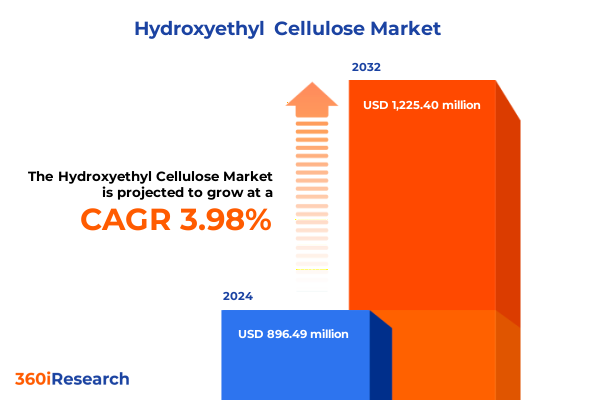

The Hydroxyethyl Cellulose Market size was estimated at USD 931.61 million in 2025 and expected to reach USD 972.11 million in 2026, at a CAGR of 3.99% to reach USD 1,225.40 million by 2032.

Revolutionizing Rheology Modifiers as Hydroxyethyl Cellulose Emerges as a Core Ingredient Fueling Sustainable Innovations Across Multiple Industrial Sectors

Hydroxyethyl cellulose stands at the intersection of natural polymer science and advanced industrial application, functioning as a nonionic, water-soluble cellulose ether prized for its thickening, stabilizing, and rheology-modifying capabilities. Its structural versatility derives from the hydroxyethyl substitution of cellulose, enabling it to deliver controlled viscosity across a broad range of aqueous systems. This property has propelled hydroxyethyl cellulose into a critical role within formulations that demand precise rheological control, from cement mortars in construction to high-performance personal care products and sophisticated pharmaceutical preparations.

Over the past decade, its adoption has expanded in tandem with rising expectations for multi-functional ingredients. In personal care, hydroxyethyl cellulose enhances texture and stability in shampoos, creams, and lotions, supporting the clean beauty movement that prizes natural and biodegradable constituents. Within industrial sectors such as paint and coatings, it provides anti-sag properties and film integrity, while in oil and gas drilling fluids it serves as a fluid-loss control agent under extreme temperature and pressure conditions.

Market stakeholders are increasingly focused not only on performance metrics but also on sustainability credentials, driving investment in biobased and greenhouse-gas-reducing production routes for cellulose ethers. Simultaneously, emerging digitalization in supply chain management and online distribution has reshaped procurement and technical support models, accelerating the delivery of specialty grades and customized solutions to end users.

This executive summary presents a comprehensive analysis of the hydroxyethyl cellulose landscape, encompassing transformative shifts, tariff impacts, segmentation dynamics, regional trends, competitive positioning, actionable recommendations, and the rigorous research methodology underpinning these insights. Our aim is to equip decision-makers with the clarity and foresight needed to navigate a market at the nexus of innovation, regulation, and sustainability.

Navigating a New Era of Green Chemistry, Digital Transformation, and Regulatory Evolution Shaping the Future of Hydroxyethyl Cellulose Markets

The hydroxyethyl cellulose arena is undergoing a profound realignment as sustainability, digitalization, and regulatory evolution converge to redefine industry benchmarks. Driven by heightened environmental consciousness, formulators are shifting toward certified biobased cellulose ethers that meet or exceed consumer expectations for biodegradability and low carbon footprints. Leading suppliers are investing in life-cycle assessments and circular economy strategies to minimize waste and energy consumption during production, reflecting an imperative to align ingredient sourcing with corporate sustainability mandates.

Concurrently, digital platforms and e-commerce channels are transforming how hydroxyethyl cellulose is marketed, specified, and delivered. Virtual formulation laboratories and online technical support portals enable real-time collaboration between producers and end-users, accelerating time-to-market for new grades and customized viscosity solutions. Social media and influencer engagement further amplify product visibility in personal care and niche specialty markets, reinforcing the importance of digital brand building.

On the regulatory front, stringent chemical safety and transparency requirements-exemplified by the European Union’s REACH framework-are mandating thorough evaluation and disclosure of cellulose derivative impurities. In response, leading manufacturers have enhanced ingredient traceability and documentation, ensuring full compliance and fostering customer trust. The rising cost and complexity of regulatory adherence underscore the strategic advantage of proactive compliance measures in securing market access across jurisdictions.

