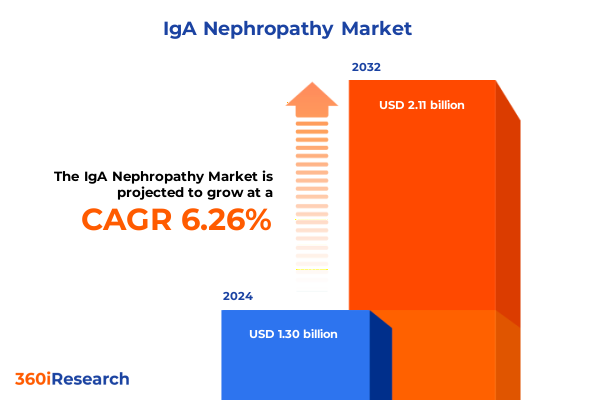

The IgA Nephropathy Market size was estimated at USD 1.37 billion in 2025 and expected to reach USD 1.46 billion in 2026, at a CAGR of 6.31% to reach USD 2.11 billion by 2032.

Exploring the Clinical and Commercial Imperatives of IgA Nephropathy to Illuminate Key Drivers and Strategic Opportunities Across the Therapeutic Landscape

Immunoglobulin A nephropathy, commonly referred to as IgA nephropathy or Berger’s disease, represents one of the most prevalent primary glomerular disorders worldwide, characterized by the deposition of IgA complexes within the renal mesangium. This immunologically driven pathology manifests through episodic hematuria, proteinuria, and progressive deterioration of kidney function, imposing a substantial clinical and economic burden on healthcare systems. As research advances into the molecular underpinnings of IgA dysregulation, stakeholders across the biopharmaceutical ecosystem are compelled to reassess therapeutic paradigms and value creation strategies. Consequently, the market landscape for IgA nephropathy is experiencing heightened activity, driven by novel monoclonal antibodies, targeted immunosuppressants, and innovative non-immunosuppressive approaches. This report opens with a concise yet comprehensive overview of the disease’s pathophysiology, evolving standard of care, and the converging interests of payers, providers, and patients. By establishing this foundational context, readers are positioned to appreciate the nuanced interplay between clinical unmet needs, regulatory frameworks, and competitive dynamics that underpin future growth trajectories in IgA nephropathy therapeutics.

Unveiling the Paradigm-Shifting Innovations and Regulatory Milestones Reshaping IgA Nephropathy Management and Driving Evolution Across Stakeholder Dynamics

The landscape of IgA nephropathy management is undergoing transformative shifts, propelled by breakthroughs in immunotherapy, advances in precision diagnostics, and evolving regulatory attitudes toward orphan and rare disease indications. Monoclonal antibodies targeting key cytokines and complement pathways have progressed into pivotal trials, signaling a departure from broad-spectrum immunosuppression toward more selective modulation of the underlying disease process. Simultaneously, digital health platforms are enabling remote monitoring of renal biomarkers and real-time patient-reported outcomes, reinforcing the move toward patient-centric care models. Regulatory agencies across major markets have demonstrated increased willingness to expedite review pathways for therapies addressing high unmet needs, further encouraging investment in novel assets. In parallel, patient advocacy networks are amplifying the voices of individuals affected by IgA nephropathy, influencing trial design, endpoint selection, and reimbursement considerations. Taken together, these converging forces are recalibrating the competitive playing field, fostering a wave of strategic partnerships and acquisitions aimed at accelerating time to market and ensuring optimized value delivery to all stakeholders.

Analyzing the Comprehensive Effects of 2025 United States Tariffs on Biopharmaceutical Supply Chains and Financial Viability of IgA Nephropathy Therapeutics

In 2025, the introduction and escalation of United States tariffs have exerted a cumulative impact on biopharmaceutical supply chains, directly influencing the cost structure of IgA nephropathy therapies. Imported active pharmaceutical ingredients have faced elevated duties, leading manufacturers to reevaluate sourcing strategies and accelerate localization of critical components. As raw material expenses rose, pricing pressures extended through to specialty drugs, with payers demanding enhanced justification of clinical value and cost-effectiveness. Concurrently, distribution networks adapted by optimizing inventory management and exploring alternative logistics partners to mitigate delays at border checkpoints. These shifts have placed increased emphasis on lean manufacturing processes, strategic inventory buffering, and transparent supplier relationships to preserve margins without compromising patient access. Amid these economic headwinds, companies with integrated supply chains have demonstrated resilience, leveraging vertical integration and near-shoring to shield operations from tariff volatility. The experience of 2025 underscores the necessity for agile supply chain frameworks and proactive policy engagement to ensure the sustainable provision of IgA nephropathy treatments in the face of evolving trade environments.

