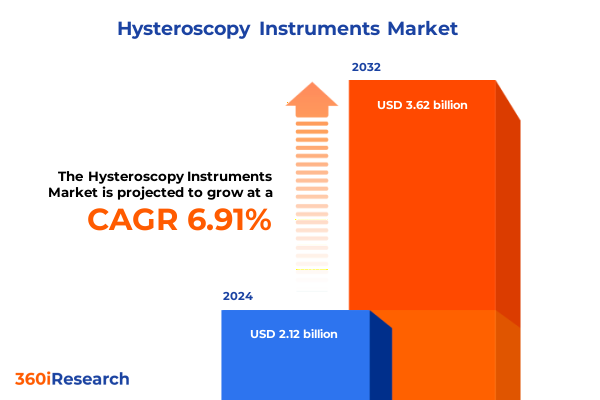

The Hysteroscopy Instruments Market size was estimated at USD 2.26 billion in 2025 and expected to reach USD 2.41 billion in 2026, at a CAGR of 6.96% to reach USD 3.62 billion by 2032.

Unlocking the Future of Hysteroscopy Instruments with Insights on Clinical Trends Technological Innovation Market Dynamics Strategic Pathways and Industry Outlook

Hysteroscopy has emerged as a cornerstone in modern gynecological care, offering clinicians a minimally invasive window into the uterine cavity for both diagnostic and therapeutic interventions. This evolution has been driven by a convergence of clinical demand and technological progress, as healthcare providers seek approaches that reduce patient discomfort, minimize recovery times, and lower the risk of complications associated with open surgery. The significance of this shift is underscored by the prevalence of abnormal uterine bleeding, which affects an estimated 10% to 30% of women of reproductive age and often manifests as excessive, irregular, or prolonged menstrual flow that warrants timely evaluation and intervention.

In parallel, the rising incidence of uterine pathologies such as intrauterine polyps, submucosal fibroids, and endometrial hyperplasia has amplified the demand for precise visualization and targeted tissue resection. Clinical guidelines increasingly recommend hysteroscopic assessment as the first-line modality for persistent abnormal uterine bleeding, reinforcing its role in both ambulatory and hospital settings. As a result, market dynamics have evolved to support a diversified portfolio of instruments capable of addressing distinct procedural requirements, from flexible scopes enabling navigation through complex anatomy to rigid systems optimized for operative myomectomy.

Moreover, structural and nonstructural etiologies of uterine disorders-classified under international standards such as PALM-COEIN-underscore the need for versatile instrumentation that can seamlessly transition between diagnostic and operative functions. These factors establish the backdrop for a market characterized by rapid innovation in imaging resolution, fluid management precision, and ergonomic design, setting the stage for the subsequent exploration of transformative shifts reshaping hysteroscopy instrumentation.

Charting the Transformative Shifts Reshaping Hysteroscopy Instrumentation from Digital Miniaturization to AI Integration and Sustainable Single Use Strategies

Over the past several years, a confluence of technological breakthroughs and shifting clinical paradigms has driven transformative change in hysteroscopy instrumentation. A primary catalyst has been the digital miniaturization of scopes and associated hardware, enabling portable, battery-powered systems that extend procedural capabilities beyond the hospital operating room into outpatient clinics and office-based settings. These all-in-one platforms integrate high-definition visualization with automated fluid management, delivering same-day diagnostic and therapeutic interventions without the logistical burden of central sterile processing.

Simultaneously, the rise of single-use instruments reflects a heightened focus on infection control and operational efficiency. Disposable hysteroscopes, sheaths, and accessory tools not only mitigate cross-contamination risks but also eliminate the time and cost associated with reprocessing. This trend has been further propelled by the persistent imperative to streamline workflows in ambulatory surgical centers and fertility clinics where patient throughput and sterility protocols are critical.

On the operative front, electrosurgical innovations-such as bipolar loops, vaporization electrodes, and mini-resectoscopes-have become more ergonomic and precise, affording surgeons enhanced control over tissue ablation while preserving endometrial integrity. Moreover, emerging AI-assisted imaging platforms leverage computer vision algorithms to differentiate tissue types in real time, flag suspicious lesions, and provide decision support during complex resections. Together, these advancements signal a paradigm shift toward more personalized, data-driven hysteroscopic procedures that align with patient-centered care models.

