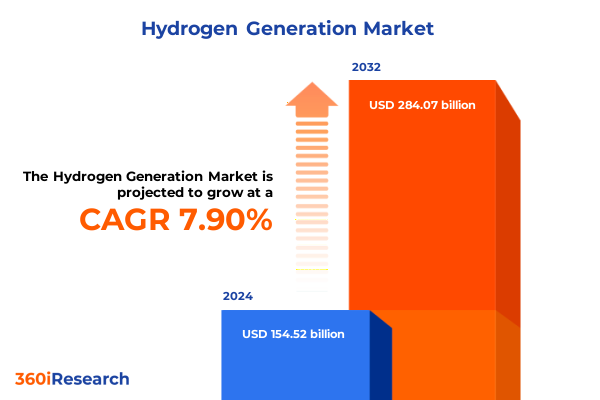

The Hydrogen Generation Market size was estimated at USD 165.82 billion in 2025 and expected to reach USD 178.29 billion in 2026, at a CAGR of 7.99% to reach USD 284.07 billion by 2032.

Introduction: Setting the Stage for Hydrogen Generation Innovation Amid a Renewables-Driven Energy Transition and Decarbonization Imperative

Hydrogen has rapidly emerged as a cornerstone of the global energy transition, offering a versatile vector to decarbonize hard-to-abate sectors and enable flexible storage of intermittent renewable power. In recent years, heightened climate commitments, technological breakthroughs, and burgeoning cross-industry collaborations have propelled hydrogen from niche demonstration projects to large-scale deployment. With governments and corporations pledging net-zero targets by mid-century, hydrogen’s appeal spans applications from heavy transport to industrial feedstocks, making it an indispensable element of future low-carbon energy systems.

Against this backdrop, industry and policy stakeholders face complex decisions on which production pathways, feedstocks, and end-use integrations to prioritize. The multiplicity of hydrogen types-ranging from fossil-based blue hydrogen coupled with carbon capture, to truly zero-emission green hydrogen produced via renewable-powered electrolysis-underscores the need for strategic clarity. This executive summary synthesizes the pivotal dynamics shaping hydrogen generation, offering decision-makers a concise yet comprehensive view of market drivers, regulatory interventions, segmentation insights, and actionable recommendations essential for navigating this transformative energy frontier.

Overview of the Transformative Forces Reshaping Hydrogen Generation Markets Through Policy, Technological Innovation, and Cost Reduction Dynamics

Emerging policy frameworks and global commitments have acted as catalysts for unprecedented momentum in hydrogen generation. Legislative measures, such as incentives for electrolyzer deployment and credits for low-carbon hydrogen use, are reshaping capital allocation across the energy and industrial sectors. Coupled with multilateral partnerships and regional hydrogen alliances, these regulatory shifts are driving a realignment of supply chains, stimulating investment in pilot zones, and accelerating roadmap targets for commercial-scale green hydrogen corridors.

Simultaneously, technological advancements continue to redefine cost curves and performance benchmarks. Breakthroughs in membrane materials, catalyst design, and process intensification have yielded efficiency gains in electrolytic and thermochemical production methods. At the same time, digitalization and data analytics are enabling predictive maintenance and operational optimization, further driving down levelized costs. As economies of scale materialize in renewable power generation and electrolyzer manufacturing, a virtuous cycle of innovation and deployment is emerging, solidifying hydrogen’s role as a bedrock of decarbonized energy systems.

Analyzing the Cumulative Consequences of United States Tariff Measures Enacted in 2025 on the Hydrogen Generation Supply Chain and Cost Structures

In 2025, a suite of tariff measures introduced by the United States has markedly influenced the hydrogen generation supply chain and cost structures. Targeted duties on imported electrolyzer components, high-grade steel used for storage vessels, and critical catalyst materials have elevated landed equipment costs and prompted companies to reassess procurement strategies. These impositions, designed to shield domestic manufacturers and promote local content, have created both headwinds and opportunities for stakeholders across the value chain.

On one hand, the heightened cost of key imports has temporarily inflated project capex, delaying certain green hydrogen initiatives and challenging price competitiveness against incumbent grey hydrogen. On the other hand, policy-driven localization is catalyzing investment in domestic production of electrolyzer modules and balance-of-plant equipment, thereby fostering supply chain resilience. Over the medium term, these dynamics are expected to underpin the growth of a robust domestic manufacturing base, even as stakeholders navigate near-term cost pressures and realign sourcing footprints in response to evolving trade policies.

