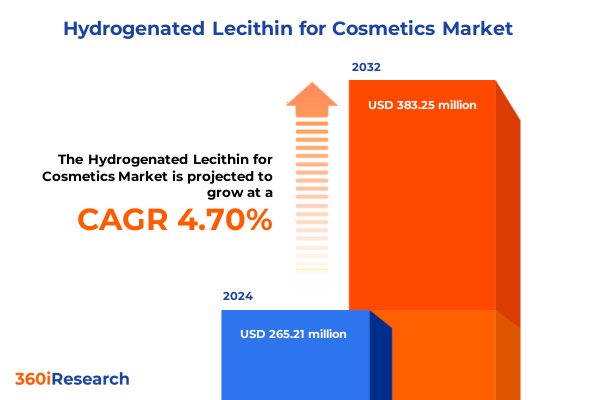

The Hydrogenated Lecithin for Cosmetics Market size was estimated at USD 266.57 million in 2025 and expected to reach USD 281.00 million in 2026, at a CAGR of 5.32% to reach USD 383.25 million by 2032.

Unveiling the Strategic Importance of Hydrogenated Lecithin in Modern Cosmetic Formulations and Emerging Trends Shaping Future Product Development

Hydrogenated lecithin has emerged as a pivotal ingredient in cosmetic science, revered for its exceptional emulsifying capabilities and skin-friendly properties. Derived from natural lecithin sources through a precise hydrogenation process, this ingredient enhances formulation stability and sensory attributes, imparting a smooth, uniform texture to a broad spectrum of personal care products. As brands strive to differentiate their offerings in an increasingly competitive landscape, hydrogenated lecithin serves as a versatile component, enabling novel delivery systems for active ingredients while reinforcing product claims around skin nourishment and barrier support.

In addition to its formulation advantages, hydrogenated lecithin aligns with the rising consumer demand for ingredients that blend efficacy with safety. Its compatibility with both oil-in-water and water-in-oil systems unlocks opportunities for innovative color cosmetics, hair care, skin care, and sun care products. Moreover, the ingredient’s natural origin and biocompatibility resonate with an expanding audience of eco-conscious consumers. Consequently, manufacturers are increasingly integrating hydrogenated lecithin to enhance product performance, accelerate development timelines, and meet evolving regulatory and consumer expectations in the global cosmetic arena.

Navigating Transformative Industry Shifts: How Sustainability, Green Chemistry, and Consumer Expectations Are Reshaping Hydrogenated Lecithin Applications

The hydrogenated lecithin landscape is undergoing transformative change as sustainability, green chemistry, and shifting consumer preferences converge to redefine formulation strategies. Brands are progressively moving away from synthetic stabilizers, driven by rigorous regulatory frameworks and heightened public scrutiny of ingredient provenance. This shift has accelerated investment in hydrogenation technologies that optimize purity levels and reduce solvent usage, thereby minimizing environmental footprints across the supply chain.

Furthermore, the influence of conscious consumerism has prompted cosmetic formulators to seek multifunctional ingredients that deliver both sensory appeal and demonstrable skin benefits. In response, researchers have fine-tuned hydrogenation parameters to yield lecithin variants with tailored hydrophilic-lipophilic balance, enhancing compatibility with novel actives and encapsulation platforms. Digital innovation, including predictive modeling and real-time monitoring, has further expedited these developments, allowing manufacturers to rapidly iterate on formulations while adhering to stringent quality controls. As a result, hydrogenated lecithin is now recognized not merely as an emulsifier, but as a strategic enabler of next-generation cosmetic experiences.

Assessing the Cumulative Impact of United States 2025 Tariff Regulations on Hydrogenated Lecithin Supply Chains and Formulation Strategies

The introduction of revised tariff regulations by the United States in early 2025 has created significant ripples across the hydrogenated lecithin supply chain. With increased duties on imported lecithin-derived ingredients, domestic producers and cosmetic manufacturers have faced mounting cost pressures. These additional financial burdens have prompted industry players to reevaluate sourcing strategies, exploring partnerships with local oilseed processors and investing in vertical integration to ensure supply continuity.

