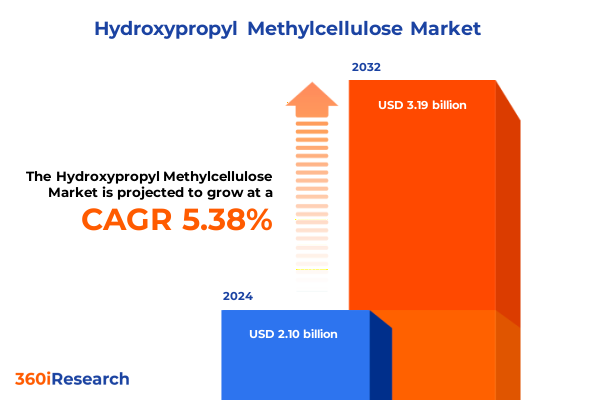

The Hydroxypropyl Methylcellulose Market size was estimated at USD 2.21 billion in 2025 and expected to reach USD 2.34 billion in 2026, at a CAGR of 5.39% to reach USD 3.19 billion by 2032.

Discover How Hydroxypropyl Methylcellulose Is Shaping Versatile Functional Performance Across Key Industries While Unlocking Operational Efficiencies

Hydroxypropyl methylcellulose, a semisynthetic, inert, viscoelastic polymer, has emerged as an indispensable functional additive across diverse industrial platforms. Derived from cellulose, its chemical versatility and thermal stability have driven its adoption in sectors ranging from construction sealants to pharmaceutical formulations. As regulatory scrutiny heightens around environmental and health impacts, hydroxypropyl methylcellulose’s biocompatibility and non-toxic profile have elevated its standing among formulating chemists and regulatory bodies. Consequently, this material has transcended its traditional boundaries, anchoring new application frontiers and catalyzing performance improvements across coatings, adhesives, food products, and drug delivery systems.

Today’s industrial decision makers recognize that hydroxypropyl methylcellulose not only confers viscosity control and film-forming properties but also enhances product consistency, shelf stability, and user experience. These functional benefits are underpinned by ongoing innovations in polymer modification techniques and precision manufacturing. With digitalization enabling real-time quality monitoring and formulation modeling, stakeholders are leveraging advanced analytics to optimize batch-to-batch performance. In turn, this has intensified collaboration between material suppliers, formulation partners, and end users, fostering an ecosystem of shared innovation and continuous improvement in hydroxypropyl methylcellulose utilization.

Pioneering Transformations in Sustainability Regulations and Technological Innovation Disrupting the Hydroxypropyl Methylcellulose Landscape

The hydroxypropyl methylcellulose landscape has undergone pivotal transformations driven by heightened sustainability imperatives and rapid technological advancements. Manufacturers have integrated green chemistry principles into their production processes, reducing solvent usage and energy consumption through enzymatic cellulose derivatization and closed-loop recovery systems. These eco-conscious initiatives align with increasingly stringent global regulations, pushing companies to secure eco-certifications and demonstrate transparent supply chain traceability. Additionally, digital twin technology has begun to reshape formulation development, enabling virtual prototyping of hydroxypropyl methylcellulose grades before physical trials, which reduces development cycles and accelerates time to market.

Parallel to sustainable manufacturing, the emergence of tailored functionalities has spurred deeper collaborations between polymer scientists and end-user industries. For example, next-generation construction materials now leverage customized hydroxypropyl methylcellulose blends that optimize workability and setting times under varying climate conditions. In pharmaceuticals, precision-engineered viscosity profiles support controlled drug release, meeting both regulatory standards and patient compliance requirements. Consequently, the interplay between regulatory drivers, digital innovation, and cross-sector partnerships is redefining how hydroxypropyl methylcellulose is developed, deployed, and perceived in the global supply chain.

Analyzing the Accumulated Effects of 2025 United States Tariff Measures on Supply Chains and Competitive Dynamics in the Hydroxypropyl Methylcellulose Sector

In early 2025, a series of revised tariff measures imposed by the United States significantly affected the hydroxypropyl methylcellulose supply chain, with cumulative duties targeting key import categories. These measures escalated the cost of raw materials sourced from major exporting nations, prompting domestic manufacturers to reassess procurement strategies and secure alternative suppliers outside traditional trade corridors. As a result, lead times have extended and logistical complexities have increased, compelling formulators to build inventory buffers and renegotiate long-term contracts. The compounded impact of these tariffs has also influenced regional sourcing hubs, with some suppliers shifting production closer to end-use markets in an effort to mitigate tariff exposure and optimize freight costs.

Against this backdrop, forward-looking organizations have embarked on strategic realignments to shield margins and maintain continuity. Some producers have accelerated the localization of key production processes, investing in new capacity within North America and forging joint ventures with domestic chemical companies. Others have diversified their supply base to incorporate suppliers from tariff-exempt regions, thereby establishing a more resilient procurement network. As these adaptive strategies take hold, companies that proactively navigate the evolving tariff landscape will be better positioned to preserve competitive pricing and service reliability in the hydroxypropyl methylcellulose sector.

