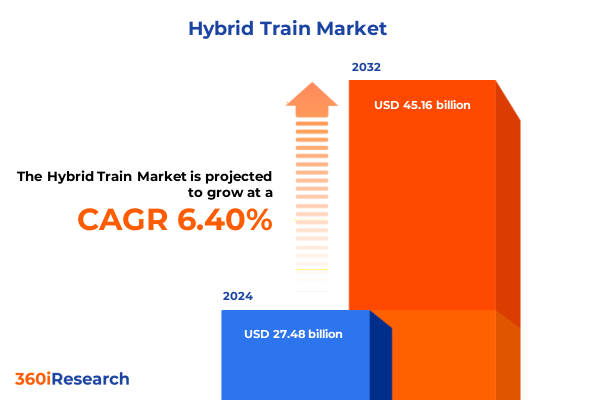

The Hybrid Train Market size was estimated at USD 28.83 billion in 2025 and expected to reach USD 30.25 billion in 2026, at a CAGR of 6.62% to reach USD 45.16 billion by 2032.

Strategic framing of hybrid train innovation that aligns stakeholder priorities, regulatory pressures, and the business case for cleaner resilient rail mobility

The hybrid train landscape is at an inflection point where technology, policy and procurement intersect to reshape how rail operators, suppliers and public authorities plan for cleaner, more resilient mobility. Increasing regulatory pressure to reduce greenhouse gas emissions, paired with new infrastructure funding streams and rising expectations from passengers and shippers, has moved hybrid traction from niche pilot projects into mainstream strategic planning for fleets and networks. As a result, executives must now evaluate hybrid options not only on lifecycle emissions but also on interoperability with existing infrastructure, total cost of ownership levers, and long‑term supply chain resilience.

In practice, this requires reframing conventional procurement conversations. Decision‑makers must weigh propulsion choices against route topology, service frequency and charging or refueling infrastructure availability, rather than treating technology selection as an isolated engineering decision. Equally important is the increasing role of systems integration and digital operations in unlocking the efficiency benefits that hybrid trains promise. With these structural shifts, leaders need concise, evidence‑based frameworks that translate technical tradeoffs into actionable procurement, operations and network planning decisions.

How decarbonization mandates, digitalization, supply chain localization and adaptive operational business models are transforming hybrid rail strategies

Several transformative shifts are converging to change how hybrid trains are designed, specified and operated. First, decarbonization mandates and public policy targets have raised the bar for fleet planners, moving the focus from incremental fuel efficiency improvements to measurable reductions in life‑cycle emissions. This policy environment has catalyzed broader investment in zero‑emission technologies and created incentives that make alternative drivetrains commercially viable for more routes and operators. Second, the rapid improvement of battery energy density and power electronics has expanded the technical envelope of battery‑electric and battery‑hybrid rail vehicles, enabling zero‑emission operation over longer unelectrified legs and simplifying depot charging strategies.

Third, hydrogen fuel cell technology is maturing for specific use cases where range and fast refuelling matter more than raw energy efficiency, particularly in hilly or longer regional corridors where overhead electrification is costly. Parallel to traction innovations, digitalization and predictive asset management are unlocking operational efficiencies that amplify the environmental and cost benefits of hybrid fleets. Lastly, supply‑chain localization and procurement resilience have moved higher on strategic agendas; where once cost and lead time were the primary procurement drivers, now sourcing diversification, content localization and tariff exposure shape sourcing strategies. Taken together, these shifts require leaders to adopt integrated planning approaches that unite rolling stock, energy infrastructure, digital operations and procurement policy in a single roadmap. Examples of hydrogen and battery deployments in global markets illustrate how operators are already aligning funding, local production and on‑site energy supply to make zero‑emission services practical and reliable.

Cumulative impact of United States tariff measures implemented through 2025 on hybrid train components, steel, batteries, and global procurement dynamics

Tariff policy enacted through 2024 and into 2025 has introduced new cost vectors and strategic constraints for manufacturers, suppliers and procurers of hybrid train systems. In particular, higher duties on steel and aluminum content have immediate implications for rolling stock manufacturing, component fabrication and the cost base of key structural subassemblies. Recent policy changes increasing tariffs on steel and aluminum mean that procurement teams must now account for duty exposure as a persistent line item in supplier evaluations and cost‑to‑deliver models. Moreover, these duties can influence supplier selection by materially changing the competitiveness of import versus domestic production options, prompting a renewed focus on near‑sourcing for major metallic components and exploring alternative materials where technically feasible.

