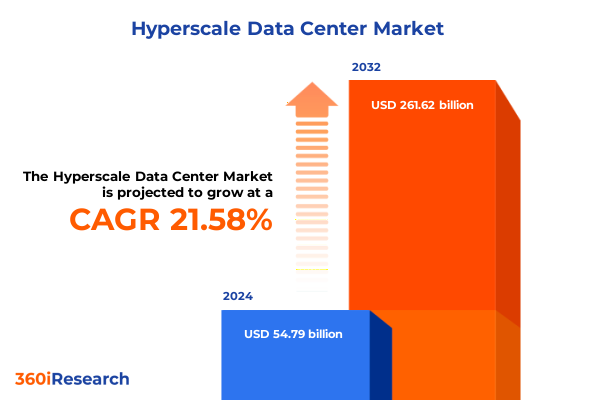

The Hyperscale Data Center Market size was estimated at USD 160.55 billion in 2025 and expected to reach USD 191.95 billion in 2026, at a CAGR of 20.13% to reach USD 579.98 billion by 2032.

Executive outlook on hyperscale data centers as AI, cloud and data-intensive workloads redefine global digital infrastructure priorities in 2025

Hyperscale data centers have become the foundational layer of the modern digital economy, underpinning everything from public cloud platforms and generative AI models to streaming media and global e-commerce. As organizations in every sector accelerate digital transformation, they increasingly rely on massive, highly automated facilities capable of scaling compute, storage, and networking capacity at unprecedented speed.

At the same time, the operating environment for these large-scale facilities is becoming more complex. Power availability, land constraints, environmental scrutiny, and rapidly evolving regulatory frameworks now shape where and how new capacity can be deployed. Intensifying geopolitical frictions, including tariffs and export controls on advanced semiconductors and networking equipment, are adding a new layer of strategic risk to global supply chains.

Against this backdrop, hyperscale operators and their ecosystem of technology, construction, and service partners are redesigning architectures and operating models. Dense AI and machine learning clusters are driving a step-change in rack power density and cooling requirements, pushing the industry toward new liquid-based systems and more sophisticated infrastructure management. Procurement, site selection, and ownership decisions are increasingly interdependent, as operators weigh trade-offs between greenfield developments, brownfield expansions, modular deployments, and colocation partnerships.

This executive summary distills the key forces reshaping the hyperscale data center landscape, from transformative technology and infrastructure shifts to the cumulative impact of current United States tariff policies. It also highlights how demand is segmenting across components, power bands, cooling strategies, deployment and ownership models, application areas, industries, and deployment environments, and how regional dynamics in the Americas, Europe, the Middle East and Africa, and Asia-Pacific are creating both opportunities and constraints. Together, these perspectives provide a concise but comprehensive foundation for strategic decision-making in 2025 and beyond.

Transformative technology, power and sustainability shifts reshaping the hyperscale data center landscape and competitive dynamics across global digital ecosystems

The most profound transformation in hyperscale data centers today stems from the explosive growth of AI and machine learning workloads. Training and inference clusters built on high-performance GPU and accelerator platforms now demand power densities several times higher than traditional enterprise racks, with leading-edge AI configurations pushing tens of kilowatts per rack and experimental designs reaching far beyond that range. This shift is straining legacy air-based cooling architectures and forcing operators to adopt direct-to-chip liquid cooling, rear-door heat exchangers, and, in select cases, full immersion systems.

In parallel, data center power has moved from a planning parameter to a binding constraint. Large AI and cloud campuses require multi-gigawatt power commitments over their lifetimes, yet many metropolitan grids were never designed for this level of concentrated demand. Developers in major North American and European hubs increasingly face multi-year queues for interconnection studies and substation upgrades, prompting a move toward earlier and deeper engagement with utilities, as well as on-site generation and microgrid strategies. Recent policy initiatives in the United States to streamline grid interconnection studies for large loads underscore how central this issue has become to national infrastructure planning.

