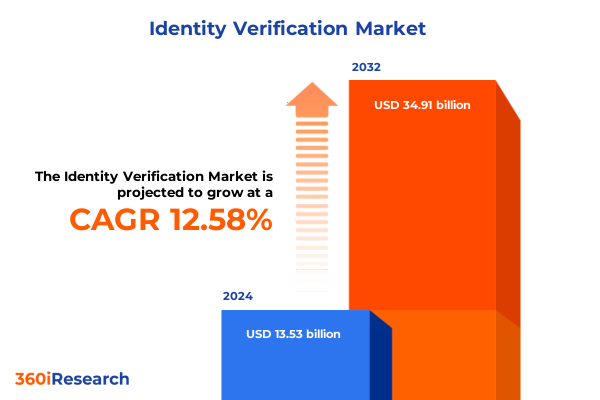

The Identity Verification Market size was estimated at USD 13.53 billion in 2024 and expected to reach USD 15.19 billion in 2025, at a CAGR of 12.58% to reach USD 34.91 billion by 2032.

Establishing a Comprehensive Perspective on the Identity Verification Ecosystem and Its Critical Role in Enhancing Digital Trust Across Industries

The modern digital economy hinges on trusted interactions, making identity verification a foundational pillar for organizations seeking to safeguard assets and foster customer confidence. As enterprises expand their online presence, the complexity of verifying identities across diverse touchpoints escalates, amplifying the need for holistic, robust solutions. This introduction sets the stage by examining the drivers behind the growing demand for secure authentication-from intensifying regulatory frameworks to rising fraud sophistication-and underscores how organizations must evolve beyond legacy practices to maintain resilience.

By contextualizing the current identity verification ecosystem, this section highlights how technological innovation, consumer expectations, and evolving threat landscapes converge to shape strategic priorities. With each new regulatory mandate and shift in user behavior, businesses face mounting pressure to streamline verification workflows while minimizing friction. Through this lens, stakeholders are encouraged to recognize the interplay between security imperatives and user experience, laying a comprehensive foundation for the insights and recommendations that follow.

Examining the Transformational Forces Redefining Identity Verification Through Technological Innovation, Regulatory Evolution, and Evolving Consumer Expectations

Digital transformation has catalyzed a series of paradigm shifts, propelling identity verification from reactive, manual processes to proactive, AI-driven frameworks. Advances in machine learning and computer vision now enable real-time analysis of biometric inputs, while organizations leverage cloud-based architectures to scale services rapidly across global operations. Meanwhile, regulatory landscapes such as KYC and AML are becoming more stringent, compelling companies to adopt adaptive systems that can evolve in lockstep with legislative changes. As a result, agility has emerged as a strategic imperative, empowering enterprises to fine-tune verification protocols without disrupting end-user engagement.

Simultaneously, consumer expectations for seamless, frictionless experiences are redefining success metrics for authentication journeys. The push toward passwordless approaches and decentralized identifiers reflects a broader trend toward empowering individuals with greater control over personal data. In turn, identity verification providers are pursuing interoperability standards, forging partnerships to deliver integrated ecosystems that balance security, privacy, and convenience. These transformative forces collectively herald a new era in which robust, user-centric identity solutions underpin trust in digital interactions.

Analyzing How Newly Imposed United States Tariffs in 2025 Are Reshaping Supply Chains, Cost Structures, and Strategic Priorities in Identity Verification

The introduction of targeted United States tariffs in 2025 has reverberated across the identity verification supply chain, particularly affecting imported biometric hardware and specialized sensors. Manufacturers are experiencing increased costs for critical components such as fingerprint and iris scanners, prompting procurement teams to reassess vendor relationships and explore alternative sourcing strategies. Meanwhile, solution providers are grappling with the challenge of balancing price adjustments against competitive pressures, ensuring that cost increases do not degrade user adoption or compromise service levels.

In response, several organizations have accelerated plans to diversify their manufacturing footprints, investing in regional partnerships to mitigate import constraints and reduce lead times. This strategic pivot underscores a broader trend towards supply chain resilience, wherein industry leaders proactively address tariff-induced volatility. By embracing modular system architectures and fostering closer collaboration with domestic assemblers, the market is adapting to tariff headwinds without stalling innovation or undermining the core promise of secure, scalable identity verification.