Decoding Comprehensive Market Segmentation to Reveal Critical Differentiators in Drug Classes, Treatment Modalities, Patient Demographics, End Users, and Distribution Channels

A granular examination of market segmentation reveals distinct patterns of demand and therapeutic positioning. Within the drug class dimension, Angiotensin Receptor Blockers and ACE Inhibitors continue to anchor the standard of care by attenuating glomerular hypertension, while the immunosuppressant category-encompassing corticosteroids, azathioprine, cyclophosphamide, and mycophenolate mofetil-remains essential for patients exhibiting aggressive disease progression. Meanwhile, the advent of monoclonal antibodies targeting complement C5 and related pathways has introduced a promising third pillar of therapy. Treatment-based segmentation highlights the complementary roles of dialysis and kidney transplantation as life-extending interventions, which juxtapose with immunosuppressive therapy, non-immunosuppressive agents, and plasmapheresis in earlier disease stages. Adult populations represent the largest patient cohort, yet the elderly demographic commands increasing attention due to unique safety and tolerability considerations, while pediatric presentations drive demand for age-appropriate formulations and dosing regimens. End users range from tertiary referral hospitals and research institutes conducting clinical trials to specialty nephrology clinics that offer advanced management protocols, along with home healthcare services facilitating peritoneal dialysis and remote patient monitoring. Distribution channels bifurcate into offline pharmacies-divided between hospital and retail outlets-and the expanding sphere of online pharmacies, which offer expedited delivery and digital engagement but must navigate stringent cold-chain requirements for certain biologics.

This comprehensive research report categorizes the IgA Nephropathy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Treatment Type

- Route Of Administration

- Formulation

- Patient Type

- End User

- Distribution Channel

- Indication

Mapping Distinct Regional Market Dynamics to Highlight Growth Drivers, Access Challenges, and Strategic Priorities Across Americas, EMEA, and Asia-Pacific in IgA Nephropathy Care

Regional analysis underscores divergent trajectories across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, robust reimbursement frameworks and high healthcare expenditure support rapid uptake of innovative IgA nephropathy therapeutics, complemented by widespread clinical trial activity. Contrastingly, Europe and its adjacent regions balance stringent cost-containment measures with adaptive health technology assessment pathways that selectively accelerate novel agents targeting rare renal disorders. In Middle Eastern and African markets, infrastructure limitations and variable insurance landscapes create heterogenous access patterns, prompting manufacturers to pursue tiered pricing models and capacity-building collaborations. Transitioning to Asia-Pacific, escalating prevalence rates driven by aging populations and rising comorbidities have galvanized government-led screening initiatives, while local manufacturing hubs and generic competition exert downward pressure on pricing. Across all regions, the convergence of localized regulatory incentives and global alliance networks fosters an increasingly interconnected ecosystem, where cross-border partnerships and knowledge exchange are pivotal to addressing the multifaceted challenges of IgA nephropathy management.

This comprehensive research report examines key regions that drive the evolution of the IgA Nephropathy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators, Partnerships, and Competitive Strategies Among Top Biopharma Players Shaping the Future of IgA Nephropathy Therapy Development and Commercialization

Key industry participants are defining the competitive contours through innovative pipelines, strategic alliances, and targeted investments. Small-cap biotechs specializing in monoclonal antibodies have attracted venture funding to propel their lead candidates through clinical development, while large pharmaceutical companies leverage their late-stage portfolios and global commercialization capabilities to fortify market presence. Collaborations between specialty biotech firms and contract manufacturing organizations have streamlined biologics production, enhancing supply reliability. In parallel, established immunosuppressant providers are exploring reformulations and combination therapies to extend product lifecycles and differentiate offerings. Diagnostic companies are partnering with therapeutic developers to co-create companion tests, refining patient stratification and accelerating personalized treatment approaches. Moreover, contract research organizations have expanded renal disease expertise to accommodate the growing volume of clinical trials. Together, these initiatives underscore a dynamic competitive environment where innovation, partnership, and operational excellence converge to drive value creation across the IgA nephropathy therapeutic continuum.

This comprehensive research report delivers an in-depth overview of the principal market players in the IgA Nephropathy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alnylam Pharmaceuticals, Inc.

- Apellis Pharmaceuticals Inc.

- Biogen Inc.

- Boehringer Ingelheim International GmbH.

- Calliditas Therapeutics AB by Asahi Kasei Corporation

- ChemoCentryx, Inc. by Amgen Inc.

- Eledon Pharmaceuticals Inc.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- Ionis Pharmaceuticals Inc

- Keymed Biosciences Inc.

- Novartis AG

- NovelMed Inc.

- Novo Nordisk A/S.

- Omeros Corporation

- Otsuka Pharmaceutical Co. Ltd

- Q32 Bio Inc.