Beyond basic metals, tariffs applied under trade remedy reviews and Section 301 reviews have affected upstream technologies that are strategic to hybrid traction systems. Increases in duties on polysilicon and solar wafers, for example, alter the economics of on‑site renewable generation projects that many operators consider to supply depot charging or hydrogen electrolysis. At the same time, higher duties on battery cells and parts sourced from specific geographies have created immediate supply chain risk for battery‑dependent designs, prompting manufacturers to accelerate supplier qualification programs in alternative jurisdictions, secure long‑lead contracts with trusted partners, and re‑examine modular architecture to reduce exposure to single‑origin components. These policy actions necessitate a tighter integration of trade compliance, engineering and procurement functions to mitigate supply disruptions and avoid last‑minute cost escalation.

Operationally, tariff volatility has consequences for lifecycle planning and asset replacement cycles. Operators with imminent refurbishment needs may find that retrofits and component replacements sourced internationally are subject to higher tariffs, nudging them toward domestic workshops, local content clauses in procurement contracts, or design choices that favor components with more resilient sourcing footprints. Transition strategies must therefore incorporate tariff scenarios into supplier scorecards and contractual clauses, including price adjustment mechanisms, multi‑sourcing commitments and collaborative inventory strategies designed to maintain service continuity despite shifts in global trade policy. For executives, the essential takeaway is that tariffs are no longer a peripheral compliance item but a core commercial variable shaping procurement, investment and infrastructure deployment decisions.

Segmentation insights across propulsion, operating speed and application that illuminate technology adoption, procurement impacts and operational tradeoffs

Segmenting the hybrid train opportunity by propulsion type, operating speed and application reveals practical tradeoffs that should guide procurement and operations decisions. When propulsion choices are examined, battery‑electric designs typically align with routes that have frequent opportunities for charging or shorter unelectrified segments and where depot or partial overhead charging can be cost‑effectively deployed. Diesel‑electric hybrids remain relevant where long‑range reliability, established refuelling infrastructure and lower upfront capital for depot upgrades are decisive factors, and they often serve as an intermediate decarbonization step while zero‑emission infrastructure is phased in. Hydrogen‑powered systems are increasingly considered where electrification is prohibitively expensive due to terrain or right‑of‑way constraints, and where operators can secure a reliable low‑carbon hydrogen supply chain. Solar‑aided propulsion and energy recovery systems can supplement onboard power in select climates and service profiles, reducing auxiliary load and supporting depot energy resilience.

Operating speed classification likewise drives architecture choices. For lower speed regional and branch services, battery systems can often meet range and duty needs while allowing operators to avoid the substantial capital expense of continuous overhead catenary. Mid‑range networks with speeds between 100–200 Km/H benefit from modular hybrid designs that balance energy density, regenerative braking and charging windows. Above 200 Km/H, high‑speed operations place different constraints on weight, aerodynamics and energy regeneration; hybridization at those speeds generally focuses on weight optimization, high‑power charging strategies and close coordination with corridor electrification plans. Application segmentation between freight and passenger services further differentiates priorities: freight operators prioritize tractive effort, endurance and payload capability, whereas passenger operators emphasize acceleration, noise, emissions and passenger comfort-factors that influence the choice between battery capacity, fuel cell range and hybrid configurations.

Taken together, this segmentation framing clarifies where technology maturity intersects with operational viability. Executives should use segmentation as a decision filter: match propulsion technology to route profile and speed class, evaluate depot and corridor energy infrastructure as part of vehicle specification, and ensure that supplier commitments support multi‑year maintenance and component continuity aligned to the chosen application profile.