Unveiling Critical Application, Viscosity, Grade, Distribution, and Form Segmentation Insights to Drive Strategic Decisions in Hydroxypropyl Methylcellulose

Hydroxypropyl methylcellulose applications span a spectrum of end-use industries, with adhesives and sealants leading adoption through hot melt and water-based formulations that enhance bonding strength and thermal stability. Within the construction arena, plaster, sealant, and tile adhesive formulations leverage controlled rheology and thixotropy to improve workability and cure performance under diverse environmental conditions. In food and beverage applications, bakery, beverage, and dairy segments depend on hydroxypropyl methylcellulose for moisture retention, texture enhancement, and emulsion stability, aligning with clean-label trends and nutritional guidelines. Emulsion paints and powder coatings in the coatings industry utilize specialized grades to regulate flow and film formation, while pharmaceutical dosage forms, including ophthalmic, oral solid, and topical preparations, benefit from precise viscosity profiles that support consistent drug delivery and patient safety.

Viscosity variations-from high through medium to low viscosities-enable formulators to fine-tune suspension stability, film thickness, and release kinetics across these applications. Meanwhile, grade distinctions, encompassing construction, food, pharmaceutical, and specialty grades, reflect rigorous purity requirements, performance specifications, and regulatory compliance levels. Distribution channels range from direct sales relationships that facilitate custom development and technical support, to distributor networks that offer regional reach and inventory flexibility, and e-commerce platforms that streamline procurement for smaller batch needs. Finally, form factors such as bead, granule, and powder dictate handling characteristics, dissolution rates, and processing methods. By integrating these segmentation insights, industry leaders can align product portfolios with evolving customer demands and regulatory landscapes.

This comprehensive research report categorizes the Hydroxypropyl Methylcellulose market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Viscosity

- Grade

- Distribution Channel

- Form

Examining Key Regional Dynamics Shaping Demand Trends and Adoption Patterns for Hydroxypropyl Methylcellulose Across Major Geographies

Across the Americas, hydroxypropyl methylcellulose demand is primarily driven by robust infrastructure investment and renovation activities, where its use in advanced construction materials and adhesives has ramped up to meet stringent performance and sustainability criteria. North American producers have capitalized on logistics efficiencies and proximity to end-use markets, while Latin American markets have shown growing interest in clean-label food and beverage applications, supported by local regulatory encouragement for food additives with minimal processing footprints.

In Europe, the Middle East, and Africa, stringent environmental regulations and a strong emphasis on circular economy principles have accelerated the adoption of eco-certified hydroxypropyl methylcellulose grades. European manufacturers lead in the development of biodegradable binder systems, whereas Middle Eastern and African markets are witnessing increased investments in pharmaceutical and cosmetic applications driven by regional healthcare expansion. Transitioning to the Asia-Pacific region, high growth rates in construction, consumer goods, and pharmaceutical manufacturing have underpinned demand, with local producers rapidly scaling capacity and leveraging cost advantages. In addition, rising urbanization and disposable income levels are catalyzing greater incorporation of hydroxypropyl methylcellulose in personal care and food products, reflecting evolving consumption patterns across major Asian economies.

This comprehensive research report examines key regions that drive the evolution of the Hydroxypropyl Methylcellulose market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers’ Strategic Initiatives and Collaborative Innovations Driving Competition in the Global Hydroxypropyl Methylcellulose Arena

Leading players in the hydroxypropyl methylcellulose space have pursued strategic initiatives to fortify their market positions and streamline innovation pipelines. Dow and Ashland have invested in proprietary modification platforms that deliver grade-specific performance enhancements, while also establishing joint development agreements with packaging and personal care formulators. Shin-Etsu Chemical has expanded production capacity in Asia-Pacific through greenfield projects, ensuring supply security for rapidly growing end-use sectors. JRS and Merck have focused on specialty grades tailored to pharmaceutical and food applications, navigating complex regulatory approvals to secure first-mover advantages in niche segments.

In addition, mid-tier and regional suppliers have formed value-added partnerships that integrate digital formulation services, enabling customers to simulate hydroxypropyl methylcellulose performance under various conditions. Collaborative research consortia between academic institutions and manufacturers have also emerged, exploring next-generation cellulose ethers with enhanced biodegradability and functional versatility. Through these combined efforts in R&D, capacity expansion, and collaborative innovation, leading companies are shaping competitive dynamics and setting new benchmarks for product quality, sustainability, and customer support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hydroxypropyl Methylcellulose market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anxin Cellulose Co., Ltd.

- Ashland Inc.

- BASF SE

- Celotech Chemical Co., Ltd.

- Changzhou Guoyu Environmental S&T Co., Ltd.

