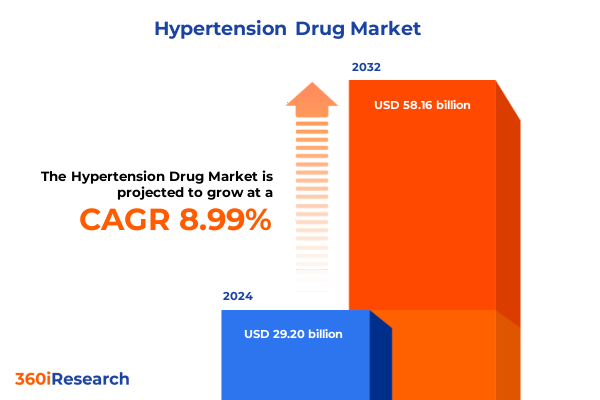

The Hypertension Drug Market size was estimated at USD 31.73 billion in 2025 and expected to reach USD 34.49 billion in 2026, at a CAGR of 9.03% to reach USD 58.16 billion by 2032.

Uncovering the Evolving Hypertension Treatment Arena Driven by Innovation in Medication Profiles, Patient Adherence Trends, and Regulatory Developments Shaping Care

Hypertension remains one of the most pervasive chronic conditions affecting global health, driving significant morbidity and mortality across diverse populations. In the United States alone, recent epidemiological studies indicate that nearly half of all adults contend with elevated blood pressure, underscoring the critical need for effective pharmacological interventions. As diagnostic thresholds and treatment guidelines have evolved over the past decade, so too has the pharmaceutical landscape, with robust competition and innovation catalyzing the development of increasingly targeted therapies. Against this backdrop, navigating the complexities of market dynamics, patient adherence trends, and regulatory frameworks is paramount for stakeholders seeking to drive meaningful impact in hypertension management.

Against this evolving clinical and regulatory environment, pharmaceutical companies face intensifying demands to deliver therapies that balance safety, efficacy, and cost considerations. Technological advancements in drug formulation and delivery systems have unlocked novel opportunities to enhance patient compliance and optimize therapeutic outcomes. Meanwhile, the convergence of precision medicine principles with real-world evidence is reshaping approaches to patient stratification and treatment personalization. In this executive summary, we provide a comprehensive overview of the forces molding the hypertension drug market, offering strategic insights across key strategic dimensions to inform decision-making and guide long-term growth initiatives.

Examining Revolutionary Changes in Hypertension Management Through Precision Medicine, Digital Therapeutics, and Collaborative Care Models Impacting Outcomes

The landscape of hypertension management has undergone transformative shifts fueled by breakthroughs in precision medicine and digital health integration. As genetic profiling and biomarker-driven strategies gain traction, clinicians can tailor therapy regimens to individual patient profiles, optimizing drug selection and dosage to mitigate adverse effects. Furthermore, the emergence of digital therapeutics and remote monitoring platforms has strengthened patient engagement by enabling real-time blood pressure tracking and automated alerts, fostering improved adherence and longitudinal outcome measurement.

Moreover, collaborative care models are redefining stakeholder interactions, with interdisciplinary teams bridging the gap between primary care physicians, cardiologists, and pharmacists. This cross-functional approach has facilitated streamlined treatment pathways, accelerating therapy adjustments based on dynamic patient data. At the same time, data analytics powered by artificial intelligence have begun to inform drug development pipelines, identifying novel targets and predicting therapeutic response patterns. Taken together, these shifts represent a fundamental reorientation toward patient-centric, data-driven hypertension care that promises to set new benchmarks for efficacy and safety.

Exploring the Far-Reaching Implications of United States Tariffs Implemented in 2025 on Hypertension Drug Supply Chains and Cost Structures

In 2025, the United States implemented a series of tariff adjustments on imported active pharmaceutical ingredients and key intermediates pivotal to hypertension drug production. These measures have triggered a ripple effect throughout the supply chain, prompting manufacturers to reassess sourcing strategies and inventory buffers. Initially, cost pressures emerged as raw material expenses climbed, compelling companies to negotiate revised supplier agreements or explore onshore API manufacturing capabilities to mitigate tariff-induced margin erosion.

Furthermore, regulatory agencies have provided temporary relief measures, including expedited approval pathways for alternative suppliers and partial tariff waivers for critical therapeutic inputs. Despite these efforts, lead times for certain branded and generic hypertension therapies have extended, underscoring the intricate interdependencies among global production sites. Looking forward, industry leaders are increasingly focused on fostering supply chain resilience through diversified procurement networks and strategic partnerships with domestic contract development and manufacturing organizations (CDMOs). Such proactive initiatives are essential to balancing cost management with uninterrupted drug availability for patients.

