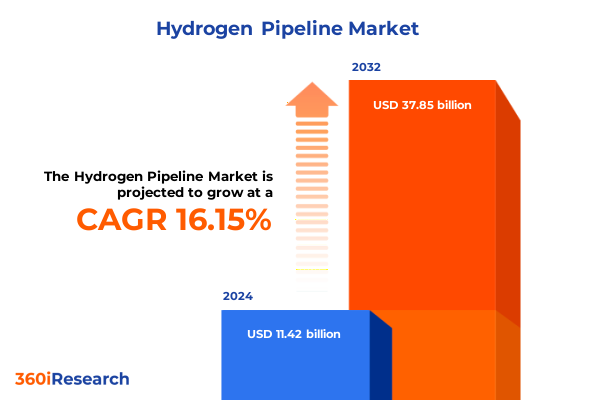

The Hydrogen Pipeline Market size was estimated at USD 13.21 billion in 2025 and expected to reach USD 15.29 billion in 2026, at a CAGR of 16.21% to reach USD 37.85 billion by 2032.

Setting the Stage for a New Era in Hydrogen Pipeline Infrastructure Emphasizing Innovation Modernization and Decarbonization Imperatives

The transition to a low-carbon economy places hydrogen pipeline infrastructure at the forefront of global energy transformations, as it serves as the lifeline for transporting one of the most versatile and cleanest energy carriers. Modernizing existing networks while expanding new corridors is critical to unlocking the potential of hydrogen across sectors such as industrial processing, power generation, and transportation. Stakeholders are now converging around the imperative to reinforce safety protocols, integrate advanced materials, and enhance operational efficiencies, creating a fertile landscape for technological innovation and strategic investment.

Against this backdrop, understanding the multifaceted elements that shape the hydrogen pipeline environment becomes paramount. From evolving regulatory mandates and competitive pressures to the emergence of next-generation sensor technologies and digital twins, each factor interplays to redefine infrastructure priorities. This executive summary distills the key drivers and challenges that will guide decision-makers in aligning their portfolios with sustainability targets while mitigating supply chain complexities. By weaving together policy analyses, technological profiles, and market segmentation insights, the narrative offers a cohesive overview designed to inform executive-level strategy and catalyze meaningful action in 2025.

Revolutionary Developments and Emerging Technologies Reshaping the Hydrogen Pipeline Landscape to Accelerate Sustainability and Operational Efficiency

Over the past two years, the hydrogen pipeline sector has undergone transformative shifts driven by a convergence of strategic policy objectives and breakthroughs in materials science. Novel polymer–metal composite linings have emerged to address embrittlement concerns previously hindering high-pressure transport, enabling operators to contemplate longer transmission loops and bidirectional flows. Concurrently, the adoption of digital monitoring platforms leveraging machine learning algorithms has shifted maintenance paradigms from calendar-based inspections to predictive interventions, thus reducing downtime while extending asset life.

Moreover, electrification trends in adjacent industries are reinforcing hydrogen’s role as a balancing medium for renewable power integration. Power-to-gas facilities are now routinely coupling electrolysis units with grid-scale storage to absorb renewable surplus, thereby demanding more flexible pipeline networks that can accommodate variable injection and withdrawal rates. This evolution has spurred collaborative demonstration projects spanning cross-border corridors, highlighting the strategic role of international standardization bodies in aligning safety and interoperability protocols. Through these converging developments, the hydrogen pipeline landscape is embarking on a new chapter where innovation and digitalization converge to drive supply security and environmental stewardship.

Assessing the Combined Effect of 2025 United States Tariffs on Hydrogen Pipeline Projects Supply Chains and Industry Competitiveness

In 2025, the United States imposed a series of targeted tariffs on imported steel pipe and specialized compressor units critical for hydrogen transport infrastructure. These measures were introduced to safeguard domestic producers and stimulate onshore manufacturing, but they have also generated repercussions along the hydrogen value chain. While domestic mills have ramped production to meet rising demand, the increased input costs for composite blend materials and high-grade alloys have fed through to project budgets, prompting developers to re-evaluate sourcing strategies and contract terms.

Furthermore, the tariff framework has reshaped competitive dynamics among equipment vendors. International players with localized production facilities have adapted by channeling investments into U.S. fabrication sites, altering supply chain footprints and fostering new joint ventures. At the same time, certain end users have explored modular skidded solutions assembled domestically to circumvent tariff exposure. Although these adaptations introduce additional logistical considerations, they also present an opportunity to enhance transparency and resilience in the long run. Ultimately, the 2025 tariffs have catalyzed a recalibration of procurement strategies, emphasizing cost-efficiency without compromising on technical specifications or regulatory compliance.