Another structural shift is the rapid maturation of automation and orchestration at both the facility and workload levels. As hardware complexity increases and hybrid, multi-cloud architectures become the norm, operators are deploying more sophisticated infrastructure management platforms to coordinate power, cooling, and capacity utilization in real time. These platforms increasingly leverage predictive analytics and digital twins to model facility behavior under extreme AI loads, improve energy efficiency, and reduce unplanned downtime.

Sustainability considerations run through each of these developments. Hyperscale operators are under intensifying pressure from regulators, investors, and customers to demonstrate credible pathways toward lower carbon intensity, higher renewable penetration, and responsible water use. This is driving siting decisions toward regions with abundant low-carbon power, prompting the reuse of waste heat in colder climates, and accelerating the shift away from water-intensive cooling towers toward closed-loop liquid systems. The net result is that technology, power, and sustainability considerations can no longer be managed separately; they are converging into a single, tightly coupled infrastructure strategy that defines competitive advantage in the hyperscale era.

Compounding effects of 2025 United States tariffs and export controls on hyperscale data center supply chains, capital allocation and capacity deployment strategies

United States tariff policy in 2025 reflects the cumulative layering of trade actions taken over several years, and its impact on hyperscale data centers is best understood by looking at the combined effect rather than any single measure. Long-standing Section 301 tariffs on a wide range of Chinese imports, including many categories of information and communications technology hardware, have been supplemented by more targeted increases. In 2024, the U.S. announced higher duties on selected Chinese products, notably scheduling tariff rates on some semiconductors to rise significantly by 2025 in order to counter perceived unfair trade practices. For hyperscale operators that depend heavily on advanced chips and memory modules, this has translated into sustained upward pressure on certain bill-of-materials components.

In 2025, these earlier actions were joined by a new baseline tariff program that imposes a universal surcharge on most imports, coupled with higher, country-specific reciprocal rates for selected trading partners. Although smartphones, computers and various electronic parts were subsequently carved out of some of these measures, the framework has increased uncertainty for procurement teams sourcing servers, storage systems, network equipment, and support infrastructure across multiple geographies. Additional executive actions have layered on targeted duties for imports from China tied to concerns over synthetic opioid supply chains, further raising the effective tariff load on many categories of Chinese goods entering the U.S. market.

At the same time, a renewed trade dispute with Canada and Mexico has introduced higher duties on most goods from both countries, with important implications for cross-border manufacturing and logistics networks that support North American data center development. Many server, rack, and power system supply chains rely on just-in-time flows across these borders, so elevated tariffs can erode the cost advantages of otherwise nearby manufacturing hubs.

Tariffs interact with, and are amplified by, parallel U.S. export controls on advanced semiconductors and data center GPUs destined for certain countries and entities, particularly in China. These controls have constrained shipments of leading-edge accelerators and some high-performance networking products, prompting vendors to design downgraded variants for restricted markets and complicating global allocation decisions. While export controls are not tariffs, from an operator’s perspective they contribute to the same outcomes: constrained availability of high-end hardware, longer lead times, and increased cost volatility.

There have been partial offsets. Selected tariff exclusions and exemptions have reduced the burden on some technology categories, including servers, personal computers, and specific types of semiconductor manufacturing equipment, providing relief for certain imports critical to data center builds. However, these carve-outs are often time-limited and subject to renewal debates, reinforcing a sense of policy instability.

Collectively, the 2025 tariff environment is reshaping hyperscale sourcing and capital allocation strategies. Operators are diversifying their vendor bases away from single-country dependence, exploring additional manufacturing capacity in Southeast Asia, India, and parts of the Americas, and negotiating longer-term contracts that share inflation and tariff risk across the value chain. Some are re-evaluating the relative attractiveness of owner-operated facilities versus colocation arrangements, particularly where colocation providers can leverage scale, diversified sourcing, or local tax incentives to smooth cost shocks. The cumulative effect is not simply higher hardware prices; it is a more complex, risk-managed procurement model that favors organizations able to integrate trade policy scenarios directly into their technology and site-selection roadmaps.

