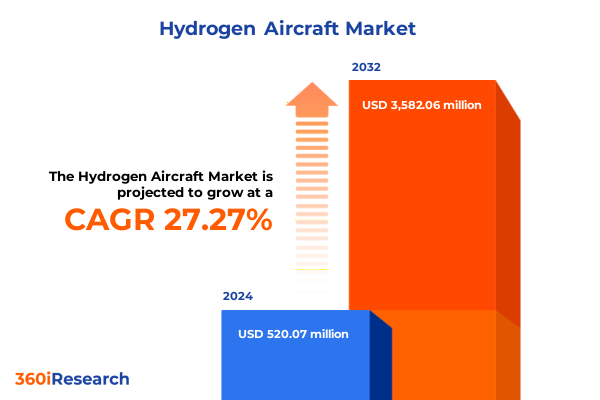

The Hydrogen Aircraft Market size was estimated at USD 520.07 million in 2024 and expected to reach USD 650.55 million in 2025, at a CAGR of 27.27% to reach USD 3,582.06 million by 2032.

Exploring the Transformative Potential of Hydrogen-Powered Aircraft to Revolutionize Aviation with Clean Propulsion and Enhanced Range Capabilities

Hydrogen-powered aviation is poised to redefine the future of flight by harnessing the highest energy-per-unit weight chemical fuel to deliver cleaner, longer-range air travel. With zero carbon emissions at the point of use and only water as a byproduct, hydrogen offers a compelling alternative to jet fuel, addressing aviation’s 2.5% share of global carbon dioxide emissions and the additional impact of contrails and nitrogen oxides on climate warming. Industry pioneers such as Bertrand Piccard’s Climate Impulse project envision nonstop global circumnavigation flights powered solely by green hydrogen, underscoring the technology’s aspirational potential. Cross-sector collaboration and supportive public policy frameworks are converging to catalyze this transformation, setting the stage for a new era where flight is both high-performance and environmentally responsible

How Recent Policy Advances and Collaborative Technology Breakthroughs Are Accelerating the Emergence of Hydrogen-Powered Aviation

In recent years, accelerating policy support and technological breakthroughs have reshaped the trajectory of hydrogen aviation. The United States, under bipartisan Congressional leadership, has preserved and expanded hydrogen production tax credits and fuel cell incentives despite global economic headwinds, affirming a strategic pivot toward energy sovereignty and decarbonization. Meanwhile, in Europe, collaborative projects between Airbus and MTU Aero Engines and the development of hydrogen infrastructure at airports reflect a maturing ecosystem for fuel cell propulsion and cryogenic storage. Simultaneously, zero-emission flight startups are securing targeted government grants, such as the Air Force’s SBIR award to integrate hydrogen-electric autonomy into tactical aircraft, validating hydrogen’s promise beyond commercial airliners. Technological progress is equally evident in the refinement of high-temperature proton exchange membrane fuel cells, modular engine designs, and thermal management innovations, which are rapidly closing the gap between laboratory success and operational viability. As these developments converge, the hydrogen aircraft landscape is transitioning from speculative concept to tangible flight demonstrations and infrastructure readiness across multiple regions

Examining the Comprehensive Impact of 2025 U.S. Tariff Measures on the Hydrogen Aircraft Supply Chain and Cost Dynamics

Throughout 2025, a series of U.S. tariffs has exerted tangible effects on the hydrogen aircraft supply chain, challenging stakeholders to adapt while safeguarding strategic ambitions. Starting March 4, the imposition of 25% duties on steel and aluminum imports and incremental increases on goods from China and select partners has driven up material costs for fuel cell stacks, cryogenic tanks, and lightweight composite structures. Concurrently, policy mechanisms like the Foreign Pollution Fee Act introduce a carbon-intensity tariff that penalizes imports with higher production emissions than U.S. equivalents, adding complexity to the sourcing strategies of hydrogen-centric components. These measures have triggered a reassessment of global procurement, prompting manufacturers to explore domestic sourcing partnerships and regional manufacturing hubs to mitigate cost pressures and ensure supply continuity. Value chain participants are adapting by redesigning supply networks, investing in local fabrication capabilities, and leveraging tariff exemptions for critical minerals, thereby reinforcing domestic resilience while maintaining momentum toward zero-emission aviation

Drawing Deep Insights from Technology, Range, Hydrogen Source, Aircraft Type, and End-Use Segmentation to Guide Strategic Decisions in Hydrogen Aviation

