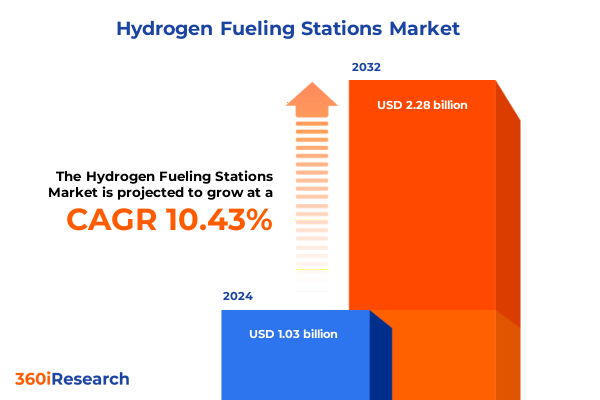

The Hydrogen Fueling Stations Market size was estimated at USD 1.13 billion in 2025 and expected to reach USD 1.24 billion in 2026, at a CAGR of 10.53% to reach USD 2.28 billion by 2032.

Discover the critical role of hydrogen fueling stations in driving the global decarbonization of transportation and unlocking new clean energy possibilities

Hydrogen fueling stations serve as the linchpin in the transition toward zero-emission transportation, providing the critical infrastructure necessary to support fuel cell electric vehicles (FCEVs) and unlock the full potential of clean energy pathways. As nations and automakers alike set ambitious decarbonization targets, these stations integrate renewable hydrogen production, advanced storage, and high-pressure dispensing technologies to enable rapid refueling and extend vehicle range. Public-private collaborations such as H2USA, launched by the U.S. Department of Energy alongside major automotive and technology stakeholders, underscore the collective efforts to address infrastructure challenges and accelerate station deployment nationwide. The growing global fleet of FCEVs, which surpassed 72,000 vehicles at the end of 2022 following a 40% year-over-year increase, highlights the imperative for a robust refueling network that can keep pace with rising demand.

Complementing fleet growth, strategic government initiatives are channeling significant investment into hydrogen infrastructure across multiple regions. Under the U.S. Energy Act, seven regional hydrogen hubs have been selected, collectively poised to channel more than $40 billion in public-private funding into production, distribution, and station networks by 2030. These efforts are mirrored by similar programs in Europe and Asia-Pacific, catalyzing the global expansion of station networks. As of early 2025, the number of publicly accessible hydrogen refueling stations worldwide has surpassed 1,200, with concentrations in Europe, Japan, South Korea, China, and North America, reflecting the accelerating pace of infrastructure growth.

Explore how rapid technological breakthroughs and public-private collaborations are reshaping hydrogen fueling infrastructure to enable zero-emission mobility

Digital transformation and data-driven operations are reshaping the hydrogen fueling station landscape, driving efficiency, reliability, and safety across the value chain. Advanced sensor networks and digital twins now monitor key station parameters-including pressure, temperature, and flow rates-in real time, enabling predictive maintenance and reducing unplanned downtime. Complementing this, AI-powered analytics forecast hydrogen demand patterns for diverse user segments, optimize supply logistics, and streamline inventory management, thereby minimizing operational costs and maximizing station uptime. Additionally, blockchain-enabled supply chain platforms are emerging to enhance traceability of green hydrogen credentials, ensuring end users can verify carbon intensity from production to pump, and reinforcing consumer confidence in hydrogen mobility.

Uncover the far-reaching consequences of recent United States tariffs on hydrogen fueling station equipment and how they are reshaping supply chains

Recent U.S. tariff measures on imported station components-such as high-pressure compressors, dispensing nozzles, and electrolyzer modules-have significantly elevated construction and equipment costs for hydrogen fueling projects. Tariffs ranging up to 25% on imported compressors and renewable energy inputs have translated into a 10%–15% increase in upfront capital expenditure, compelling developers to reassess project budgets and procurement strategies. These added costs can cascade through the value chain, potentially leading to higher hydrogen prices at the pump and affecting station profitability in price-sensitive markets.

