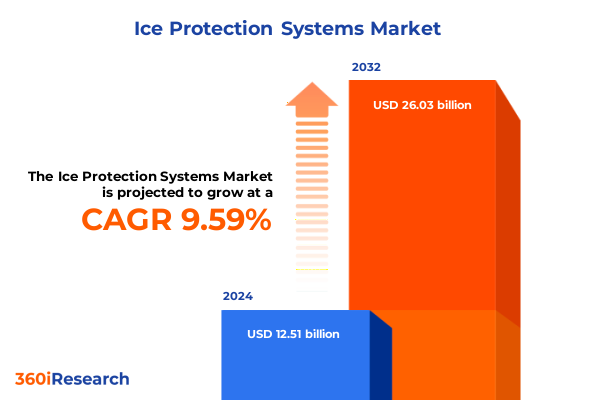

The Ice Protection Systems Market size was estimated at USD 13.55 billion in 2025 and expected to reach USD 14.69 billion in 2026, at a CAGR of 9.76% to reach USD 26.03 billion by 2032.

Setting the Stage for Advancements in Aircraft Ice Protection Systems Amid Growing Safety, Efficiency, and Regulatory Demands Worldwide

Aircraft operating in icing conditions face critical safety and performance challenges that demand robust and reliable protection solutions. With layers of ice forming on structural surfaces and control elements, even minor inaccuracies in ice detection and shedding can escalate into severe operational hazards. Recognizing this imperative, industry stakeholders have prioritized the development of advanced ice protection systems that seamlessly integrate prevention, detection, and removal capabilities. This evolution is driven by the dual goals of safeguarding flight safety and optimizing operational efficiency, ensuring that operators can comply with regulatory requirements without compromising on performance or cost-effectiveness.

As airlines and aircraft manufacturers chart their modernization pathways, they face mounting pressure to adopt systems that are not only effective but also lightweight, energy-efficient, and compatible with diverse airframe architectures. Regulatory bodies worldwide have intensified standards for certification and in-flight performance, placing a premium on continuous ice monitoring and rapid-response deicing functionalities. In this context, the ice protection systems sector has emerged as a focal point for innovation, bridging aerothermal engineering, advanced materials science, and digital sensing techniques. By setting the stage with this introduction, we underscore the urgency and complexity of the challenges confronting the aerospace community and frame the subsequent analysis of the forces reshaping this high-stakes market.

Emerging Technological Breakthroughs and Sustainability Pressures Reshaping the Direction and Innovation Trajectory of Ice Protection Systems

In recent years, the ice protection systems landscape has undergone a profound transformation as manufacturers leverage cutting-edge technologies and respond to mounting sustainability imperatives. Breakthroughs in material science have produced ultralight composite coatings that reduce system weight while maintaining exceptional thermal conductivity. Simultaneously, the integration of digital twin modeling and real-time analytics is enabling proactive maintenance regimes, allowing operators to predict icing events before they compromise aerodynamic performance. These shifts underscore a broader trend toward smarter, more connected platforms that merge traditional deicing approaches with advanced sensing and control algorithms.

Moreover, environmental considerations are accelerating the transition away from legacy chemical-based deicing fluids toward electrically driven and hybrid systems that curtail fluid consumption and associated ecological impacts. This pivot aligns with both airline decarbonization targets and stricter environmental regulations governing runoff and emissions at airports. At the same time, novel ice-detection methodologies-leveraging optical, resistive, ultrasonic, and vibrational sensing-are converging to deliver multi-layered assurance, further enhancing in-flight reliability. Consequently, the landscape now rewards solution providers that can marry performance with environmental stewardship, driving a new wave of competitive differentiation and setting the stage for continued evolution in ice protection technology.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Measures on the Manufacturing and Procurement of Ice Protection Systems

The introduction of targeted United States tariffs in 2025 has introduced complex challenges for manufacturers and operators within the ice protection systems industry. Suppliers that historically relied on international sourcing for key components-ranging from electrical heating elements to advanced sensor modules-have encountered elevated input costs, prompting a reevaluation of global supply networks. As a result, many organizations are accelerating initiatives to diversify their procurement strategies, exploring nearshoring and developing relationships with domestic vendors to hedge against tariff-induced price volatility.

