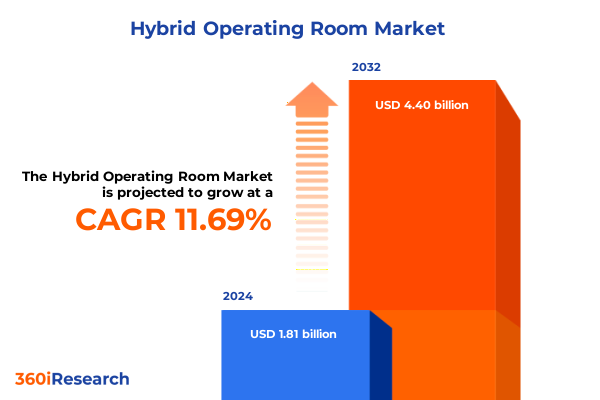

The Hybrid Operating Room Market size was estimated at USD 2.00 billion in 2025 and expected to reach USD 2.21 billion in 2026, at a CAGR of 11.88% to reach USD 4.40 billion by 2032.

Setting the Stage for the Future of Hybrid Operating Environments and Their Role in Revolutionizing Surgical Outcomes through Advanced Technologies

Hybrid operating rooms represent the next frontier in surgical care, integrating advanced imaging, navigation, and procedural technologies within a single, versatile environment. By merging the capabilities of high-resolution imaging systems with sophisticated integration and navigation platforms, these facilities enable multidisciplinary teams to perform complex procedures with unprecedented precision. This convergence of technologies not only supports minimally invasive techniques but also enhances intraoperative decision making, driving improvements in patient safety and clinical outcomes.

As healthcare providers strive to balance cost containment with the demand for state-of-the-art interventions, hybrid operating rooms have emerged as a strategic solution to address both clinical and economic imperatives. This executive summary offers a concise yet comprehensive overview of the key dynamics shaping the hybrid operating room landscape. It highlights technological developments, regulatory influences, market segmentation insights, and regional variances that collectively define current trends. Additionally, it outlines actionable recommendations for stakeholders to capitalize on emerging opportunities, as well as an overview of the robust research methodology employed to underpin these findings.

Identifying the Key Transformative Shifts in Hybrid Operating Room Technology and Workflow That Are Redefining Modern Surgery

The hybrid operating room landscape is undergoing transformative shifts driven by rapid technological innovations and evolving clinical workflows. High-definition imaging systems have advanced to incorporate real-time three-dimensional reconstruction, while integration platforms now offer seamless interoperability between modalities such as CT, MRI, and fluoroscopy. These improvements facilitate precise intraoperative guidance and reduce procedure times. In parallel, navigation systems leveraging electromagnetic and optical tracking have become more intuitive, enabling surgeons to navigate complex anatomical structures with enhanced confidence and accuracy.

Workflow optimization constitutes another pivotal change, as healthcare institutions adopt integrated control and display systems that centralize command functions and streamline team communication. The integration of visualization systems with control consoles has minimized physical movement within the suite, reducing infection risk and enhancing ergonomic efficiency. Furthermore, the growing convergence of robotics with hybrid environments is opening new frontiers in surgical dexterity, allowing for robotic-assisted interventions that combine the benefits of minimally invasive approaches with real-time imaging guidance.

Artificial intelligence and data analytics are also reshaping the hybrid OR by enabling predictive maintenance of equipment and providing intraoperative decision support. Machine learning algorithms can analyze imaging data to identify anatomical landmarks and predict optimal instrument trajectories, bolstering procedural accuracy and reducing human error. As these technologies continue to mature, their integration within hybrid suites will redefine clinical pathways and set new benchmarks for patient care.