Segment-level insights across components, power, cooling, ownership, deployment, applications, industries and deployment modes guiding hyperscale data center positioning

Viewed through the lens of components, the hyperscale landscape is moving from a hardware-centric paradigm toward an integrated stack where solutions and services carry growing strategic weight. On the hardware side, servers, storage, network equipment, accelerators and support infrastructure remain the backbone of capital expenditure, but design priorities are shifting. High-performance accelerators and specialized network fabrics now sit at the heart of AI and high performance computing clusters, while support infrastructure such as power systems and cooling systems is being redesigned to handle higher densities, more dynamic loads, and tighter sustainability requirements. At the same time, demand for infrastructure management and automation and orchestration solutions is increasing as operators seek to manage complex, hybrid environments more efficiently.

Services are emerging as a crucial differentiator rather than a simple adjunct. Professional services are needed to plan, design, and commission new hyperscale campuses that weave together power, cooling, network topology, cyber security, and regulatory compliance. As environments grow more complex, managed services are expanding around ongoing infrastructure operations, capacity planning, and lifecycle management. Many operators now prefer to offload parts of their stack to specialized partners that can guarantee service levels across multi-region and multi-cloud architectures, freeing internal teams to focus on application and business logic.

Power capacity segmentation reveals that the middle band of facilities between one and fifty megawatts continues to serve as the workhorse of regional cloud and colocation expansion, while projects above one hundred megawatts increasingly correspond to very large AI and cloud campuses in a small number of strategic locations. Within the lower power range, smaller but highly connected facilities are used to extend coverage, reduce latency, or provide edge aggregation, especially for content delivery and internet of things platforms.

Cooling solutions are undergoing a structural shift but remain mixed. Air-based cooling continues to dominate legacy deployments and many general-purpose workloads, yet it is reaching its practical limits for the densest AI racks. Liquid-based cooling, including direct-to-chip systems and immersion architectures, is rapidly gaining ground in new builds and targeted retrofits, particularly where operators need to support extreme power density with tight energy-efficiency and water-use constraints. Over time, this mix is expected to support a tiered approach in which air-based systems handle conventional workloads and liquid-based systems concentrate under AI, machine learning, and high performance computing clusters.

Ownership models for hyperscale capacity remain bifurcated between owner operated facilities and colocation provider operated sites. Large cloud and internet platforms continue to build and operate their own campuses in key strategic regions where they can secure long-term power and land, assert tighter control over design, and capture scale economies. In parallel, they increasingly lease significant capacity from colocation providers, especially in markets where planning constraints, energy regulations, or access to capital favor a shared infrastructure model. Enterprises outside the cloud-native cohort rely heavily on colocation arrangements to gain access to hyperscale-class infrastructure without assuming full ownership and operational risk.

Deployment models further nuance these patterns. Greenfield development remains the preferred approach for large, integrated campuses where land and high-capacity grid connections can be secured well in advance. Brownfield expansion is common in mature hubs where existing campuses are incrementally extended as new power becomes available. Modular deployment has moved from niche to mainstream, providing prefabricated, scalable blocks that shorten time to market, facilitate replication across regions, and allow capacity to be added in line with demand, an especially valuable attribute in volatile AI-driven markets.

Application areas cut across all of these structural choices. Cloud infrastructure services, including infrastructure as a service, platform as a service, and software as a service, continue to account for a large share of hyperscale utilization and underpin a broad base of enterprise workloads. Big data and analytics, as well as artificial intelligence and machine learning, are driving the most aggressive performance and density requirements, especially where training data sets and models grow rapidly. Within high performance computing, scientific computing, financial modeling and risk analytics, and engineering simulation and design increasingly share the same accelerator-rich platforms as AI, blurring boundaries between these workloads.

Content delivery and media processing remain critical for video streaming, gaming, and social platforms, often dictating where edge clusters are deployed to minimize latency. Internet of things platforms generate continuous streams of telemetry that must be ingested, stored, and analyzed, linking hyperscale cores with distributed nodes closer to endpoints. Enterprise business applications continue to migrate toward cloud-led or hybrid designs, but in many regulated industries they retain specific latency, security, or data residency requirements that influence facility location and architecture.

