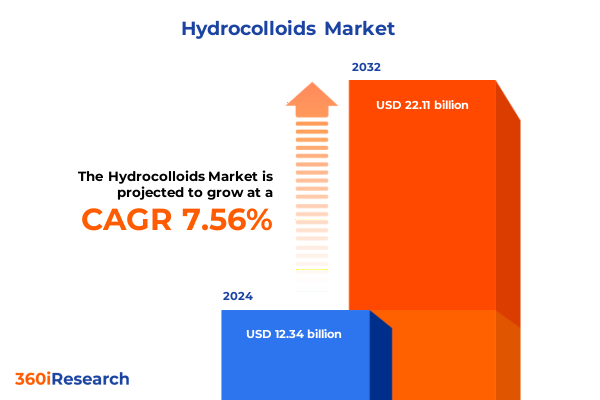

The Hydrocolloids Market size was estimated at USD 13.27 billion in 2025 and expected to reach USD 14.26 billion in 2026, at a CAGR of 7.56% to reach USD 22.11 billion by 2032.

Setting the Stage for a New Era of Hydrocolloid Applications That Drive Innovation, Efficiency, and Sustainable Growth Across Key End Use Sectors

Setting the Stage for a New Era of Hydrocolloid Applications That Drive Innovation, Efficiency, and Sustainable Growth Across Key End Use Sectors

Hydrocolloids have transcended their traditional roles as simple thickening and gelling agents to become pivotal enablers of innovation across a diverse array of end use segments. Originally valued primarily for their rheological properties in food systems, these versatile biopolymers now underpin a wide spectrum of product enhancements, from extending shelf life in frozen desserts to improving the stability of pharmaceuticals. At the same time, escalating demand for natural, label-friendly ingredients has amplified the strategic importance of hydrocolloids within research and development agendas for manufacturers and formulators worldwide. This introduction explores the foundational principles that have elevated hydrocolloids to critical status in modern formulations and the confluence of drivers that continues to expand their relevance.

As consumer preferences tilt toward cleaner ingredient decks, suppliers have intensified efforts to secure sustainable, traceable sources of alginates, carrageenan, and xanthan gum, among others. Concurrently, advances in production techniques-ranging from precision fermentation to enzyme-assisted extraction-are reshaping cost structures and quality benchmarks. Regulatory scrutiny over permissible residuals and allergen labeling has further influenced product specifications and supplier audits, demanding greater transparency throughout the supply chain. These developments combine to set the stage for a dynamic phase in hydrocolloid application development, characterized by accelerated product differentiation and heightened emphasis on environmental stewardship.

Uncovering the Major Technological, Regulatory, and Consumer-Driven Shifts Redefining How Hydrocolloids Are Developed, Sourced, and Utilized Across Industries

Uncovering the Major Technological, Regulatory, and Consumer-Driven Shifts Redefining How Hydrocolloids Are Developed, Sourced, and Utilized Across Industries

The hydrocolloid landscape is undergoing transformative shifts driven by converging technological, regulatory, and consumer trends. On the technology front, novel extraction methods and bioprocessing approaches are enabling the production of high-purity xanthan gum and carrageenan variants with tailored molecular weights and functional profiles. These innovations are expanding application horizons, particularly where controlled viscosity and gel strength are paramount, such as in advanced drug delivery systems and low-fat dairy formulations. Furthermore, digital traceability platforms are increasingly integrated into supplier networks, providing end users with real-time data on raw material provenance and processing parameters.

Regulatory changes have paralleled technological advances, introducing more rigorous guidelines around microbial limits and heavy-metal content. Such developments have prompted suppliers to adopt heightened quality-management systems and to pursue certifications that validate compliance with global food safety and pharmaceutical standards. At the same time, sustainability targets set by multinational corporations have driven a shift toward responsibly harvested seaweed sources for carrageenan extraction and more efficient water-recycling processes in gelatin production. This regulatory and environmental pressure is balanced by evolving consumer preferences for plant-derived, clean-label ingredients, which are reshaping demand curves and incentivizing the sourcing of seaweed over animal-based hydrocolloids in certain geographies.