Analyzing the Cumulative Impact of the Latest United States Tariff Measures on Hybrid Operating Room Equipment Supply Chains in 2025

The most recent tariff measures implemented by the United States in early 2025 have introduced significant considerations for stakeholders within the hybrid operating room ecosystem. Tariffs levied on advanced imaging components, such as MRI and CT subsystems, have increased procurement costs for equipment manufacturers, prompting them to explore alternative sourcing strategies. These duties also extend to high-precision navigation sensors and integration hardware, which are often imported from specialized international suppliers, thereby affecting the total landed cost of hybrid suite installations.

In response, forward-thinking providers have begun renegotiating supplier agreements and exploring nearshoring opportunities to mitigate cost volatility. Some industry participants are accelerating localization efforts, partnering with domestic manufacturers to produce ceiling mounts, surgical lights, and control consoles within U.S. facilities. While these initiatives may incur initial capital expenditures, they are projected to stabilize supply chains and reduce exposure to future tariff fluctuations. Concurrently, service providers are adapting maintenance and support frameworks to encompass tariff-driven component availability challenges, reinforcing preventive maintenance protocols to optimize equipment uptime.

Despite these obstacles, the cumulative impact of tariffs has underscored the strategic importance of diversified supplier networks and agile procurement processes. Organizations that proactively reassess supply agreements and leverage multi-tiered vendor ecosystems are better positioned to absorb incremental costs, maintain competitive pricing, and ensure uninterrupted access to critical technologies. This environment also presents an opportunity for service integrators to differentiate their offerings through cost-management expertise and robust contingency planning.

Unveiling Critical Segmentation Insights by Equipment, Service, Application, and End User That Illuminate Market Dynamics in Hybrid Surgical Spaces

A comprehensive understanding of market segmentation reveals nuanced demands across various equipment categories, service offerings, procedural applications, and end-user profiles. Examination by equipment type must consider accessories such as ceiling mounts and surgical lights, imaging systems including CT, fluoroscopy, and MRI, integration frameworks composed of control systems, display monitors, and visualization modules, navigation solutions offering electromagnetic and optical guidance, and operating tables that range from manual to motorized variants. Demand patterns fluctuate based on each facility’s procedural focus and technology maturity.

Service type analysis further clarifies the market landscape, encompassing consulting services that guide implementation and workflow optimization, installation and integration packages covering initial setup, system design, and technical integration, maintenance and support programs addressing both corrective and preventive needs, and training services delivered through on-site sessions or virtual platforms. Stakeholders increasingly prioritize end-to-end service models that ensure seamless upgrades and rapid issue resolution, reflecting the complexity of hybrid environments.

Application-centric segmentation identifies cardiovascular procedures such as electrophysiology, interventional cardiology, and vascular surgery; neurosurgical approaches including endovascular and stereotactic interventions; orthopedic operations focused on joint replacement and spinal surgery; and urological treatments ranging from endourology to uro-oncology. Each procedural category imposes distinct specifications on imaging resolution, navigation precision, and integration flexibility.

End user diversity spans ambulatory surgery centers with both multispecialty and single specialty configurations, hospitals categorized as academic medical centers or community facilities, and specialty clinics dedicated to cardiology or orthopedics. The convergence of these segmentation criteria offers a granular perspective on technology adoption drivers and service expectations across the hybrid operating room market.

This comprehensive research report categorizes the Hybrid Operating Room market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Service Type

- Application

- End User

Highlighting Essential Regional Dynamics across Americas, EMEA, and Asia-Pacific That Influence Adoption and Deployment of Hybrid Operating Facilities

Regional dynamics exert a profound influence on the adoption and implementation of hybrid operating rooms. In the Americas, advanced healthcare infrastructure and reimbursement frameworks that support high-cost procedural suites have catalyzed early deployment of integrated imaging and navigation solutions. Leading hospital networks in the United States continue to pilot cutting-edge robotic interfaces and AI-driven software, establishing best practices that are subsequently emulated by community hospitals and ambulatory centers nationwide.