Innovation in formulation science is also pivotal, with advanced encapsulation techniques and shear-thinning hydroxyethyl cellulose variants enabling superior active ingredient delivery and sensory attributes. These technological breakthroughs are unlocking new applications in fields ranging from next-generation personal care systems to performance coatings and precision agricultural formulations, underscoring the ingredient’s adaptability in a rapidly evolving market landscape.

Assessing the Full Spectrum of United States Trade Policy Revisions and Their Compound Effects on Hydroxyethyl Cellulose Import Economics

Recent revisions to U.S. trade policy have introduced a complex tariff landscape for hydroxyethyl cellulose imports, combining traditional customs duties with new, sweeping levies on goods originating from China. As of June 2025, the White House has reinstated a 20% additional tariff on all Chinese imports, intended to address broader trade imbalances and illicit trafficking concerns-applicable to hydroxyethyl cellulose shipments from China unless exempted under an exclusion process.

Under the Harmonized Tariff Schedule of the United States, hydroxyethyl cellulose classified within the “other cellulose ethers” category (HTS 3912.39.00) is subject to a general duty rate of 4.2% on non-preferential imports. Special tariff provisions grant duty-free entry for qualifying shipments from select trade partners, though these do not extend to products of China under current Section 301 measures.

Consequently, Chinese-origin hydroxyethyl cellulose now carries a cumulative duty burden of approximately 24.2%, combining the base levy with the additional Section 301 surcharge. This elevated cost structure has prompted U.S. formulators and distributors to reassess sourcing strategies, exploring alternative suppliers in duty-free markets and leveraging free trade agreements to mitigate landed cost pressures. The need to balance cost, reliability, and regulatory compliance is reshaping procurement models throughout the value chain.

Deriving Actionable Segment-Based Intelligence to Unveil High-Value Pathways Across Application, Molecular Weight, Form, and Channel Dimensions

Insightful segmentation of the hydroxyethyl cellulose market reveals distinct value pools driven by application specifics, molecular weight distributions, formulation formats, and channel pathways. Demand for high-viscosity grades in detergents and cleaners-particularly in industrial cleaners requiring robust soil-release performance and laundry detergents seeking enhanced fabric care-underscores the critical role of high molecular weight hydroxyethyl cellulose variants. In oil and gas applications, mid-range molecular weights achieve optimal fluid-loss control and thermal stability in drilling fluids and well-stimulation campaigns, reflecting segment-specific requirements for rheological tuning.

Within the paint and coatings domain, architectural formulations favor liquid hydroxyethyl cellulose grades for immediate viscosity control during application, whereas specialty industrial coatings leverage powdered grades for on-site blending and supply chain efficiency. Personal care innovations-spanning conditioners, creams, lotions, and shampoos-demand ultra-high clarity and shear-thinning behavior, favoring low to medium molecular weight grades with robust electrolyte tolerance. Pharmaceuticals rely on fine powder grades for precise dosing in tablets, capsules, and topical preparations, with form selection instrumental in determining bioavailability profiles.

Type segmentation further delineates high, medium, and low molecular weight offerings, where premium, high molecular weight grades drive performance in paint, coating, and oil field specialties, and low molecular weight grades address controlled-release needs in pharmaceutical matrices. Liquid and powder forms serve complementary roles, with liquid hydroxyethyl cellulose favored in closed-system personal care manufacturing and powders supporting flexible onsite blending across industrial verticals. Distribution channels split between traditional offline channels-where technical support and bulk logistics underpin industrial procurement-and burgeoning online platforms, which enable rapid, small-batch access for specialty and personal care users seeking faster innovation cycles.

This comprehensive research report categorizes the Hydroxyethyl Cellulose market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Type

- Form

- Distribution Channel

Strategic Perspectives on Hydroxyethyl Cellulose Adoption Dynamics and Growth Drivers Across the Americas, EMEA, and Asia-Pacific Markets

The Americas maintain a commanding presence in the hydroxyethyl cellulose landscape, driven by sustained construction activity, robust personal care consumption, and strict environmental regulations that incentivize biodegradable ingredient adoption. U.S. formulators are at the forefront of biobased chemistry investments, leveraging domestic supply chains and free trade arrangements with Mexico and Canada to optimize cost efficiencies and supply resilience. Meanwhile, Brazil’s expanding pharmaceutical sector and growing paint and coatings industry underscore the region’s diverse demand drivers.