A nuanced examination of market segmentation reveals critical levers shaping hydrogen aircraft development and deployment. Propulsion technology is bifurcated into direct hydrogen combustion systems and hydrogen fuel cell powertrains, each with unique trade-offs in thrust density, noise profile, and emissions control. In operational scope, long-haul itineraries targeting transcontinental routes demand high-capacity cryogenic storage solutions, while medium-haul missions prioritize rapid refueling cycles and fuel cell efficiency. Conversely, short-haul regional and urban air mobility services leverage compact powertrains and gaseous hydrogen infrastructure to optimize turnaround times. From a hydrogen source perspective, gaseous hydrogen systems offer simpler refueling interfaces for light aircraft, whereas liquid hydrogen enables higher volumetric energy density essential for larger airframes. Aircraft type segmentation underscores the versatility of hydrogen propulsion across cargo freighters, military platforms, passenger jets, and unmanned aerial vehicles, each leveraging tailored powertrains to meet mission requirements. Finally, end-use distinctions illuminate strategic adoption pathways: commercial airlines seek emissions credits and brand differentiation, freight and logistics operators value operational cost stability and range extension, and defense agencies focus on silent operation and reduced thermal signatures, showcasing hydrogen’s breadth of application across diverse flight profiles

This comprehensive research report categorizes the Hydrogen Aircraft market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Wing Configuration

- Operation Mode

- Technology

- Hydrogen Source

- Range

- Passenger Capacity

- End User

Navigating Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Map Hydrogen Aircraft Adoption Pathways

Regional dynamics are emerging as pivotal drivers of hydrogen aircraft adoption, with each geography presenting distinct enablers and challenges. In the Americas, robust legislation such as the U.S. Inflation Reduction Act and Bipartisan Infrastructure Law has underpinned a burgeoning green hydrogen production pipeline, while targeted SBIR grants facilitate flight test programs for hydrogen-electric prototypes. This supportive environment has encouraged leading innovators to establish domestic manufacturing footprints and aviation partnerships. Across Europe, the Middle East, and Africa, carbon border adjustment mechanisms and substantial public investments in sustainable aviation fuels are fostering a parallel push to scale hydrogen fuel cell infrastructure. High-profile collaborations between aircraft OEMs and airport authorities are laying the groundwork for hydrogen hubs at key international gateways. In the Asia-Pacific region, national hydrogen strategies in Japan, South Korea, and Australia are prioritizing hydrogen ecosystem development, from production and storage to aircraft operations, spurring feasibility studies and memoranda of understanding at major airports. Governments in this region are coupling substantial public funding with streamlined regulations to position their aerospace industries at the forefront of zero-emission flight, thereby creating a globally competitive landscape for hydrogen aviation technology and services

This comprehensive research report examines key regions that drive the evolution of the Hydrogen Aircraft market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Incumbent Aerospace Firms Driving Hydrogen Propulsion Developments and Strategic Collaborations

Key players are defining the competitive horizon for hydrogen aircraft through strategic investments, partnerships, and advanced R&D pipelines. ZeroAvia has secured multiple SBIR grants to pair autonomous flight control systems with hydrogen-electric propulsion, advancing the certification of its ZA600 powertrain and expanding its patent portfolio for cryogenic management and fuel cell catalysts. Airbus remains a central force with its ZEROe program, showcasing 2 MW fuel cell demonstrators and forging alliances with MTU Aero Engines to accelerate propulsion system maturity, although it has adjusted its commercial service entry to the latter half of the 2030s in response to technological and infrastructure complexities. Rolls-Royce, in collaboration with easyJet, is nearing ground tests of its AE 2100 hydrogen combustion engine and pioneering liquid hydrogen pump technologies to enable mid-size aircraft operations by the mid-2030s. Meanwhile, Universal Hydrogen’s pioneering flight tests underscored the viability of modular conversion kits for regional turboprops, even as its insolvency highlights financial and market execution risks. Emerging innovators such as H2FLY, engaged by Japan Airlines to study powertrain integration, further enrich the ecosystem, signaling diversified pathways to scalable hydrogen aviation solutions

This comprehensive research report delivers an in-depth overview of the principal market players in the Hydrogen Aircraft market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AeroVironment, Inc.

- Airbus SAS

- APUS Zero Emission GmbH

- Beyond Aero

- Cummins Inc.

- Destinus Group BV

- Deutsche Aircraft GmbH

- Doosan Corporation

- Embraer S.A

- GE Aerospace

- GKN Aerospace Services Limited

- H3 Dynamics Holdings Pte. Ltd.

- Hanwha Corporation

- Honeywell International Inc.

- Intelligent Energy Limited

- Joby Aero, Inc.

- Kawasaki Heavy Industries, Ltd.

- MAGNIX USA, INC.

- MTU Aero Engines AG

- Piasecki Aircraft Corporation

- Pipistrel by Textron Inc.

- Plug Power Inc.

- Rolls-Royce plc

- RTX Corporation

- Safran Group

- Siemens AG

- Stellar Aircraft Inc.

- Stralis Aircraft Pty Ltd

- The Boeing Company

- Urban Aeronautics Ltd.

- ZeroAvia, Inc.