Analyzing the Multifaceted Consequences of Newly Instituted United States Tariffs on Hydrocolloid Trade Flows, Supply Chains, and Competitive Strategies in 2025

Analyzing the Multifaceted Consequences of Newly Instituted United States Tariffs on Hydrocolloid Trade Flows, Supply Chains, and Competitive Strategies in 2025

In 2025, the introduction of targeted tariffs on hydrocolloid imports into the United States has precipitated a complex realignment of supply chains and competitive strategies. Tariffs on alginate and carrageenan entries from traditional sourcing regions, including Southeast Asia and South America, have elevated landed costs and reduced price competitiveness for end users. This disruption has catalyzed the search for alternative origins, prompting buyers to diversify procurement toward emerging suppliers in the Mediterranean basin and North Africa, where tariff differentials are less punitive. As a result, logistical networks have been restructured, with an uptick in direct shipments from regional production hubs that can absorb or mitigate additional duties.

These trade measures have also spurred downstream negotiations between formulators and distributors as both parties seek to share cost burdens and preserve margin structures. In some cases, strategic alliances with local extractors have emerged, offering co-investment models to develop processing capacity within the United States and reduce reliance on cross-border shipments. Competitive behaviors are likewise shifting, with manufacturers accelerating product differentiation and emphasizing proprietary blends that can better justify adjusted price points. Altogether, the 2025 tariff regime has ushered in an era of supply chain resilience, wherein agility and regional collaboration have become critical success factors.

Mapping the Diverse Hydrocolloid Market Landscape Through Type, Application, Source, Form, and Distribution Channel Perspectives to Reveal Growth Drivers and Challenges

Mapping the Diverse Hydrocolloid Market Landscape Through Type, Application, Source, Form, and Distribution Channel Perspectives to Reveal Growth Drivers and Challenges

Dissecting the hydrocolloid market through a multidimensional segmentation lens uncovers nuanced growth drivers and potential obstacles. The hydrocolloid category based on type encompasses a broad spectrum, from alginates prized for their emulsion stabilizing capacity to gelatin renowned for its gelling finesse; from guar gum’s water-binding efficiency to tara gum’s cold-swelling properties. Within these, carrageenan variants-iota for elastic gels, kappa for rigid structures, and lambda for thickening-demonstrate the fine-tuning options available to formulators. Complementing this, the application segmentation spans cosmetics and personal care, where hair care systems benefit from conditioning polymers and skin care emulsions rely on controlled viscosity, extending through food and beverage subsegments such as bakery with moisture retention, dairy desserts offering mouthfeel enhancement, and savory sauces ensuring uniform texture. Meanwhile, oil and gas procedures leverage completion fluids optimized for rheology, and pharmaceutical dosage forms-liquid, solid, and topical-capitalize on hydrocolloids for sustained-release matrices.

Examining source reveals another dimension of strategic consideration: animal-derived materials like fish and porcine gelatin cater to traditional benchmarks but face substitution pressure from microbial producers such as Leuconostoc mesenteroides and Xanthomonas campestris, as well as from plant-derived alternatives sourced from legumes, fruits, and seaweed. Each origin carries its own supply risks and certification demands. Form-based segmentation further delineates user preferences for granular grades in industrial mixing, powders favored for high-concentration blending, and liquids used in continuous processing lines. Finally, distribution channels underscore the importance of direct sales for bulk industrial consumers and the expanding role of indirect sales via distributor networks and online retail platforms to reach niche formulators and end users.

This comprehensive research report categorizes the Hydrocolloids market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Source

- Form

- Application

- Distribution Channel

Examining Regional Dynamics Across the Americas, EMEA, and Asia-Pacific to Highlight Distinct Demand Patterns, Regulatory Frameworks, and Growth Opportunities

Examining Regional Dynamics Across the Americas, EMEA, and Asia-Pacific to Highlight Distinct Demand Patterns, Regulatory Frameworks, and Growth Opportunities

The Americas region exhibits a mature demand profile characterized by high consumption in food and beverage applications, especially within dairy and confectionery segments. Producers here have optimized their formulations around customer expectations for low-fat textures and clean-label ingredient declarations, prompting suppliers to offer modified alginates and tailor-made guar gum grades. North and South American regulatory environments continue to enforce stringent safety standards, which in turn shape procurement strategies and incentivize certification investments.