- Takeda Pharmaceutical Company

- Travere Therapeutics Inc

- Vera Therapeutics Inc

- Vertex Pharmaceuticals Incorporated

Strategic Imperatives and Operational Tactics for Industry Leaders to Capitalize on Emerging Opportunities and Enhance Value Propositions in the IgA Nephropathy Market

Industry leaders aiming to secure competitive advantage should prioritize a multifaceted strategy. First, advancing targeted immunotherapies demands deep engagement with translational research to identify novel biomarkers and validate mechanism-based endpoints, thereby enhancing regulatory success probability. Next, expanding manufacturing flexibility through dual-sourcing agreements and adaptive capacity planning can mitigate the risks associated with tariff fluctuations and supply bottlenecks. Additionally, cultivating relationships with patient advocacy groups will not only inform trial design but also strengthen market access dossiers by reflecting real-world patient needs and quality-of-life metrics. From a commercial standpoint, tiered pricing frameworks and value-based contracting with payers will be critical to balancing affordability with sustainable revenue streams. Furthermore, forging digital partnerships to deploy remote monitoring and adherence tools can improve patient outcomes while generating longitudinal data to inform post-market studies. By executing these integrated actions, companies can navigate regulatory complexity, drive differentiation, and ultimately enhance the therapeutic armamentarium for IgA nephropathy patients.

Elucidating Rigorous Research Methodologies, Data Triangulation Techniques, and Analytical Frameworks Employed to Ensure Robust Insights into the IgA Nephropathy Landscape

This analysis is underpinned by a rigorous research framework combining quantitative data synthesis and qualitative expert consultations. Primary research comprised in‐depth interviews with key opinion leaders across nephrology, pharmacy, and payers, complementing field surveys of community nephrologists to gauge prescribing behaviors and unmet needs. Secondary sources included peer‐reviewed journals, regulatory filings, and clinical trial registries to capture the latest developments in therapeutic and diagnostic innovations. Market intelligence triangulation integrated pipeline databases, patent landscapes, and supply chain audits to elucidate competitive positioning and manufacturing dynamics. Data were validated through cross‐referencing proprietary financial disclosures and import/export statistics to assess the impact of trade policies. Analytical methodologies encompassed SWOT analysis, scenario modeling of tariff scenarios, and regional benchmarking using health system indicators. Collectively, these approaches ensure the robustness of insights while providing stakeholders with a transparent account of assumptions and limitations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our IgA Nephropathy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- IgA Nephropathy Market, by Drug Class

- IgA Nephropathy Market, by Treatment Type

- IgA Nephropathy Market, by Route Of Administration

- IgA Nephropathy Market, by Formulation

- IgA Nephropathy Market, by Patient Type

- IgA Nephropathy Market, by End User

- IgA Nephropathy Market, by Distribution Channel

- IgA Nephropathy Market, by Indication

- IgA Nephropathy Market, by Region

- IgA Nephropathy Market, by Group

- IgA Nephropathy Market, by Country

- United States IgA Nephropathy Market

- China IgA Nephropathy Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1908 ]

Synthesizing Critical Findings and Strategic Implications to Provide a Cohesive Understanding of Market Dynamics and Guide Future Stakeholder Decision-Making in IgA Nephropathy

The culmination of this executive summary reveals a market at the inflection point of scientific breakthroughs and commercial acceleration. Enhanced understanding of IgA nephropathy’s immunopathogenesis has catalyzed an innovative pipeline centered on targeted biologics and precision diagnostics, redefining therapeutic paradigms. Concurrently, external forces such as evolving tariff policies and shifting regional healthcare architectures have illuminated the criticality of agile supply chains and adaptive market access strategies. Segmentation analysis highlights the multifaceted needs across drug classes, treatment modalities, patient demographics, end users, and distribution channels, while competitive profiling underscores the strategic value of partnerships and integrated solutions. In synthesizing these findings, a clear imperative emerges: success in the IgA nephropathy domain will hinge on the ability to seamlessly align scientific innovation with operational excellence and patient-centric commercial models. This report equips decision-makers with the clarity required to navigate complexity, seize emerging opportunities, and ultimately improve outcomes for individuals living with IgA nephropathy.

Engage with Ketan Rohom to Unlock Comprehensive, Actionable Intelligence and Secure the Definitive IgA Nephropathy Market Research Report for Informed Strategic Execution

The comprehensive exploration of IgA nephropathy market dynamics concludes with a decisive invitation to unlock unparalleled depth and strategic clarity. Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide you through the wealth of actionable intelligence contained within the full market research report. By engaging with this tailored analysis, stakeholders gain access to critical insights into competitive positioning, regulatory trends, and emerging opportunities that will shape the future of IgA nephropathy care. Don’t miss the chance to equip your leadership teams with the definitive resource for informed strategic execution in a rapidly evolving therapeutic landscape. Connect directly with Ketan Rohom to secure your copy of the definitive IgA nephropathy market research report and catalyze your organization’s growth trajectory.

- How big is the IgA Nephropathy Market?

- What is the IgA Nephropathy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?