Assessing the Cumulative Impact of 2025 United States Tariffs on Hysteroscopy Instrument Supply Chains Manufacturing Costs and Strategic Sourcing Decisions

The implementation of revised Section 301 tariffs on medical imports in 2024 and 2025 has introduced notable complexities for manufacturers and healthcare providers within the hysteroscopy instruments market. Under the USTR’s final modifications, critical components such as surgical gloves were subject to a 50% tariff increase starting January 1, 2025, while syringes and needles faced duties of up to 100% from September 27, 2024. Additional tariffs on disposable textile masks and respirators further exacerbated cost pressures for consumable supplies integral to hysteroscopic procedures.

Concurrently, broader proposals to extend duties to triage and fluid management electronics threaten to elevate expenses for hysteroscopic fluid management systems that incorporate advanced pumping and sensor technologies. As a result, manufacturers relying on global supply chains-particularly those importing metal sheaths, optical fibers, and electronic modules from mainland China-are confronted with increased landed costs, extended lead times, and potential supply disruptions. These dynamics have prompted several key industry players to reevaluate their sourcing strategies, exploring nearshoring and enhanced domestic production to mitigate tariff exposure.

Healthcare facilities have responded by negotiating multi-year contracts to lock in pricing and by diversifying vendor portfolios to balance cost and availability. Despite these efforts, the regulatory landscape continues to evolve, underscoring the importance for stakeholders to maintain agility in procurement and to advocate for targeted exemptions for critical medical instruments. Ultimately, the cumulative impact of heightened tariffs underscores the necessity for robust strategic planning across manufacturing, distribution, and purchasing functions.

Decoding Key Segmentation Insights in the Hysteroscopy Instruments Market Across Products Procedures Applications End Users to Drive Targeted Growth Strategies

The hysteroscopy instruments market can be best understood through an analysis of key segmentation dimensions, each revealing distinct growth drivers and competitive dynamics. From the standpoint of product type, the market encompasses flexible hysteroscopes prized for their navigational capabilities, fluid management systems designed to optimize intrauterine distension and visualization, hysterosheaths that facilitate sterile access and instrument exchange, and rigid hysteroscopes favored for operative procedures requiring robust instrumentation.

Procedure type segmentation further differentiates between diagnostic and operative uses. Diagnostic hysteroscopy, leveraging high-resolution optics and narrow-bore scopes, has become routine for evaluating abnormal uterine bleeding and confirming structural anomalies. Conversely, operative hysteroscopy demands larger working channels and electrosurgical capabilities to perform interventions such as myomectomy, polypectomy, and endometrial ablation. This procedural bifurcation underscores the need for versatile platforms capable of transitioning seamlessly from diagnostic assessment to therapeutic intervention.

Application-based segmentation highlights the specific clinical settings in which hysteroscopy instruments are deployed, including endometrial ablation for heavy menstrual bleeding, hysteroscopic myomectomy and polypectomy for fibroid and polyp removal, office-based hysteroscopy for rapid outpatient diagnostics, and tubal sterilization techniques that leverage enhanced visualization. Each application imposes unique requirements on instrument ergonomics, channel size, and fluidics.

Finally, the end-user landscape-spanning academic and research institutions, ambulatory surgical centers, fertility centers, and hospitals-reflects varying procurement processes, budgetary considerations, and procedural volumes. Academic and research institutions drive innovation through clinical trials and early adoption of novel platforms, while ASCs and fertility centers emphasize patient throughput and cost efficiency. Hospitals, for their part, balance inpatient procedural needs with outpatient expansion, making them critical hubs for both diagnostic and operative hysteroscopy.

This comprehensive research report categorizes the Hysteroscopy Instruments market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Procedure Type

- Instrument Design

- Application

- End User

Unearthing Key Regional Dynamics Across the Americas Europe Middle East Africa and Asia Pacific to Illuminate Growth Patterns and Market Opportunities

Regional dynamics within the hysteroscopy instruments market reveal distinct patterns of adoption, investment, and regulatory influence. In the Americas, the United States commands a substantial share, driven by advanced healthcare infrastructure, favorable reimbursement pathways for minimally invasive procedures, and a robust network of ambulatory surgical centers. Canadian adoption, while more measured, benefits from coordinated public health initiatives that emphasize cost-effective diagnostics and therapeutics.

