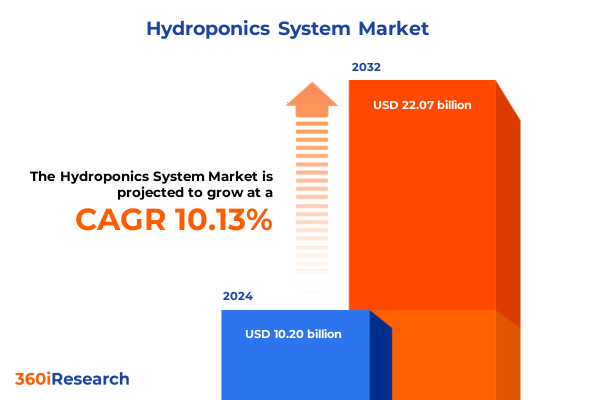

The Hydroponics System Market size was estimated at USD 11.17 billion in 2025 and expected to reach USD 12.26 billion in 2026, at a CAGR of 10.20% to reach USD 22.07 billion by 2032.

Discover How Innovative Soilless Cultivation Methods Are Set to Transform Food Production and Drive Sustainable Growth Across Global Agriculture

Hydroponics has swiftly emerged as a pivotal force in modern agriculture, reshaping traditional cultivation paradigms by enabling precise resource management and year-round production. As water scarcity and arable land constraints become increasingly critical, hydroponic systems offer an unparalleled solution that decouples crop output from soil dependency while minimizing environmental footprint. This shift has accelerated adoption by commercial growers seeking consistent yields, by urban farmers maximizing limited space, and by research institutions exploring novel plant varieties. Consequently, an in-depth comprehension of hydroponics market dynamics is essential for stakeholders aiming to align with sustainability objectives and capitalize on technological advancements.

This executive summary synthesizes key findings on how hydroponic cultivation is redefining food security frameworks, driving investments in controlled environment agriculture, and enabling circular economy practices. It outlines transformative trends, assesses policy and tariff implications, and delivers strategic segmentation and regional perspectives. By presenting a concise yet comprehensive overview, this introduction equips decision-makers with the foundational context necessary to navigate emerging opportunities and anticipate disruptive innovations within the hydroponics ecosystem.

Witness the Era of Smart Soilless Farming Where Advanced Controls and Digital Intelligence Propel Hydroponics into Commercial Mainstream

In recent years, hydroponics has transitioned from niche experimentation to mainstream adoption, propelled by advances in environmental controls and digital integration. Sophisticated HVAC and irrigation technologies now enable precise manipulation of temperature, humidity, and nutrient delivery, ensuring optimal plant performance and lower energy consumption. Concurrently, LED grow lighting has evolved to deliver customizable light spectra that enhance photosynthetic efficiency while reducing operational costs. These engineering breakthroughs have attracted a new wave of agritech investors, catalyzing further improvements in system scalability and reliability.

Moreover, the integration of data analytics and remote monitoring platforms has created an ecosystem of smart farming solutions. Growers can now leverage IoT sensors and AI-powered dashboards to predict crop health, optimize nutrient recipes, and automate labor-intensive tasks. This digital transformation has not only amplified productivity but also fortified traceability and quality assurance, an attribute increasingly demanded by premium markets. Together, these technological and operational shifts are redefining the hydroponics landscape, enabling a transition from experimental prototype farms to robust, commercially viable enterprises.

Analyze the Far-Reaching Consequences of America’s 2025 Tariff Adjustments on Hydroponic Cultivation Systems and Associated Supply Chains

In 2025, the implementation of adjusted tariffs on agricultural imports and equipment has introduced a new variable into the hydroponics supply chain. The imposition of higher duties on key components such as specialized LED fixtures, nutrient formulations, and irrigation modules has elevated input costs for domestic producers. As a result, growers and system integrators are reevaluating sourcing strategies, seeking to balance quality mandates with cost containment imperatives. Some have responded by fostering closer partnerships with local manufacturers to mitigate exposure to cross-border levies, while others have accelerated diversification across alternative suppliers in tariff-exempt regions.

Beyond direct equipment costs, ancillary impacts have reverberated through distribution networks, affecting transportation lead times and inventory planning. The cumulative burden of these measures has spurred industry dialogue around potential tariff relief, with several trade associations advocating for targeted exemptions on environmentally beneficial technologies. Despite these headwinds, the sector has demonstrated adaptive resilience, employing modular design principles and standardized interfaces to facilitate interchangeability and reduce dependency on tariff-sensitive imports. This strategic agility underscores the industry’s capacity to maintain growth trajectories even amid evolving trade policy dynamics.

