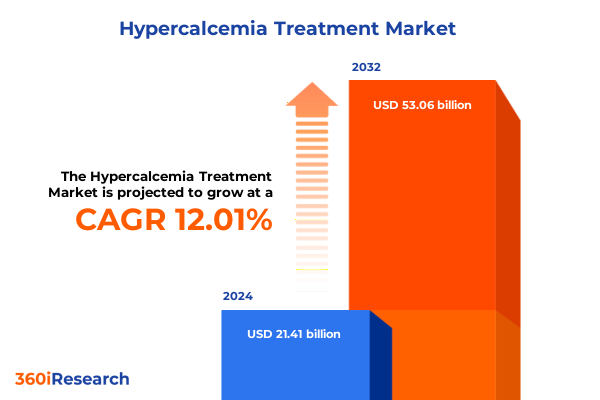

The Hypercalcemia Treatment Market size was estimated at USD 23.77 billion in 2025 and expected to reach USD 26.39 billion in 2026, at a CAGR of 12.15% to reach USD 53.06 billion by 2032.

Unveiling the Clinical Challenges and Rapidly Evolving Therapeutic Strategies that Are Redefining the Global Hypercalcemia Treatment Landscape

The complexity of hypercalcemia arises from its multifaceted etiology, spanning primary hyperparathyroidism, malignancy-associated calcium dysregulation, and medication-induced imbalances. Patients experiencing elevated serum calcium often present with nonspecific symptoms such as fatigue, nausea, neurocognitive disturbances, and renal impairment, underscoring the need for timely diagnosis and tailored interventions. Clinicians must weigh the risks and benefits of each therapeutic class, considering both the underlying pathophysiology and patient comorbidities. Historically, treatment paradigms relied heavily on hydration, intravenous bisphosphonates, and loop diuretics, but the therapeutic armamentarium has expanded markedly in recent years.

As the prevalence of hypercalcemia continues to rise alongside aging populations and oncology survivorship, the demand for innovative and safer treatment modalities has never been greater. Pharmaceutical developers and clinical investigators are collaborating to refine dosing regimens, mitigate adverse effects, and explore novel targets in calcium homeostasis pathways. Today’s landscape is shaped by a convergence of robust clinical evidence, emerging biologics, and evolving regulatory guidelines, all of which are propelling the field toward more personalized and effective care strategies.

Analyzing the Profound Technological, Regulatory, and Patient-Centric Shifts That Are Revolutionizing Clinical Outcomes and Market Dynamics Across the Hypercalcemia Treatment Ecosystem

Over the past decade, regulatory agencies around the world have introduced expedited pathways for breakthrough therapies targeting endocrine and metabolic disorders, prompting a surge of research into hypercalcemia. Advances in biomarker discovery and point-of-care diagnostics have shortened time to diagnosis, enabling earlier intervention and reducing morbidity. Emerging evidence has spotlighted the critical role of the calcium-sensing receptor and its downstream signaling mechanisms, catalyzing the development of more selective calcimimetic agents that offer improved safety profiles and sustained efficacy.

In parallel, digital health platforms and telemedicine adoption have transformed patient monitoring, enhancing adherence through remote assessments and dose adjustments. Real-world data consortia are now informing post-marketing surveillance, ensuring that late-stage adverse events are swiftly identified and addressed. Together, these technological, regulatory, and patient-centric shifts are reshaping clinical pathways, driving faster adoption of next-generation therapies, and setting a new standard for comprehensive management of hypercalcemia.

Evaluating the Comprehensive Effects of 2025 U.S. Tariff Measures on Pharmaceutical Supply Chains and Hypercalcemia Treatment Accessibility

In 2025, U.S. tariff policies have introduced significant headwinds for pharmaceutical supply chains, particularly for active pharmaceutical ingredients sourced from Asia and Europe. A 25% duty on APIs from China and 20% on those from India has directly increased manufacturing costs for both branded and generic hypercalcemia therapies, compelling manufacturers to reassess sourcing strategies and accelerate domestic production initiatives. Tariffs on medical packaging and key drug intermediates, levied at 15%, have created bottlenecks in the supply of sterile vials and analytical instruments, leading to extended lead times for delivery of bisphosphonate infusions and calcimimetic injectables.

Moreover, import duties on finished pharmaceutical products amounting to 10–15% have been projected to raise U.S. drug costs by as much as 12.9% if fully passed through, potentially increasing treatment expenses for patients and payers. While policymakers aim to bolster domestic manufacturing capacity, risks of drug shortages and price inflation remain, as domestic infrastructure typically requires significant capital investment and time to scale. Stakeholders across the value chain are actively engaging with the U.S. government, seeking exemptions and phased implementations to ensure continuity of care for hypercalcemia patients.