Strategic Imperatives and Collaborations to Accelerate Ecosystem Development and Operational Readiness for Hydrogen Aircraft Deployment

Industry leaders poised to capitalize on the hydrogen aviation transition should sharpen their strategic focus on several key imperatives. First, forging cross-industry alliances that span OEMs, engine manufacturers, airline operators, and infrastructure providers will accelerate ecosystem creation and regulatory harmonization. By pooling expertise and co-investing in shared test facilities, stakeholders can de-risk technical development and expedite certification processes. Second, diversifying supply chains to incorporate regional manufacturing and sourcing partners will mitigate the impact of tariff volatility and logistics disruptions, reinforcing resilience and cost containment. Third, actively engaging with policymakers to shape favorable financial incentives, carbon-border measures, and airworthiness standards will ensure that hydrogen aircraft benefit from sustained regulatory support. Fourth, investing in workforce development and pilots, technicians, and ground-crew training programs will build the human capital foundation required for safe, efficient operations. Lastly, aligning deployment strategies with target segments-regional operators for short-haul fuel cell aircraft, cargo carriers for combustion-powered platforms, and defense agencies for autonomous UAV applications-will optimize capital allocation and match technology readiness with market demand, positioning organizations for leadership in this transformative domain

Employing a Blended Primary and Secondary Research Approach to Deliver Comprehensive Insights on Hydrogen Aircraft Technologies and Market Dynamics

This research synthesizes insights from a multifaceted methodology designed to deliver rigorous, actionable intelligence. It integrates primary interviews with senior executives, engineers, and policymakers across the hydrogen and aviation sectors to capture firsthand perspectives on technological feasibility, infrastructure barriers, and commercial strategies. Secondary data analysis draws from patent databases, government policy documents, trade associations, and academic publications to quantify innovation trajectories and regulatory frameworks. Flight test and certification records were systematically reviewed to benchmark propulsion system performance and identify critical path milestones. Supply chain assessments leverage trade data and tariff schedules to evaluate cost dynamics and sourcing scenarios. Scenario modeling employed qualitative expert panels to explore market entry timing and adoption curves for different aircraft types. Finally, comparative case studies of pioneering programs, such as zero-emission demonstrators and airport hydrogen hub pilots, contextualize best practices and lessons learned. This blended approach ensures a comprehensive, evidence-based foundation for strategic planning in hydrogen-powered aviation

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hydrogen Aircraft market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hydrogen Aircraft Market, by Wing Configuration

- Hydrogen Aircraft Market, by Operation Mode

- Hydrogen Aircraft Market, by Technology

- Hydrogen Aircraft Market, by Hydrogen Source

- Hydrogen Aircraft Market, by Range

- Hydrogen Aircraft Market, by Passenger Capacity

- Hydrogen Aircraft Market, by End User

- Hydrogen Aircraft Market, by Region

- Hydrogen Aircraft Market, by Group

- Hydrogen Aircraft Market, by Country

- United States Hydrogen Aircraft Market

- China Hydrogen Aircraft Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Synthesizing Policy Momentum, Technological Advances, and Market Segmentation to Chart the Path Toward Commercial Hydrogen-Powered Flight Potentially Operational by the 2030s

Hydrogen propulsion stands at the cusp of transforming commercial and defense aviation by offering pathways to net-zero operational emissions, enhanced energy security, and novel mission capabilities. While challenges remain in scaling cryogenic logistics, achieving robust supply chains, and validating performance under regulatory scrutiny, the cumulative momentum of policy incentives, technological breakthroughs, and strategic collaborations underscores a credible roadmap toward viable hydrogen flight. Segmentation analysis highlights tailored avenues for technology deployment across mission profiles, while regional insights reveal differentiated adoption strategies informed by sovereign energy policies and infrastructure readiness. Leading firms and agile startups are now converging efforts to refine powertrains, secure airworthiness certifications, and pilot demonstration programs, laying the groundwork for the first commercial operations in the 2030s. By embracing a collaborative, resilient, and market-focused approach, industry participants can surmount current barriers and transition from experimental testbeds to mainstream operational fleets, ushering in an era of clean, efficient, and sustainable aviation

Unlock Exclusive Hydrogen Aircraft Market Intelligence by Engaging with Ketan Rohom to Propel Your Strategic Decision-Making

To explore deeper insights and obtain the comprehensive market research report on hydrogen aircraft, contact Ketan Rohom (Associate Director, Sales & Marketing) at 360iResearch today. This report offers unparalleled analysis, strategic assessments, and actionable intelligence to empower your organization’s decision-making in the rapidly evolving hydrogen aviation landscape. Don’t miss the opportunity to gain a competitive edge with data-driven insights and expert guidance; reach out now to secure your copy and propel your business toward zero-emission flight innovation.

- How big is the Hydrogen Aircraft Market?

- What is the Hydrogen Aircraft Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?