Uncovering Critical Segmentation Insights to Navigate Components, Deployment Modes, Industry Verticals, and Organization Scales in Identity Verification

Understanding identity verification through the lens of component segmentation reveals distinct dynamics between professional services and technology solutions. Within services, consulting engagements are driving early-stage strategy and compliance advisory, while integration services streamline the deployment of verification platforms into existing IT ecosystems. Support and maintenance offerings ensure ongoing system reliability, enabling organizations to respond swiftly to regulatory updates or emerging threats. Conversely, solutions segmentation highlights the divergence between biometric and non-biometric approaches, with face, fingerprint, iris, and voice recognition technologies each addressing unique use cases-from high-assurance access control to remote onboarding.

Examining deployment modes further underscores strategic considerations, as cloud-based implementations deliver rapid scalability and continuous feature updates, while on-premise installations offer heightened data sovereignty and customization. Industry vertical segmentation illuminates the nuanced demands of banking, financial services and insurance, government and defense, healthcare and life sciences, and retail and eCommerce, each requiring tailored verification paradigms aligned with sector-specific compliance and user behavior. Finally, assessing organization size differentiates the priorities of large enterprises-where integration breadth and enterprise governance are paramount-from those of small and medium-sized enterprises seeking streamlined, cost-effective solutions that accelerate time to value.

This comprehensive research report categorizes the Identity Verification market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Verification Channel

- Data Type

- Use Case

- Industry Vertical

- Deployment Mode

- Organization Size

Gaining Strategic Perspective on Regional Dynamics Influencing Identity Verification Across the Americas, EMEA, and Asia Pacific Markets

Regional market dynamics are shaped by regulatory regimes, technological maturity, and customer behaviors unique to each geography. In the Americas, stringent regulations in the United States and Canada drive demand for comprehensive, audit-ready solutions, while emerging markets in Latin America pursue digital identity frameworks to enable financial inclusion. This diversity has led providers to offer flexible compliance modules and multilingual support services, ensuring that verification processes align with localized legal and cultural requirements.

Across Europe, the Middle East, and Africa, the pervasive influence of GDPR and related data protection laws has heightened sensitivity around privacy and consent. Enterprises in this region prioritize solutions that facilitate rigorous data governance, enabling seamless cross-border operations within the regulatory mosaic. Meanwhile, in the Asia-Pacific, surging eCommerce penetration and digital payment adoption in countries such as India and China have accelerated investments in electronic KYC and biometric verification. Regional solution providers are collaborating with government bodies to support national identity programs, driving innovation in mobile-first, low-bandwidth verification workflows.

This comprehensive research report examines key regions that drive the evolution of the Identity Verification market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Strategic Moves and Competitive Advantages of Leading Identity Verification Solution Providers Driving Innovation and Market Leadership

Market leadership in identity verification is defined by a blend of technological innovation, strategic partnerships, and comprehensive service portfolios. Industry pioneers specializing in AI-driven document authentication have set new benchmarks for accuracy and automation, while biometric hardware specialists continue to refine sensor capabilities and integration flexibility. Simultaneously, established data intelligence firms leverage extensive consumer credit and identity databases to enhance fraud detection through predictive analytics.

Collaborations between technology startups and global system integrators have created robust end-to-end ecosystems that marry advanced biometrics with deep data insights. This convergence enables organizations to deploy modular verification stacks that cater to specific risk profiles and regulatory demands. Moreover, strategic alliances between identity verification vendors and financial institutions have accelerated co-development of tailored solutions, fostering a network effect that elevates overall system resilience and user trust.

This comprehensive research report delivers an in-depth overview of the principal market players in the Identity Verification market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Affinidi Pte. Ltd.

- Au10tix Ltd. by ICTS International N.V.

- Entrust Corporation

- Equifax, Inc.

- Experian Information Solutions, Inc.

- GB Group PLC

- HyperVerge Technologies Private Limited

- ID.me, Inc.

- IDEMIA Group SAS

- Idenfy

- IDMERIT LLC

- IDnow GmbH

- Incode Technologies, Inc.

- Innovatrics, s.r.o.

- Jumio Corporation

- KYC Hub

- LexisNexis Risk Solutions by Relx Group

- Mastercard International Incorporated

- Melissa Data Corporation

- Mitek Systems, Inc.

- NEC Corporation

- Okta, Inc.

- Ondato UAB

- Persona Identities, Inc.

