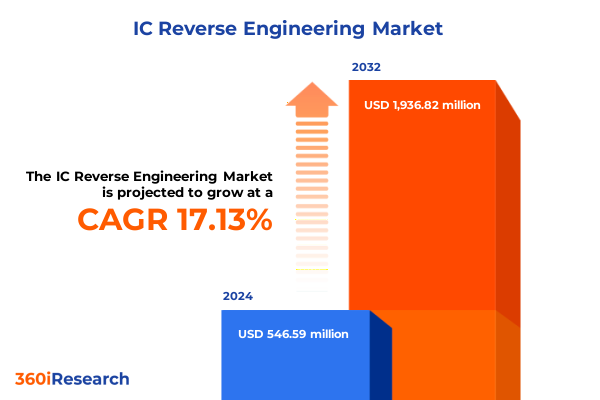

The IC Reverse Engineering Market size was estimated at USD 634.48 million in 2025 and expected to reach USD 738.48 million in 2026, at a CAGR of 17.28% to reach USD 1,936.82 million by 2032.

Unlocking the Foundations of Integrated Circuit Reverse Engineering: A Comprehensive Introduction to Techniques, Trends, and Strategic Relevance

The world of integrated circuit reverse engineering stands at the crossroads of technological ingenuity and strategic necessity, where deciphering the inner workings of semiconductor devices has become a critical enabler for innovation, competitive intelligence, and product validation. As industries ranging from consumer electronics to defense pursue ever-increasing performance and miniaturization, the ability to deconstruct chips layer by layer has evolved from a niche skill into an essential capability. This transformation is driven by advances in instrumentation, analytical software, and collaborative frameworks that bridge the gap between hardware design and forensic examination, and it underpins pivotal advancements across multiple application domains.

Against this backdrop, reverse engineering has emerged as both a defensive measure for intellectual property protection and an offensive strategy to glean best-in-class design practices. Practitioners leverage a spectrum of physical and digital techniques-spanning decapping to X-ray imaging and software analysis-to extract architectural details, validate manufacturing integrity, and identify potential vulnerabilities. By combining high-resolution electron and optical microscopy with voltage probing and algorithmic code reconstruction, experts can reconstruct circuit schematics, functional blocks, and firmware interactions. This introduction lays the groundwork for understanding how reverse engineering methods are orchestrated to deliver strategic value, setting the stage for a deeper exploration of the landscape’s transformative shifts and emerging imperatives.

Transformative Shifts in the Industry Landscape: Unveiling Breakthroughs in Techniques, Tools, and Market Dynamics Driving Change

The reverse engineering landscape has witnessed transformative shifts, driven by a convergence of sophisticated analytical tools, evolving regulatory environments, and a surge in collaborative research initiatives. Cutting-edge hardware platforms now integrate artificial intelligence into microscopy workflows, enabling automated defect detection and pattern recognition at unprecedented speeds. At the same time, software analysis frameworks have matured to support dynamic code tracing and simulation-based reverse compilation, which enhance the ability to validate firmware behavior under real-world operating conditions.

Simultaneously, the proliferation of open-access knowledge repositories and consortium-led research programs has democratized access to best practices, fostering cross-industry synergies. Regulatory developments, particularly those addressing export controls and intellectual property enforcement, have further shaped vendor strategies, prompting the adoption of enhanced encryption and tamper-resistant packaging. As a result, market participants must continuously adapt their toolsets, combining voltage probing and X-ray imaging with advanced decapping protocols to maintain analytical accuracy. Together, these breakthroughs and collaborative modalities redefine the boundaries of what is possible in integrated circuit reverse engineering, heralding a new era of precision, efficiency, and strategic impact.

Assessing the Cumulative Impact of 2025 United States Tariffs on Integrated Circuit Reverse Engineering Ecosystem and Stakeholder Strategies

The imposition of additional 2025 United States tariffs has exerted a layered influence on the integrated circuit reverse engineering sector, with ripple effects permeating supply chains, tooling costs, and cross-border collaboration. Elevated duties on semiconductor fabrication equipment, analytical instrumentation, and specialized consumables have increased operating expenses for labs reliant on imports, compelling many to reassess vendor relationships and sourcing strategies. In response to cost pressures, some organizations have accelerated efforts to qualify domestic suppliers and invest in onshore production capabilities, thereby mitigating exposure to fluctuating tariff regimes.

Moreover, the new tariff landscape has prompted industry stakeholders to revisit contractual frameworks, placing greater emphasis on total landed cost analysis and risk-sharing mechanisms. Collaborative reverse engineering projects between U.S.-based research institutions and international partners have encountered administrative complexities, as import compliance reviews extend project timelines. Nonetheless, these challenges have spurred a resurgence of investment in automation and high-throughput analytical processes, as firms seek to offset duty-related cost increases. By balancing strategic inventory planning with diversified procurement channels, market participants are adapting to these trade policy shifts, ensuring that essential reverse engineering capabilities remain accessible and cost-effective.

