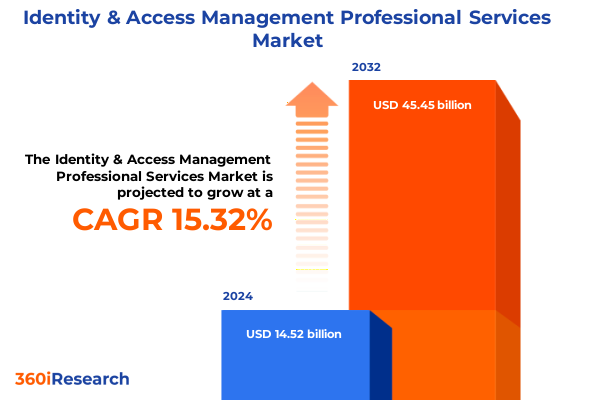

The Identity & Access Management Professional Services Market size was estimated at USD 16.73 billion in 2025 and expected to reach USD 19.19 billion in 2026, at a CAGR of 15.34% to reach USD 45.45 billion by 2032.

Navigating the Complex Terrain of Digital Transformation with Robust Identity and Access Management Professional Services

The digital landscape is becoming increasingly complex, requiring organizations to adopt sophisticated identity and access management professional services to secure their environments. According to a Gartner survey, 63% of organizations worldwide have fully or partially implemented a zero-trust strategy to mitigate evolving cyberthreats and strengthen access controls. This shift underscores the strategic importance of professional services that provide expert guidance throughout planning, deployment, and ongoing management.

As enterprises accelerate digital transformation initiatives, the demand for identity and access management services continues to expand. Hardware, software, and software-as-a-service (SaaS) providers are no longer sufficient on their own; organizations require specialized services to integrate adaptive authentication, privileged access management, and identity governance frameworks. Notably, Forrester research indicates that three-quarters of enterprise and government technology spending targets software and IT services, highlighting the significant opportunity for professional services in this segment.

Moreover, the rise of cloud-centric infrastructures and hybrid work models has driven a transition toward cloud-based IAM solutions. IDC research warns of rising technology prices due to new tariffs that disrupt supply chains and inflate costs for hardware and datacenter components, which in turn places pressure on internal teams to seek external expertise for efficient deployment and cost optimization. Paired with tighter regulatory mandates and growing Zero Trust adoption, these trends position professional services as a critical enabler for organizations striving to maintain security resilience and compliance.

Uncovering the Pivotal Technological and Strategic Shifts Reshaping Identity and Access Management Service Offerings Amid Evolving Threats and Regulations

The identity and access management landscape is undergoing significant transformation driven by advances in AI, shifting threat dynamics, and evolving regulatory requirements. Gartner projects that by 2028, 60% of zero-trust technologies will incorporate AI capabilities to detect anomalous behaviors and enable real-time threat prevention, elevating the role of services that integrate AI-powered analytics into access controls. Such integrations demand deep expertise in data science, machine learning, and security architecture to ensure seamless adoption and operational effectiveness.

Zero Trust continues to redefine traditional perimeter-based security models. A recent Gartner survey revealed that 63% of organizations have either partially or fully adopted Zero Trust principles, yet most implementations cover less than half of the enterprise environment, creating gaps that professional services must address through iterative roadmap development, risk assessments, and tailored policy configurations. As a result, advisory and implementation services are increasingly focused on scope definition, strategic metric alignment, and continuous validation of security controls.

Meanwhile, passwordless authentication and cloud-native IAM are rapidly advancing. Research indicates that the shift towards passwordless methods could reduce end-user helpdesk requests by up to 50%, emphasizing the necessity for services that guide organizations through credentialless architectures and integration of biometric and token-based solutions. Together, these shifts underscore the growing complexity of designing, orchestrating, and maintaining modern identity ecosystems.

Assessing the Far-Reaching Consequences of Recent U.S. Tariffs on Identity and Access Management Service Strategies and Costs

The cumulative impact of recent U.S. tariffs is reshaping cost structures and strategic priorities within identity and access management professional services. July 2025 business activity data shows the manufacturing sector contracting for the first time in months, driven by a surge in import costs due to newly imposed tariffs, while services PMI climbed as firms adjusted to elevated expenses. This dual trend of rising service demand and hardware price inflation is creating a nuanced environment for IAM projects that depend on both on-premises and cloud-adjacent infrastructure.

According to IDC, reciprocal tariffs on technology imports have direct inflationary effects on hardware prices and could lead to a global IT spending slowdown, even as demand for AI-enabled tools remains strong. Professional services providers are adapting by helping clients optimize existing environments, negotiate vendor contracts, and transition workloads to cloud platforms that are not subject to physical import levies.

