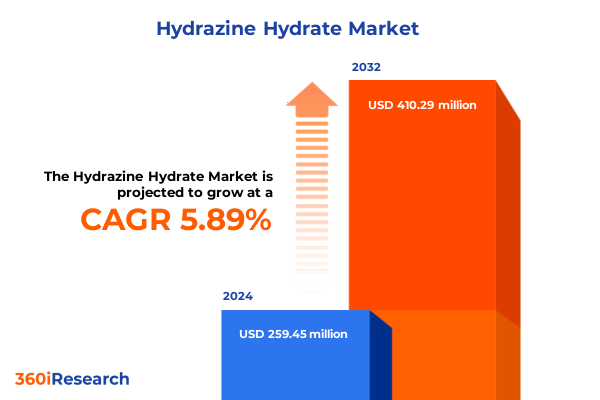

The Hydrazine Hydrate Market size was estimated at USD 274.93 million in 2025 and expected to reach USD 289.63 million in 2026, at a CAGR of 5.88% to reach USD 410.29 million by 2032.

Unveiling the Critical Role of Hydrazine Hydrate Across Diverse Industrial Applications and Its Escalating Strategic Importance in Modern Manufacturing Operations

Hydrazine hydrate stands as a cornerstone chemical intermediate whose unique properties-volatile stability and strong reducing potential-have earned it a central role across multiple industrial verticals. Most notably, its function as an oxygen scavenger in boiler water treatment and its capability to generate gas-blowing agents via azodicarbonamide synthesis underpin countless manufacturing processes, from polymer-based foams to specialty adhesives. Meanwhile, its reactivity makes it an indispensable reagent in pharmaceutical pathways, where high-purity grades facilitate the production of critical anticancer and antimicrobial APIs, as well as several antihypertensive and antitubercular compounds. Furthermore, the compound’s disrupting presence as a fuel cell catalyst precursor has catalyzed interest in advanced energy applications, further broadening its strategic significance in the transition toward cleaner energy technologies.

Navigating the Transformative Shifts in Regulatory, Technological, and Geopolitical Forces Reshaping the Hydrazine Hydrate Value Chain

The hydrazine hydrate ecosystem has undergone a profound metamorphosis driven by converging regulatory, technological, and geopolitical currents. Regulatory momentum has intensified following its classification as a substance of very high concern under stringent European chemical frameworks, compelling stakeholders to elevate compliance protocols and invest in advanced waste treatment methodologies to satisfy both emissions targets and worker-safety mandates. Technologically, the emergence of continuous flow reactor systems has enhanced throughput consistency, reduced energy footprints, and heightened process safety-an evolution vividly demonstrated by recent pilot successes in modular reactor design that boast nearly 20% efficiency gains over legacy batch processes. Concurrently, geopolitical disruptions-ranging from maritime chokepoint tensions impacting raw material routes to 2025 tariff impositions in the United States-have introduced new layers of complexity in sourcing strategies, underscoring the imperative for diversified supply networks and localized production capabilities.

Assessing the Far-Reaching Impacts of 2025 United States Tariff Measures on the Hydrazine Hydrate Supply Chain and Industry Economics

The introduction of cumulative tariff measures in the United States in early 2025 has imposed elevated duties on both precursor chemicals and imported hydrazine hydrate, reverberating throughout the entire supply chain. Domestic manufacturers have responded by reassessing procurement frameworks, negotiating long-term supply contracts to stabilize input costs, and accelerating investments in localized production to circumvent escalating import levies. Downstream industries such as agrochemical and pharmaceutical manufacturing are feeling acute cost pressures as formulation expenses climb, prompting a strategic pivot toward regional suppliers to mitigate cross-border fees and minimize margin erosion. Despite these challenges, nimble stakeholders are forging strategic alliances with logistics providers and offering value-added technical support services in the field-a tactical shift that not only offsets distribution overheads but also justifies premium pricing in a higher-cost operating environment.