- Colorcon Inc.

- CP Kelco U.S., Inc.

- Daicel Corporation

- Deepak Cellulose Private Limited

- Dow Chemical Company

- J.M. Huber Corporation

- JRS Pharma GmbH & Co. KG

- Kima Chemical Co., Ltd.

- KPX Chemical Co., Ltd.

- LG Household & Health Care

- LOTTE Fine Chemical Co., Ltd.

- Meihua Group

- Nouryon

- SE Tylose GmbH & Co. KG

- Shandong Head Group Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Sidley Chemical Co., Ltd.

- Wacker Chemie AG

- Zhejiang Haishen New Materials Co., Ltd.

- Zhejiang Jianye Chemical Co., Ltd.

Strategic Roadmap of Actionable Recommendations to Navigate Regulatory Complexities and Maximize Operational Efficiencies in the Hydroxypropyl Methylcellulose

Industry stakeholders should prioritize diversification of supply chains to mitigate exposure to tariff volatility and geopolitical risks. Establishing partnerships with multiple regional producers and securing spot-and-term contracts will safeguard continuity while preserving margin integrity. Concurrently, investing in sustainable manufacturing technologies-such as enzymatic derivatization and solvent-recovery systems-will enhance operational resilience and align with tightening environmental regulations.

Moreover, organizations must leverage advanced data analytics and digital twin modeling to accelerate formulation development and reduce trial-and-error cycles. Embracing collaborative platforms that integrate real-time performance feedback will drive iterative improvements and unlock product differentiation opportunities. Finally, targeting high-value segments-such as pharmaceutical dosage forms and specialty food applications-through customized grade innovations will foster premium positioning and reinforce long-term customer relationships in a competitive landscape.

Comprehensive Research Methodology Combining Primary, Secondary, and Analytical Techniques to Ensure Rigorous Insights into Hydroxypropyl Methylcellulose Markets

The research methodology underpinning this analysis integrates both primary and secondary data collection techniques to ensure robust, multidimensional insights. Primary research involved in-depth interviews with industry executives, formulation experts, and procurement specialists to validate trends and uncover emerging use cases. Complementing this, secondary sources-such as trade publications, regulatory filings, and technical white papers-provided historical context and comparative performance benchmarks.

Quantitative data was triangulated using a mix of company disclosures, customs import/export records, and specialized chemical industry databases. Analytical techniques included scenario analysis to model the impact of tariff changes and sensitivity testing to assess formulation variability across viscosity and grade specifications. This rigorous approach ensures that the research captures both the nuanced technical attributes of hydroxypropyl methylcellulose and the strategic imperatives shaping its supply chain and end-use dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hydroxypropyl Methylcellulose market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hydroxypropyl Methylcellulose Market, by Application

- Hydroxypropyl Methylcellulose Market, by Viscosity

- Hydroxypropyl Methylcellulose Market, by Grade

- Hydroxypropyl Methylcellulose Market, by Distribution Channel

- Hydroxypropyl Methylcellulose Market, by Form

- Hydroxypropyl Methylcellulose Market, by Region

- Hydroxypropyl Methylcellulose Market, by Group

- Hydroxypropyl Methylcellulose Market, by Country

- United States Hydroxypropyl Methylcellulose Market

- China Hydroxypropyl Methylcellulose Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Future Outlook to Support Informed Decision Making in the Hydroxypropyl Methylcellulose Value Chain

In synthesizing the key findings, it is evident that hydroxypropyl methylcellulose stands at the intersection of sustainability, performance, and regulatory compliance. The 2025 tariff adjustments have underscored the importance of strategic sourcing and local production, while evolving end-use requirements continue to drive product differentiation. Segmentation analysis reveals that application-specific grades and tailored viscosity profiles will be critical levers for capturing value in adhesives, construction, food and beverage, coatings, and pharmaceutical sectors.

Looking forward, stakeholders must remain agile in monitoring regulatory developments and embracing digital transformation within formulation and supply chain management. By aligning product portfolios with regionally distinct adoption patterns and investing in collaborative R&D, companies can navigate uncertainty and secure competitive advantages. Ultimately, a combination of strategic foresight, innovation, and operational excellence will determine success in the dynamic hydroxypropyl methylcellulose landscape.

Engage with Associate Director Ketan Rohom to Unlock the Full Hydroxypropyl Methylcellulose Market Research Report for Strategic Business Growth

To gain an in-depth understanding of how hydroxypropyl methylcellulose is influencing industry strategies and innovation pipelines, we invite you to engage with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in translating detailed research findings into actionable insights will equip your team to capitalize on emerging trends and navigate market complexities with confidence. Reach out to Ketan Rohom today to secure the comprehensive market research report and empower your strategic decision making moving forward.

- How big is the Hydroxypropyl Methylcellulose Market?

- What is the Hydroxypropyl Methylcellulose Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?