Deep Dive into Market Segmentation Revealing Distinct Opportunities Across Hydrogen Types, Production Methods, and Industry Applications

Hydrogen market dynamics are profoundly shaped by the diversity of available production pathways and end-use applications. The segmentation based on hydrogen types reveals that blue hydrogen remains a transitional bridge, leveraging existing natural gas infrastructure with carbon capture to reduce CO₂ intensity, while green hydrogen-generated through renewable-powered electrolysis-witnesses accelerating adoption thanks to shrinking electrolyzer costs and expanding renewable capacity. Grey hydrogen, produced from unabated fossil feedstocks, continues to serve as a baseline for comparison but faces mounting regulatory and carbon pricing pressures.

Disaggregating by production method exposes varying maturity levels and deployment trajectories; electrolytic processes are leading the charge as commercial-scale projects scale up, and thermochemical routes are gaining traction where geothermal or concentrated solar heat is readily available. Biological methods and direct solar water splitting, while promising for certain geographies, remain in demonstration phases. Looking through the lens of source, fossil-fuel-based hydrogen persists in established markets, whereas renewable sources-especially wind- and solar-driven electrolysis-are rapidly becoming the focal point of new investments. Further segmentation of products underscores that hydrogen fuel cells are achieving broader mobility and stationary power adoption, hydrogen generators are integral to industrial off-grid applications, and storage tanks play a critical role in enabling seasonal buffer and peak-shaving strategies. Lastly, mapping applications across ammonia production, energy storage and grid injection, methanol synthesis, petroleum refining, and power generation highlights the broad spectrum of demand drivers, while end-user industry analysis shows that chemical manufacturers, energy and utilities companies, oil and gas operators, and transportation providers are each forging distinct hydrogen agendas to meet sustainability and operational objectives.

This comprehensive research report categorizes the Hydrogen Generation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Production Method

- Source

- Product

- Application

- End-User Industry

Key Regional Insights Exposing Divergent Growth Drivers, Policy Frameworks, and Infrastructure Development across Global Hydrogen Markets

Regional trajectories in hydrogen development display pronounced variation, driven by local policy frameworks, resource endowments, and infrastructure maturity. In the Americas, a combination of federal incentives, state-level hydrogen hubs, and sustained oil and gas expertise is fostering a hybrid ecosystem where blue and green hydrogen projects coexist, and where strategic partnerships between traditional energy firms and technology innovators are redefining industrial clusters.

In Europe, Middle East, and Africa, ambitious decarbonization targets and cross-border green hydrogen alliances are reshaping energy trade flows. Europe’s extensive pipeline of offshore wind capacity positions it as a future exporter, while Gulf nations leverage abundant solar resources to pursue large-scale green hydrogen production for both domestic use and international markets. Conversely, Africa’s potential remains nascent but significant, with pilot projects demonstrating the viability of solar-driven electrolysis in remote communities.

Asia-Pacific stands out for its policy-driven appetite and rapid infrastructure rollout. Countries such as Australia and Japan are accelerating export-oriented green hydrogen production, while South Korean and Chinese firms are investing heavily in domestic electrolyzer manufacturing and offtake partnerships. Collectively, the region’s integrated supply chains, robust manufacturing ecosystems, and strategic government directives are underpinning an ambitious hydrogen roadmap that is poised to influence global market balances.

This comprehensive research report examines key regions that drive the evolution of the Hydrogen Generation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Highlighting Competitive Strategies, Technological Portfolios, and Partnerships Advancing Hydrogen Generation

A focused review of leading organizations reveals varied competitive strategies in the hydrogen generation arena. Major players are pursuing technology leadership through proprietary electrolyzer and catalyst R&D, while simultaneously forging alliances with utilities, renewable developers, and industrial end users to secure long-term offtake and streamline project execution. Strategic joint ventures and consortium memberships are widespread, aimed at sharing risk and aggregating the scale required for cost-effective deployment.

In parallel, several fast-growing newcomers are leveraging specialized capabilities in areas such as fuel cell integration, digital process optimization, and materials innovation to carve out niche segments. These agile entrants often collaborate with established industrial gas companies, accelerating their path to commercialization. Across the board, a relentless focus on improving operational efficiency, reducing lifecycle emissions, and advancing circular economy principles indicates a maturing competitive landscape where differentiation is driven by sustainability credentials as much as technical performance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hydrogen Generation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- Ally Hi-Tech Co., Ltd.

- AquaHydrex, Inc.

- Ballard Power Systems Inc.

- Caloric Anlagenbau GmbH

- Casale SA

- Claind S.r.l.

- Cummins Inc.

- Enapter S.r.l.

- ErreDue SpA

- FuelCell Energy, Inc.

- Hiringa Energy Limited

- HyGear

- Hyster-Yale Materials Handling, Inc.