Turning to Europe, Middle East & Africa (EMEA), diversity of demand profiles emerges. Western Europe leads in premium applications such as specialty confectioneries and nutraceutical encapsulations, while Eastern European markets show growing interest in cost-effective thickeners. In the Middle East, investments in oil-field chemicals drive demand for hydrocolloids in drilling fluids and enhanced recovery processes, often sourced through well-established trading channels. African markets, though smaller in absolute terms, are demonstrating consistent growth as local processing capacity increases and regulatory regimes align more closely with international standards.

Asia-Pacific remains the fastest-evolving landscape, propelled by vibrant food and beverage innovation hubs in Japan and South Korea, as well as expanding dairy and beverage sectors in China and India. Rising consumer incomes and a shift toward convenience foods are boosting utilization of pectin in fruit-based snacks and xanthan gum in ready-to-drink products. Regulatory harmonization efforts across ASEAN nations are facilitating cross-border raw material flows, and local manufacturing investments are accelerating to meet domestic demand while managing cost pressures.

This comprehensive research report examines key regions that drive the evolution of the Hydrocolloids market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Hydrocolloid Innovators and Analyzing Strategic Moves, Partnerships, and Product Portfolios That Are Reshaping Competitive Dynamics Globally

Profiling Leading Hydrocolloid Innovators and Analyzing Strategic Moves, Partnerships, and Product Portfolios That Are Reshaping Competitive Dynamics Globally

Key industry players have been redefining competitive dynamics through targeted investments in research, strategic collaborations, and portfolio optimization. Major specialty ingredient producers have expanded their hydrocolloid offerings by acquiring niche technology providers, enabling them to introduce proprietary blends with enhanced functional attributes. Simultaneously, several global firms have entered into joint ventures with seaweed cultivators to secure year-round access to high-quality raw materials, thereby improving cost control and reducing supply risks. These alliances often include co-development agreements for novel carrageenan and alginate grades tailored to specific end use applications, such as high-protein dairy alternatives and plant-based meat analogs.

In parallel, leading distributors are integrating value-added services such as formulation support and regulatory intelligence to differentiate themselves in mature markets. They have leveraged digital platforms to provide customers with 24/7 access to technical data sheets, online ordering, and supply chain visibility tools. At the same time, several vertically integrated hydrocolloid suppliers are expanding their global footprint by establishing processing plants in strategic regions, reducing lead times and enhancing responsiveness to local regulatory requirements. These initiatives collectively underscore the drive toward agility and customer-centricity as defining principles for competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hydrocolloids market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- Ashland Global Holdings Inc.

- BASF SE

- Cargill, Incorporated

- CP Kelco U.S., Inc.

- Darling Ingredients Inc.

- DuPont de Nemours, Inc.

- FMC Corporation

- GELITA AG

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Kerry Group plc

- Roquette Frères

- Tate & Lyle PLC

Delivering Targeted Strategic Recommendations for Manufacturers, Distributors, and End Users to Navigate Market Complexities and Capitalize on Emerging Trends

Delivering Targeted Strategic Recommendations for Manufacturers, Distributors, and End Users to Navigate Market Complexities and Capitalize on Emerging Trends

To thrive in an environment marked by escalating raw material costs and shifting regulatory imperatives, manufacturers should prioritize the development of differentiated hydrocolloid blends that address specific performance challenges. Investing in co-development programs with key end users can accelerate product validation and create proprietary formulations that command premium pricing. Distributors, for their part, must reinforce their advisory capabilities by integrating regulatory compliance services and application-focused technical support, thereby deepening customer relationships and fostering long-term loyalty.

End users should adopt a multi-source procurement strategy to mitigate the impact of geopolitical disruptions and tariff fluctuations. Establishing strategic partnerships with local producers in key regions will not only buffer against import duties but also enable just-in-time inventory models that reduce working capital demands. Across the value chain, companies are advised to implement advanced analytics for demand forecasting and quality monitoring, ensuring that fluctuations in viscosity and purity are detected early and managed effectively. By embracing these strategic imperatives, industry stakeholders can convert market complexities into competitive advantages and secure sustainable growth trajectories.