Deriving Strategic Insights from Multifaceted Segmentation to Decode Application, Industry, Product, Purity, and Distribution Dynamics

When examined through the prism of application segmentation, hydrazine hydrate’s market footprint unfolds across agricultural chemical formulations-where it underpins fungicide, herbicide, and pesticide production-alongside its critical role as a precursor in azodicarbonamide for foam-blowing, fuel cell catalyst materials, and hydrazine sulfate intermediates. In parallel, the pharmaceutical domain leverages high-purity variants for the synthesis of anticancer agents and broad-spectrum antimicrobials, while industrial water systems rely on oxygen-scavenging grades to preserve boiler integrity and manage wastewater corrosion. Layering end-use industries atop this reveals a demand matrix spanning agrochemical, chemical, and pharmaceutical manufacturing hubs as well as power generation facilities that implement hydrazine-based corrosion control. In terms of product typology, industry demand bifurcates around standard 64% concentration grades and premium 85% grades, each tailored to specific performance thresholds. Purity considerations further subdivide the market into commercial, electronic, and laboratory grades, aligning with escalating quality requirements from bulk industrial use to semiconductor and research applications. Distribution channels follow suit, with direct sales forming the cornerstone of large-scale contract fulfillment, regional distributors anchoring mid-market engagements, and emerging online platforms facilitating niche-volume procurement and expedited delivery across key chemical corridors.

This comprehensive research report categorizes the Hydrazine Hydrate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- End Use Industry

- Product Type

- Purity Grade

- Distribution Channel

Distilling Regional Market Dynamics and Strategic Drivers: Comparative Analysis of Hydrazine Hydrate Trends Across Americas, EMEA, and Asia-Pacific Regions

Regional dynamics in the hydrazine hydrate landscape reveal a tapestry of distinctive drivers and challenges. In the Americas, robust aerospace initiatives and established water treatment infrastructures have propelled sustained demand, catalyzing investments in secure supply chains and just-in-time logistics to support mission-critical operations. Transitioning to Europe, Middle East, and Africa, rigorous environmental regulations and advanced R&D ecosystems have heightened the emphasis on greener synthesis routes and closed-loop chemical processing, even as production clusters navigate rising compliance costs and workforce safety imperatives. Across Asia-Pacific, burgeoning agrochemical production in agricultural powerhouses, coupled with rapid polymer processing expansions in East Asia, has established the region as the largest consumer base, with major producers scaling capacity to satisfy domestic growth and emerging export opportunities. Together, these regional profiles underscore the necessity for geographically nuanced strategies that reconcile local regulatory landscapes, infrastructure maturity, and end-use demand patterns.

This comprehensive research report examines key regions that drive the evolution of the Hydrazine Hydrate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Hydrazine Hydrate Industry Stakeholders: Key Operational Strengths, Innovation Trajectories, and Competitive Positioning

Leading stakeholders across the hydrazine hydrate arena have differentiated through a blend of production scalability, process innovation, and strategic investment. Several key manufacturers have optimized legacy Bayer-Ketazine and H₂O₂–Ketazine routes, integrating on-site hydrogen peroxide facilities to streamline feedstock handling and reduce energy intensity. Others have pivoted toward hybrid continuous–batch platforms, showcasing efficiency uplifts in pilot operations and laying the groundwork for broader commercial rollout. Strategic capital deployments have also featured prominently, with facility expansions in critical hubs-most notably in China and South Korea-driven by emerging contracts for polymer and agrochemical derivatives. Beyond capacity moves, several players have advanced research collaborations with academic institutes to mature bio-based synthesis pathways that promise reduced waste streams and a lower carbon footprint. These efforts, combined with proactive stakeholder engagement, solidify competitive moats and reinforce the long-term positioning of frontrunners in an increasingly complex and regulated market environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hydrazine Hydrate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acuro Organics Limited

- Arkema S.A.

- Capot Chemical Co., Ltd.

- Chemtex Speciality Limited

- Chongqing Yinguang Chemical Co., Ltd.

- Gujarat Alkalies and Chemicals Limited

- HPL Additives Limited

- Hubei Xinyangfeng Fertilizer Co., Ltd.

- Hunan Zhuzhou Chemical Industry Group Co., Ltd.

- Japan Finechem Co., Inc.

- Kadox LLC

- LANXESS AG

- Lonza Group Ltd.

- Merck KGaA

- Meru Chem Private Limited

- Nippon Carbide Industries Co., Inc.

- Otsuka Chemical Co., Ltd.

- Thermo Fisher Scientific Inc.

- Weifang Yaxing Chemical Co., Ltd.