Across Europe, the Middle East, and Africa, heterogeneous healthcare systems shape market trajectories. Western Europe remains at the forefront of high-definition imaging and single-use instrument adoption, supported by regional medical device regulations that facilitate rapid market entry for innovative platforms. In contrast, emerging markets in Eastern Europe and the Middle East present growth opportunities rooted in expanding insurance coverage and investments in women’s health. Africa’s market, though nascent, shows promise through targeted public-private partnerships aimed at enhancing gynecological care access and reducing maternal morbidity.

The Asia-Pacific region exhibits the fastest growth rates, propelled by rising healthcare expenditures, increasing awareness of minimally invasive gynecological diagnostics, and government-led programs to improve women’s health outcomes. Key markets such as China, Japan, India, and Australia are prioritizing the procurement of advanced hysteroscopy systems, while Southeast Asian countries leverage regional manufacturing hubs to produce cost-competitive disposable instrumentation. As a result, Asia-Pacific's demand underscores the global shift toward outpatient-centric care and highlights the strategic importance of localized production and distribution networks to address diverse regulatory and economic environments.

This comprehensive research report examines key regions that drive the evolution of the Hysteroscopy Instruments market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Company Insights on Innovation Partnerships and Competitive Strategies Shaping the Global Hysteroscopy Instruments Landscape

A cadre of leading medical device companies continues to drive innovation and shape the competitive landscape of the hysteroscopy instruments market. Karl Storz has advanced high-definition imaging with its latest camera systems and LED-illuminated scopes, enhancing optical clarity for both diagnostic and operative procedures. Olympus, in partnership with AI specialist Iterative Scopes, is pioneering machine-learning algorithms that assist clinicians in lesion detection and procedural decision support, signaling a new frontier in smart operating environments. Hologic’s launch of the Omni 30° hysteroscope, which integrates both diagnostic and operative functionalities, demonstrates the trend toward multipurpose platforms suited for office-based interventions.

Medtronic’s commitment to a unified electrosurgical platform reflects a strategic investment in interoperability across gynecological instruments, reducing the need for multiple generators and streamlining inventory requirements. Cooper Surgical and B. Braun have bolstered their portfolios through targeted acquisitions and partnerships, expanding access to single-use sheaths and adjunct devices that enhance procedural sterility and efficiency. Boston Scientific, known for its robust resectoscope offerings, continues to refine ergonomic designs and channel geometries to improve surgeon control during complex myomectomies.

These companies are not only competing on device performance but also on service models, offering comprehensive training programs, telehealth-enabled support, and value-based contracting arrangements. Such holistic approaches underscore their recognition that clinical outcomes and operational support are as critical as instrumentation in driving long-term adoption and customer loyalty.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hysteroscopy Instruments market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Endoscopy Solutions, Inc.

- B. Braun Melsungen AG

- Boston Scientific Corporation

- ConMed Corporation

- Cook Medical Inc.

- CooperSurgical Inc.

- Delmont imaging

- Endoscan Technologies, Inc.

- EndoWave Technologies, Inc.

- Erbe Elektromedizin GmbH

- Fujifilm Holdings Corporation

- Hologic, Inc.

- Hospiinz International

- Johnson & Johnson Services, Inc.

- Karl Storz GmbH & Co. KG

- MedGyn Products, Inc.

- Mediviz Solutions, Inc.

- Medtronic PLC

- Minerva Surgical, Inc.

- Olympus Corporation

- Richard Wolf GmbH

- RZ-Medizintechnik GmbH

- Smith & Nephew plc

- Stryker Corporation

- Surgical Holdings is a Limited Company

Actionable Recommendations Empowering Industry Leaders to Capitalize on Technological Advances Supply Chain Optimization and Market Diversification

To navigate the complex and evolving hysteroscopy instruments market, industry leaders should embrace a multifaceted strategy. First, prioritizing modular platform development will allow rapid reconfiguration between diagnostic and operative modes, enabling providers to address diverse patient needs with a single system. Second, investing in domestic or regional manufacturing facilities can mitigate exposure to tariff volatility and supply chain disruptions, while also enhancing responsiveness to local regulatory requirements.