Key Segmentation Insights Driving Tailored Approaches in Integrated Circuit Reverse Engineering Across Types, Techniques, and End-User Applications

A nuanced understanding of market segmentation reveals tailored insights that guide investment and development priorities across diverse use cases. By examining segmentation based on IC type, stakeholders can discern distinct adoption patterns for Application-Specific Integrated Circuits, Memory ICs, and Microprocessors & Microcontrollers, recognizing that each category demands specialized analytical protocols and varying levels of reverse-engineering sophistication. Similarly, segmentation by technique surfaces strategic trade-offs between physical deconstruction methods such as decapping, electron microscopy, optical microscopy, X-ray imaging, and voltage probing, and the increasingly essential role of software analysis for firmware extraction.

Further granularity emerges when evaluating end-user segmentation, which encompasses Academic & Research Institutions, Electronic Component Manufacturers, and Semiconductor Companies. Academic laboratories often prioritize methodological innovation and academic publication, while component manufacturers emphasize quality assurance, counterfeit detection, and competitive benchmarking. Semiconductor companies, in turn, integrate reverse engineering within product development cycles to validate intellectual property and optimize design iterations. These segmentation insights illuminate how the interplay between device type, analytical technique, and end-user objectives shapes capability roadmaps and strategic investments across the industry.

This comprehensive research report categorizes the IC Reverse Engineering market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- IC Type

- Technique

- End-User

- Application

Regional Perspectives Shaping the Future of Integrated Circuit Reverse Engineering in the Americas, EMEA, and Asia-Pacific Markets

Diverse regional dynamics influence the evolution of integrated circuit reverse engineering, with the Americas, Europe, Middle East & Africa, and Asia-Pacific each exhibiting unique market drivers. In the Americas, robust R&D funding and a strong ecosystem of semiconductor foundries support advanced initiatives in high-performance computing chip analysis and defense-related reverse engineering projects. North American academic institutions further accelerate methodological advances through publicly funded grants that foster collaboration between universities, national laboratories, and private-sector partners.

Meanwhile, Europe, Middle East & Africa combine stringent intellectual property regulations with innovative consortium programs that streamline cross-border research. Regulatory harmonization efforts within the European Union facilitate technology transfer, while Middle Eastern and African nations increasingly invest in localized analytical capabilities to reduce dependency on external service providers. In contrast, the Asia-Pacific region leverages economies of scale in electronics manufacturing and benefits from vertically integrated supply chains to drive cost-effective deployment of reverse engineering services. Regional centers of excellence in East Asia and Oceania promote specialized expertise in memory IC validation and mobile chipset analysis, reflecting the region’s dominance in consumer electronics manufacturing.

This comprehensive research report examines key regions that drive the evolution of the IC Reverse Engineering market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Innovating in Integrated Circuit Reverse Engineering Through Strategic Partnerships and Advanced Technological Capabilities

Leading providers in the integrated circuit reverse engineering domain distinguish themselves through proprietary technology platforms, strategic partnerships, and comprehensive service portfolios. Some organizations have invested heavily in next-generation electron microscopy systems coupled with machine learning algorithms, enabling rapid layer-by-layer reconstruction of complex chip architectures. Others have forged alliances with equipment manufacturers and academic consortia to co-develop advanced decapping techniques and enhance failure analysis capabilities.

In parallel, select firms have expanded their offerings to include turnkey software analysis suites that automate firmware extraction and decompilation workflows, reducing time-to-insight for critical security and IP validation use cases. Strategic acquisitions further bolster technical depth, as companies integrate specialized teams with proven expertise in voltage probing, X-ray imaging, and reverse compilation. By blending cutting-edge instrumentation, bespoke analytical software, and multidisciplinary talent, these key market players set the benchmark for quality, reliability, and innovation in reverse engineering services.

This comprehensive research report delivers an in-depth overview of the principal market players in the IC Reverse Engineering market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3DIMETIK GmbH & Co. KG

- Chip Position System Intelligence Co., Ltd

- Fast PCB Studio

- FASTPCBCOPY

- Flatworld Solutions Pvt. Ltd.

- Fullbax Sp. z o.o.

- GHB Intellect

- ICmasters Ltd.

- Kinectrics Inc.

- LTEC Corporation

- New Prajapati Electronics

- RAITH GmbH

- REATISS LLC

- Reliable Techno Systems India Pvt. Ltd.

- Sagacious IP

- Sauber Technologies AG

- scia Systems GmbH

- Shenzhen Sichi Technology Co., Ltd.

- SS Metrology Solutions

- Synopsys, Inc.

- TechInsights Inc.