Gain deep insights into how station types, pressure levels, production modes, technologies, and end users define diverse opportunities in hydrogen fueling infrastructure

A nuanced segmentation of the hydrogen fueling station market reveals distinct opportunities across multiple dimensions. When examining station types, gas hydrogen and liquid hydrogen offerings cater respectively to applications requiring high throughput or extended range, influencing site design and storage requirements. Pressure classifications-up to 350 bar versus up to 700 bar-determine vehicle compatibility, with lower pressures meeting heavy-duty vehicle needs and higher pressures tailored to passenger cars seeking rapid fill times. Operation mode segmentation contrasts off-site production with on-site production, the latter co-located with electrolyzers or reformers to reduce transport logistics and leverage renewable energy sources. Production technologies-spanning biomass gasification, water electrolysis, and steam methane reforming-impact the carbon intensity and cost structure of station operations. Finally, end-user segmentation underscores diverse demand drivers, ranging from commercial vehicles and material handling equipment to passenger cars and public transit fleets, each requiring tailored refueling strategies and service models.

This comprehensive research report categorizes the Hydrogen Fueling Stations market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Pressure Level

- Installation

- Supply Mode

- Capacity

- End User

Explore the unique hydrogen fueling infrastructure dynamics across the Americas, EMEA, and Asia-Pacific regions and their distinct growth drivers

Regional dynamics play a pivotal role in shaping hydrogen station deployment strategies. In the Americas, the U.S. federal government’s Inflation Reduction Act incentives and the H2USA public-private collaboration have propelled station build-out, with state-level grants further accelerating infrastructure growth along major freight and corridor routes. Canada’s complementary strategies emphasize clean hydrogen hubs tied to heavy-duty transportation and industrial applications. Across Europe, the Alternative Fuels Infrastructure Regulation mandates hydrogen refueling stations along key transport corridors, while consortia such as H2 MOBILITY Deutschland operate over 90 stations and plan continued expansion to support both light- and heavy-duty vehicle fleets. In Asia-Pacific, national hydrogen roadmaps-exemplified by China’s Medium- and Long-Term Plan targeting 1,000 stations by 2030 and substantial bus and truck fleet rollouts in South Korea and Japan-underscore a region-wide commitment to scaling refueling infrastructure alongside aggressive FCEV adoption.

This comprehensive research report examines key regions that drive the evolution of the Hydrogen Fueling Stations market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Discover how leading industry players are strategically partnering, innovating, and scaling hydrogen fueling station solutions to gain competitive advantage

Shell’s strategic pivot highlights the importance of aligning station deployment with market realities. After closing its light-duty hydrogen stations in California amid supply challenges, the energy major is reallocating resources toward heavy-duty corridors in Europe, including a hydrogen freight network spanning Rotterdam, Cologne, and Hamburg in partnership with Daimler Truck, with plans for 150 stations by 2030.

H2 MOBILITY Deutschland exemplifies consortium-based expansion, leveraging joint industry investment to manage over 90 stations across Germany. The group’s modular approach to 350-bar and 700-bar stations ensures compatibility with both passenger and commercial vehicles, and its roadmap targets several hundred stations aligned with EU corridor mandates.

Nel ASA continues to broaden its global footprint, securing orders for its H2Station™ equipment in Italy’s Bruneck site co-hosted with Alperia, slated to serve Olympic transport operations, as well as a 16-station framework agreement in California valued at over $24 million, illustrating the firm’s expanding presence in key markets.

Nikola Corporation has forged a ten-year partnership with FirstElement Fuel to develop a heavy-duty hydrogen refueling station in Oakland capable of servicing up to 200 trucks per day, marking the first HYLA station and signaling a broader strategy to deploy up to 60 stations in California ports and freight hubs.

Air Liquide’s deployment of high-capacity stations in Fukushima for large commercial vehicles and its role in multiple DOE hydrogen hubs underscore the company’s integrated approach to combining production, distribution, and infrastructure development to accelerate market adoption.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hydrogen Fueling Stations market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AIR LIQUIDE S.A.

- Air Products and Chemicals, Inc.

- Ally Hi-Tech Co.,Ltd.

- AW-Lake Company

- Ballard Power Systems Inc.

- Black & Veatch Holding Company

- China Petrochemical Corporation

- Cummins Inc.

- Dover Fueling Solutions

- FirstElement Fuel Inc.

- H2Tools

- Honda Motor Co., Ltd.

