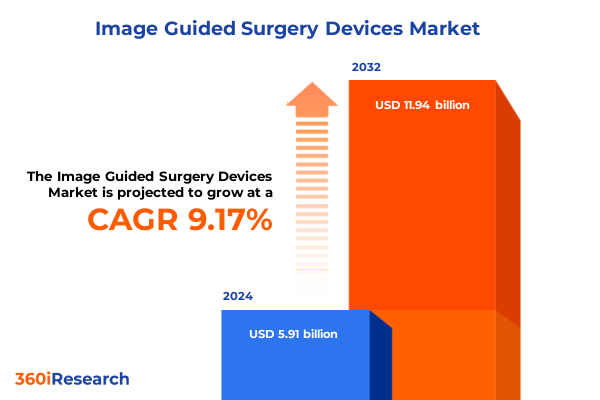

The Image Guided Surgery Devices Market size was estimated at USD 6.44 billion in 2025 and expected to reach USD 7.01 billion in 2026, at a CAGR of 9.21% to reach USD 11.94 billion by 2032.

Revolutionizing the Operating Room with Precision Navigation: An In-Depth Introduction to Image Guided Surgery Devices and Their Role in Healthcare

Image guided surgery devices represent a paradigm shift in operative care, enabling clinicians to navigate complex anatomical structures with unprecedented precision and confidence. These systems integrate preoperative and intraoperative imaging modalities-including computed tomography (CT), magnetic resonance imaging (MRI), fluoroscopy, and ultrasound-with advanced tracking technologies such as optical and electromagnetic systems to continuously monitor surgical instruments relative to patient anatomy in real time. By translating imaging data into intuitive visual overlays, surgeons can perform minimally invasive procedures while maintaining complete spatial orientation, reducing the reliance on large incisions and extensive tissue retraction.

The core components of these platforms include high-resolution imaging devices, sophisticated computational workstations, and tracking instruments equipped with markers or sensors that relay positional data to the navigation software. Hybrid systems may combine multiple tracking approaches to enhance accuracy and overcome line-of-sight limitations, while mechanical tracking systems provide robust, contact-based guidance in confined surgical fields. The emergence of active and passive optical marker systems further refines tracking fidelity, allowing for seamless instrument localization in delicate procedures such as neurosurgery and otorhinolaryngology.

Originally rooted in stereotactic neurosurgery, image guided surgery has evolved to encompass a wide spectrum of specialties, from orthopedic implant placements to cardiovascular interventions. Robotics and augmented reality have been progressively integrated, enabling computerized assistance and immersive visualizations that bolster surgeon dexterity and reduce procedural variability. As an established standard of care for many complex surgeries, these platforms continue to evolve, driven by innovations in artificial intelligence, 3D reconstruction, and real-time data analytics.

Emerging Technologies and Paradigm Shifts Redefining Surgical Practices through AI Integration and Augmented Reality in Image Guided Surgery

The landscape of image guided surgery is undergoing transformative shifts fueled by rapid technological breakthroughs and evolving clinical imperatives. Artificial intelligence and machine learning have emerged as cornerstones of this evolution, enabling automated image segmentation, anomaly detection, and predictive analytics that guide surgical planning and intraoperative decision-making. By harnessing convolutional neural networks and advanced algorithms, systems can now construct accurate 3D reconstructions from 2D imaging data, dynamically adapt to anatomical variations, and forecast surgical challenges before they arise.

In parallel, augmented reality platforms are redefining the surgeon’s field of view by superimposing holographic anatomical models and real-time instrument trajectories directly onto the operative site. These MR headsets and holographic displays facilitate immersive, hands-free navigation, enhancing spatial awareness and reducing reliance on distant monitors. The advent of lightweight, high-resolution AR headsets optimized for clinical environments exemplifies this shift, offering seamless integration with existing operating room workflows.

