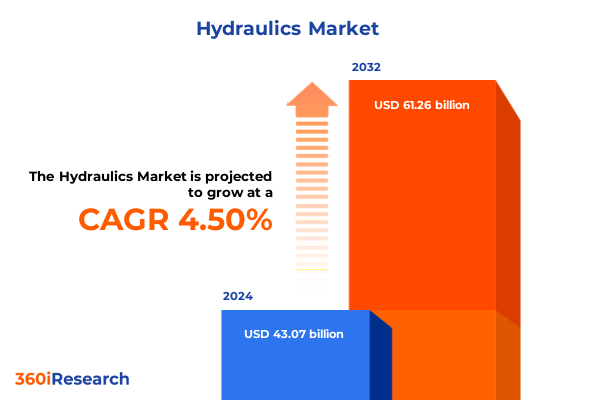

The Hydraulics Market size was estimated at USD 44.92 billion in 2025 and expected to reach USD 46.89 billion in 2026, at a CAGR of 4.52% to reach USD 61.26 billion by 2032.

Setting the Stage for Hydraulics Market Evolution by Highlighting Technological Drivers and Emerging Industry Dynamics and Sustainability Trends

Setting clear context is essential when navigating the complexities of the modern hydraulics market. As industries worldwide accelerate toward greater automation and efficiency, hydraulic technologies have emerged as pivotal enablers of power transmission and motion control. This report delves into the underlying forces shaping the sector and outlines the innovations that redefine performance benchmarks.

To begin with, rapid advancements in sensor integration, predictive analytics, and connectivity have blurred the lines between mechanical systems and digital intelligence. These converging trends have elevated expectations around uptime, precision, and remote diagnostics, transforming hydraulics from static components into dynamic, information-driven assets. Moreover, the industry faces mounting pressure to reduce environmental footprints, prompting a shift toward energy-efficient fluids, lightweight materials, and eco-conscious manufacturing processes.

Against this backdrop, organizations must reconcile the drive for technological excellence with evolving regulatory requirements and shifting supply chain landscapes. Stakeholders must stay informed about emerging alternatives to traditional hydraulic solutions, such as electro-hydraulic hybrids and all-electric actuators, which challenge conventional definitions of fluid power. By understanding the interplay of these forces, readers will gain a solid foundation for the deeper analyses that follow, setting the stage for informed decision making in an increasingly complex ecosystem.

Unveiling the Crucial Transformations Reshaping Hydraulics Through Digital Integration, Sustainability Initiatives, Supply Chain Resilience, and Talent Evolution

The hydraulics sector is undergoing transformative shifts that will redefine its future trajectory. Digitalization stands at the forefront, with intelligent control systems and real-time data analytics enabling condition-based maintenance and adaptive performance tuning. As systems become more interconnected, stakeholders can anticipate service models evolving from break-fix repair frameworks to continuous monitoring and outcome-oriented contracts.

Simultaneously, the push toward sustainability has accelerated the adoption of biodegradable fluids, energy-recovery systems, and design practices that prioritize resource conservation. Leading manufacturers have begun investing in lifecycle assessments to quantify environmental impacts, driving more transparent supply chain practices and fostering a culture of circularity. These initiatives have significant knock-on effects for procurement and end users, who increasingly demand assurances of eco-credentials alongside traditional performance metrics.

Supply chain resilience has also shifted into the spotlight. Recent disruptions have highlighted vulnerabilities in single-source dependencies, prompting companies to diversify critical component suppliers and explore nearshoring options. This propensity for geographic diversification pairs with a growing emphasis on talent development, as organizations recognize the need for multidisciplinary skill sets that blend fluid power expertise with software, data science, and systems engineering capabilities. Together, these transformative shifts create both challenges and opportunities as the industry marches toward greater complexity and interdependence.

