limited charging infrastructure, offering cost-effective emissions reductions. Simultaneously, plug-in hybrids bridge the gap, enabling extended electric-only operation while preserving conventional fueling flexibility.

Diverse vehicle typologies inform product development and go-to-market approaches. Light commercial vehicles cater to logistics and intracity delivery services, demanding payload optimization, connectivity for telematics, and rapid charging or battery-swap capabilities. Passenger cars, ranging from compact models to multi-purpose vehicles and sedans, emphasize comfort and efficiency, integrating regenerative braking and smart energy management systems to enhance everyday usability.

Market engagement spans multiple end-user categories, encompassing large commercial fleets that prioritize total cost of ownership and operational uptime, government agencies deploying emergency services and municipal fleets to meet sustainability mandates, and individual purchasers seeking environmental stewardship combined with driving convenience. These segments demand tailored solutions-from robust telematics for fleet operators to seamless user interfaces for private drivers-driving OEMs to diversify offerings across a broad spectrum of customer requirements.

This comprehensive research report categorizes the Hybrid Light Vehicle market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propulsion Type

- Vehicle Type

- End User

Analyzing How Regional Policies, Incentives, and Infrastructure Shape Hybrid Light Vehicle Adoption Across Global Markets

The Americas region exhibits a complex interplay of policy shifts and consumer momentum. The Electric Vehicle Tax Credit spurred early adoption, yet recent regulatory reversals have tempered growth projections, with EV penetration expected to plateau near 11% of total new light-vehicle sales in 2025 due to subsidy expirations and heightened tariffs on imports. Despite these headwinds, North American OEMs are investing in localized battery gigafactories and expanding hybrid portfolios to sustain market momentum.

In Europe, Middle East & Africa, stringent emissions targets and low-emission zones are catalyzing fleet electrification, particularly in urban centers. While passenger car electrification approaches a 25% sales share, commercial operators navigate transitional challenges as only 6.1% of new light commercial vehicles were electric in 2024, prompting dialogues on regulatory flexibility and infrastructure expansion to accelerate uptake.

Asia-Pacific remains the epicenter of electrification, led by China’s continued dominance with EV sales accounting for nearly 60% of new car purchases in 2025. The region’s combination of consumer incentives, manufacturing scale, and competitive pricing has driven battery pack cost declines by 30%, reinforcing the cost advantage of locally produced electrified vehicles over imports. Other markets in Southeast Asia are launching targeted duties waivers and purchase subsidies through 2027, fostering nascent adoption among both hybrid and battery electric light vehicles.

This comprehensive research report examines key regions that drive the evolution of the Hybrid Light Vehicle market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Pivotal Roles and Distinct Approaches of Major Automakers Driving Hybrid Light Vehicle Innovation

Leading automakers and technology providers are executing divergent strategies to capture share in the hybrid light vehicle domain. Tesla, despite reporting a 13% decline in global EV sales, is banking on its upcoming affordable model and autonomous vehicle initiatives to reignite growth and broaden market appeal. Toyota maintains its hybrid leadership through continuous improvements in nickel-metal hydride battery lifespan and fuel-efficiency gains, leveraging its extensive hybrid lineage to address diverse consumer needs.

General Motors and Ford are pursuing dual electrification pathways, scaling battery production partnerships while expanding hybrid variants in their commercial lineups, such as the Mustang Mach-E and E-Transit vans. BYD’s vertical integration-from cathode material sourcing to cell manufacturing-has secured its position as the world’s top EV seller, undercutting competitors on price without sacrificing performance. European incumbents like Volkswagen and Renault are diversifying powertrain offerings and streamlining platforms to reduce complexity, balancing regulatory compliance with cost containment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hybrid Light Vehicle market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Audi AG

- BMW AG

- BYD Company Ltd.

- Ford Motor Company

- General Motors Company

- Groupe Renault

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Jaguar Land Rover Automotive PLC

- Mazda Motor Corporation

- Mercedes-Benz Group AG

- Mitsubishi Motors Corporation

- Nissan Motor Co., Ltd.

- Porsche AG

- Stellantis N.V.

