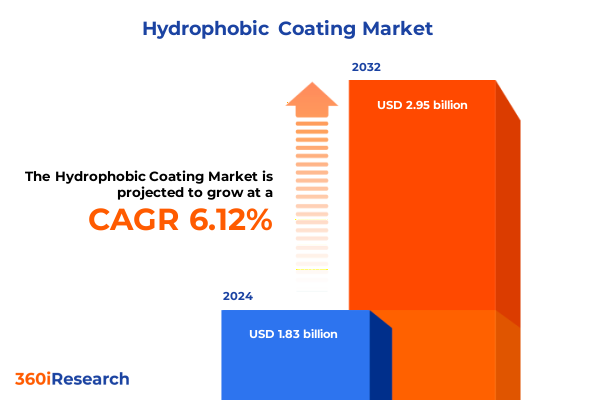

The Hydrophobic Coating Market size was estimated at USD 1.92 billion in 2025 and expected to reach USD 2.01 billion in 2026, at a CAGR of 6.35% to reach USD 2.95 billion by 2032.

Unveiling the Power of Hydrophobic Coatings in Modern Industries Through Cutting-Edge Chemistry and Surface Science Innovations

Hydrophobic coatings represent a groundbreaking evolution in surface protection technologies, harnessing advanced chemistry to repel water and contaminants from a wide range of substrates. By leveraging materials science breakthroughs, these coatings create surfaces that maintain cleanliness, resist corrosion, and extend the service life of critical components. Through a combination of molecular engineering and nanoscale formulation, modern hydrophobic solutions deliver performance that was once considered unattainable, enabling enterprises to solve longstanding challenges across multiple industries.

Amid rapid adoption, hydrophobic coatings are redefining approaches to maintenance, sustainability, and efficiency. Industries such as automotive, electronics, construction, and healthcare are embracing these innovations to achieve lower operational costs and improved product reliability. As enterprises navigate tightening regulatory standards and escalating performance expectations, hydrophobic technologies emerge as a strategic enabler of competitive differentiation. Consequently, decision-makers are prioritizing these coatings within their materials roadmaps and capital planning cycles.

This executive summary offers a concise yet comprehensive introduction to the hydrophobic coating landscape, spotlighting the key market drivers, technological advancements, and strategic imperatives that will shape future trajectories. It serves to orient leaders to the transformative potential of hydrophobic surface treatments and to frame the in-depth analyses presented in subsequent sections.

Navigating Transformative Shifts in Surface Protection with Emerging Materials, Regulation, and Sustainability Trends

Over recent years, the hydrophobic coating landscape has undergone profound transformations fueled by technological breakthroughs, evolving regulatory frameworks, and shifting customer demands. Advanced nanoparticle systems and fluoropolymer formulations have supplanted legacy approaches, delivering unprecedented durability and performance under extreme environmental conditions. At the same time, sustainability concerns are driving research into eco-friendly chemistries, prompting companies to explore bio-based silanes and water-borne siloxanes that minimize environmental impact without compromising efficacy.

Simultaneously, regulatory agencies around the world have begun to scrutinize per- and polyfluoroalkyl substances, spurring industry participants to innovate toward low-PFAS alternatives. This regulatory impetus has accelerated collaborations between specialty chemical innovators and end users, fostering cross-sector partnerships that expedite product qualification and market entry. Moreover, the rise of digital characterization tools and predictive modeling has enhanced formulation development, enabling rapid iteration and optimization at a fraction of the former time and cost.

Consequently, the hydrophobic coating ecosystem is experiencing a paradigm shift in which agility, sustainability, and performance converge. Organizations are reevaluating their material selection criteria, supplier relationships, and R&D priorities to align with these transformative forces. In doing so, they are laying the groundwork for next-generation coatings that will redefine industry benchmarks and unlock new application horizons.