Delving into Critical Patient and Market Segmentation Insights by Dosage Form, Age Group, Treatment Regimen, Drug Class, Distribution Channel, and End User

A nuanced understanding of market segmentation is crucial for tailoring product development and commercialization strategies in the hypertension drug arena. Segmentation by dosage form highlights distinct value propositions: capsules offer patient-friendly administration with potential for taste masking, injectables deliver rapid pharmacokinetic profiles suitable for acute care settings, and tablets remain the mainstay for everyday management due to cost efficiencies and manufacturing scalability. Transitioning to age group considerations, adult patients often require flexible dosing regimens that accommodate lifestyle factors, whereas geriatric populations benefit from low-volume formulations and combination therapies that minimize pill burden. Pediatric cohorts, in contrast, demand age-appropriate flavoring and safety profiles that support long-term adherence.

In addition, treatment type segmentation contrasts monotherapy with combination regimens, where dual therapy and fixed-dose combinations have emerged as key strategies to achieve target blood pressure levels more rapidly. Triple therapy options are gaining traction for patients with resistant hypertension, reflecting a shift toward aggressive early intervention. Evaluating drug class segmentation, ACE inhibitors and ARBs continue to dominate first-line therapy, while beta blockers and calcium channel blockers serve as valuable adjuncts in comorbid conditions. Diuretics maintain relevance in volume-overloaded patients, often forming the backbone of multidrug protocols. From a distribution channel perspective, hospital pharmacies facilitate inpatient and emergency administration, online pharmacies enhance patient convenience and adherence, and retail outlets cater to broad outpatient access. Finally, end user segmentation underscores the varied touchpoints for drug utilization: clinics drive routine monitoring and prescription management; home care services support self-administration and telehealth check-ins; hospital settings deliver acute intervention and transitional care.

This comprehensive research report categorizes the Hypertension Drug market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Dosage Form

- Age Group

- Treatment Type

- Drug Class

- Distribution Channel

- End User

Illuminating Key Regional Dynamics Shaping Hypertension Drug Adoption Across the Americas, EMEA Territories, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping the adoption and uptake of hypertension therapies across major markets. In the Americas, well-established reimbursement frameworks and robust healthcare infrastructures facilitate rapid formulary inclusion and broad patient access. This environment encourages pharmaceutical companies to pursue value-based contracting and patient support programs to differentiate offerings and secure preferred placement. Moreover, heightened regulatory scrutiny around drug safety has driven proactive pharmacovigilance efforts, further strengthening market confidence.

Conversely, Europe, the Middle East, and Africa present a heterogeneous landscape in which regulatory harmonization initiatives coexist with diverse healthcare funding models. In Western European nations, centralized approval mechanisms under the European Medicines Agency streamline market entry, while emerging economies in the Middle East and Africa often contend with variable infrastructure and pricing pressures. As a result, manufacturers must adopt flexible pricing and distribution frameworks, leveraging local partnerships to navigate complex regulatory terrains and ensure consistent supply.

Across Asia-Pacific, rapid economic development and expanding urban populations have accelerated demand for hypertension treatments. Public health campaigns aimed at early screening and lifestyle interventions are complemented by growing private sector involvement in pharmaceutical distribution. However, affordability concerns and patent expirations have heightened competition from generics, prompting innovators to underscore differentiated clinical benefits and support access initiatives through tiered pricing models.

This comprehensive research report examines key regions that drive the evolution of the Hypertension Drug market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Movements and Product Portfolios of Leading Pharmaceutical Companies Driving Innovation in Hypertension Therapies

Leading pharmaceutical companies have demonstrated strategic agility through portfolio diversification, strategic alliances, and targeted R&D investments. Major multinationals continue to extend their reach by acquiring promising pipeline assets and forging research collaborations focused on novel hypertensive pathways. Simultaneously, organizations with established product lines are enhancing lifecycle management through next-generation formulations, such as extended-release tablets and fixed-dose combination injectables designed to optimize patient adherence and streamline clinical protocols.

Moreover, several industry players have embraced digital engagement platforms, partnering with technology firms to integrate remote monitoring solutions that complement drug therapies and provide holistic treatment offerings. These cross-sector alliances not only fortify brand loyalty but also generate valuable real-world data to inform regulatory submissions and health economic evaluations. At the same time, mid-sized innovators specializing in niche therapy segments have carved out competitive niches by focusing on differentiated mechanisms of action and personalized care models, exemplifying how agile execution can propel market penetration even in highly saturated environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hypertension Drug market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alembic Pharmaceuticals Ltd.

- Astellas Pharma Inc.

- AstraZeneca PLC

- Bayer AG

- Boehringer Ingelheim International GmbH

- Cipla Limited

- Daiichi Sankyo Company, Limited

- Dr. Reddy’s Laboratories Ltd.

- Eli Lilly and Company

- Gilead Sciences, Inc.