Assessing the Far-Reaching Consequences of United States 2025 Tariffs on Hydraulics Supply Chains, Cost Structures, and Strategic Sourcing Decisions

The United States tariffs enacted in early 2025 have had a profound and cumulative impact on hydraulics supply chains, compelling stakeholders to reassess sourcing strategies and cost structures. Tariff escalation on steel, aluminum, and select hydraulic components has increased landed costs and squeezed margins for both manufacturers and end-user segments. In response, many organizations have accelerated efforts to qualify alternative materials and reengineer designs to minimize tariff exposure.

This shifting cost paradigm has also intensified interest in nearshoring production closer to key markets, reducing lead times and transportation expenses. While this strategy can mitigate duty burdens, it often requires capital investments in new facilities and workforce training. In parallel, procurement teams have adopted more rigorous total cost of ownership models, incorporating tariff scenarios into supplier evaluations and contract negotiations.

End users have felt the ripple effects in service and aftermarket channels, where components sourced under prior trade regimes may no longer be economically viable. Original equipment manufacturers and distributors have tightened inventory management practices to avoid overstocking at pre-tariff price points. Looking ahead, companies able to navigate fluctuating duty rates while maintaining supply continuity will secure competitive advantages in an environment defined by policy volatility and cost consciousness.

Illuminating the Nuanced Insights Derived from Comprehensive Segmentation Spanning Products, Hydraulics Type, Operation, Distribution Channels, and End Users

A nuanced understanding of the hydraulics market emerges when evaluated through multiple segmentation lenses. Product distinctions reveal differing growth vectors: hydraulic accumulators command attention for energy storage applications, while cylinders and pumps remain foundational for linear and rotational motion control. Filters underscore the sector’s focus on system reliability, and valves form the critical nexus of flow regulation. Each component category carries unique performance requirements, influencing investment priorities and R&D roadmaps.

Hydraulics type further refines the landscape. Industrial hydraulics dominate manufacturing and process-driven environments, where high-pressure systems and precision control are paramount. Mobile hydraulics, in contrast, power construction equipment, agricultural machinery, and mining vehicles, emphasizing durability under variable conditions and weight-to-power optimization. Understanding the operational context for each type informs development strategies and aftermarket support models.

Operating mode introduces another dimension of complexity. Automatic systems leverage electronic controls for adaptive behavior and reduced human intervention, catering to applications requiring tight tolerance and repeatability. Manual operations maintain relevance in settings where simplicity and ease of maintenance outweigh the benefits of full automation. Distribution channels shape market access, as aftermarket suppliers compete with original equipment manufacturers to deliver replacement parts and value-added services. Finally, end users span aerospace and defense sectors with mission-critical requirements, agriculture and construction markets seeking productivity gains, and energy sectors in marine, mining, and oil & gas where reliability and safety standards drive vendor selection. Integrating these segmentation insights equips decision makers with the granular perspective necessary to tailor product portfolios and service offerings.

This comprehensive research report categorizes the Hydraulics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Hydraulics Type

- Operation

- Distribution Channel

- End User

Revealing Distinct Regional Dynamics and Growth Drivers across the Americas, Europe Middle East and Africa, and Asia-Pacific Hydraulics Markets

Regional dynamics play a pivotal role in shaping the future of the hydraulics market. In the Americas, established manufacturing hubs in North America pair with growing infrastructure investments in Latin America, driving demand for both industrial and mobile hydraulic solutions. The region’s regulatory environment supports research and innovation, particularly in energy-efficient fluid power systems, while nearshoring trends reinforce supply chain resilience and shorten delivery cycles.

Europe, the Middle East, and Africa present a diverse tapestry of market drivers. Western Europe leads in sustainability mandates, pushing companies to adopt biodegradable fluids and energy-recovery technologies. Central and Eastern Europe focus on modernizing legacy equipment, catalyzing opportunities for aftermarket services and retrofit solutions. Meanwhile, the Middle East and Africa exhibit robust growth in oil and gas projects, maritime applications, and defense procurement, creating pockets of high-value hydraulic system demand.