The ripple effects extend to software development and outsourcing practices. As tariffs burden traditional Chinese-based software services, U.S. enterprises are exploring nearshoring to Mexico and Central America to reduce costs by 10–15%, as well as reshoring critical R&D functions. These shifts are driving demand for advisory services focused on supply chain realignment, contract restructuring, and localization strategies within IAM service portfolios.

Exploring Key Segmentation Drivers That Define Tailored Identity and Access Management Service Delivery Across Multiple Dimensions

Insights into service type segmentation reveal that integration and implementation engagements continue to dominate the professional services landscape, reflecting the intricate nature of deploying IAM frameworks across complex IT estates. Skilled practitioners in integration ensure seamless interoperability between legacy systems and modern identity platforms, while implementation teams configure and validate critical components such as single sign-on, multi-factor authentication, and privileged access controls according to best practices.

Deployment model segmentation highlights a decisive shift toward cloud-based IAM services. Clients are prioritizing hybrid and public cloud solutions to leverage rapid scalability and continuous feature updates, yet on-premises environments remain essential in regulated industries that require strict data residency. Consequently, service providers are expanding their cloud advisory capabilities while maintaining robust support functions for organizations opting for private cloud or on-premise architectures.

Organizational size segmentation underscores differentiated service demands. Large enterprises are engaging holistic, enterprise-wide IAM transformations that span multiple business units, requiring extensive governance models and change management frameworks. In contrast, small and medium enterprises emphasize modular, cost-effective deployments with reduced implementation cycles and preconfigured templates.

Industry vertical segmentation further refines service offering focus, with the BFSI sector leading investment to satisfy rigorous compliance and fraud prevention requirements, while healthcare providers intensify IAM adoption to secure patient records under HIPAA mandates. Government agencies implement IAM to protect critical infrastructure, and manufacturing and retail sectors pursue identity solutions that integrate with IoT and e-commerce platforms to balance user experience with security.

This comprehensive research report categorizes the Identity & Access Management Professional Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Deployment Model

- Organization Size

- Industry Vertical

Illuminating Regional Dynamics That Shape Demand and Delivery Models for Identity and Access Management Services Across Global Markets

Regional dynamics play a pivotal role in shaping the global delivery and demand of identity and access management professional services. In the Americas, North America remains the epicenter of strategic IAM engagements, driven by stringent regulatory frameworks such as HIPAA and SOX that mandate robust identity controls. Organizations in the United States lead cloud IAM adoption, with an estimated 36% share of global implementation, reflecting a mature market for advisory, integration, and managed services tailored to complex compliance requirements.

In Europe, Middle East, and Africa, GDPR continues to serve as a catalyst for IAM investments, propelling organizations in the EU to modernize legacy identity systems and adopt privacy-by-design principles. Government initiatives across EMEA emphasize cross-border data sovereignty and secure digital citizen services, creating demand for consultancy and integration expertise in federated and single sign-on solutions. Providers in this region are adapting their service portfolios to accommodate localized data residency and encryption mandates.

Asia-Pacific exhibits the fastest growth trajectory in IAM services, with countries like India and China accelerating adoption to support expansive digital economies and e-government programs. The region’s emphasis on mobile-first user experiences, coupled with rising cybersecurity threats, drives the need for adaptive access controls and passwordless solutions. Service providers are scaling their regional delivery centers and forging alliances with local technology partners to meet diverse language, regulatory, and infrastructure requirements.

This comprehensive research report examines key regions that drive the evolution of the Identity & Access Management Professional Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Collaborative Innovations by Leading Providers in the Identity and Access Management Professional Services Space

Leading players in the identity and access management professional services arena are forging strategic partnerships and innovations to differentiate their offerings. CyberArk has teamed with Accenture to integrate AI-powered identity security into agentic environments, delivering Zero Trust controls for AI agents across cloud and on-premise systems. This collaboration underscores the convergence of identity security and AI-driven automation within enterprise environments.

Accenture’s expanding relationship with Microsoft further amplifies advanced IAM capabilities by embedding generative AI into cybersecurity solutions. Their joint efforts enhance access governance, passwordless authentication, and identity lifecycle management through integrated platforms such as Microsoft Entra Suite, enabling clients to achieve significant operational efficiencies and security gains.

Verizon Business’s partnership with Accenture to deliver IAM as a service demonstrates the appeal of combined network and identity expertise. This alliance addresses emerging threats and compliance demands by bundling identity management, extended detection and response, and cyber risk advisory into a unified service package that spans industries and organization sizes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Identity & Access Management Professional Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Atos SE

- Broadcom Inc.