Assessing the Cumulative Impact of 2025 United States Tariff Adjustments on Hydrophobic Coating Supply Chains and Competitiveness

The United States tariff adjustments implemented in early 2025 have exerted a multifaceted influence on the hydrophobic coating supply chain, reshaping procurement strategies and competitive dynamics. Heightened duties on select fluoropolymer imports have elevated input costs for manufacturers, compelling procurement teams to diversify their supplier bases and to explore regional sourcing alternatives. At the same time, downstream industries have faced margin pressures that underscore the need for leaner operational models and value-added service offerings.

Amid these trade headwinds, several coating producers have responded by localizing manufacturing capabilities within North America, forging joint ventures and licensing agreements to mitigate tariff exposure. These strategic moves have not only streamlined logistics but have also fostered deeper collaboration between formulators and OEMs, accelerating product development cycles. Moreover, the tariff environment has catalyzed investment in alternative chemistries; companies are actively testing nanoparticle-based and silane-driven formulations that fall outside of the higher-duty classifications.

As organizations adapt to the evolving trade landscape, resilience emerges as a defining attribute of competitive advantage. Forward-thinking stakeholders are establishing flexible supply chain architectures, integrating real-time analytics to anticipate trade policy shifts, and reinforcing relationships with domestic chemical producers. By embracing adaptive sourcing strategies and aligning with tariff-exempt technologies, industry leaders are safeguarding profitability and positioning themselves to capitalize on future market expansions.

Gaining Key Insights into Hydrophobic Coating Markets through Multifaceted Technology, Application, and Channel Segmentation Analysis

The hydrophobic coating market is characterized by diverse technology platforms that serve a wide array of performance needs. Fluoropolymer systems anchored by FEP, PFA, and PTFE deliver unmatched chemical resistance, while silica and titanium dioxide nanoparticles offer tunable surface textures for superhydrophobic effects. Silanes, including alkyl and functional variants, enable low-surface-energy films with versatile adhesion properties, and siloxanes such as methyl phenyl and polydimethyl siloxane balance flexibility with water repellency. These technology distinctions inform R&D priorities, application engineering, and supplier selection across industry verticals.

Coating type segmentation further delineates market dynamics between permanent treatments, valued for their long-term durability, and removable solutions that permit periodic renewal or replacement. End-use segmentation unveils distinct adoption patterns among automotive OEMs-where commercial and passenger vehicle applications demand high abrasion resistance-and construction players that differentiate offerings across commercial, infrastructure, and residential projects. In the electronics sector, consumer gadget producers prioritize thin-film anti-fogging coatings, while industrial electronics manufacturers focus on anti-corrosion and self-cleaning functionality to ensure uptime.

Healthcare users, spanning hospital supplies and medical devices, adhere to stringent biocompatibility standards and leverage anti-fogging and antimicrobial enhancements as competitive differentiators. Marine operators of commercial vessels and recreational watercraft require anti-fouling and anti-icing properties to optimize fuel efficiency and reduce maintenance. Textile processors in apparel and home furnishings exploit self-cleaning finishes to elevate brand value and user convenience. Across all these segments, application needs for anti-corrosion, anti-fogging, anti-fouling, anti-icing, and self-cleaning drive product roadmaps. Sales channels, including direct, distributor, and online models, further shape market reach and customer engagement strategies.

This comprehensive research report categorizes the Hydrophobic Coating market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Coating Type

- End Use

- Application

- Sales Channel

Uncovering Regional Dynamics Shaping Hydrophobic Coating Adoption Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics exert a profound influence on hydrophobic coating demand patterns and growth trajectories. In the Americas, robust manufacturing infrastructure and stringent environmental regulations have spurred uptake of eco-compliant formulations, with major OEM clusters in the United States and Brazil driving high-value applications in automotive and aerospace. Meanwhile, the Middle East and Africa region balances rapid infrastructure development with water scarcity concerns, creating demand for anti-corrosion and self-cleaning coatings in desalination plants, oil refineries, and urban construction projects.