End-use industry patterns reflect these varying demands. Banking, financial services, and insurance organizations rely on hyperscale resources for digital channels, risk analytics, and real-time payments. Government and defense agencies are adopting cloud and AI while maintaining strict sovereignty and security requirements that shape colocation and ownership decisions. Healthcare institutions are increasingly dependent on large-scale storage and compute for medical imaging, genomics, and electronic health records, often under stringent privacy rules. IT and telecom operators both consume and provide hyperscale capacity, enabling 5G, edge computing, and network function virtualization. Manufacturing companies use AI and analytics for supply chain optimization and smart factory initiatives, while media and entertainment businesses lean heavily on content distribution, rendering, and personalization engines. Retailers continue to expand omni-channel commerce and customer analytics platforms, further deepening their reliance on hyperscale back ends.

Deployment environments complete the segmentation picture. Cloud-based delivery remains the dominant consumption model for new applications, especially when global reach and elastic scaling are required. On-premises deployments persist where regulatory, latency, or legacy-integration requirements demand it, but even these environments increasingly connect back to hyperscale campuses through hybrid architectures. Together, these interlocking segments define where value is created along the hyperscale value chain and where operators and suppliers can differentiate most effectively.

This comprehensive research report categorizes the Hyperscale Data Center market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Power Capacity

- Cooling Solutions

- Ownership Model

- Deployment Model

- Application Area

- End-Use Industry

Regional performance and strategic considerations for hyperscale data center development across the Americas, Europe, Middle East, Africa and Asia-Pacific regions

Regional dynamics are playing an outsized role in shaping hyperscale strategies, as digital demand, power availability, regulatory frameworks, and tariff environments vary widely across geographies. In the Americas, North America remains the single largest concentration of hyperscale capacity, with major clusters anchored around key metropolitan and suburban regions in the United States and an expanding footprint in Canada. Developers are increasingly gravitating toward markets in the U.S. Southeast, Midwest, and Southwest where power and land are more accessible, even as traditional hubs continue to densify. In Latin America, countries such as Brazil, Mexico, Chile, Colombia, and parts of the Andean region are seeing increased investment as cloud providers seek to localize workloads and improve latency, although energy reliability and permitting complexity still constrain the pace of some projects.

However, the Americas are not immune to policy headwinds. The evolving United States tariff framework, including elevated duties on goods from Canada and Mexico, creates an additional variable for developers that depend on integrated North American supply chains for data center equipment and construction materials. At the same time, federal and state-level initiatives to expand grid capacity, streamline interconnection for large data centers, and incentivize clean energy procurement are helping to offset some of these challenges.

In Europe, Middle East and Africa, the picture is equally nuanced. Core European markets centered on major connectivity hubs continue to attract strong hyperscale investment, although power and land constraints are forcing new developments into outer metropolitan zones and secondary cities. Data protection regimes and tightening energy-efficiency and emissions rules are pushing operators toward more efficient designs, higher renewable penetration, and in some cases mandatory heat reuse. Nordic countries are leveraging abundant low-carbon power and cool climates to position themselves as attractive destinations for compute-intensive workloads, while the United Kingdom and continental hubs adapt their strategies to evolving national and European policy frameworks.

Across the Middle East and Africa, several countries are making large, coordinated bets on digital infrastructure as part of broader economic diversification agendas. In the Gulf, national transformation programs and sovereign-backed investment vehicles are catalyzing hyperscale campuses co-located with new tech, finance, and media districts, often tied to large-scale solar or wind resources. In Africa, markets such as South Africa, Kenya, and a handful of other coastal and inland hubs are emerging as regional anchors for cloud and content delivery, although constraints around grid stability, permitting, and connectivity remain real and must be factored into risk assessments.