At the same time, downstream stakeholders are experiencing ripple effects in procurement cycles and total cost of ownership assessments. Airlines and maintenance, repair, and overhaul (MRO) providers now factor in potential tariff pass-through costs when negotiating service contracts and aligning budgets for component replacements. This evolving dynamic necessitates closer collaboration between OEMs and end users to structure pricing models that account for regulatory fluctuations while preserving predictable maintenance expenditures. Furthermore, the tariff environment has underscored the importance of supply chain transparency, leading to enhanced tracking protocols and dual-source qualification processes that reinforce resilience against future trade disruptions. Ultimately, stakeholders that proactively adapt to these policy shifts can mitigate financial exposure, maintain program continuity, and safeguard margin performance despite a more constrained trade landscape.

Uncovering Critical Patterns across System Types, Aircraft Categories, Detection Technologies, Distribution Channels, and End-User Profiles

Insightful evaluation of system type shows that thermal-based solutions-spanning bleed air, electrothermal, hybrid, and pneumatic boots-continue to anchor safety assurance, with each approach presenting distinct trade-offs in energy consumption, weight impact, and installation complexity. When attention turns to aircraft categories, it becomes evident that business jets demand compact, low-power configurations to align with limited onboard power availability, while large fixed wing commercial and military platforms can leverage higher-capacity systems for extended-range operations. Rotary-wing aircraft introduce additional constraints, requiring flexible boots or conformal heating elements that accommodate rotor blade dynamics and varying rotor tip speeds.

Examining the evolution of detection methodologies reveals a shift toward multi-technology integration. Optical ice detection is prized for its rapid visual confirmation, resistive sensors offer straightforward temperature-based feedback, ultrasonic techniques deliver sub-surface monitoring, and vibrational methods capture nascent ice accumulation on sensitive components. In distribution channels, established OEM supply pathways coexist with a robust aftermarket ecosystem, where authorized and independent MROs play complementary roles in extending fleet readiness and addressing unplanned deicing demands. Finally, end-user profiles underscore differentiated value drivers: airlines prioritize rapid turnaround and regulatory compliance; general aviation stakeholders-spanning flight schools and private owners-focus on installation simplicity and cost containment; and military branches, including air force, army, and naval aviation units, emphasize mission-critical reliability and system ruggedization. Through this multi-faceted lens, the segmentation insights reveal the nuanced requirements and growth vectors that inform strategic portfolio decisions.

This comprehensive research report categorizes the Ice Protection Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Aircraft Type

- Technology Type

- Distribution Channel

- End-User

Examining Distinct Regional Dynamics Influencing Market Trajectories in Americas, Europe Middle East & Africa, and the Asia-Pacific Aviation Sectors

Regional dynamics exert a powerful influence over the strategic direction and adoption rate of ice protection solutions. In the Americas, a robust pipeline of retrofit programs and fleet renewal initiatives has fueled demand for next-generation deicing technologies, particularly among major North American carriers facing stringent FAA certification requirements. With harsh winter operating environments spanning from the northeastern United States to Canadian Arctic routes, stakeholders in this region emphasize systems that deliver repeatable performance amid extreme temperature fluctuations and prolonged icing exposure.

Across Europe, the Middle East, and Africa, regulatory harmonization has emerged as a key enabler, facilitating the cross-border deployment of standardized ice protection components among carriers and MRO networks. European Union directives on aviation safety mesh with Gulf region ambitions to expand hub-based operations, generating opportunities for advanced electrothermal and hybrid systems that support high-frequency turnaround. Conversely, some EMEA markets contend with limited MRO infrastructure, prompting strategic partnerships that integrate local service capabilities with global technology providers. Asia-Pacific presents a diverse tapestry of growth drivers, from China’s growing commercial fleet modernization to Southeast Asia’s expanding rotorcraft sector. With a mix of tropical storm risks and high-altitude approach corridors in regions such as the Himalayas, operators seek modular solutions that adjust dynamically to both warm precipitation and ice crystal events. Collectively, these regional insights underscore the importance of tailoring product portfolios and service models to distinct operational environments and regulatory regimes.