Detailing a Comprehensive Research Framework Incorporating Primary Interviews, Secondary Data Analysis, and Rigorous Validation Protocols for Hydrocolloid Market Intelligence

Detailing a Comprehensive Research Framework Incorporating Primary Interviews, Secondary Data Analysis, and Rigorous Validation Protocols for Hydrocolloid Market Intelligence

This research employs a multi-tiered methodology designed to ensure depth, accuracy, and actionable relevance. Primary research comprised in-depth interviews with senior executives from leading supplier organizations, formulators in the food and beverage sector, procurement heads in cosmetics firms, and technical experts in the oil and gas industry. These conversations provided qualitative perspectives on supply chain dynamics, product innovation cycles, and regulatory challenges. Complementing this, extensive secondary data analysis drew upon trade publications, industry patents, and legislative documents to chart historical trends and emerging forecasts.

To validate our findings, a triangulation protocol was followed, cross-referencing responses from multiple sources to detect inconsistencies and refine insights. Quantitative data was subjected to rigorous statistical checks, including variance analysis and correlation testing, to confirm the robustness of observed patterns. Finally, a peer review process involving external subject matter experts ensured that the research conclusions and recommendations are grounded in practical realities and reflect the latest technological developments, regulatory changes, and evolving end user requirements.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hydrocolloids market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hydrocolloids Market, by Type

- Hydrocolloids Market, by Source

- Hydrocolloids Market, by Form

- Hydrocolloids Market, by Application

- Hydrocolloids Market, by Distribution Channel

- Hydrocolloids Market, by Region

- Hydrocolloids Market, by Group

- Hydrocolloids Market, by Country

- United States Hydrocolloids Market

- China Hydrocolloids Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Core Takeaways from Market Trends, Regulatory Impacts, and Strategic Insights to Outline the Path Forward for Hydrocolloid Stakeholders

Synthesizing Core Takeaways from Market Trends, Regulatory Impacts, and Strategic Insights to Outline the Path Forward for Hydrocolloid Stakeholders

The hydrocolloid sector stands at a pivotal juncture, with innovation accelerating in tandem with heightened regulatory and consumer expectations. Advancements in extraction technologies and formulation science are creating differentiated opportunities for targeted applications, while sustainability and traceability have become non-negotiable criteria for both suppliers and end users. The 2025 tariff changes in the United States have reconfigured global supply chains, emphasizing the need for agility and diversified partnerships to manage cost escalations and duty barriers.

Looking ahead, stakeholder success will hinge on the ability to integrate strategic recommendations into core operations-such as co-development alliances, digital traceability implementations, and multi-source procurement frameworks. By aligning product portfolios with evolving consumer demands for clean-label and plant-based solutions, and by adopting robust quality management systems, companies can secure competitive advantage. Ultimately, the path forward combines technological prowess with proactive risk mitigation and customer-centric innovation, setting the stage for sustained growth in the dynamic hydrocolloid market.

Engage Directly with Ketan Rohom to Access the Comprehensive Hydrocolloid Market Insights Report and Uncover Strategic Imperatives for Your Organization

Engage Directly with Ketan Rohom to Access the Comprehensive Hydrocolloid Market Insights Report and Uncover Strategic Imperatives for Your Organization

Unlock unparalleled expertise by arranging a conversation with Ketan Rohom, Associate Director, Sales & Marketing, to delve into the findings of this market research report. This session offers you tailored guidance on how to apply these insights to optimize your supply chains, streamline product development pipelines, and strengthen your competitive positioning. By engaging directly with Ketan Rohom, you will gain clarity on critical strategic imperatives and operational best practices that are essential in a rapidly evolving hydrocolloid landscape.

During this consultative discussion, you can explore in depth the implications of shifting tariffs, evolving regulatory frameworks, and emerging technology integrations described in this report. Ketan Rohom will provide contextual analysis around your unique business challenges, recommend prioritized action steps, and suggest partnership models to accelerate market entry or expansion. This interactive engagement is designed to help you translate data-driven observations into actionable roadmaps.

Secure your access to this in-depth hydrocolloids market intelligence by connecting with Ketan Rohom today. Elevate your strategic planning with authoritative guidance, ensure your organization is prepared for disruption, and capitalize on the opportunities unveiled within this comprehensive research.

- How big is the Hydrocolloids Market?

- What is the Hydrocolloids Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?