Asia-Pacific stands out for the breadth and velocity of its hyperscale build-out. China, India, Japan, Australia, and several Southeast Asian nations are experiencing sustained waves of investment as digital adoption, e-commerce, and AI demand surge. While established hubs such as Tokyo, Sydney, Singapore, and Hong Kong remain central to the region’s infrastructure, land and power constraints in some of these locations are pushing development toward secondary and emerging markets, including nearby Malaysian and Indonesian cities that can offer more favorable permitting and energy conditions. In parallel, data residency rules and digital sovereignty concerns are encouraging more localized deployments, driving a more distributed regional topology than in earlier cloud eras.

Taken together, the Americas, Europe, Middle East and Africa, and Asia-Pacific each present distinct combinations of opportunity and constraint. Successful hyperscale strategies now require a portfolio approach, balancing mature, supply-constrained hubs that offer dense connectivity against newer markets that provide room for growth but carry greater execution risk. Operators and investors must calibrate their regional mix with an eye on policy stability, power and land availability, customer proximity, and emerging tariff and trade dynamics.

This comprehensive research report examines key regions that drive the evolution of the Hyperscale Data Center market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive landscape and strategic positioning of leading cloud, colocation, hardware, network and infrastructure vendors in the hyperscale data center ecosystem

The competitive landscape around hyperscale data centers is defined by a dense web of cloud platforms, colocation providers, hardware and semiconductor vendors, power and cooling specialists, and network infrastructure suppliers. At the center sit the global cloud and internet companies that build and operate many of the world’s largest campuses and drive much of the industry’s innovation. Their priorities around AI acceleration, sustainability, and edge expansion set de facto standards for architectures, components, and operating practices across the ecosystem.

Colocation and wholesale data center providers form the second major pillar. These companies develop large-scale campuses and lease capacity to cloud platforms, content networks, software-as-a-service vendors, and enterprises seeking scalable infrastructure without full ownership. Their ability to secure power, land, and permits in strategic locations, and to design facilities that can flex between hyperscale and enterprise requirements, has become a key differentiator. In many markets, they also act as intermediaries between regulators, utilities, and international cloud tenants, translating policy and grid constraints into practical deployment timelines and service level expectations.

Up the stack, server and system vendors are racing to optimize platforms for AI, analytics, and high performance computing workloads. Partnerships between original equipment manufacturers, accelerator providers, and networking specialists are tightening as operators demand integrated solutions that can deliver extreme performance while remaining manageable at scale. Semiconductor companies at the forefront of GPU, CPU, and specialized accelerator design play a critical role in defining what is technically feasible inside hyperscale facilities, yet they now operate under heightened export controls, intellectual property concerns, and capacity bottlenecks that make long-term roadmapping more complex.

Power and cooling solution providers have moved from background enablers to strategic partners. Their portfolios now span high-efficiency power distribution, advanced uninterruptible power supply systems, direct-to-chip liquid cooling solutions, immersion systems, and increasingly sophisticated monitoring and control software. Companies that can offer integrated power and thermal management stacks, as well as credible pathways to lower carbon intensity, are gaining share of mind among hyperscale decision-makers.

Network carriers, subsea cable consortia, and edge data center operators round out the ecosystem, ensuring that hyperscale facilities remain deeply interconnected and capable of serving end-users with low latency. Strategic alliances among these players and the cloud and colocation majors are proliferating, as all parties seek to secure long-term access to routes, landing stations, and regional aggregation points.

Across all of these segments, leading companies are converging on similar strategic themes: deepening collaboration across the supply chain, investing heavily in AI-optimized platforms, redesigning facilities around higher power densities and liquid cooling, and embedding sustainability and regulatory resilience into product and site strategies. Those able to execute consistently on these fronts are best positioned to shape the next decade of hyperscale infrastructure.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hyperscale Data Center market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- AirTrunk Operating Pty Ltd.

- Amazon Web Services, Inc.

- Arista Networks, Inc.

- Broadcom Inc.

- China Telecom Corporation Limited

- Chindata Group Holdings Limited

- Cisco Systems, Inc.

- CtrlS Datacenters Ltd.

- Dell Technologies Inc.

- Delta Electronics, Inc.

- Eaton Corporation plc

- EdgeConneX Inc.