Simultaneously, surgical robotics are converging with image guidance to create highly automated and teleoperated platforms. Robotic arms calibrated via image navigation provide unparalleled precision in instrument positioning and force control, particularly beneficial in intricate procedures such as spine fusion or tumor resection. Tele-operated humanoid prototypes further hint at the future of remote and decentralized surgery, where expert operators guide robotic systems in underserved regions. Collectively, these innovations are ushering in an era of intelligent operating theaters, where real-time data visualization, predictive modeling, and robotic assistance converge to elevate safety, efficiency, and patient outcomes.

Evaluating the Strategic and Operational Consequences of United States Medical Device Tariffs on Image Guided Surgery Supply Chains and Innovation Landscapes

In 2025, the reintroduction of United States tariffs on imported medical devices has created significant strategic and operational headwinds for manufacturers and healthcare providers alike. Under the revived Section 301 measures, Class I and II surgical instruments and diagnostic equipment sourced from China now face increased duties, compelling suppliers to reassess their global sourcing strategies. Industry analysts at GlobalData highlight that these tariffs risk inflating production costs, disrupting established supply chains, and delaying critical device deployments in operating rooms nationwide.

The immediate consequence of heightened import duties is an upward pressure on procurement budgets for hospitals and ambulatory surgical centers. Reports from Medical Design Briefs reveal that a majority of medtech leaders are exploring diversified sourcing, regional manufacturing partnerships, and logistics optimization to mitigate tariff-related cost escalations. Such strategic pivots, however, require significant capital investment and can extend lead times for device approvals and certification, exacerbating current challenges in technology deployment and maintenance cycles.

While the intent of tariff policy is to bolster domestic manufacturing and reduce reliance on foreign imports, stakeholders caution that abrupt policy shifts may erode innovation incentives. Domestic production of advanced imaging and navigation components demands specialized manufacturing ecosystems and regulatory approvals, which cannot be rapidly replicated. Consequently, the cumulative impact of these trade measures may constrain patient access to cutting-edge surgical technologies and slow the pace of procedural adoption, underscoring the need for nuanced policy dialogue between industry and regulators.

Unlocking Market Dynamics through Advanced Segmentation Insights Spanning Technology Platforms, Clinical Applications, User Profiles, and Comprehensive Components

Analyzing the market through its foundational segments provides a granular understanding of competitive dynamics and clinical applications. From a technology perspective, electromagnetic tracking systems leveraging high-frequency and low-frequency generators play a critical role in navigating confined anatomical pathways, while optical tracking methodologies-spanning both active marker and passive marker systems-excel in open-field visualization. Hybrid platforms that fuse electromagnetic and optical tracking are gaining traction for their dual-mode adaptability in complex procedures.

When considering clinical applications, image guided surgery devices have become indispensable across cardiovascular interventions, dental implant placements, ear, nose, and throat operations, spinal neurosurgery, and orthopedic reconstructions. Each specialty demands tailored navigation interfaces and imaging modalities, influencing vendor strategies and R&D investments. End users of these systems range from ambulatory surgical centers seeking streamlined outpatient workflows to tertiary hospitals driving high-complexity case volumes, with specialty clinics anchoring niche practices such as neurosurgical tumor resections and dental implantology.

Component segmentation highlights the interdependence of hardware, software, and services in delivering comprehensive surgical navigation solutions. Hardware offerings-from precision cameras and display units to sophisticated sensors and tracking instruments-constitute the tangible interface with the surgical field. Meanwhile, software modules for 3D reconstruction, navigation planning, and workflow management form the digital backbone of these platforms. Complementary services encompassing installation, maintenance, and clinician training ensure seamless system integration and sustained performance over the product lifecycle.