Uncover How Multi-Dimensional Segmentation of Components, System Types, Crop Varieties, Cultivation Areas, and Applications Yields Strategic Market Insights

A nuanced examination of system components reveals critical value levers within the hydroponics market. Environmental control systems encompass climate regulation through HVAC installations, advanced irrigation engineering, targeted LED lighting solutions, and efficient material handling processes, each contributing to optimized plant habitats. In parallel, the selection of growing media-ranging from coco fiber and perlite blends to rockwool substrates-remains central to root zone aeration and moisture retention strategies. Nutrient solutions, formulated to precise pH and electrical conductivity parameters, drive plant health and yield consistency.

Turning to system typology, aggregate approaches such as ebb and flow configurations and wick-based assemblies cater to smaller scale or modular deployments, while liquid systems including aeroponics, deep water culture applications, drip automation, and nutrient film technique installations serve high-density commercial operations. Crop type segmentation highlights differential adoption rates across ornamental flowering varieties, fruit cultivation cycles, herb propagation, and leafy vegetable production, each with distinct environmental and nutrient profile requirements. Furthermore, facility footprints vary from compact, sub-1000 square foot residential setups to multi-acre industrial greenhouses exceeding 50,000 square feet, influencing infrastructure choices and energy management tactics. Within this diverse landscape, commercial farms, research institutions, and urban growers leverage tailored applications to align with their specific performance, quality, and sustainability targets.

This comprehensive research report categorizes the Hydroponics System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Type

- Crop Type

- Crop Area

- Application

Explore How Distinct Regional Drivers and Policy Frameworks in the Americas, EMEA, and Asia-Pacific Shape Hydroponic Cultivation Adoption

Geographically, the Americas region continues to spearhead adoption, driven by robust venture capital investments and a favorable regulatory climate that incentivizes sustainable food production. Pioneering projects in North American urban centers have demonstrated the feasibility of decentralized supply models, reducing farm-to-consumer transit times and associated carbon emissions. In Latin America, government-backed pilot programs are integrating hydroponic modules into agri-extension services, expanding outreach to smallholder farmers and community cooperatives.

Meanwhile, Europe, the Middle East, and Africa present a mosaic of opportunity and challenge. European initiatives prioritize energy efficiency and circular water reuse schemes, supported by stringent environmental standards. In the Gulf Cooperation Council, strategic food security mandates have triggered significant investment in controlled environment agriculture facilities, while parts of Africa are utilizing mobile hydroponic units to enhance resilience in remote regions. Across these markets, cross-border collaborations and public-private partnerships have been instrumental in scaling infrastructure and knowledge transfer.

In Asia-Pacific, rapid urbanization and land scarcity have catalyzed aggressive deployment of rooftop farms and vertical stacking systems. Japan’s precision agriculture research institutes continue to pioneer sensor-based cultivation, while Southeast Asian food conglomerates partner with technology providers to localize nutrient formulations for tropical crops. Australia’s water-stressed landscapes have also embraced hydroponics as a hedge against drought, reinforcing the region’s role as a testbed for resource-efficient farming models.

This comprehensive research report examines key regions that drive the evolution of the Hydroponics System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examine How Leading Innovators and System Integrators Are Driving Differentiation Through Advanced Portfolios, Sustainable Solutions, and Integrated Services

Leading technology innovators and system integrators have cemented their positions through diversified portfolios and ongoing research collaborations. State-of-the-art environmental control suppliers continue to refine climate orchestration platforms, integrating renewable energy inputs and advanced recirculation methods. Meanwhile, specialty media producers are exploring biodegradable substrate alternatives to reduce end-of-cycle waste, aligning with circular economy objectives.

Concurrently, nutrient specialists are investing heavily in custom-engineered formulations optimized for specific crop cycles, leveraging precision dosing technologies to enhance resource efficiency. A second cohort of companies is deploying turnkey solution packages that bundle hardware, software, and agronomic support into subscription-based models, lowering adoption barriers for emerging urban farmers. Additionally, consortiums of academia and industry partners have formed innovation hubs to accelerate automation in seeding, transplanting, and harvest processes. Collectively, these efforts underscore a competitive landscape where product differentiation and service excellence remain primary pillars of strategic growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hydroponics System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agromatic Corporation Pty Ltd

- Alien Hydroponics by Black Dog Horticulture Technologies & Consulting

- American Hydroponics, Inc.

- Arable

- Atlas Scientific, LLC

- Avisomo AS.

- Babylon Micro-Farms Inc.

- CropKing Incorporated

- Croppico LLP

- CubicFarm Systems Corp.

- Denso Corporation

- Eden Grow Systems Inc.

- Engineering Services & Products Company.

- Freight Farms, Inc.

- Greentech Organic Hydroponics Systems Mfrs.