This comprehensive research report categorizes the Hybrid Train market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propulsion Type

- Operating Speed

- Application

Regional insights covering Americas, EMEA and Asia-Pacific that highlight policy levers, investment patterns and infrastructure readiness for hybrid trains

Regional dynamics create differentiated pathways for hybrid train adoption and scale‑up. In the Americas, public funding programs and targeted grants are accelerating pilot projects and short‑line upgrades while encouraging private‑public partnerships for depot electrification and hydrogen demonstrations. Federal infrastructure funding streams have been explicitly used to support battery and hydrogen pilots, signaling that operators who combine grant capture with clear performance metrics can advance fleet renewal while sharing risk with government partners. This creates opportunities for smaller operators and regional authorities to pilot zero‑emission traction in corridor segments where local air quality and community impacts justify public investment.

In Europe, Middle East & Africa, policy frameworks and procurement cycles tend to favor rapid adoption of battery and hydrogen rolling stock where regional targets and EU‑level funding enable integrated projects that bundle vehicle purchase with on‑site renewable generation and refuelling infrastructure. The regulatory and funding environment in several European markets has produced early large‑scale fleet procurements for battery and hydrogen trains, coupled with commitments to domestic production content and integrated energy projects, which in turn create replicable models for other regions.

The Asia‑Pacific region demonstrates a wide spectrum of approaches: some jurisdictions prioritize rapid electrification and electrified fleet expansion where network density and high passenger volumes justify overhead investment, while others pursue hydrogen and battery options to serve less densely electrified corridors. Across all regions, the shared drivers are similar-policy ambition, infrastructure funding, and robust local supplier ecosystems-but the sequencing and emphasis vary by national priorities, capital availability and industrial policy. For multinational manufacturers and suppliers, success requires regionally tailored strategies that align product offerings and commercial models to local procurement rules, funding windows and infrastructure maturity.

This comprehensive research report examines key regions that drive the evolution of the Hybrid Train market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key company insights on OEMs, suppliers and systems integrators that reveal strategic partnerships, technology differentiation and competitive positioning

Company capabilities and strategic positioning are now decisive competitive differentiators in the hybrid train ecosystem. Original equipment manufacturers that pair platform engineering with flexible propulsion options and modular architectures are better positioned to meet diverse operator requirements. Component suppliers that can demonstrate multi‑source, geographically balanced supply chains for batteries, power electronics and hydrogen systems reduce single‑point sourcing risk for purchasers and become preferred partners in competitive procurement processes. Systems integrators and service providers that combine predictive maintenance platforms, energy management software and depot optimization services can capture higher value by delivering total lifecycle operational benefits beyond the hardware sale.

Strategic partnerships are also reshaping competitive dynamics. Joint ventures between rolling stock manufacturers and energy providers, alliances for localized cell manufacturing, and consortium models that bundle vehicle delivery with depot energy infrastructure are emerging as the dominant route to de‑risk projects for public buyers. These collaborations often include long‑term service contracts and performance‑based outcomes, which change the negotiation prism for procurement teams. For executives evaluating partner selection, the critical questions are whether vendors can provide demonstrable evidence of technology integration, validated safety cases for new fuel types, and a track record of managing multi‑stakeholder deployments across operations, energy providers and regulators.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hybrid Train market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Alstom SA

- Construcciones y Auxiliar de Ferrocarriles

- CRRC Corporation Limited

- Cummins Inc.

- Hitachi Ltd.

- Hyundai Rotem Company

- Kawasaki Heavy Industries Ltd.

- Mitsubishi Heavy Industries Ltd.

- PESA Bydgoszcz S.A.

- Rolls-Royce Holdings PLC

- Siemens AG

- Stadler Rail AG

- Talgo S.A.

- The Kinki Sharyo Co. Ltd.

- Toshiba Corporation

- Voith GmbH & Co. KGaA

- Vossloh Rolling Stock GmbH

- Wabtec Corporation

- Škoda Transportation AS

Actionable recommendations for industry leaders to advance hybrid train deployment through procurement reform, infrastructure coordination and supply strategies

Industry leaders can take a set of high‑impact, actionable steps to reduce program risk and accelerate value capture from hybrid train investments. First, align procurement specifications with operational use cases by embedding route profile and charging/refuelling constraints into the technical tender documents, rather than relying on generic vehicle templates. This reduces misalignment between delivered assets and service requirements and lowers integration risk. Second, develop procurement clauses that explicitly address supply chain resilience: include multi‑sourcing requirements for critical components, duty and tariff pass‑through mechanisms, and collaborative inventory strategies with suppliers to mitigate lead‑time volatility.