This comprehensive research report categorizes the Image Guided Surgery Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Application

- End User

Analyzing Regional Adoption Patterns and Growth Drivers across the Americas, Europe Middle East and Africa, and Asia Pacific Image Guided Surgery Markets

Regional differentiation in the adoption and evolution of image guided surgery devices underscores the importance of localized strategies. In the Americas, North America remains the dominant innovation hub, driven by mature healthcare infrastructure, favorable reimbursement policies, and high procedural volumes. Ambulatory surgical centers are expanding their adoption of robotic systems and navigation tools for outpatient joint replacement and spine procedures, reflecting a trend toward minimally invasive, cost-efficient care delivery. Meanwhile, in Latin America, private hospitals and specialized clinics are incrementally integrating advanced guidance systems, supported by growing medical tourism and targeted public-private partnerships to enhance accessibility.

Within Europe, Middle East, and Africa, Europe stands out for its structured healthcare frameworks and collaborative research networks. Germany, France, and the United Kingdom have incorporated image guided technologies into national clinical guidelines, fostering widespread adoption in oncology and neurology. In the Middle East, premier medical centers and government-sponsored healthcare initiatives in the Gulf Cooperation Council are rapidly expanding surgical navigation capabilities, positioning themselves as regional centers of excellence. Across Africa, innovative telemedicine projects leveraging 3D imaging and mobile units are beginning to bridge gaps in specialist availability, offering remote guidance and education to field practitioners in underserved areas.

The Asia Pacific region exhibits the highest growth momentum, underpinned by substantial public investments in hospital infrastructure and rising demand for minimally invasive interventions. China and India lead in volume, with government programs subsidizing high-tech surgical platforms, while Japan and South Korea continue to pioneer robotic-augmented navigation for complex oncological and spinal procedures. Lower device costs from local manufacturers and expanding networks of tier 2 and 3 city hospitals further accelerate regional uptake.

This comprehensive research report examines key regions that drive the evolution of the Image Guided Surgery Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Players Driving Innovation and Competitive Growth in the Image Guided Surgery Devices Ecosystem

Leading device manufacturers are spearheading innovation through strategic product launches, partnerships, and regulatory milestones. Industry pioneer Intuitive Surgical continues to refine its da Vinci robotic platforms, introducing force-feedback enhancements and modular expansions for orthopedic and cardiothoracic applications, supported by robust clinical data and a global service network. Medtronic has advanced its Mazor robotic systems with integrated navigation and real-time image fusion, targeting improved accuracy in spine instrumentation.

Joint ventures and collaborations are reshaping the competitive landscape. Medivis’ FDA clearance of its AR-AI powered spinal navigation platform underscores the momentum behind mixed-reality surgical intelligence, providing holographic guidance in both open and minimally invasive procedures. Meanwhile, Brainlab and Zeta Surgical have secured regulatory approvals for AI-driven navigation suites, combining computer vision with machine learning to enhance real-time intraoperative decision support.

Diversification strategies extend beyond core surgical robotics and navigation. Technology incumbents such as GE Healthcare and Siemens Healthineers are integrating their imaging modalities with navigation software, offering end-to-end solutions for hybrid operating rooms. Independent innovators like ImmersiveTouch’s ImmersiveAR platform highlight the rising importance of cloud-enabled 3D surgical planning and simulation for resident training and patient education. This convergence of imaging, software, and AI is catalyzing an ecosystem where agility and interoperability determine market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Image Guided Surgery Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 7D Surgical, Inc.

- Abbott Laboratories

- Accuray Incorporated

- Agfa-Gevaert N.V.

- Analogic Corporation

- Bracco Imaging S.p.A.

- Canon Medical Systems Corporation

- FUJIFILM Holdings Corporation

- Hitachi, Ltd.

- IMRIS, Inc.

- Johnson & Johnson

- Koninklijke Philips N.V.

- Medrobotics Corporation

- Nanjing Perlove Medical Equipment Co., Ltd.

- Olympus Corporation

- OnLume, Inc.

- Renishaw plc

- Shimadzu Corporation

- Stereotaxis, Inc.

- Titan Medical Inc.

- Zeta Surgical, Inc.