- Subaru Corporation

- Toyota Motor Corporation

- Volkswagen AG

- Volvo Car Corporation

Strategic Imperatives for Strengthening Resilience, Accelerating Innovation, and Maximizing Market Opportunities in Hybrid Mobility

Industry leaders should prioritize resilient supply chain architectures by diversifying component sourcing beyond high-risk regions and leveraging free trade zones to mitigate tariff exposures. Establishing strategic partnerships with battery innovators can accelerate the integration of next-generation chemistries, reducing reliance on critical minerals susceptible to geopolitical constraints. Furthermore, aligning product roadmaps with evolving regulatory thresholds-such as zero-emission mandates and fuel-efficiency standards-will enable timely compliance and unlock potential incentives.

Deploying advanced data analytics across manufacturing and after-sales networks can uncover operational efficiencies, enhance predictive maintenance, and optimize battery life cycles, translating into reduced total cost of ownership for fleet customers. Engaging with policymakers to advocate for infrastructure expansion and harmonized standards will support broader adoption, while pilot programs with key end-users-ranging from municipal fleets to ride-sharing platforms-can validate technology performance and inform iterative enhancements. Emphasizing modular vehicle architectures and scalable software platforms will ensure adaptability to shifting market demands and emerging mobility services.

Exploring the Rigorous Multi-Source Research and Triangulation Methodology Underpinning Market Insights and Analyses

This study synthesizes a multi-tiered research framework combining secondary data analysis, expert interviews, and triangulated validation. Initial desk research encompassed industry publications, government regulations, and quarterly earnings reports from leading OEMs to map policy impacts and technology trends. Subsequently, structured interviews with supply chain executives, powertrain specialists, and fleet managers provided qualitative insights into operational challenges and emerging requirements.

Quantitative data were sourced from publicly disclosed sales figures, harmonized across markets through conversion of regional metrics to a common baseline. A rigorous cross-examination methodology reconciled discrepancies between multiple data points, ensuring consistency and reliability. Segmentation analysis was conducted to elucidate performance differentials across propulsion types, vehicle classes, and end-user cohorts. Finally, regional deep-dives integrated macroeconomic indicators and infrastructure benchmarks, yielding comprehensive market narratives aligned with current and anticipated regulatory landscapes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hybrid Light Vehicle market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hybrid Light Vehicle Market, by Propulsion Type

- Hybrid Light Vehicle Market, by Vehicle Type

- Hybrid Light Vehicle Market, by End User

- Hybrid Light Vehicle Market, by Region

- Hybrid Light Vehicle Market, by Group

- Hybrid Light Vehicle Market, by Country

- United States Hybrid Light Vehicle Market

- China Hybrid Light Vehicle Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

Synthesis of Key Findings Highlighting the Vital Role of Hybrid Architectures and Strategic Agility in Future Mobility Transitions

The hybrid light vehicle sector stands at the nexus of sustainability imperatives and technological ingenuity, offering a vital bridge toward fully electrified mobility. Against the backdrop of volatile trade policies and shifting incentive structures, manufacturers and suppliers are recalibrating strategies to align with decarbonization goals while safeguarding profitability. Hybrid architectures, encompassing battery electric, hybrid electric, and plug-in hybrid variants, remain indispensable in markets where infrastructure and economic constraints preclude immediate full electrification.

As competition intensifies, success will hinge on agility-both in adapting to policy reversals and in harnessing collaborative networks for R&D and supply chain optimization. The delineation of end-user requirements across commercial, government, and personal segments underscores the necessity for tailored offerings, underpinned by advanced analytics and modular design principles. By leveraging the insights presented herein and executing the recommended strategic imperatives, stakeholders can fortify their market positions and drive the next phase of hybrid light vehicle evolution.

Don’t Miss Out on Critical Data: Engage with Ketan Rohom for Tailored Access to In-Depth Hybrid Light Vehicle Market Intelligence

Seize the opportunity to gain a competitive edge by requesting the comprehensive market research report. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore how in-depth insights can guide your strategic initiatives and support decision-making in the hybrid light vehicle market. Elevate your market understanding today and secure the data-driven intelligence your organization needs to navigate the evolving landscape with confidence.

- How big is the Hybrid Light Vehicle Market?

- What is the Hybrid Light Vehicle Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?