Asia-Pacific remains the largest consumer region, driven by expansive electronics manufacturing hubs in China, South Korea, and Taiwan, where anti-fogging and self-cleaning coatings on consumer devices have become de facto standards. At the same time, infrastructure expansion across India and Southeast Asia has created a lucrative market for anti-corrosion and anti-icing treatments in power generation and transportation sectors. Importantly, regional policymakers in several Asia-Pacific nations are tightening regulations on PFAS materials, fueling the shift toward silane-based and nanoparticle-reinforced alternatives.

Collectively, these regional insights underscore the importance of tailoring product portfolios, compliance strategies, and go-to-market models to local market characteristics. Organizations that align R&D roadmaps with regional end-user needs, regulatory environments, and supply chain realities will be best positioned to capture emerging opportunities and to foster sustainable growth across global markets.

This comprehensive research report examines key regions that drive the evolution of the Hydrophobic Coating market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Industry Titans Shaping the Future of Hydrophobic Coatings with Strategic Partnerships and R&D Investments

The hydrophobic coating space features a competitive landscape driven by a mix of global chemical majors, specialty formulators, and agile start-ups. Leading players are investing heavily in green chemistry initiatives, strategic acquisitions, and co-development partnerships to fortify their product portfolios. For example, several established suppliers have expanded their nanocoating divisions through targeted R&D alliances, obtaining exclusive rights to proprietary silicon-based technologies that enhance performance while mitigating regulatory risk.

At the same time, pure-play innovators are differentiating through digital applications, offering IoT-enabled coating services that monitor surface health in real time. This integration of smart sensors with hydrophobic treatments exemplifies a broader industry move toward predictive maintenance and outcome-based service models. Meanwhile, cross-industry collaborations between coating manufacturers and OEMs are proliferating, reflecting a consensus that early integration of hydrophobic solutions can deliver both product performance gains and cost efficiencies.

Mergers and partnerships have also reshaped competitive dynamics: market participants are consolidating complementary capabilities to expand geographic reach and technology depth. Through these strategic maneuvers, companies are forging integrated supply networks, aligning formulation expertise with application-engineering resources to serve complex end clients more effectively. As a result, the competitive arena has shifted from a traditional supplier-buyer relationship to a more collaborative ecosystem focused on co-innovation and shared value creation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hydrophobic Coating market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Abrisa Technologies, Inc.

- Akzo Nobel N.V.

- Axalta Coating Systems Ltd.

- BASF SE

- Chemische Werke Kluthe GmbH

- Cytonix Corporation

- DryWired, Inc.

- Endura Manufacturing Company Ltd

- GVD Corporation

- Hempel A/S

- Kansai Paint Co., Ltd

- Lotus Leaf Coatings, Inc.

- NanoSlic Smart Coatings

- NAONIX srl

- NEI Corporation

- NeverWet LLC

- Nippon Paint Holdings Co., Ltd

- PPG Industries, Inc.

- RPM International Inc.

- SilcoTek Corporation

- The Sherwin-Williams Company

Driving Actionable Strategies for Industry Leaders to Capitalize on Hydrophobic Coating Opportunities and Mitigate Market Challenges

Industry leaders should adopt a multi-pronged strategy to capitalize on evolving hydrophobic coating dynamics. First, accelerating R&D investments in low-PFAS and bio-based chemistries will ensure compliance and sustainability, while also meeting rising customer expectations for green solutions. Simultaneously, expanding collaboration with equipment manufacturers and end users can fast-track product validation, enabling rapid scale-up and reducing time to market. In parallel, establishing flexible supply chain structures-encompassing both domestic and regional manufacturing hubs-will mitigate trade-related risks and optimize logistics costs.

Moreover, leaders should explore digital service models that link hydrophobic performance metrics to predictive analytics, creating opportunities for subscription-based maintenance offerings and recurring revenue streams. This shift toward outcome-oriented value propositions can deepen customer engagement and unlock new competitive differentiation. Furthermore, companies must continuously monitor global regulatory landscapes-particularly emerging restrictions on fluorinated chemistries-to anticipate policy changes and adapt formulation platforms accordingly.