- Ping Identity

- Precise Biometrics AB

- Regula

- SEON Technologies Ltd.

- Shufti Pro

- Signicat AS

- Socure Inc.

- Sumsub

- Thales Group

- TMT ID

- TransUnion LLC

- Trulioo Information Services Inc.

- Veriff

- Visma Software International AS

Empowering Industry Leaders with Actionable Guidance to Optimize Identity Verification Strategies, Enhance Compliance, and Accelerate Digital Transformation

To navigate the evolving identity verification landscape, industry leaders must adopt a multifaceted approach that balances innovation, compliance, and customer experience. Investing in advanced machine learning capabilities will enhance threat detection and reduce false positives, while integrating passwordless and decentralized identity frameworks can streamline user journeys and bolster privacy protections. At the same time, organizations should cultivate cross-industry partnerships to accelerate technology adoption and share best practices in regulatory alignment.

Operational resilience demands proactive supply chain diversification, ensuring that hardware dependencies do not hinder scalability amid tariff fluctuations. Embedding compliance as a design principle-rather than a post-deployment checklist-can preempt regulatory challenges and facilitate smoother audit processes. Finally, fostering a culture of continuous improvement, underpinned by real-time analytics and user feedback loops, will help organizations iterate on verification workflows, ultimately strengthening trust and enabling sustainable growth.

Detailing the Rigorous Research Methodology Employed to Ensure Data Integrity, Comprehensive Coverage, and Actionable Market Insights

This research leverages a blended methodology that integrates primary and secondary research to ensure data integrity and comprehensive coverage. Primary research encompassed in-depth interviews with industry stakeholders-including solution providers, enterprise end users, and regulatory experts-to capture firsthand insights on emerging trends and strategic priorities. Concurrently, secondary research drew from public filings, technical white papers, and regulatory publications to contextualize market drivers and constraints.

A meticulous data triangulation process validated findings across multiple sources, enhancing the robustness of segmentation analysis and regional mapping. Company profiles were developed through direct engagement with vendor leadership and cross-referencing of financial and product documentation. Finally, iterative review sessions with subject-matter experts ensured that the research outputs reflect current market realities and deliver actionable, credible insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Identity Verification market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Identity Verification Market, by Offering

- Identity Verification Market, by Verification Channel

- Identity Verification Market, by Data Type

- Identity Verification Market, by Use Case

- Identity Verification Market, by Industry Vertical

- Identity Verification Market, by Deployment Mode

- Identity Verification Market, by Organization Size

- Identity Verification Market, by Region

- Identity Verification Market, by Group

- Identity Verification Market, by Country

- United States Identity Verification Market

- China Identity Verification Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2544 ]

Concluding Reflections on the Evolutionary Trajectory of Identity Verification and the Strategic Imperatives Shaping Its Future Outlook

As identity verification continues its evolution from point solutions to integrated trust frameworks, organizations must embrace holistic strategies that reconcile security, compliance, and user experience. The convergence of biometric innovation, AI-driven analytics, and cloud architectures offers unprecedented opportunities to streamline verification workflows, yet also introduces complexities in vendor management and data governance. Recognizing these dualities is essential for stakeholders seeking to maintain competitive advantage and regulatory alignment.

Looking ahead, strategic imperatives center on fostering interoperability, reinforcing supply chain resilience, and embedding privacy by design. By remaining vigilant to shifting regulations and emerging threat vectors, organizations can adapt their identity verification roadmaps to safeguard digital interactions. Ultimately, those who cultivate agility and prioritize trust will be best positioned to thrive in an increasingly interconnected world.

Engage with Ketan Rohom to Secure Your Comprehensive Identity Verification Market Research Report and Drive Informed Strategic Decisions Today

If you are ready to gain an unparalleled strategic advantage in the identity verification domain, now is the time to take decisive action. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore how this report can address your organization’s unique challenges and opportunities. By securing comprehensive insights into the latest market dynamics, technological breakthroughs, and competitive landscapes, you can make informed decisions that drive growth, enhance compliance, and future-proof your identity verification strategy. Engage directly with Ketan Rohom to discuss tailored licensing options, enterprise packages, and value-added services designed to support your specific business objectives. Don’t let uncertainty slow your progress-connect with Ketan Rohom today to initiate the process of acquiring this authoritative market research report and begin transforming your identity verification initiatives.

- How big is the Identity Verification Market?

- What is the Identity Verification Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?