Asia-Pacific remains the most dynamic growth frontier, underpinned by rapid industrialization, infrastructure expansion, and advancements in smart manufacturing. China’s emphasis on self-sufficiency and domestic innovation has spurred local incumbents to invest heavily in R&D, while Southeast Asia’s rising middle class fuels agricultural mechanization and construction activity. Across the region, the convergence of local manufacturing capabilities and global partnerships continues to redefine competitive benchmarks, making Asia-Pacific a critical arena for strategic investments and collaborations.

This comprehensive research report examines key regions that drive the evolution of the Hydraulics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Competitive Positioning and Strategic Initiatives of Leading Hydraulics Suppliers Driving Innovation and Market Penetration

Examining the strategies of leading hydraulics suppliers reveals a landscape marked by aggressive innovation and strategic partnerships. Major incumbents invest heavily in additive manufacturing to accelerate prototyping and reduce material waste, while forging alliances with software providers to enhance system intelligence. These collaborations yield predictive maintenance platforms that transform traditional service contracts into performance-based agreements, aligning manufacturer incentives with uptime targets.

At the same time, focused acquisitions enable companies to broaden capabilities in adjacent domains such as filtration, pneumatics, and motion control. These moves bolster portfolio breadth and facilitate cross-selling opportunities, particularly in end-user segments that value integrated solutions. Joint ventures and strategic equity stakes in specialized engineering firms further support the development of niche technologies, from high-speed hydraulic pumps to advanced valve manifolds.

Leadership in sustainability also emerges as a competitive differentiator. Forward-looking suppliers have established internal metrics for carbon reduction and launched eco-certification programs for key components. By highlighting these credentials, they appeal to customers navigating tight environmental regulations and corporate responsibility mandates. As a result, corporate commitment to green hydraulics is no longer an optional positioning strategy but a required element of market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hydraulics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atos Spa

- Bucher Industries AG

- Caterpillar Inc.

- Daikin Industries, Ltd.

- Danfoss A/S

- Emerson Electric Company

- Fluid Power Engineering Solutions Pty Ltd

- Fluitronics GmbH

- HAWE Hydraulik SE

- Helios Technology, Inc.

- HYDAC International GmbH

- JOST Werke SE

- JTEKT Corporation

- Kawasaki Heavy Industries Ltd.

- Komatsu Ltd.

- KYB Corporation

- Moog Inc.

- Nachi-Fujikoshi Corporation

- Parker-Hannifin Corporation

- Permco Inc.

- Queensland Hydraulics Pty Ltd

- Questas Group

- Rikenkiki. Co. Ltd.

- Robert Bosch GmbH

- Salami SpA

- SMC Corporation

- Specialised Force Pty Ltd

- Yuken Kogyo Co., Ltd.

Presenting Tactical Recommendations for Hydraulics Industry Leaders to Harness Technological Advances, Optimize Operations, and Build Resilient Supply Chains

Industry leaders can take concrete steps to navigate the complex hydraulics landscape and secure long-term growth. First, they should prioritize digital transformation initiatives that integrate sensors, cloud analytics, and predictive modeling directly into hydraulic systems. This approach not only reduces unplanned downtime but also unlocks new service revenue streams through outcome-based contracts and remote monitoring.

Second, companies must diversify supply chains by qualifying dual or multiple sources for critical components, including valves and high-precision pumps. In parallel, exploring nearshore manufacturing options can mitigate tariff impacts and reduce logistical risks. To support these changes, organizations should invest in workforce training programs that blend fluid power fundamentals with data science skills, ensuring teams can maximize the value of connected systems.

Third, embedding sustainability into product development pipelines will become increasingly non-negotiable. Firms should accelerate the adoption of eco-fluids and lightweight materials and publish transparent environmental impact metrics. Collaborating with regulatory bodies and industry consortia can help shape standards that reward green hydraulics solutions. By actioning these recommendations, industry players will position themselves to capitalize on evolving customer expectations and regulatory landscapes.