Consequently, formulation teams have been driven to adjust ingredient mixes, seeking alternative lipid-based emulsifiers to mitigate cost escalation while preserving product performance. Many R&D departments have accelerated efforts to optimize hydrogenation processes in-house, reducing reliance on external suppliers. At the same time, some companies have leveraged the tariff context as an opportunity to advocate for innovation incentives, engaging with trade associations and regulatory bodies to secure support for sustainable hydrogenation projects. The net effect has been a more resilient, diversified supply ecosystem, in which cost volatility is tempered by regional sourcing and enhanced process efficiency.

Unlocking Market Potential Through Deep Segmentation Analysis Across Diverse Applications, End Uses, Product Types, Formulations, and Distribution Channels

Market segmentation in the hydrogenated lecithin arena reveals differentiated usage patterns driven by application categories including color cosmetics, hair care, skin care, and sun care, where each segment leverages the ingredient’s ability to stabilize emulsions and enhance delivery of active compounds. Color cosmetic formulators prize hydrogenated lecithin for its capacity to impart a velvety texture, while hair care developers integrate it for improved scalp compatibility and conditioning properties. In skin care, its barrier-supporting attributes are harnessed in serums and moisturizers, whereas sun care specialists exploit its emulsifying strength to ensure uniform UV filter dispersion.

End-use industries further distinguish between consumer and professional channels, with consumer brands typically emphasizing multifunctional benefits and clean-label positioning, and professional-grade offerings focusing on higher concentration formulas validated through clinical studies. Product type segmentation extends to fractionated variants characterized by high and low hydrophilic–lipophilic balance values, enabling formulators to tailor oil–water ratios for specific textures and release profiles. High-purity grades, available in cosmetic and pharmaceutical classifications, address stringent safety and regulatory requirements, while standard grades offer broad-spectrum utility for cost-effective formulations.

Form-driven market segmentation differentiates granule, liquid, and powder forms, each suited to distinct manufacturing workflows and equipment. Granules offer ease of handling and precise dosing; liquid forms integrate seamlessly in continuous production lines; and powders facilitate dry blending. Distribution channels span offline hypermarkets, pharmacies, and specialty stores, where consumers seek in-person consultation, alongside online brand websites and e-commerce retailers that cater to digital-savvy shoppers seeking convenience and direct engagement with manufacturers.

This comprehensive research report categorizes the Hydrogenated Lecithin for Cosmetics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Application

- End Use Industry

- Distribution Channel

Comparative Regional Dynamics in the Americas, Europe Middle East & Africa, and Asia-Pacific Shaping Hydrogenated Lecithin Adoption and Growth Patterns

In the Americas, robust raw material availability from North and South American oilseed producers has underpinned a competitive hydrogenated lecithin manufacturing base. Producers in this region have capitalized on advanced refining infrastructure, aligning with consumer demand for sustainable ingredients. Meanwhile, regulatory frameworks emphasize transparency and safety, prompting manufacturers to adopt voluntary certifications that reinforce market credibility. As a result, the Americas have emerged as both a leading production hub and a key consumption market for novel lecithin variants.

Across Europe, the Middle East, and Africa, stringent regulatory standards such as the European Union’s cosmetic ingredient directives have spurred investment in high-purity, pharmaceutical-grade lecithin. Sustainability mandates and circular economy initiatives have driven R&D toward bio-based solvent alternatives and energy-efficient hydrogenation methods. Consumer preferences in this region favor premium, clean-label formulations, creating fertile ground for specialized hydrogenated lecithin products that meet the most rigorous safety and environmental benchmarks.