- Extreme Networks, Inc.

- Google LLC by Alphabet Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Intel Corporation

- International Business Machines Corporation

- Iron Mountain Incorporated

- Legrand SA

- Lenovo Group Ltd.

- LG Group

- LightWave Networks, Inc.

- Marvell Technology Group Ltd.

- Meta Platforms, Inc.

- Microsoft Corporation

- Nlyte Software Ltd.

- NTT Corporation

- NVIDIA Corporation

- Oracle Corporation

- PLDT Group

- Schneider Electric SE

- TierPoint, LLC

- TRUE INTERNET DATA CENTER CO., LTD. by Charoen Pokphand Group

- Vertiv Holdings Co.

Actionable strategic recommendations for hyperscale data center leaders to navigate regulatory shifts, technology disruption, power constraints and evolving customer demand

In this environment of rapid technological change and policy volatility, industry leaders need a disciplined yet flexible agenda to guide action. A first priority is to embed trade and tariff intelligence directly into strategic sourcing and network planning processes. Rather than treating duties as an external shock to be managed tactically, operators should model multiple tariff scenarios over the life of major projects, adjust vendor portfolios and contract structures accordingly, and explore alternative manufacturing footprints where feasible. Building optionality into supply chains can reduce the risk that sudden policy shifts derail capacity plans or impair economics.

In parallel, executives should prioritize the rapid transition from air-centric to hybrid cooling architectures that incorporate liquid-based systems for AI and other high-density workloads. This requires not only technical evaluation of direct-to-chip and immersion options but also long-term planning around water use, fluid selection, maintenance practices, and staff training. Early pilot deployments can de-risk broader rollouts and ensure that future greenfield and brownfield projects are designed from the outset to accommodate higher densities without excessive retrofitting.

Power strategy deserves similarly proactive attention. Leaders should treat grid access, on-site or nearby generation, and participation in demand-response or microgrid schemes as core elements of data center design, not afterthoughts. Where possible, long-term power purchase agreements and co-development arrangements with utilities can secure both capacity and a clearer trajectory toward decarbonization. In markets facing interconnection backlogs, securing queue positions and aligning construction schedules with grid upgrade timelines can make the difference between first-mover advantage and multi-year delays.

From an application and customer perspective, operators can sharpen their value proposition by aligning offerings more closely with key segments such as AI and analytics, high performance computing, content delivery, and industry-specific cloud platforms. This may involve designing tailored zones within campuses optimized for certain workloads, providing specialized interconnect options, or offering managed services that reduce integration complexity for customers in sectors such as financial services, healthcare, and manufacturing.

Finally, organizational capabilities must evolve alongside physical infrastructure. Investment in automation, observability, and digital twin technologies can help operations teams manage increasingly heterogeneous environments with greater confidence. Cross-functional governance that brings together legal, regulatory, sustainability, procurement, and engineering stakeholders can improve the organization’s ability to respond coherently to new tariffs, export controls, and environmental rules. By taking these steps, industry leaders can convert today’s uncertainty into a source of competitive resilience and strategic differentiation.

Research design, data sources and analytical framework underpinning this hyperscale data center market assessment and strategic executive-level insights

The insights summarized in this executive overview are grounded in a structured research methodology designed to capture both the technological and policy-driven complexity of the hyperscale data center ecosystem. The study begins with extensive secondary research, drawing on official government publications, regulatory filings, international trade and tariff databases, corporate annual and quarterly reports, technical white papers, academic publications, and reputable industry news sources. Particular attention is paid to recent changes in tariff schedules, export controls, energy and environmental regulations, and large-scale infrastructure initiatives that directly affect data center development.

Building on this foundation, the research incorporates targeted primary insights from industry participants. These include perspectives from cloud and colocation operators, hardware and semiconductor vendors, power and cooling solution providers, construction and engineering firms, and regional economic development agencies. These conversations help validate desk-based findings, surface emerging practices that have not yet been widely documented, and contextualize quantitative indicators within real-world deployment and procurement decisions.