Synthesizing Deep-Dive Segmentation Findings Across End Use Pipeline Type Material Pressure Rating and Diameter Range in the Hydrogen Pipeline Market

A granular examination of end use applications reveals the intricate tapestry of hydrogen pipeline demand drivers. Fertilizer production, anchored by ammonia synthesis processes, necessitates dedicated lines optimized for ultra-pure feed streams, while fuel cell station deployments for road transport and stationary applications prioritize modular pipeline loops and rapid-connect assemblies. In petrochemical contexts, pipelines serve dual functions for ammonia and methanol synthesis feedstocks, demanding compatibility with varied pressure and purity thresholds. Conversely, power generation nodes employing combined cycle turbines and fuel cell systems require flexible flow capacities to align with grid stabilization roles. Within refining operations, hydrocracking and hydrotreating units depend on high-integrity pipeline segments resistant to corrosion and frequent pressure cycling.

From the perspective of pipeline typologies, distribution networks underpin industrial parks and urban fueling corridors, whereas gathering systems funnel hydrogen from production hubs in upstream and midstream zones. Transmission arteries, segmented by high, medium, or low pressure, form the backbone for long-haul transfers and cross-regional interconnectivity. Material composition further differentiates the market, with carbon steel remaining predominant for cost-sensitive segments, while composite laminates and stainless steel find favor in high-pressure or purity-sensitive applications. Pressure rating distinctions drive design rigor, with high-pressure pipelines demanding robust weld protocols and real-time monitoring. Meanwhile, diameter range considerations-from small, skid-mounted loops to large, trunk lines-dictate installation methodologies and flow dynamics across the network.

This comprehensive research report categorizes the Hydrogen Pipeline market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pipeline Type

- Material

- Pressure Rating

- Diameter Range

- End Use

Unveiling Regional Dynamics and Strategic Drivers Influencing Hydrogen Pipeline Deployment Across the Americas Europe Middle East Africa and Asia Pacific

Regional disparities in hydrogen pipeline expansion reflect the interplay of policy momentum, infrastructure readiness, and stakeholder collaboration. In the Americas, ambitious federal funding initiatives and state-level incentives have catalyzed pilot corridors linking production clusters in the Gulf Coast with mid-continent storage facilities. Cross-sector alliances are forging ahead to address permitting bottlenecks and integrate renewable hydrogen into existing natural gas grids, illustrating the region’s pragmatic transition strategy.

Across Europe, the Middle East, and Africa, regulatory roadmaps such as the European Hydrogen Backbone initiative and emerging green hydrogen hubs in North Africa are fostering transnational pipeline networks. This region’s strategic emphasis on decarbonizing heavy industries has accelerated the deployment of composite-lined transmission mains, while sovereign wealth fund investments are underwriting major demonstration projects. Collaborative governance structures ensure alignment on safety standards and tariff frameworks.

Meanwhile, in Asia-Pacific markets, government-driven electrification programs in Japan and South Korea are coupling electrolyzer installations with dedicated domestic pipeline loops. China’s robust manufacturing ecosystem continues to supply critical pipeline components, but local authorities are increasingly mandating advanced steel grades and real-time leak detection systems. The region’s vast geography necessitates a tiered approach, balancing large-diameter trunk lines with localized distribution spurs to reach remote industrial centers.

This comprehensive research report examines key regions that drive the evolution of the Hydrogen Pipeline market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Their Strategic Initiatives Collaborations and Technological Advancements Shaping the Hydrogen Pipeline Ecosystem

A cadre of established engineering firms and specialized equipment vendors is spearheading advancements in hydrogen pipeline infrastructure. These organizations are investing in next-generation welding techniques, sensor-integrated pigging solutions, and advanced coatings designed to mitigate hydrogen-induced cracking. Strategic partnerships between pipeline operators and technology startups are yielding modular compressor designs, leveraging additive manufacturing to reduce lead times and enhance part customization.

Competitors are also differentiating through service offerings, bundling feasibility assessments with digital asset management platforms that facilitate remote inspections and data-driven maintenance planning. Collaboration agreements with research institutions are underpinning the development of novel non-destructive testing methods, aiming to certify long-duration operations under fluctuating pressure regimes. Meanwhile, consortium-driven initiatives are standardizing interface protocols for supervisory control and data acquisition systems, enabling cross-vendor interoperability and streamlined data exchange across heterogeneous networks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hydrogen Pipeline market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Products and Chemicals, Inc.

- Approtium

- ArcelorMittal S.A.

- Cenergy Holdings S.A. by Viohalco S.A.

- China National Petroleum Corporation

- China Petrochemical Corporation

- DNV AS

- Enbridge Inc.

- Engie Group

- Equinor ASA

- Exxon Mobil Corporation

- Gassco AS

- Georg Fischer Piping Systems Ltd.

- H2 Clipper, Inc.

- Hexagon Purus ASA

- Howden Group Limited by Chart Industries, Inc.

- JFE Steel Corporation

- John Wood Group PLC

- Linde PLC

- L’Air Liquide S.A

- Mannesmann Line Pipe GmbH by Salzgitter AG

- N.V. Nederlandse Gasunie

- NovoHydrogen

- Nowega GmbH

- NPROXX B.V.