In the Asia-Pacific, rapid growth in personal care spending and the rising influence of K-beauty and J-beauty trends have accentuated the demand for innovative emollient systems. Local manufacturers are augmenting production capacity, often through joint ventures with global technology providers, to service expansive domestic and export markets. Additionally, heightening awareness of natural and eco-friendly ingredients has encouraged formulators to position hydrogenated lecithin as a core component in both mass-market and prestige cosmetic portfolios.

This comprehensive research report examines key regions that drive the evolution of the Hydrogenated Lecithin for Cosmetics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Driving Competitive Advantage in Hydrogenated Lecithin Manufacturing and Supply

Key players in the hydrogenated lecithin sector have distinguished themselves through strategic investments in technology and sustainability. Leading global suppliers have expanded their portfolios via acquisitions of specialized hydrogenation facilities, securing proprietary process patents that enhance purity levels and broaden the HLB range. Others have entered collaborative research partnerships with universities and biotech firms to pioneer enzymatic hydrogenation techniques that minimize solvent usage and energy consumption.

Several companies have also differentiated through forward integration initiatives, establishing dedicated cosmetic labs to offer co-development services, thereby accelerating time-to-market for brand partners. Strategic alliances with raw material growers have ensured secured supply chains, enabling just-in-time production models that mitigate inventory risk. Moreover, the roll-out of digital platforms has facilitated real-time quality tracking and batch-level traceability, reinforcing customer confidence in ingredient provenance and consistency.

Competitive positioning further hinges on value-added services such as educational workshops and regulatory support, designed to help clients navigate evolving compliance landscapes. Through these multifaceted approaches, leading hydrogenated lecithin manufacturers have successfully created high barriers to entry, sustainability credentials, and innovation pipelines that underpin long-term market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hydrogenated Lecithin for Cosmetics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AllyOrganic

- American Lecithin Company, LLC

- Archer-Daniels-Midland Company

- BASF SE

- Cargill, Incorporated

- Conscientia Industrial Co., Ltd.

- Croda International Plc

- Evonik Industries AG

- Guangzhou Hisoya Biological Science and Technology Co., Ltd.

- Huateng Pharmaceutical Co., Ltd.

- Kewpie Corporation

- Lecico GmbH

- Lipoid GmbH

- Lucas Meyer Cosmetics

- Lucas Meyer Cosmetics, Inc.

- NIKKO CHEMICALS Co., Ltd.

- Sensient Technologies Corporation

- Shankar Nutricon Pvt., Ltd.

- Vantage Specialty Chemicals, Inc.

- Zhengzhou Jiuyi Time New Materials Co., Ltd.

Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Challenges in the Hydrogenated Lecithin Market

Industry leaders seeking to harness the full potential of hydrogenated lecithin should first prioritize establishing transparent, sustainable supply chains. By collaborating directly with oilseed growers and incentivizing green hydrogenation practices, companies can secure preferential access to high-quality lecithin and reduce exposure to raw material price fluctuations. Furthermore, investing in in-house research capabilities-particularly in enzymatic and solvent-less hydrogenation-will help maintain a competitive edge as environmental regulations tighten globally.

Next, producers and brands alike should develop tailored lecithin grades that address niche formulation needs, such as ultra-low HLB for advanced encapsulation systems or pharmaceutical-grade purity for dermaceutical applications. Co-creation models, where formulators and ingredient suppliers innovate in tandem, can accelerate product development cycles and yield differentiated end products. In parallel, it is imperative to leverage digital tools for supply chain transparency, batch-level traceability, and consumer engagement, amplifying trust in ingredient integrity.

Finally, organizations should expand their presence in high-growth regions by forging joint ventures or licensing agreements with local manufacturers. These partnerships can facilitate market entry and ensure regulatory compliance, while also enabling the adaptation of lecithin grades to regional preferences and formulation traditions. By executing these strategic initiatives, industry stakeholders can capitalize on emerging opportunities, mitigate risk, and drive sustained growth in the dynamic cosmetics landscape.