Within Europe, the Middle East and Africa, regulatory heterogeneity and varied payment models present both challenges and opportunities. Western European nations benefit from centralized approval pathways and well-established public health systems, whereas emerging markets in the Middle East and Africa exhibit growing demand for turnkey solutions that address both cost containment and clinical expansion. Cross-border collaborations and multinational partnerships are increasingly common, enabling technology transfer and capacity building across these diverse territories.

The Asia-Pacific region is characterized by rapid infrastructure investment and government-led initiatives to enhance surgical capabilities. China and India are at the forefront of adopting hybrid suites, motivated by the need to optimize resource utilization in densely populated urban centers. Meanwhile, Australia, Japan, and South Korea leverage their technological prowess to integrate advanced imaging modalities and tele-mentoring platforms into hybrid environments. These regional variances underscore the importance of localized strategies and regulatory alignment to maximize market potential.

This comprehensive research report examines key regions that drive the evolution of the Hybrid Operating Room market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Companies’ Strategies, Partnerships, and Innovations Shaping Competitive Advantages in the Hybrid Operating Room Market

Leading participants in the hybrid operating room segment are distinguished by their ability to synergize hardware innovation with comprehensive service ecosystems. Global imaging and healthcare technology firms continuously invest in research and development to deliver modular platforms that support scalable upgrades. Meanwhile, specialized integrators network with software vendors to offer cloud-enabled analytics and remote monitoring services that enhance operational efficiency and clinical decision support.

Collaborative partnerships between medical device manufacturers and hospital consortia have accelerated the introduction of turnkey hybrid suites. Joint development projects frequently focus on customized interface protocols that align with existing hospital information systems, reducing integration complexity. In addition, mergers and acquisitions are reshaping the competitive landscape by consolidating niche navigation specialists and system design consultancies under larger corporate umbrellas, thereby expanding service portfolios and global reach.

Strategic initiatives also encompass workforce training and credentialing programs, where technology leaders partner with academic institutions to certify multidisciplinary teams in hybrid OR procedures. Value-based service contracts that tie equipment performance to clinical outcomes have gained traction, incentivizing vendors to maintain high operational uptime and deliver continuous software enhancements. Together, these tactics define the competitive contours of the market and set performance benchmarks for both incumbents and new entrants.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hybrid Operating Room market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alvo Medical

- Amico Corporation

- Barco NV

- Brainlab AG

- Brandon Medical

- Canon.Inc

- Carl Zeiss Meditec AG

- Covenant Health

- General Electric Company

- Getinge AB

- Hitachi Medical Corporation

- IMRIS

- Koninklijke Philips N.V.

- Mindray Medical International Co. Ltd.

- Mizuho Co.Ltd

- NDS Surgical Imaging LLC.

- Nuvo Surgical

- Schaerer Medical AG

- Siemens AG

- Skytron LLC

- Steris PLC.

- Stryker Corporation

- Trumpf Medical

Presenting Actionable Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Challenges in Hybrid Surgical Environments

To thrive in the evolving hybrid operating room environment, industry leaders must pursue a multifaceted approach encompassing technology, partnerships, and workflow enhancement. Prioritizing modular integration architectures enables incremental upgrades and reduces lock-in risk, empowering facilities to adopt emerging imaging and navigation innovations without extensive retrofitting. Additionally, expanding nearshore and domestic manufacturing partnerships will safeguard supply chain resilience and limit exposure to geopolitical disruptions.

Investing in comprehensive training programs for surgeons, technicians, and perioperative staff is critical. On-site and virtual education initiatives should be integrated into service agreements, ensuring that teams maintain proficiency as new tools and software versions are introduced. This focus on human capital development strengthens clinical outcomes and fosters customer loyalty.

Moreover, stakeholders should explore strategic collaborations with payers to align reimbursement frameworks with value-based care objectives in hybrid settings. Crafting service models that link equipment performance to patient outcomes can unlock novel revenue streams and enhance cost transparency. Finally, embracing digital platforms for remote monitoring, predictive maintenance, and AI-driven clinical support will differentiate service offerings and drive sustained market leadership.