Third, forming strategic alliances with software and AI developers will be critical for embedding advanced diagnostic capabilities into existing hardware, creating differentiated offerings that support precision medicine. Fourth, broadening distribution channels to include fertility clinics and ambulatory surgical centers can capture growth in outpatient care, as these settings increasingly favor minimally invasive approaches for both routine and complex interventions.

Finally, proactive engagement with payers and regulatory bodies can accelerate reimbursement approvals for novel technologies and secure exemptions from tariffs that disproportionately affect medical devices. By integrating these recommendations, leaders can fortify their competitive positioning, optimize cost structures, and deliver enhanced clinical value throughout the care continuum.

Explaining the Rigorous Research Methodology Underpinning Hysteroscopy Instruments Market Analysis to Ensure Data Integrity and Insight Reliability

This analysis is founded on a robust methodology combining primary and secondary research to ensure comprehensive and reliable insights. Secondary sources, including peer-reviewed journals, regulatory filings, and industry publications, were reviewed to identify clinical trends, technological advancements, and policy changes affecting hysteroscopy instrumentation. In parallel, primary research involved structured interviews with key opinion leaders-such as gynecologic surgeons, procurement specialists, and medical device executives-to validate secondary findings and uncover nuanced market dynamics.

Data triangulation was employed to reconcile differing viewpoints and ensure consistency across sources. Segmentation variables were defined in consultation with industry experts to reflect the practical categorizations used by manufacturers and healthcare purchasers. Regional analyses incorporated country-specific regulatory frameworks and healthcare spending data, while tariff impact assessments leveraged official USTR notices and trade law commentary.

Finally, all findings underwent rigorous quality checks, including cross-referencing against publicly available financial statements, patent filings, and product launch announcements. This systematic approach guarantees that the resulting insights are both actionable and grounded in verifiable evidence, providing stakeholders with a transparent and defensible basis for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hysteroscopy Instruments market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hysteroscopy Instruments Market, by Product Type

- Hysteroscopy Instruments Market, by Procedure Type

- Hysteroscopy Instruments Market, by Instrument Design

- Hysteroscopy Instruments Market, by Application

- Hysteroscopy Instruments Market, by End User

- Hysteroscopy Instruments Market, by Region

- Hysteroscopy Instruments Market, by Group

- Hysteroscopy Instruments Market, by Country

- United States Hysteroscopy Instruments Market

- China Hysteroscopy Instruments Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Drawing a Strategic Conclusion Emphasizing Critical Trends Opportunities and Imperatives for Stakeholders in Hysteroscopy Instrumentation

The hysteroscopy instruments market stands at the intersection of clinical necessity and technological possibility, shaped by evolving patient demographics, procedural preferences, and policy frameworks. Advancements in digital miniaturization, single-use disposables, and AI-enabled imaging are redefining procedural efficiency and diagnostic precision, while heightened tariffs underscore the importance of resilient supply chain strategies.

Segmentation analysis reveals distinct pathways for growth across product types-from flexible scopes to fluid management systems-and applications ranging from office-based diagnostics to complex operative myomectomy. Regional dynamics highlight both mature markets with established reimbursement models and emerging economies poised for rapid expansion, underscoring the value of localized approaches to manufacturing, distribution, and regulatory compliance.

Leading companies continue to differentiate through integrated platforms, strategic partnerships, and service-based models that augment device performance with training and support. As stakeholders navigate this intricate landscape, the synthesis of clinical insights, technological innovation, and strategic foresight will be essential to capturing market share and driving improved patient outcomes in the realm of minimally invasive gynecological care.

Take the Next Step with an Exclusive Offer to Connect with Associate Director Ketan Rohom to Secure Your Comprehensive Hysteroscopy Instruments Market Report

Ready to elevate your strategic decision-making in the hysteroscopy instrumentation market? Connect directly with Associate Director Ketan Rohom to discuss how this comprehensive report can address your organization’s unique challenges and unlock growth opportunities. Whether you aim to refine product portfolios, optimize supply chains in response to evolving tariffs, or capitalize on emerging regional dynamics, Ketan’s expertise will guide you toward actionable insights tailored to your strategic objectives. Seize this opportunity to gain an authoritative perspective on market segmentation, competitive landscapes, and transformative technology trends. Reach out today to secure your copy of the full market research report and empower your team with the foresight needed to lead in this fast-evolving domain

- How big is the Hysteroscopy Instruments Market?

- What is the Hysteroscopy Instruments Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?