- GROWRILLA SRLS

- Harvester Horticulture Products

- Hawthorne Gardening Company by The Scotts Company LLC

- Heliospectra AB

- Hydra Unlimited by Flow-Rite Controls

- Hydrofarm Holdings Group, Inc.

- HydroGarden Limited

- JH Hydroponic Systems, S.L.

- NEW GROWING SYSTEM S.L.

- NuLeaf Farms Inc.

- Ponix, Inc

- Signify N.V.

- Tower Garden, LLC

- Urban Crop Solutions BV

- Verdant Farms & Developers Private Limited.

- WE Hydroponics

- ZipGrow Inc.

Implement Strategic Roadmaps Centered on Renewable Integration, Supply Chain Diversification, Data-Driven Cultivation, and Collaborative Innovation

Industry leaders should prioritize strategic investments in energy-efficient technologies and modular design frameworks to achieve scalable expansions with minimal capital outlay. By embracing renewable energy integration, firms can mitigate operating costs associated with climate control and reduce overall carbon footprints, thereby enhancing appeal to sustainability-focused stakeholders. Simultaneously, diversifying supply chains through localized manufacturing partnerships will inoculate businesses against tariff volatility and logistical disruptions.

Furthermore, adopting data-driven decision support platforms can unlock insights for yield optimization and product consistency, empowering growers to fine-tune operational parameters in real time. Collaborations with research institutions should be pursued to accelerate proprietary cultivar development and to validate best practices for emerging crop varieties. Finally, fostering cross-sector alliances with retail and distribution networks will streamline market entry for specialty produce, ensuring premium products reach end consumers efficiently. These targeted initiatives will collectively reinforce competitive positioning and accelerate innovation cycles.

Discover the Robust Mixed-Methods Research Framework That Integrates Primary Expert Insights, Comprehensive Surveys, and Verified Secondary Data for Unbiased Analysis

This study employs a mixed-methods approach that combines primary interviews, expert surveys, and secondary research from authoritative industry publications. Primary data was collected through in-depth discussions with growers, system integrators, equipment manufacturers, and policy advisors to capture practical perspectives on operational challenges and technological adoption. Complementary surveys of agronomists and sustainability experts provided quantitative insights into performance metrics and resource utilization trends.

Secondary research encompassed analysis of trade publications, government reports, and proprietary white papers to contextualize regulatory developments, tariff frameworks, and funding initiatives. Data triangulation was achieved by cross-verifying interview findings with published case studies and peer-reviewed journal articles. Throughout the process, a rigorous validation protocol was maintained, ensuring that key assumptions and conclusions were corroborated by multiple independent sources. This robust methodology underpins the credibility of the insights presented and supports informed strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hydroponics System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hydroponics System Market, by Component

- Hydroponics System Market, by Type

- Hydroponics System Market, by Crop Type

- Hydroponics System Market, by Crop Area

- Hydroponics System Market, by Application

- Hydroponics System Market, by Region

- Hydroponics System Market, by Group

- Hydroponics System Market, by Country

- United States Hydroponics System Market

- China Hydroponics System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesize Key Findings Illustrating How Technological, Policy, and Market Forces Are Converging to Establish Hydroponics as a Pillar of Future Food Security

As hydroponic cultivation continues its ascent, stakeholders are presented with a compelling opportunity to redefine traditional agricultural value chains. The convergence of advanced environmental controls, digital monitoring, and modular system architectures has already yielded demonstrable gains in productivity and resource conservation. While trade policy shifts have introduced cost pressures, industry adaptability and strategic supply chain realignments have maintained momentum toward sustainable growth.

Looking ahead, the integration of renewable energy sources, the maturation of precision agriculture technologies, and the expansion of urban farming ecosystems will further solidify hydroponics as a cornerstone of resilient food systems. By leveraging the segmentation and regional insights outlined herein, decision-makers can align investments with emerging hotspots and cultivate partnerships that accelerate innovation. Ultimately, the path forward hinges on collaborative leadership, data-driven optimization, and an unwavering commitment to environmental stewardship.

Seize Your Competitive Advantage with Direct Engagement to Secure the Definitive Hydroponics Market Intelligence Report from Our Leadership

If you are ready to unlock the full strategic value of advanced hydroponics insights and position your organization at the forefront of sustainable cultivation innovation, connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report today. Embark on a journey to gain exclusive access to in-depth analysis, expert perspectives, and tailored recommendations that will empower your next growth phase. Reach out to Ketan Rohom to transform opportunity into actionable intelligence and accelerate your competitive edge in the rapidly evolving hydroponics landscape.

- How big is the Hydroponics System Market?

- What is the Hydroponics System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?