- Open Grid Europe GmbH

- Pipelife International GmbH

- ROSEN Swiss AG

- Smartpipe Technologies

- SoluForce B.V.

- Southern California Gas Company by Sempra Energy

- Strohm B.V.

- Tata Steel Limited

- Tenaris S.A.

- The Pipe Line Development Company

- The Williams Companies, Inc.

- thyssenkrupp AG

- TotalEnergies SE

- TÜV SÜD AG

- Welspun Corp Ltd.

Actionable Strategic Directions for Industry Leaders to Navigate Market Complexity Innovate and Capitalize on Growth Opportunities in Hydrogen Infrastructure

Leaders in the hydrogen pipeline arena should prioritize end-to-end digitalization, integrating real-time analytics with asset management to preemptively address integrity threats and optimize throughput. Strengthening supplier diversification strategies will mitigate exposure to geopolitical shifts in tariff policies while fostering competitive pricing on materials and equipment. Embracing modular construction approaches can accelerate project timelines, reduce capital outlays, and enhance the scalability of pipeline loops across different pressure and diameter classifications.

Furthermore, proactive engagement with regulatory bodies will be essential to shape harmonized safety standards, permitting processes, and incentive structures. By participating in industry consortia and standardization committees, organizations can influence policy frameworks and gain early visibility into compliance trajectories. Finally, cultivating cross-sector partnerships-spanning power producers, petrochemical corporations, and transport operators-will unlock integrated hydrogen ecosystems, enabling load balancing, demand aggregation, and optimized use of shared pipeline assets.

Detailing the Rigorous Research Design Data Collection Methods and Analytical Framework Employed to Ensure Precision and Credibility in the Hydrogen Pipeline Study

This research employed a multi-layered design combining primary interviews with senior executives from pipeline operators, equipment manufacturers, and regulatory agencies, alongside secondary data gathering from technical journals, policy white papers, and industry databases. A rigorous screening process ensured the validity of insights, with multiple rounds of data triangulation conducted to reconcile discrepancies between reported capacities and operator disclosures.

Quantitative analysis was augmented by scenario planning exercises to explore the implications of tariff variations, material cost fluctuations, and evolving policy levers. Qualitative evaluations incorporated technology readiness assessments and supply chain risk matrices, enabling a holistic understanding of innovation adoption barriers. Throughout the study, strict adherence to ethical guidelines and confidentiality protocols was maintained, ensuring stakeholder trust and data integrity. The resulting framework delivers a comprehensive perspective on pipeline infrastructure dynamics without reliance on proprietary projections or undisclosed financial metrics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hydrogen Pipeline market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hydrogen Pipeline Market, by Pipeline Type

- Hydrogen Pipeline Market, by Material

- Hydrogen Pipeline Market, by Pressure Rating

- Hydrogen Pipeline Market, by Diameter Range

- Hydrogen Pipeline Market, by End Use

- Hydrogen Pipeline Market, by Region

- Hydrogen Pipeline Market, by Group

- Hydrogen Pipeline Market, by Country

- United States Hydrogen Pipeline Market

- China Hydrogen Pipeline Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Concluding Insights That Synthesize Key Learnings From Market Dynamics Technological Innovations and Policy Impacts Driving Hydrogen Pipeline Progress

In closing, the hydrogen pipeline landscape stands at a pivotal juncture, propelled by technological breakthroughs, policy incentives, and evolving market structures. The integration of advanced materials, digital monitoring, and modular construction techniques is redefining pipeline design, while targeted tariffs are reshaping supply chain architectures. Segmentation analysis highlights the distinct requirements across end uses, pipeline types, materials, pressure ratings, and diameter ranges, underscoring the importance of tailored strategies. Regional insights reveal a mosaic of deployment models, each driven by unique regulatory and economic drivers. Against this dynamic backdrop, companies that excel in collaboration, innovation, and adaptive procurement will position themselves at the vanguard of the energy transition. As stakeholders chart their paths forward, the ability to synthesize these multidimensional insights will separate visionary leaders from the rest of the field.

Take the Next Step With Associate Director Ketan Rohom to Secure Exclusive Access to Comprehensive Hydrogen Pipeline Market Intelligence

Are you ready to transform the way your organization approaches hydrogen infrastructure? Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored solutions that will empower your strategic planning and decision-making. By securing this comprehensive market intelligence, you will gain unrivaled insights into segmentation nuances, regional dynamics, policy impacts, and competitive strategies, all meticulously analyzed to drive your growth objectives in 2025 and beyond. Reach out to Ketan today to arrange a personalized briefing, discuss customized packages, and embark on a data-driven journey toward hydrogen pipeline excellence.

- How big is the Hydrogen Pipeline Market?

- What is the Hydrogen Pipeline Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?