In Europe, Middle East & Africa, stringent chemical registration and environmental frameworks such as REACH and the UK REACH mandate exacting safety evaluations, fostering adoption of hydroxyethyl cellulose grades with comprehensive impurity profiles. Manufacturers in Germany, Italy, and the UK are focusing on high-performance, eco-certified grades to meet rising consumer and regulatory expectations. In the Middle East, regional infrastructure projects catalyze demand for construction-grade cellulose ethers, while North African pharmaceutical initiatives support growth in specialty excipient applications.

Asia-Pacific exhibits the fastest growth trajectory, led by China and India’s large-scale public works and oilfield drilling programs and a booming personal care market underpinned by rising disposable incomes. Local producers are expanding capacity and upgrading facilities to supply domestic demand, while multinational players establish strategic partnerships to introduce advanced hydroxyethyl cellulose grades into emerging markets. Consumer preferences for natural and clean beauty formulations are also providing a springboard for innovative product launches across the region’s dynamic fragrance and cosmetic sectors.

This comprehensive research report examines key regions that drive the evolution of the Hydroxyethyl Cellulose market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Competitive Profiles and Strategic Initiatives of Leading Manufacturers Shaping the Hydroxyethyl Cellulose Ecosystem

The competitive landscape of the hydroxyethyl cellulose market features a blend of global chemical majors and specialized cellulose ether producers. Prominent players include Ashland, Dow Chemical, Shin-Etsu Chemical, AkzoNobel, Henkel, DAICEL, Chemcolloids, Zhejiang Haishen, Yillong, and Wuxi Sanyou, all vying for leadership through product portfolio differentiation, capacity expansion, and sustainability initiatives.

Dow’s CELLOSIZE™ HEC portfolio exemplifies the push toward biobased and biodegradable rheology modifiers, offering a range of viscosity grades optimized for personal care and industrial formulations. The emphasis on renewable carbon sourcing, partially non-GMO feedstocks, and broad surfactant compatibility underscores the strategic direction toward eco-conscious innovation.

In parallel, Ashland, Shin-Etsu, CP Kelco, and AkzoNobel are strengthening their market positions by broadening specialty grade offerings, investing in R&D for advanced performance characteristics, and scaling up production facilities to meet regional demand surges. Collaborative ventures and targeted acquisitions are common tactics, enabling these firms to secure feedstock integration, accelerate novel product launches, and reinforce service capabilities in key geographies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hydroxyethyl Cellulose market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashland Global Holdings Inc

- BASF SE

- Celotech Chemical Co Ltd

- Chemcolloids Ltd

- Daicel Corporation

- Eastman Chemical Company

- Hebei Landcel Cellulose Tech Co Ltd

- J.M. Huber Corporation

- Lotte Fine Chemical Co Ltd

- Lubrizol Corporation

- Luzhou North Chemical

- Nouryon Chemicals Holding BV (formerly AkzoNobel Specialty Chemicals)

- Qingdao New Sanda Industry Co Ltd

- Salius Pharma Pvt Ltd

- Shandong Head Group Co Ltd

- Shin-Etsu Chemical Co Ltd

- SNF Floerger

- Sumitomo Seika Chemicals Co Ltd

- The Dow Chemical Company

- Wacker Chemie AG

- WOTAIchem

- Wuxi Sanyou New Material Technology Co Ltd

- Yil-Long Chemical Group

- Zhejiang Haishen New Materials Limited

Implementing Forward-Looking Strategic Roadmaps to Drive Growth, Resilience, and Sustainability in the Hydroxyethyl Cellulose Value Chain

Industry participants should prioritize the integration of sustainability metrics throughout the hydroxyethyl cellulose value chain, from raw material selection to end-of-life disposal. Investing in renewable feedstock certification and transparent life-cycle assessments will not only ensure regulatory compliance but also resonate with eco-conscious customers and brand partners.

Strengthening supply chain flexibility through near-regional sourcing partnerships and flexible inventory strategies can mitigate the impact of fluctuating tariff regimes and logistical disruptions. Cultivating relationships with multiple suppliers and leveraging digital procurement platforms will safeguard continuity and pricing stability.