Analytically, the study employs a segmentation framework that spans components, power capacity bands, cooling approaches, ownership and deployment models, application areas, end-use industries, and deployment environments. This framework is applied consistently across regions, allowing comparisons between the Americas, Europe, the Middle East and Africa, and Asia-Pacific. Cross-checking of data points from multiple independent sources, along with internal consistency checks across segments and regions, is used to reduce the likelihood of bias or misinterpretation.

Throughout, the focus remains on explaining structural trends, technological shifts, regulatory drivers, and competitive dynamics rather than on producing revenue-based market sizing or forecasting. This qualitative and structural emphasis is intended to support strategic decision-making by senior stakeholders who must integrate infrastructure, policy, and customer demand considerations into long-term planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hyperscale Data Center market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hyperscale Data Center Market, by Component

- Hyperscale Data Center Market, by Power Capacity

- Hyperscale Data Center Market, by Cooling Solutions

- Hyperscale Data Center Market, by Ownership Model

- Hyperscale Data Center Market, by Deployment Model

- Hyperscale Data Center Market, by Application Area

- Hyperscale Data Center Market, by End-Use Industry

- Hyperscale Data Center Market, by Region

- Hyperscale Data Center Market, by Group

- Hyperscale Data Center Market, by Country

- United States Hyperscale Data Center Market

- China Hyperscale Data Center Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Integrating technology, policy, infrastructure and regional dynamics to crystallize the strategic outlook for the global hyperscale data center ecosystem

Taken together, the trends examined in this report portray an industry that is both indispensable to the global economy and subject to unprecedented pressures. Hyperscale data centers now enable the AI and cloud platforms that drive innovation across nearly every sector, yet they must operate within finite power grids, constrained land markets, tightening environmental expectations, and a volatile trade environment shaped by tariffs and export controls. These realities are transforming site selection, facility design, sourcing strategies, and ownership models.

The interplay of segmentation and regional dynamics underscores that there is no single path forward. Component choices, power and cooling strategies, deployment and ownership models, and target application and industry segments all vary by geography and regulatory regime. Operators in mature hubs are focusing on efficiency gains, brownfield extensions, and advanced cooling and power strategies, while those in emerging markets emphasize greenfield campuses, modular deployments, and partnerships that navigate local regulatory and infrastructure challenges.

Amid this complexity, a few constants emerge. AI and data-intensive workloads will continue to demand higher-density infrastructure and more sophisticated management. Policymakers will remain active in shaping the operating environment through trade, energy, and data governance rules. Competitive differentiation will increasingly hinge on the ability to integrate technology, sustainability, and regulatory resilience into a coherent infrastructure strategy. Organizations that move early to internalize these forces, strengthen their supply chains, and modernize their facilities will be best positioned to capture the next wave of digital demand while managing risk.

Next steps for decision-makers and how Ketan Rohom can support strategic investments through acquisition of the comprehensive hyperscale data center report

As you assess next steps, the difference between a high-level understanding and a decision-grade view of the hyperscale data center landscape lies in the depth and structure of insight at your disposal. This executive summary highlights the critical themes, but the full study delivers the underlying evidence, segment-level detail, and case-based analysis required to support major capital commitments and long-range planning.

The complete report examines component-level dynamics from hardware to services, power and cooling strategies, ownership and deployment models, and application and industry demand patterns with far greater granularity than can be conveyed here. It also dissects tariff and trade policy scenarios, regional development pipelines, and competitive moves by leading cloud, colocation, and infrastructure providers, enabling you to benchmark your roadmap against the most active market participants.

To translate these insights into an actionable agenda for your organization, engage directly with Ketan Rohom, Associate Director, Sales and Marketing. Through a focused conversation, you can clarify your specific information needs, explore available deliverables and licensing options, and determine how best to integrate the full report into your strategy, planning, or investment workflows. Visit the company’s official website or your existing account portal to connect with Ketan and initiate the purchase process, and secure immediate access to the complete hyperscale data center research for your leadership team.

- How big is the Hyperscale Data Center Market?

- What is the Hyperscale Data Center Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?