This comprehensive research report examines key regions that drive the evolution of the Ice Protection Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Maneuvers and Collaborative Ventures of Leading Players Driving Innovation and Competitive Differentiation in Ice Protection Systems

Within the competitive arena, a handful of established and emergent players have executed strategic initiatives to consolidate their leadership positions. Major aerospace suppliers have broadened their portfolios through targeted acquisitions of niche sensor specialists and partnerships with materials innovators, thereby integrating advanced detection modules and low-weight heating substrates into their core offerings. Meanwhile, specialized technology firms are leveraging joint development agreements with airlines to co-design custom solutions that address unique route profiles and aircraft configurations, reinforcing customer lock-in through performance-based contracts.

R&D investment has skewed toward electrical heating architectures that promise lower life-cycle costs by eliminating bleed air dependencies. At the same time, alliances between avionics manufacturers and software developers are driving the emergence of predictive maintenance platforms that overlay weather forecast data and aircraft telemetry to anticipate icing conditions. Collaboration between OEMs and leading MRO providers ensures streamlined rollout of these technologies, with pilot programs demonstrating up to a 40 percent reduction in unscheduled downtime. Furthermore, regional system integrators in high-growth markets are tailoring certified packages to local specifications, enabling rapid certification and deployment. These combined strategies underscore a broader competitive imperative: organizations that seamlessly blend technological prowess, service excellence, and global footprint stand to define the next generation of ice protection system leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ice Protection Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- CAV Systems Ltd.

- Clariant AG

- Collins Aerospace by Raytheon Technologies Corporation

- Cox & Company, Inc.

- Curtiss-Wright Corporation

- EGC Enterprises Inc.

- General Electric Company

- Honeywell International Inc.

- Hutchinson SA

- IceShield De-Icing Systems

- ITT Inc.

- JBT Corporation

- Leonardo S.p.A

- Liebherr-International Deutschland GmbH

- Meggit PLC

- Melrose Industries plc

- NEI Corporation

- Qarbon Aerospace

- Rapco, Inc.

- RHEA Group

- Safran S.A.

- Thales Group

- The DOW Chemical Company

- Thermocoax

- Ultra Electronics Group

Strategic Imperatives and Tactical Measures for Industry Leaders to Accelerate Adoption, Enhance Resilience, and Capture Value in Ice Protection Systems

Industry leaders should prioritize investments in modular ice protection architectures that can be customized across multiple airframe platforms, reducing development timelines and amplifying return on engineering expenditures. By advancing standard interfaces for both sensor arrays and heating elements, organizations can facilitate plug-and-play upgrades within existing fleets, thereby accelerating adoption and minimizing AOG events. Alongside technical innovation, it is imperative to cultivate resilient supply chains through dual-sourcing strategies and strategic inventory positioning, ensuring continuity in the face of policy shifts such as tariffs and trade restrictions.

Leadership teams must also embrace digital transformation by deploying analytics-driven maintenance solutions that ingest real-time in-flight data and environmental inputs. These platforms can trigger pre-emptive deicing cycles, optimize energy use, and extend component lifespans, translating into measurable cost savings. To capture the full potential of these advancements, providers should explore outcome-based commercial models, aligning incentives around system availability and performance rather than unit sales alone. Finally, forging cross-industry partnerships-bridging OEMs, MRO networks, avionics vendors, and regulatory authorities-will be critical to harmonizing certification pathways and accelerating time to airworthiness. By executing these strategic imperatives, industry participants can strengthen their competitive position, foster innovation, and deliver superior value to airlines and operators.