Continued innovation in high-performance formulations-particularly in shear-thinning variants and encapsulated delivery systems-will unlock new premium segments in personal care, advanced coatings, and pharmaceutical delivery. Allocating R&D resources to application engineering and collaborative pilot projects will accelerate time-to-market and fortify technological leadership.

Finally, developing omnichannel distribution models that blend technical field support with streamlined e-commerce experiences will enhance customer reach and responsiveness. Tailored service solutions, including virtual formulation assistance and rapid small-batch sampling, will cater to emerging niche markets and drive incremental growth.

Employing Rigorous Multi-Source Methodological Frameworks for Robust and Transparent Hydroxyethyl Cellulose Market Intelligence

Our research framework combines rigorous primary interviews with industry executives, formulators, and regulatory specialists, alongside comprehensive secondary data gathering from trade associations, customs databases, and scientific journals. Quantitative shipment analyses were performed using Harmonized Tariff Schedule datasets to assess supply chain dynamics and tariff impacts.

Segment sizing and trend validation were conducted through product-level application mapping, integrating proprietary datasets on molecular weight distributions, form factors, and channel performance metrics. Global trade flows were modeled using customs and import-export statistics, ensuring robust geographic and source-market delineations.

Competitive benchmarking leveraged company annual reports, investor presentations, and peer-reviewed research to profile strategic initiatives, capacity expansions, and technology partnerships. Regulatory reviews encompassed a systematic analysis of REACH, U.S. TSCA, and national chemical controls to frame compliance trajectories.

This multi-source methodology ensures the accuracy, transparency, and actionability of our insights, equipping stakeholders with a reliable foundation for strategic decision-making in the hydroxyethyl cellulose market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hydroxyethyl Cellulose market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hydroxyethyl Cellulose Market, by Application

- Hydroxyethyl Cellulose Market, by Type

- Hydroxyethyl Cellulose Market, by Form

- Hydroxyethyl Cellulose Market, by Distribution Channel

- Hydroxyethyl Cellulose Market, by Region

- Hydroxyethyl Cellulose Market, by Group

- Hydroxyethyl Cellulose Market, by Country

- United States Hydroxyethyl Cellulose Market

- China Hydroxyethyl Cellulose Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Critical Insights and Emerging Imperatives to Guide Strategic Decisions in the Dynamic Hydroxyethyl Cellulose Market Landscape

The hydroxyethyl cellulose market stands at a strategic crossroads shaped by sustainability imperatives, technological advancements, and evolving trade policies. As demand for eco-certified, high-performance grades intensifies, stakeholders must balance innovation with regulatory compliance and supply chain agility. The convergence of digital procurement, life-cycle transparency, and application-driven product engineering offers a fertile ground for differentiation and growth.

Regional dynamics underscore the need for tailored approaches: nearshoring and free trade arrangements define procurement strategies in the Americas, stringent chemical standards drive premium adoption in EMEA, and rapid industrial expansion fuels capacity race in Asia-Pacific. Competitive advantage will hinge on the ability to integrate sustainability metrics with advanced rheology solutions and omnichannel service models.

By synthesizing tariff implications, segmentation intelligence, regional nuances, and competitive profiles, this analysis equips decision-makers to navigate uncertainty and capture high-value opportunities. The recommended strategic imperatives-spanning sustainable sourcing, supply flexibility, formulation innovation, and digital engagement-form a cohesive blueprint for resilient growth and market leadership.

Partner Directly with Ketan Rohom for Tailored Hydroxyethyl Cellulose Market Intelligence and Propel Your Strategic Growth with Expert Insights

To explore these insights further and secure dedicated guidance tailored to your organization’s unique strategic requirements, reach out directly to Ketan Rohom. As Associate Director of Sales & Marketing, he specializes in translating complex market intelligence into clear roadmaps that drive competitive distinction and sustainable growth. Engage with a one-on-one consultation to refine your positioning, unlock new vertical opportunities, and optimize supply chain resilience within the hydroxyethyl cellulose landscape. Empower your strategic roadmap with expert-backed recommendations and transform data into decisive action by partnering with Ketan for an in-depth briefing and bespoke research solutions.

- How big is the Hydroxyethyl Cellulose Market?

- What is the Hydroxyethyl Cellulose Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?