Extracting Critical Insights from Multi-Dimensional Segmentation to Illuminate Targeted Opportunities in Hypercalcemia Treatment Modalities and Channels

Segmenting the hypercalcemia treatment market by therapy type reveals distinct growth trajectories and competitive dynamics. Bisphosphonates such as Pamidronate and Zoledronic Acid remain foundational for rapid serum calcium reduction, yet they face erosion from next-generation calcimimetics including Cinacalcet and Etelcalcetide, which offer enhanced receptor selectivity. Loop diuretics and thiazide diuretics continue to play supportive roles in fluid management, with ongoing studies exploring optimal dosing schedules. Monoclonal antibodies like Denosumab are carving out niche positions, particularly in cases where conventional therapies are contraindicated or poorly tolerated.

Administration route segmentation underscores diverging patient and provider preferences. Intravenous options, encompassing bolus injections and continuous infusions, account for initial acute management, while oral capsules and tablets support chronic maintenance. Subcutaneous formulations are gaining momentum as they combine outpatient convenience with predictable pharmacokinetics. End-user insights point to differentiated channel dynamics: ambulatory surgical centers prioritize rapid turnover and cost-effectiveness, general and specialty clinics emphasize patient convenience and monitoring capabilities, and hospitals-both private and public-leverage comprehensive care models. Home healthcare services foster long-term adherence through nurse-led administration and telehealth support.

Patient demographics further refine market opportunities, as dosage requirements and safety considerations vary across adult patients aged 18 to 65, geriatric cohorts spanning 65 to 80 and beyond, and pediatric populations including children, infants, and neonates. Finally, distribution channels range from hospital pharmacies that integrate directly with inpatient services to online pharmacies offering home delivery, and retail pharmacies-both chain and independent-providing local access and personalized counselling.

This comprehensive research report categorizes the Hypercalcemia Treatment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapy Type

- Route Of Administration

- End User

- Patient Group

- Distribution Channel

Highlighting Distinct Regional Dynamics and Emerging Market Drivers in the Americas, EMEA, and Asia-Pacific Influencing Hypercalcemia Treatment Adoption

Across the Americas, robust healthcare infrastructures and high patient awareness are fostering early adoption of innovative hypercalcemia treatments. The United States and Canada, in particular, benefit from streamlined regulatory pathways and significant venture investment in specialty endocrinology pipelines. Meanwhile, Latin American markets are seeing gradual growth driven by public/private partnerships and the expansion of specialty clinics into underserved regions.

In Europe, Middle East & Africa, heterogeneous reimbursement landscapes and diverse clinical guidelines shape treatment uptake. Western European nations lead in the use of monoclonal antibody therapies, supported by favorable reimbursement policies and domestic manufacturing capabilities. In contrast, emerging markets within the Middle East and Africa face challenges in ensuring drug accessibility, where ongoing health system reforms and local production initiatives are critical to bridging care gaps.

The Asia-Pacific region is characterized by rapid urbanization, a rising geriatric population, and increased investment in domestic pharmaceutical innovation. Countries such as Japan, South Korea, and Australia are advancing clinical trials of novel calcimimetics, whereas China and India are strengthening API production facilities to meet both local and export demand. Cross-border collaborations and regulatory harmonization efforts under regional economic partnerships are further enhancing market potential.

This comprehensive research report examines key regions that drive the evolution of the Hypercalcemia Treatment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Pharmaceutical and Biotech Innovators Driving Competitive Advances and Strategic Collaborations in Hypercalcemia Therapeutic Development

Several leading pharmaceutical and biotech companies are at the forefront of hypercalcemia treatment innovation, each pursuing differentiated strategies. Major multinationals are optimizing their bisphosphonate portfolios through lifecycle management, developing next-generation delivery formats and extended-release formulations to improve patient adherence. At the same time, specialist firms are focusing on calcimimetic compounds, working to refine receptor targeting for improved safety in complex comorbid populations.

Biotech innovators are employing advanced bioprocessing techniques to scale monoclonal antibody therapies like Denosumab, while concurrently exploring antibody-drug conjugates and novel protein-based inhibitors. Partnerships between established pharma giants and biotech startups are accelerating translational research, leveraging real-world evidence to support regulatory filings. Additionally, manufacturing alliances aimed at reshoring API production are gaining traction, reducing supply chain vulnerability amid global trade shifts. Together, these competitive and collaborative dynamics are driving a wave of strategic investments, licensing agreements, and clinical collaborations that are reshaping the hypercalcemia treatment arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hypercalcemia Treatment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Actiza Pharmaceutical Private Limited

- Aetna Inc.

- Alkem Labs

- Amgen, Inc.

- Apotex Inc.

- Aridis Pharmaceuticals, Inc.

- Boehringer Ingelheim International GmbH

- Cipla, Inc.

- Crinetics Pharmaceuticals, Inc

- DiaSorin S.p.A.

- Dr. Reddy's Laboratories Ltd.

- Eli Lilly & Company

- Glenmark Pharmaceuticals Ltd

- Hikma Pharmaceuticals PLC

- Kyowa Kirin Co., Ltd.