- Hanmi Pharmaceutical Co., Ltd.

- Lupin Limited

- Mankind Pharma Limited

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sandoz

- Sanofi S.A.

- Servier Laboratories

- Sun Pharmaceutical Industries Ltd.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

- Zydus Lifesciences Ltd.

Actionable Strategies for Pharmaceutical Executives to Accelerate Growth, Enhance Market Penetration, and Foster Sustainable Competitive Advantages

To thrive in the fiercely competitive hypertension drug market, industry leaders must execute a multifaceted growth playbook rooted in innovation, strategic partnerships, and supply chain resilience. First, prioritizing the development of combination therapies with proven efficacy and convenience can accelerate time to target blood pressure and enhance patient satisfaction. Furthermore, integrating digital adherence tools directly into product offerings will not only foster improved compliance but also differentiate brands in the eyes of payers and providers.

In parallel, executives should diversify raw material sourcing to mitigate geographic concentration risks exposed by recent tariff changes, establishing strategic alliances with multiple CDMOs and exploring localized API production where feasible. Additionally, embracing adaptive pricing models that align drug costs with demonstrated clinical outcomes can facilitate formulary negotiations and underpin value-based agreements. To capture growth in emerging markets, stakeholders are advised to customize market entry approaches by aligning with regional regulatory frameworks, leveraging patient access programs, and co-creating disease awareness initiatives with local healthcare influencers.

Comprehensive Research Methodology Combining Rigorous Primary Interviews, Extensive Secondary Analysis, and Robust Data Triangulation Protocols

The findings presented herein are underpinned by a rigorous research framework that integrates both primary and secondary methodologies. In the primary phase, structured interviews were conducted with a diverse set of key opinion leaders, including cardiologists, clinical pharmacologists, and senior executives at pharmaceutical organizations. These sessions provided firsthand perspectives on patient needs, competitive dynamics, and emerging therapeutic trends.

Complementing this qualitative input, an exhaustive secondary research effort encompassed peer-reviewed journals, regulatory filings from leading agencies, and corporate disclosures. Detailed patent landscape analyses and drug pipeline reviews furnished insights into innovation trajectories. To ensure reliability, data triangulation protocols were employed, cross-verifying findings across multiple sources and statistical datasets. Advanced analytical techniques, including scenario modeling and trend extrapolation, were applied to discern patterns without engaging in explicit forecasting, thereby preserving analytical integrity and actionable relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hypertension Drug market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hypertension Drug Market, by Dosage Form

- Hypertension Drug Market, by Age Group

- Hypertension Drug Market, by Treatment Type

- Hypertension Drug Market, by Drug Class

- Hypertension Drug Market, by Distribution Channel

- Hypertension Drug Market, by End User

- Hypertension Drug Market, by Region

- Hypertension Drug Market, by Group

- Hypertension Drug Market, by Country

- United States Hypertension Drug Market

- China Hypertension Drug Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Concluding Reflections Highlighting the Critical Role of Collaboration, Innovation, and Strategic Agility in Driving Hypertension Treatment Success

In conclusion, the hypertension drug landscape is defined by rapid innovation, evolving regulatory environments, and shifting patient expectations. Collaboration between pharmaceutical innovators, healthcare providers, and technology partners is paramount to drive therapeutic advancements and deliver holistic care pathways. The cumulative impact of policy changes such as the 2025 tariff adjustments underscores the necessity of strategic agility and proactive supply chain management.

Looking ahead, companies that successfully integrate precision medicine principles, leverage digital health solutions, and adopt adaptive market strategies will be well-positioned to capture emerging opportunities and address unmet patient needs. By maintaining a relentless focus on efficacy, safety, and value demonstration, industry stakeholders can jointly propel the next wave of breakthroughs in hypertension treatment, ultimately improving patient outcomes and strengthening health systems worldwide.

Empowering Stakeholders to Unlock In-Depth Market Insights and Competitive Intelligence Through Direct Engagement with Our Senior Sales Leadership

We invite you to gain unparalleled insights into the hypertension drug market by engaging directly with our Associate Director, Sales & Marketing, Ketan Rohom. Leveraging a wealth of industry experience and deep domain expertise, Ketan is ideally positioned to answer your strategic questions, tailor research solutions to your organization’s needs, and unlock actionable intelligence that drives competitive advantage. By connecting with Ketan, you ensure timely access to the full breadth of our comprehensive report, including exclusive data analyses, executive interviews, and forward-looking trend evaluations. Don’t miss this opportunity to transform your decision-making with authoritative market intelligence delivered by a seasoned sales and marketing leader. Reach out today to secure your copy and empower your team with the knowledge needed to navigate the rapidly evolving hypertension treatment landscape.

- How big is the Hypertension Drug Market?

- What is the Hypertension Drug Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?