Outlining Rigorous and Transparent Research Methods Employed to Gather, Validate, and Analyze Data on Ice Protection System Technologies and Markets

This research leverages a multi-stage methodology designed to ensure rigor, transparency, and accuracy in uncovering market dynamics. Primary data collection involved structured interviews with a cross-section of stakeholders, encompassing senior engineering executives at OEMs, maintenance directors at leading airlines and MRO organizations, and innovation leads at avionics and materials technology firms. These firsthand insights were complemented by site visits to key manufacturing facilities and operational assessments at maintenance hangars, providing ground-level validation of technology performance and service models.

Secondary research encompassed an exhaustive review of regulatory filings, certification guidelines, patent databases, and white papers from international aviation authorities. This was augmented by analysis of proprietary internal technical reports and case studies documenting in-service performance metrics. Data triangulation techniques were applied to reconcile discrepancies between varied sources, while a proprietary scoring framework evaluated technology readiness, environmental impact, and total life-cycle considerations. Finally, an expert advisory panel comprised of former regulators, flight operations specialists, and aerospace materials scientists reviewed draft findings and offered critical feedback to refine the conclusions. This layered approach ensures that the insights presented here reflect both leading-edge innovations and pragmatic operational realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ice Protection Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ice Protection Systems Market, by System Type

- Ice Protection Systems Market, by Aircraft Type

- Ice Protection Systems Market, by Technology Type

- Ice Protection Systems Market, by Distribution Channel

- Ice Protection Systems Market, by End-User

- Ice Protection Systems Market, by Region

- Ice Protection Systems Market, by Group

- Ice Protection Systems Market, by Country

- United States Ice Protection Systems Market

- China Ice Protection Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Core Insights and Strategic Outlook to Navigate Emerging Opportunities and Challenges within the Evolving Ice Protection Systems Domain

The convergence of advanced materials, digital sensing, and regulatory imperatives has propelled the ice protection systems market into a new era of innovation and complexity. Stakeholders that embrace integrated architectures-combining robust detection methodologies with energy-efficient heating mechanisms-are better positioned to deliver cost-effective and environmentally responsible solutions. Simultaneously, supply chain resilience and tariff mitigation strategies have become non-negotiable components of long-term planning, underscoring the need for agile procurement and dual-sourcing frameworks.

Across regions, the interplay between regulatory harmonization and infrastructure maturity continues to shape adoption patterns, while leading companies differentiate through strategic partnerships and outcome-based service models. As the industry navigates these evolving dynamics, the ability to align product development with end-user priorities-ranging from rapid turnaround in commercial fleets to mission-critical reliability in military operations-will define success. Ultimately, the insights outlined in this executive summary illuminate a path forward for decision-makers seeking to harness technological trends, navigate policy shifts, and capture emerging opportunities within the competitive ice protection systems domain.

Secure Comprehensive Ice Protection Systems Market Intelligence with an Expert Consultation and Unlock Actionable Strategies for Immediate Competitive Advantage

To obtain a comprehensive understanding of the evolving ice protection systems landscape and secure a strategic advantage, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Partnering with Ketan enables you to gain direct access to in-depth analysis, tailored insights, and expert counsel designed to inform critical decisions across design, procurement, and regulatory compliance. By engaging today, you will unlock a set of actionable recommendations that align with your organizational objectives, mitigate emerging risks such as supply chain disruptions and tariff impacts, and highlight opportunities created by technology shifts.

Whether you require a customized briefing, deeper dive into segmentation trends, or a roadmap for enhancing your competitive positioning, Ketan’s expertise ensures that you receive the most pertinent data and strategic guidance. A single conversation can illuminate paths to cost optimization, enhanced reliability, and accelerated time to market. Act now to schedule your consultation, explore bespoke study modules, and secure your copy of the full market research report. By taking this step, you will equip your leadership team with the insights necessary to navigate market complexities and chart a course for sustained growth in the ice protection systems domain.

- How big is the Ice Protection Systems Market?

- What is the Ice Protection Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?