Finally, robust talent development programs are critical to sustain innovation momentum. By cultivating cross-functional teams with expertise in surface science, data analytics, and sustainability, organizations will be better equipped to navigate future technology inflection points. Through these actionable steps, industry leaders can fortify their market positions, drive long-term growth, and shape the next generation of hydrophobic coating applications.

Detailing Rigorous Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Expert Validation for Reliable Insights

This research draws on a rigorous methodology that integrates primary interviews, secondary data, and expert validation to ensure comprehensive and reliable insights. Primary research included in-depth interviews with C-level executives, strategic procurement officers, and R&D leaders across key industries. These discussions provided firsthand perspectives on technology adoption, regulatory impacts, and emerging use cases, forming the bedrock of this analysis.

Secondary research encompassed a systematic review of technical journals, patent filings, industry conference proceedings, and regulatory publications. This enabled the identification of breakthrough materials, patenting trends, and policy drivers shaping the hydrophobic coating landscape. Data triangulation techniques were applied to cross-verify findings from multiple sources, ensuring consistency and accuracy in capturing market dynamics.

Expert validation rounds involved consultations with academic researchers specializing in surface science, senior application engineers at OEMs, and regulatory analysts. Their feedback refined our segmentation framework, clarified regional nuances, and validated strategic recommendations. Throughout the process, quality assurance measures-such as cross-reference checks and peer reviews-were employed to maintain analytical rigor and objectivity. This robust approach underpins the strategic insights and conclusions presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hydrophobic Coating market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hydrophobic Coating Market, by Technology

- Hydrophobic Coating Market, by Coating Type

- Hydrophobic Coating Market, by End Use

- Hydrophobic Coating Market, by Application

- Hydrophobic Coating Market, by Sales Channel

- Hydrophobic Coating Market, by Region

- Hydrophobic Coating Market, by Group

- Hydrophobic Coating Market, by Country

- United States Hydrophobic Coating Market

- China Hydrophobic Coating Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Key Findings to Highlight the Strategic Imperatives for Stakeholders in the Hydrophobic Coating Ecosystem

In synthesizing the key findings, it becomes clear that hydrophobic coatings are at the nexus of performance innovation and sustainability imperatives. Technological differentiation-spanning fluoropolymers, nanoparticles, silanes, and siloxanes-underscores the need for specialized formulation strategies aligned with distinct end-use demands. Concurrently, trade policies and regional regulatory shifts are reshaping supply chain architectures and compelling diversification of sourcing models.

Moreover, the competitive landscape is evolving toward co-innovation partnerships, digital service integration, and outcome-based value propositions, reflecting a broader shift from transactional supplier relationships to collaborative ecosystems. Regional disparities in adoption rates and regulatory environments further highlight the importance of tailoring product and go-to-market strategies to local market contexts. Against this backdrop, actionable recommendations centered on sustainable chemistry, flexible manufacturing, digital services, and talent development emerge as strategic imperatives.

Ultimately, organizations that embrace adaptive R&D roadmaps, responsive supply chain configurations, and customer-centric service models will lead the next wave of hydrophobic coating applications. By leveraging the insights contained in this report, stakeholders can make informed decisions that drive innovation, mitigate risk, and capture the full potential of this transformative market.

Connect with Ketan Rohom to Secure Comprehensive Hydrophobic Coating Market Intelligence and Strategic Guidance

To explore the comprehensive insights, detailed analyses, and strategic guidance contained in the full hydrophobic coating report, interested organizations and decision-makers are invited to reach out and connect directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Through a personalized consultation, you can uncover how the market intelligence, competitive benchmarking, and actionable recommendations align with your growth objectives and innovation roadmaps. Engage with Ketan to secure immediate access to proprietary data, in-depth case studies, and tailored advisory services designed to accelerate your competitive advantage. Position your enterprise at the forefront of hydrophobic coating technology by leveraging expert guidance, market foresight, and a collaborative partnership with our research team. Begin shaping your future strategy today by contacting Ketan Rohom for more information on purchasing the complete market research report and unlocking the full potential of hydrophobic surface engineering.

- How big is the Hydrophobic Coating Market?

- What is the Hydrophobic Coating Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?