Third, pursue bundled investment models that pair rolling stock purchase with depot energy infrastructure or hydrogen production capacity, enabling operators to manage energy price risk and secure low‑carbon fuel supply. Fourth, invest in digital operations and predictive maintenance platforms early in the procurement cycle; these capabilities materially improve availability and life‑cycle economics and should be evaluated as integral components of a tender. Finally, engage proactively with regulators and funding agencies to align pilot metrics and secure grant co‑funding, keeping performance data transparent to de‑risk scale‑up. These recommendations are intentionally practical, and when implemented together they reduce technical, commercial and political risk while creating the operational conditions necessary for successful hybrid deployments.

Research methodology describing data sources, expert interviews, evidence synthesis and validation processes that underpin the hybrid train analysis

This research is grounded in a structured methodology that triangulates public policy releases, primary stakeholder interviews, vendor technical documentation and curated case studies of live deployments. Secondary source material is systematically screened for recency and relevance, while primary interviews with operators, OEM engineers, energy providers and procurement leads provide the qualitative context required to interpret technical tradeoffs and commercial structures. Evidence synthesis emphasizes replicable patterns across geographies rather than isolated anecdotes, and findings are validated through cross‑checking with regulatory filings and government grant documentation.

Where applicable, the analysis applies scenario thinking to map how discrete policy or supply‑chain events influence procurement outcomes, while sensitivity checks ensure that recommended strategies remain robust across a range of plausible operational conditions. The approach privileges transparency; each major conclusion is traceable to the underlying evidence set, and methodological assumptions are documented to support bespoke client requests for deeper drill‑downs or alternate weighting of criteria.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hybrid Train market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hybrid Train Market, by Propulsion Type

- Hybrid Train Market, by Operating Speed

- Hybrid Train Market, by Application

- Hybrid Train Market, by Region

- Hybrid Train Market, by Group

- Hybrid Train Market, by Country

- United States Hybrid Train Market

- China Hybrid Train Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 636 ]

Conclusion synthesizing strategic implications for operators, OEMs and policy leaders to navigate technological shifts, supply chain challenges and regulation

In conclusion, hybrid trains present a pragmatic pathway for operators and governments seeking substantial emissions reductions without the immediate capital outlays required for full network electrification. The intersection of technology maturity, digital operations and targeted public funding has created a window of opportunity for carefully sequenced fleet renewals and infrastructure investments. However, the commercial success of hybrid programs depends on integrated planning that treats propulsion choice, energy supply, regulatory alignment and procurement design as a single, interconnected challenge.

To move from pilots to repeatable deployments, organizations must adopt procurement architectures that explicitly mitigate tariff and supply‑chain risks, incentivize performance through outcome‑based contracting, and align with regional policy frameworks to secure funding. Executives who coordinate technical, commercial and regulatory workstreams will be best placed to capture the operational and environmental benefits that hybrid traction can deliver, while maintaining service reliability and protecting against trade policy volatility.

Contact Ketan Rohom, Associate Director Sales & Marketing, to request tailored access and purchase options for the comprehensive hybrid train research report

To acquire the full, in‑depth market research report and access tailored briefings, please contact Ketan Rohom, Associate Director Sales & Marketing, to request tailored access and purchase options for the comprehensive hybrid train research report

Our sales and insights team can arrange a confidential briefing, walkthrough of the report’s chapters, and a modular licensing plan that aligns with procurement cycles and board‑level timelines. For organizations seeking customized deliverables-such as supplier due diligence, technical roadmaps, or regulatory impact briefings-Ketan can coordinate scope, timelines and a secure data delivery protocol. Engage now to secure prioritized analyst time and executive summaries that accelerate decision making and procurement strategy.

- How big is the Hybrid Train Market?

- What is the Hybrid Train Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?