Research Methodology Employed to Ensure Robust Data Collection, Expert Validation, and Comprehensive Analysis of the Hydrogenated Lecithin Cosmetic Landscape

This research draws upon a rigorous methodology designed to ensure comprehensive coverage and robust validation. Primary data was collected through in-depth interviews with cosmetic formulators, procurement executives, and research and development specialists, providing firsthand insights into current formulation trends and sourcing challenges. Secondary research involved a detailed review of industry publications, patent filings, and regulatory dossiers, ensuring that the analysis reflects both historical developments and the latest regulatory changes.

Data triangulation was employed to cross-verify findings, combining quantitative indicators such as import-export records and production capacity data with qualitative intelligence gathered from expert panels. Market segmentation analysis used a layered approach, mapping application areas, end-use verticals, product types, forms, and distribution channels to elucidate nuanced patterns of ingredient utilization. Quality assurance protocols included peer review by industry veterans and periodic updates to incorporate emerging technologies and policy shifts.

Together, these methodological pillars guarantee that the insights presented are not only current but also deeply anchored in empirical evidence and subject-matter expertise. This rigorous framework enables stakeholders to make informed strategic decisions grounded in the most reliable data available.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hydrogenated Lecithin for Cosmetics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hydrogenated Lecithin for Cosmetics Market, by Product Type

- Hydrogenated Lecithin for Cosmetics Market, by Form

- Hydrogenated Lecithin for Cosmetics Market, by Application

- Hydrogenated Lecithin for Cosmetics Market, by End Use Industry

- Hydrogenated Lecithin for Cosmetics Market, by Distribution Channel

- Hydrogenated Lecithin for Cosmetics Market, by Region

- Hydrogenated Lecithin for Cosmetics Market, by Group

- Hydrogenated Lecithin for Cosmetics Market, by Country

- United States Hydrogenated Lecithin for Cosmetics Market

- China Hydrogenated Lecithin for Cosmetics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Insights on the Strategic Role of Hydrogenated Lecithin and Future Considerations for Stakeholders in Cosmetic Innovation

Throughout this executive summary, hydrogenated lecithin has been highlighted as a vital ingredient shaping the future of cosmetic formulations. Its multifaceted benefits, from emulsification and texture enhancement to skin compatibility and stability, underscore its strategic value. The industry is navigating significant shifts-driven by sustainability imperatives, regulatory changes, and evolving consumer preferences-that together amplify the need for sophisticated hydrogenation processes and diversified supply chains.

Segmentation insights reveal that value creation spans multiple application areas, end-use channels, and product forms, each presenting distinct development pathways. Regional dynamics further delineate opportunities and challenges, as producers calibrate offerings to meet localized standards and consumer tastes. Meanwhile, competitive landscapes are defined by technological leadership, strategic integrations, and service-oriented partnerships.

In conclusion, stakeholders equipped with a deep understanding of the hydrogenated lecithin ecosystem-spanning tariff impacts, segmentation strategies, regional trends, and company initiatives-will be best positioned to drive innovation and secure sustainable growth. By translating these insights into concrete actions, industry leaders can not only adapt to present market conditions but also chart a course for long-term success in the ever-evolving cosmetics sector.

Act Now to Unlock Exclusive Hydrogenated Lecithin Market Intelligence and Connect with Ketan Rohom for Personalized Insights and Report Purchase

To explore the full depth of strategic insights and technical expertise surrounding hydrogenated lecithin and its burgeoning role in cosmetic innovation, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan brings extensive experience in guiding decision-makers through complex ingredient landscapes and can provide personalized advice on how this research can inform your product development and market entry strategies.

By partnering with Ketan Rohom, you will gain access to comprehensive data, expert analyses, and actionable recommendations tailored to your organization’s unique needs. Secure your copy of the complete market research report today and empower your team with the critical intelligence required to stay ahead of industry shifts. Connect directly with Ketan to discuss custom consultancy options and licensing arrangements that ensure you leverage this report to its fullest potential.

- How big is the Hydrogenated Lecithin for Cosmetics Market?

- What is the Hydrogenated Lecithin for Cosmetics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?