Detailing a Robust Research Methodology Combining Qualitative Interviews, Secondary Research, and Analytical Frameworks to Ensure Rigor and Credibility

The research underpinning this report was developed through a rigorous methodology that combines extensive secondary research with primary interviews and analytical validation. Secondary research encompassed a thorough review of peer-reviewed journals, regulatory filings, proprietary databases, and patents to establish a foundational understanding of technology trajectories and regulatory landscapes. In parallel, primary research involved structured conversations with surgeons, biomedical engineers, procurement specialists, and service managers to capture real-world perspectives on adoption drivers and operational hurdles.

To ensure data integrity, multiple triangulation techniques were employed, cross-referencing qualitative insights with documented trends in capital expenditure and clinical trial outcomes. A segmentation framework was constructed by layering equipment type, service type, application, and end-user criteria to facilitate granular analysis. Regional assessments were informed by published government health statistics and healthcare investment reports, while competitive dynamics were mapped through a combination of public announcements, earnings calls, and M&A activity tracking.

Analytical frameworks such as SWOT and Porter’s Five Forces were applied to synthesize findings and identify strategic inflection points. The methodology emphasizes transparency and replicability, with all assumptions and data sources documented in an annex to support auditability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hybrid Operating Room market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hybrid Operating Room Market, by Equipment Type

- Hybrid Operating Room Market, by Service Type

- Hybrid Operating Room Market, by Application

- Hybrid Operating Room Market, by End User

- Hybrid Operating Room Market, by Region

- Hybrid Operating Room Market, by Group

- Hybrid Operating Room Market, by Country

- United States Hybrid Operating Room Market

- China Hybrid Operating Room Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3339 ]

Summarizing Key Findings and Strategic Implications That Offer a Cohesive Perspective on the Future Direction of Hybrid Operating Room Adoption

This executive summary has underscored the pivotal technological innovations, market drivers, and strategic considerations that define the hybrid operating room landscape. Advanced imaging integrations, modular navigation systems, and AI-enabled analytics are converging to elevate procedural precision and workflow efficiency, while evolving service models and partnership strategies are reshaping competitive dynamics. The impact of regulatory measures such as U.S. tariffs has further highlighted the importance of supply chain agility and diversified sourcing.

Segmentation insights have illuminated the varied demands of equipment categories ranging from accessories through integrated display and navigation systems, as well as the critical role of consulting, maintenance, and training services in sustaining operational performance. Application-level analysis across cardiovascular, neurosurgical, orthopedic, and urological procedures, coupled with end-user profiling across ambulatory centers, hospitals, and specialty clinics, offers a holistic perspective on market needs.

Regional variances in adoption and investment patterns point to distinct growth opportunities in the Americas, EMEA, and Asia-Pacific regions. Leading companies continue to differentiate through strategic partnerships, M&A activities, and workforce development initiatives. Collectively, these insights equip stakeholders with the strategic foresight necessary to navigate emerging challenges and capitalize on growth areas within the hybrid operating room domain.

Empowering Decision Makers with an Exclusive Call to Action to Connect with Ketan Rohom and Access the Comprehensive Hybrid Operating Room Market Report

For organizations seeking deeper insights and strategic guidance, there is no better time to secure the comprehensive Hybrid Operating Room market report. To explore tailored solutions, detailed market breakdowns, and actionable strategies, decision makers are encouraged to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Through this partnership, you will gain privileged access to exclusive data, one-on-one consultations, and a customized briefing that aligns with your specific objectives. Engage with an expert who can guide your acquisition of critical intelligence, ensuring your organization remains at the forefront of hybrid surgical innovation and competitive performance.

- How big is the Hybrid Operating Room Market?

- What is the Hybrid Operating Room Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?