- Tetrane by eShard

- Texplained

- UnitedLex

- V5 semiconductors

Actionable Recommendations for Industry Leaders to Enhance Competitive Advantage and Foster Innovation in Integrated Circuit Reverse Engineering Initiatives

To navigate the complexities of the reverse engineering landscape, industry leaders should prioritize investments in automation and cross-disciplinary talent acquisition. Establishing collaborative frameworks that bring together materials scientists, electrical engineers, and software analysts will ensure that emerging analytical techniques are swiftly translated into operational workflows. Simultaneously, adopting modular equipment architectures allows for rapid integration of new microscopy, probing, and imaging modalities, reducing capital expenditure risks while maintaining analytical agility.

Furthermore, organizations should reevaluate supply chain resilience by diversifying equipment and consumable sources, incorporating dual-sourcing strategies to mitigate tariff-related disruptions. Implementing digital twin models of chip architectures can streamline reverse engineering processes and enhance predictive failure analysis. Lastly, fostering partnerships with academic institutions and consortium-led initiatives will keep teams abreast of the latest methodological breakthroughs and regulatory developments. By aligning internal capabilities with external expertise and preventive planning, industry leaders can secure a sustained competitive advantage in reverse engineering endeavors.

Rigorous Research Methodology Employing Multi-Source Data Collection, Expert Validation, and Analytical Frameworks for In-Depth Insights

This research employs a rigorous methodology that integrates multi-source data collection, expert validation, and structured analytical frameworks. Secondary sources, including peer-reviewed journals, patent databases, and open-access technical whitepapers, provided a foundational understanding of reverse engineering techniques and regulatory landscapes. Primary research comprised in-depth interviews with domain experts across academia, equipment manufacturers, and service providers, ensuring that practical perspectives on emerging technologies and market challenges were accurately captured.

Data triangulation techniques validated key findings by cross-referencing quantitative insights from bibliometric analysis with qualitative inputs from expert roundtables. A standardized rubric assessed the maturity, scalability, and cost implications of each technique, while regional factors were evaluated through case studies of representative institutions and companies. This comprehensive approach guarantees that the research delivers balanced, evidence-based insights, offering stakeholders a clear roadmap to inform strategic planning and operational execution.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our IC Reverse Engineering market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- IC Reverse Engineering Market, by IC Type

- IC Reverse Engineering Market, by Technique

- IC Reverse Engineering Market, by End-User

- IC Reverse Engineering Market, by Application

- IC Reverse Engineering Market, by Region

- IC Reverse Engineering Market, by Group

- IC Reverse Engineering Market, by Country

- United States IC Reverse Engineering Market

- China IC Reverse Engineering Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Conclusive Insights Summarizing Critical Findings and Strategic Implications for Stakeholders in Integrated Circuit Reverse Engineering

The integrated circuit reverse engineering domain is characterized by rapid innovation, regulatory flux, and strategic significance for multiple industries. Critical findings underscore the importance of advanced analytical techniques-ranging from AI-enhanced microscopy to automated firmware decompilation-as key drivers of efficiency and precision. The cumulative impact of 2025 United States tariffs has further highlighted the need for diversified procurement strategies and domestic qualification of essential tooling to maintain operational continuity.

Segmentation insights reveal that device type, analytical methodology, and end-user objectives collectively shape capability roadmaps, guiding tailored investment decisions. Regional analyses emphasize the pivotal roles of established research hubs in the Americas, regulatory harmonization in Europe, Middle East & Africa, and manufacturing scale in Asia-Pacific. Leading companies set benchmarks through strategic alliances and technology integration, while actionable recommendations point to cross-disciplinary collaboration, digital twin implementations, and supply chain resilience as critical levers for sustained competitive advantage. These conclusions equip stakeholders with a cohesive understanding of current dynamics and the strategic imperatives required to thrive in the evolving reverse engineering landscape.

Engage with Associate Director Sales & Marketing to Secure Access to Invaluable Integrated Circuit Reverse Engineering Market Research Reports

To initiate your deep dive into the complexities of integrated circuit reverse engineering and secure actionable insights that will bolster your strategic positioning, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to obtain the complete market research report. Our analysts have meticulously compiled a comprehensive dossier that dissects industry dynamics, technological advancements, and competitive intelligence, empowering you to make informed investment, development, and partnership decisions. By connecting with Ketan, you will gain exclusive access to detailed profiles, segmentation analyses, regional breakdowns, and forward-looking recommendations tailored to your organization’s priorities.

Don’t miss the opportunity to transform your understanding of the reverse engineering landscape and drive innovation at every level of your operations. Engage with our team today to discuss customized research packages, licensing options, and advisory consultations that align with your objectives. Your partnership with Ketan Rohom will unlock the full potential of the integrated circuit reverse engineering market, providing the clarity and direction needed to excel in a rapidly evolving environment.

- How big is the IC Reverse Engineering Market?

- What is the IC Reverse Engineering Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?