- Merck & Co., Inc.

- Mylan N.V.

- Novartis AG

- Opko Health, Inc.

- Pfizer Inc.

- Rockwell Medical Inc.

- Sun Pharmaceutical Industries Ltd

- Teva Pharmaceuticals Industries Ltd.

- Torrent Pharmaceuticals Ltd

Strategic Imperatives and Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends in Hypercalcemia Treatment Innovation and Market Access

To navigate the evolving hypercalcemia treatment environment, industry leaders should prioritize a multifaceted approach that balances innovation with operational resilience. Key recommendations include enhancing supply chain agility by investing in modular manufacturing capabilities for APIs and final drug products, thereby mitigating the impact of tariff fluctuations and global sourcing disruptions. Concurrently, organizations must deepen collaborations with regulatory bodies, advocating for conditional approvals and real-world data frameworks that reflect the complexity of calcium dysregulation disorders.

On the commercial front, companies should refine patient segmentation models to deliver personalized treatment pathways, integrating digital health solutions for remote monitoring and adherence support. Strategic alliances with healthcare providers and payers will be essential to design value-based pricing agreements that align clinical outcomes with cost efficiencies. Moreover, expanding educational initiatives for endocrinologists, nephrologists, and primary care clinicians can accelerate adoption of emerging therapies. Finally, continuous portfolio optimization through internal R&D and external licensing will ensure sustained innovation, positioning organizations to capture long-term growth in the hypercalcemia treatment market.

Outlining the Rigorous Research Framework and Methodological Approaches Underpinning Comprehensive Analysis of the Hypercalcemia Treatment Market

This analysis is founded on a rigorous research framework combining primary and secondary methodologies. Primary research included in-depth interviews with key opinion leaders in endocrinology, oncology, and nephrology, as well as discussions with senior supply chain executives at pharmaceutical manufacturers. These qualitative insights were triangulated with quantitative data derived from proprietary hospital and pharmacy shipment records, clinical trial registries, and regulatory approval databases.

Secondary research encompassed a comprehensive review of peer-reviewed journals, regulatory agency publications, and industry white papers. Market dynamics were further validated through cross-comparison of global tariff schedules, trade association reports, and trade press articles. Data integration employed advanced analytics tools to identify pattern correlations across therapy types, administration routes, end-user channels, and regional markets. Quality assurance protocols ensured that all data points met stringent standards for accuracy and relevance, with continuous expert validation throughout the research lifecycle.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hypercalcemia Treatment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hypercalcemia Treatment Market, by Therapy Type

- Hypercalcemia Treatment Market, by Route Of Administration

- Hypercalcemia Treatment Market, by End User

- Hypercalcemia Treatment Market, by Patient Group

- Hypercalcemia Treatment Market, by Distribution Channel

- Hypercalcemia Treatment Market, by Region

- Hypercalcemia Treatment Market, by Group

- Hypercalcemia Treatment Market, by Country

- United States Hypercalcemia Treatment Market

- China Hypercalcemia Treatment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Synthesizing Key Findings to Chart the Future Trajectory of Hypercalcemia Treatment Landscape in Light of Evolving Therapeutic Innovations and Market Forces

The treatment landscape for hypercalcemia is undergoing a transformative period driven by scientific advances, evolving patient care models, and shifting global trade dynamics. Novel calcimimetics and monoclonal antibodies are complementing established bisphosphonate regimens, offering clinicians a broader toolkit to tailor interventions. At the same time, digital health integrations and supply chain resiliency measures are enhancing patient outcomes and market responsiveness.

Regional nuances, from the mature markets of North America and Western Europe to the rapidly developing Asia-Pacific and Latin America, underscore the importance of localized strategies. Leading companies are responding with targeted therapeutic portfolios, manufacturing investments, and strategic partnerships that address both clinical and commercial imperatives. As U.S. tariff measures introduce new operational considerations, stakeholders must adapt through supply diversification and advocacy to sustain accessibility and affordability. Ultimately, a cohesive alignment of innovation, regulation, and market execution will define success in the next chapter of hypercalcemia treatment evolution.

Empower Your Strategic Decision-Making in Hypercalcemia Treatment by Securing an Exclusive Market Research Report with Ketan Rohom Today

For decision makers seeking to gain a competitive edge and unlock critical insights into the hypercalcemia treatment market, acquiring the full report is the next step. Ketan Rohom, Associate Director of Sales & Marketing, can facilitate access to a bespoke research package tailored to your organization’s strategic goals. Whether you aim to benchmark against leading therapeutic players, evaluate regional expansion opportunities, or refine portfolio forecasting, this comprehensive analysis offers the clarity and depth required to act with confidence. Reach out to secure your copy and embark on a path to informed decision-making that will drive growth and innovation in hypercalcemia treatment.

- How big is the Hypercalcemia Treatment Market?

- What is the Hypercalcemia Treatment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?