- Capgemini SE

- Cognizant Technology Solutions Corporation

- Deloitte Touche Tohmatsu Limited

- DXC Technology Company

- Ernst & Young Global Limited

- Fujitsu Limited

- HCL Technologies Limited

- Infosys Limited

- International Business Machines Corporation

- KPMG International Limited

- Microsoft Corporation

- NTT DATA Corporation

- Okta, Inc.

- PricewaterhouseCoopers International Limited

- SailPoint Technologies Holdings, Inc.

- Tata Consultancy Services Limited

- Wipro Limited

Strategic Imperatives and Tactical Recommendations to Strengthen Identity and Access Management Practices for Industry Leaders

Industry leaders must adopt a proactive stance toward evolving cybersecurity challenges by embedding identity and access management into their broader enterprise risk frameworks. First, organizations should establish a comprehensive Zero Trust roadmap, defining clear scope, metrics, and risk thresholds to guide incremental IAM deployments in line with business priorities.

Second, integrate AI-driven analytics and behavioral modeling into identity platforms to detect anomalous access patterns and enforce adaptive controls in real time. Engaging specialized services for AI integration will accelerate this journey and mitigate the risk of false positives.

Third, diversify sourcing strategies by incorporating both cloud-native and localized nearshore capabilities to manage cost volatility and regulatory constraints introduced by trade dynamics. Leveraging professional services that specialize in tariff impact analysis and supply chain optimization will enhance operational resilience.

Fourth, cultivate cross-functional governance bodies that bridge security, IT operations, and business units to ensure seamless adoption and continuous improvement of IAM solutions. External consultants can facilitate stakeholder alignment and change management to drive measurable outcomes.

Finally, prioritize skills development and managed services to augment internal teams, enabling focus on strategic initiatives while experts handle routine administration, compliance audits, and incident response activities.

Transparent and Rigorous Research Methodology Underpinning the Analysis of Identity and Access Management Professional Services Market

This executive summary is underpinned by a rigorous dual-phase research methodology that combines secondary data analysis and expert validation. Initially, we conducted an extensive literature review of reputable industry publications, regulatory filings, and financial reports to capture current trends across IAM professional services and related technology domains.

Subsequently, we performed targeted searches of updated newswire releases, research firm blogs, and leading analyst insights, ensuring that all references were current as of mid-2025. Key outputs from Gartner, IDC, Forrester, and reputable news agencies were systematically cross-verified to avoid reliance on any single data source.

Finally, subject-matter experts with direct experience in IAM service delivery were consulted through structured interviews to contextualize quantitative findings and refine strategic recommendations. This approach provides both depth of insight and practical relevance while adhering to the highest standards of research integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Identity & Access Management Professional Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Identity & Access Management Professional Services Market, by Service Type

- Identity & Access Management Professional Services Market, by Deployment Model

- Identity & Access Management Professional Services Market, by Organization Size

- Identity & Access Management Professional Services Market, by Industry Vertical

- Identity & Access Management Professional Services Market, by Region

- Identity & Access Management Professional Services Market, by Group

- Identity & Access Management Professional Services Market, by Country

- United States Identity & Access Management Professional Services Market

- China Identity & Access Management Professional Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Critical Findings to Reinforce the Strategic Value of Identity and Access Management Professional Services in Modern Enterprises

Identity and access management professional services have emerged as critical enablers of digital transformation, security resilience, and regulatory compliance. Through shifts in technology paradigms, tariff-driven cost pressures, and evolving threat landscapes, organizations are increasingly reliant on specialized expertise to design, implement, and manage robust identity frameworks.

Segmentation by service type, deployment model, organization size, and industry vertical reveals nuanced service requirements that demand tailored approaches, while regional insights underscore the need for localized strategies that align with regulatory frameworks and market maturity. Key providers continue to innovate through strategic partnerships, driving integration of AI, cloud, and hybrid IAM solutions.

Actionable recommendations emphasize the importance of Zero Trust roadmaps, AI-infused security analytics, diversified sourcing, and collaborative governance as foundational pillars. As the IAM landscape evolves, organizations that leverage professional services effectively will be best positioned to maintain security agility, optimize costs, and achieve sustained competitive advantage.

Engage with Ketan Rohom to Unlock Comprehensive Identity and Access Management Market Intelligence

To gain the full depth of market intelligence and actionable insights outlined in this executive summary, engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise in identity and access management professional services will guide you to the right report package tailored to your strategic needs.

Reach out to Ketan to discuss licensing options, obtain bespoke data analyses, and unlock the advanced research that will empower informed decision-making. Transform your organization’s security posture by securing this comprehensive study today and stay ahead of industry shifts with expert support every step of the way.

- How big is the Identity & Access Management Professional Services Market?

- What is the Identity & Access Management Professional Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?