Detailing a Robust Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Rigorous Validation to Ensure High Credibility

This report’s findings rest on a rigorous research methodology designed to ensure validity and reliability. Primary research comprised in-depth interviews with senior executives and technical experts across component manufacturers, system integrators, distributors, and end-user organizations. These discussions unearthed firsthand insights on procurement priorities, technology adoption barriers, and emerging application areas.

Secondary research included an exhaustive review of corporate filings, press releases, industry trade journals, and regulatory documentation to contextualize interview findings within broader market trends. Data triangulation techniques reconciled multiple sources to reduce bias and verify claims, while scenario analyses tested the robustness of strategic narratives under varying economic and policy conditions.

Quantitative inputs were segmented according to product type, hydraulics type, operation mode, distribution channel, and end-user category to yield granular insights. Regional data were cross-checked with local industry associations and government databases. The combined approach of expert validation and multi-source verification underpins the credibility of our conclusions and ensures that stakeholders can rely on this report to guide critical strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hydraulics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hydraulics Market, by Product

- Hydraulics Market, by Hydraulics Type

- Hydraulics Market, by Operation

- Hydraulics Market, by Distribution Channel

- Hydraulics Market, by End User

- Hydraulics Market, by Region

- Hydraulics Market, by Group

- Hydraulics Market, by Country

- United States Hydraulics Market

- China Hydraulics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Takeaways on Hydraulics Market Dynamics, Core Influencers, and Strategic Imperatives to Guide Ongoing Decision Making

In summary, the hydraulics market stands at an inflection point defined by digital breakthroughs, sustainability imperatives, and evolving trade dynamics. Companies that embrace intelligent hydraulics architectures and establish resilient supply networks will drive superior performance and customer satisfaction. Meanwhile, tariff pressures underscore the importance of proactive sourcing strategies and total cost of ownership assessments.

Segmentation analysis highlights the unique demands across product categories-from accumulators and cylinders to filters and valves-while distinctions between industrial and mobile hydraulics illuminate divergent growth pathways. Operational modes and distribution channels further shape value propositions, and end-user diversity ranging from aerospace to agriculture underscores the market’s complexity.

Regionally, the Americas leverage robust manufacturing ecosystems, EMEA balances maturity with regulatory rigor, and Asia-Pacific offers the most dynamic expansion prospects. Competitive insights reveal that leading suppliers are investing in additive manufacturing, sustainability, and partnerships to extend their technological and commercial footprints. By synthesizing these takeaways, stakeholders will gain a clear view of strategic imperatives and be equipped to harness emerging opportunities in the evolving hydraulics domain.

Act Now to Secure Expert Insights from Ketan Rohom Associate Director Sales and Marketing to Empower Strategic Investments in Hydraulics Markets

Don’t Miss Out on Critical Insights to Drive Your Hydraulics Strategy Forward

For industry professionals seeking a competitive edge, securing access to a comprehensive hydraulics market research report can transform strategic planning and operational decision making. Ketan Rohom, Associate Director of Sales and Marketing, stands ready to guide you through the report’s rich insights and help you identify the most impactful findings for your organization’s growth.

Engaging with Ketan offers personalized support, whether you need clarity on segmentation analysis, tariff impacts, or regional growth drivers. His expertise ensures you extract maximum value from the report’s detailed exploration of technological innovations, policy shifts, and market dynamics. By partnering with Ketan, you gain a trusted advisor who will tailor the deliverable to your specific objectives and facilitate swift integration of findings into your strategic roadmap.

Reach out to Ketan Rohom today to secure your copy of the hydraulics market research report. Empower your team with data-driven guidance and actionable recommendations designed to unlock new opportunities and fortify your market position.

- How big is the Hydraulics Market?

- What is the Hydraulics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?