- HORIBA, Ltd.

- HYDROGEN REFUELING SOLUTIONS

- Hyundai Motor Company

- Ingersoll Rand Inc.

- ITM Power PLC

- Iwatani Corporation

- Linde plc

- Mahler AGS GmbH

- MAXIMATOR Hydrogen GmbH

- Nel ASA.

- Nikola Corporation

- Nuvera Fuel Cells, LLC by Hyster-Yale Group, Inc.

- Plug Power Inc.

- Shell plc

- TotalEnergies SE

- Toyota Motor Corporation

Implement pragmatic strategies to optimize hydrogen fueling through targeted partnerships, standardized operations, and innovative technology integration

Industry leaders should act decisively to capitalize on the hydrogen refueling opportunity. First, forging targeted partnerships across the value chain-linking vehicle OEMs, energy producers, and station operators-can streamline project execution and leverage shared expertise, as demonstrated by Shell’s European corridor initiative and Nikola’s collaboration with FirstElement Fuel. Second, standardizing station interfaces and operational protocols will reduce technical barriers, enhance interoperability, and foster user confidence, drawing lessons from the open refueling standards defined by the H2Accelerate consortium. Third, investing in advanced digital tools-such as AI-driven demand forecasting, predictive maintenance platforms, and blockchain-based certification systems-will optimize capacity utilization and ensure consistent performance across dispersed station networks. Lastly, localizing manufacturing of key components, including compressors and electrolyzer modules, can mitigate tariff pressures and strengthen supply chain resilience while tapping into government incentives aimed at domestic production.

Understand the rigorous research methodology, data triangulation, and stakeholder engagement that underpin this comprehensive hydrogen fueling station analysis

This analysis integrates primary and secondary research methodologies to ensure robust and balanced insights. Secondary data collection involved an extensive review of public policy documents, government announcements-including the DOE’s H2USA and Hydrogen Hubs program-and industry consortium releases. Company case studies were sourced from press releases and leading energy and mobility publications, with data triangulated against independent media reports. Primary research comprised interviews with infrastructure developers, OEM engineers, and end-user fleet managers to validate market drivers, challenges, and adoption timelines. Quality control measures included cross-referencing data points, scenario testing of tariff impacts, and peer reviews by sector experts to ensure analytical rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hydrogen Fueling Stations market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hydrogen Fueling Stations Market, by Type

- Hydrogen Fueling Stations Market, by Pressure Level

- Hydrogen Fueling Stations Market, by Installation

- Hydrogen Fueling Stations Market, by Supply Mode

- Hydrogen Fueling Stations Market, by Capacity

- Hydrogen Fueling Stations Market, by End User

- Hydrogen Fueling Stations Market, by Region

- Hydrogen Fueling Stations Market, by Group

- Hydrogen Fueling Stations Market, by Country

- United States Hydrogen Fueling Stations Market

- China Hydrogen Fueling Stations Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Summarize the hydrogen fueling station market dynamics, technological evolution, regulatory impacts, segmentation insights, regional trends, and strategic priorities

The hydrogen fueling station landscape is evolving at an unprecedented pace, driven by technological innovation, supportive policy frameworks, and strategic industry collaborations. Digitalization and AI are delivering unprecedented operational efficiencies, while tariff dynamics are reshaping supply chain strategies and incentivizing domestic manufacturing. Segmentation analysis reveals tailored opportunities across station types, pressure levels, production technologies, and end-user applications. Regional outlooks highlight the Americas’ hub-driven growth, Europe’s corridor expansion, and Asia-Pacific’s aggressive station targets. Leading companies are forging innovative partnerships, optimizing station designs, and scaling deployments to capture emerging demand. By adopting standardized protocols, localizing key component production, and leveraging data-driven operations, industry stakeholders can navigate market complexities and drive the hydrogen mobility revolution forward.

Engage directly with Ketan Rohom to secure your comprehensive hydrogen fueling station market research report and empower your strategic decision-making process

If you’re ready to transform your strategic approach to hydrogen fueling infrastructure, engage directly with Ketan Rohom to secure your comprehensive hydrogen fueling station market research report and empower your decision-making with data-driven insights

- How big is the Hydrogen Fueling Stations Market?

- What is the Hydrogen Fueling Stations Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?