- Iwatani Corporation

- Linde PLC

- Mahler AGS GmbH by by BME Group

- McPhy Energy S.A.

- Messer Se & Co. KGaA

- Nel ASA

- NewHydrogen, Inc.

- Nippon Sanso Holdings Corporation

- Parker Hannifin Corporation

- Plug Power Inc.

- Teledyne Energy Systems, Inc.

- Xebec Adsorption Inc.

Actionable Strategic Recommendations Empowering Industry Leaders to Navigate Technological, Regulatory, and Market Complexities in Hydrogen Generation

To capitalize on the accelerating hydrogen opportunity, executives should prioritize strategic investments in renewable-based production and domestic manufacturing capabilities. Strengthening upstream partnerships with renewable energy developers will mitigate exposure to volatile power markets, while engaging proactively with policymakers can secure incentives and favorable regulatory frameworks. Forward-looking organizations should also embed circular economy thinking by exploring carbon capture integration for blue hydrogen and valorizing byproducts from production processes.

Moreover, fostering cross-industry consortia will be critical for addressing common infrastructure challenges such as pipeline networks and standardized fueling protocols. Companies that invest early in digital twins, predictive analytics, and modular system architectures will unlock operational efficiencies and rapidly iterate on technological improvements. Finally, aligning corporate sustainability goals with tangible hydrogen use cases in heavy transport, grid balancing, and industrial feedstocks will ensure that hydrogen strategies deliver measurable emissions reductions and robust economic returns.

Research Methodology Outlining Comprehensive Data Collection, Multi-Tiered Validation, and Expert Engagement Techniques Underpinning the Analysis

This analysis is grounded in a rigorous research approach combining comprehensive secondary data review, expert interviews, and primary market surveys. Initial desk research encompassed publicly available material from industry associations, academic journals, patent databases, and government publications to establish a foundational understanding of hydrogen technologies and policies. This was followed by structured interviews with executive-level stakeholders across the value chain, including equipment manufacturers, electrolyzer suppliers, energy utilities, and end-user corporations.

Data triangulation techniques were applied to synthesize insights from quantitative and qualitative inputs, ensuring consistency and resolving divergences between sources. The segmentation framework and regional evaluation were validated through consultation with technical specialists and policy analysts, while iterative peer review sessions refined the final narratives. This multi-tiered methodology ensures that the findings presented here accurately reflect both current market realities and emerging trends within the hydrogen generation domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hydrogen Generation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hydrogen Generation Market, by Type

- Hydrogen Generation Market, by Production Method

- Hydrogen Generation Market, by Source

- Hydrogen Generation Market, by Product

- Hydrogen Generation Market, by Application

- Hydrogen Generation Market, by End-User Industry

- Hydrogen Generation Market, by Region

- Hydrogen Generation Market, by Group

- Hydrogen Generation Market, by Country

- United States Hydrogen Generation Market

- China Hydrogen Generation Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Conclusion Synthesizing Key Findings and Underscoring the Critical Role of Hydrogen Generation in Achieving Energy Transition and Sustainability Goals

The hydrogen generation sector stands at a pivotal juncture, characterized by rapid policy evolution, breakthrough technology maturation, and evolving competitive dynamics. As the world strives to meet stringent decarbonization targets, hydrogen’s multifunctional role across industrial feedstocks, power systems, and mobility applications is becoming increasingly vital. The convergence of cost declines in electrolyzers, scaling renewable capacities, and supportive regulatory regimes is creating a fertile environment for both established industry players and innovative entrants.

However, challenges remain, including the need for standardized safety protocols, harmonized certification schemes for low-carbon hydrogen, and robust infrastructure development to connect production hubs with demand centers. Navigating these complexities will require strategic agility, cross-sector collaboration, and a commitment to continuous innovation. Stakeholders that proactively align technology investments with emerging policy frameworks and end-user requirements will be best positioned to capture the transformative potential of hydrogen generation in the path to net-zero.

Drive Your Strategic Decisions Forward Today by Accessing the Comprehensive Hydrogen Generation Market Research Report with Our Senior Sales Expert

To explore the full depth of insights into market structures, competitive positioning, and emerging opportunities across the hydrogen generation landscape, connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure immediate access to the comprehensive report. Engaging directly will ensure you receive tailored guidance on how the findings can be applied within your organization’s strategic planning and investment roadmap. Don’t miss the chance to arm your leadership team with the data-driven intelligence needed to navigate evolving policies, technological innovations, and dynamic supply chains-reach out today to transform market intelligence into decisive action.

- How big is the Hydrogen Generation Market?

- What is the Hydrogen Generation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?