- Yibin Tianyuan Group Co., Ltd.

Proposing Actionable Strategies for Industry Leaders to Enhance Resilience, Optimize Operations, and Capitalize on Emerging Hydrazine Hydrate Market Opportunities

To thrive amid accelerating regulatory scrutiny, tariff headwinds, and shifting demand patterns, industry leaders must enact a multifaceted strategic agenda. First, diversifying raw material sourcing through geographically dispersed supply alliances and joint ventures can mitigate single-point vulnerabilities and stabilize procurement costs. Second, targeted investments in modular, continuous production units will enhance process agility and reduce the environmental footprint, thereby aligning operations with evolving sustainability mandates. Third, embedding digital monitoring systems across the value chain-leveraging IoT-enabled sensors for real-time purity analytics and emissions tracking-will foster both operational resilience and compliance assurance. Fourth, cultivating deeper partnerships with downstream formulators through technical support and customized grade solutions can unlock premium pricing opportunities and reinforce customer loyalty. Finally, accelerating R&D into bio-derived hydrazine alternatives will position first movers at the forefront of next-generation green chemistry, ensuring regulatory adaptability and long-term relevance in decarbonizing industries.

Detailing Rigorous Research Methodology: Integrating Primary Engagements, Secondary Validation, and Qualitative-Quantitative Triangulation Techniques

This analysis synthesizes insights derived from a rigorous multi-stage research process. Initially, comprehensive secondary research entailed reviewing technical bulletins, regulatory filings, and corporate disclosures to map the current hydrazine hydrate landscape and identify transformative trends. Concurrently, primary engagements-including structured interviews with C-level executives, plant operations managers, and supply chain directors-provided nuanced perspectives on real-world operational challenges and strategic responses. Quantitative data points were triangulated across multiple sources to validate consistency and detect emergent patterns. The resulting framework was further refined through expert panel workshops, where key assumptions and thematic findings were stress-tested against scenario projections. Throughout, the methodology maintained strict adherence to ethical research standards, ensuring data integrity, respondent confidentiality, and a balanced representation of industry viewpoints.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hydrazine Hydrate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hydrazine Hydrate Market, by Application

- Hydrazine Hydrate Market, by End Use Industry

- Hydrazine Hydrate Market, by Product Type

- Hydrazine Hydrate Market, by Purity Grade

- Hydrazine Hydrate Market, by Distribution Channel

- Hydrazine Hydrate Market, by Region

- Hydrazine Hydrate Market, by Group

- Hydrazine Hydrate Market, by Country

- United States Hydrazine Hydrate Market

- China Hydrazine Hydrate Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings and Strategic Imperatives into a Cohesive Outlook on the Future Trajectory of Hydrazine Hydrate Applications

In summation, hydrazine hydrate remains an indispensable chemical asset whose multifaceted applications span critical industrial segments from pharmaceutical synthesis to advanced materials and energy systems. The convergence of stricter chemical regulations, disruptive geopolitical events, and rapid technological advancements is reshaping the competitive landscape, demanding strategic agility and operational excellence. Segmentation insights highlight the importance of tailored grade offerings and targeted channel strategies, while regional analyses underscore the need for location-specific approaches to regulatory and demand-side variables. The competitive arena is defined by manufacturing scale, innovation velocity, and sustainability credentials, all of which will determine who captures the next wave of market value. By embracing a holistic strategy that integrates supply chain diversification, process modernization, digital transformation, and green R&D, stakeholders can not only navigate current headwinds but also unlock new avenues for growth and differentiation in this evolving chemical ecosystem.

Empowering Decision-Makers with Direct Access to Expert Insights: Secure Your Comprehensive Hydrazine Hydrate Market Report with Ketan Rohom

Ready to unlock the full depth of data, analysis, and strategic guidance on the hydrazine hydrate landscape? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report. Ketan brings over a decade of industry expertise and will tailor the insights, intelligence, and competitive context to your organization’s needs. Don’t miss the opportunity to leverage detailed segmentation breakdowns, tariff impact assessments, regional analyses, and actionable recommendations that will empower your decisions in the evolving hydrazine hydrate market. Connect with Ketan now to elevate your strategic planning and gain a competitive edge.

- How big is the Hydrazine Hydrate Market?

- What is the Hydrazine Hydrate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?