- Ziehm Imaging GmbH

Implementing Strategic Recommendations to Capitalize on Technological Innovations, Supply Chain Resilience, and Market Opportunities in Image Guided Surgery

To optimize competitive positioning, industry leaders should prioritize integration of advanced AI and machine learning capabilities within navigation platforms. Embedding predictive analytics and automated image segmentation can accelerate intraoperative decision-making and minimize surgeon cognitive load. Collaborative R&D partnerships with academic institutions and technology startups will facilitate accelerated validation of novel imaging algorithms and hardware prototypes, ensuring a continuous innovation pipeline.

Strengthening supply chain resilience is imperative in light of evolving tariff landscapes and geopolitical uncertainties. Companies must diversify component sourcing across multiple regions, establish regional manufacturing hubs, and leverage digital supply-chain monitoring tools to reduce lead times and buffer against trade disruptions. Joint ventures with local manufacturing partners can circumvent import duties while maintaining quality and regulatory compliance.

Investing in clinician education and workflow optimization will amplify technology adoption. Customized training programs, supported by immersive reality simulations and on-site technical support, will shorten the learning curve and enhance procedural efficiencies. Simultaneously, deploying integrated service models-combining installation, predictive maintenance, and tele-mentoring-will reinforce long-term system uptime and customer satisfaction.

Finally, market entrants should explore emerging channels such as ambulatory surgical centers and tele-guided platforms in underserved regions. Tailored business models, including subscription-based software licensing and per-procedure pricing, can lower barriers to entry and expand addressable markets.

Comprehensive Research Methodology Overview Detailing Data Collection, Expert Insights, Validation Processes, and Analytical Frameworks for Rigorous Market Analysis

This report’s methodology combines rigorous secondary research and primary validation to ensure comprehensive and accurate market insights. Secondary sources include industry press releases, peer-reviewed journals, regulatory filings, and specialized databases covering clinical applications, technology trends, and tariff regulations. Key literature was reviewed to capture the latest advancements in AI, robotics, and augmented reality applicable to surgical navigation.

Primary research was conducted through structured interviews with senior executives, product managers, clinical specialists, and end users across hospitals, ambulatory surgical centers, and specialty clinics. These interviews provided firsthand perspectives on deployment challenges, procurement decisions, and clinical outcomes, augmenting secondary data with real-world context. Insights were further validated through consultation with industry analysts and regulatory experts.

Quantitative data points-such as procedure volumes, device installation figures, and tariff schedules-were triangulated across multiple sources, including market intelligence platforms, government trade data, and company disclosures. Qualitative assessments of competitive strategies and technology roadmaps were synthesized to evaluate vendor positioning and future trajectories. The segmentation framework was developed based on technology type, application, end user, and component categories, ensuring alignment with clinical workflows and purchasing structures.

All findings underwent iterative peer review to maintain analytical rigor and relevance for decision makers seeking actionable insights into the image guided surgery domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Image Guided Surgery Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Image Guided Surgery Devices Market, by Component

- Image Guided Surgery Devices Market, by Technology

- Image Guided Surgery Devices Market, by Application

- Image Guided Surgery Devices Market, by End User

- Image Guided Surgery Devices Market, by Region

- Image Guided Surgery Devices Market, by Group

- Image Guided Surgery Devices Market, by Country

- United States Image Guided Surgery Devices Market

- China Image Guided Surgery Devices Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Executive Conclusion Emphasizing Key Insights and Strategic Direction for Stakeholders in the Evolving Image Guided Surgery Devices Landscape

The evolving landscape of image guided surgery devices is characterized by rapid technological convergence, shifting trade policies, and region-specific adoption dynamics. The integration of AI, augmented reality, and robotic systems is elevating surgical precision and enabling minimally invasive procedures across a broad spectrum of clinical specialties. Concurrently, the reinstatement of tariffs underscores the strategic importance of supply-chain resilience and regional manufacturing agility.

Segmentation analysis reveals opportunities across established segments-such as optical and electromagnetic tracking-and emerging domains including AI-driven image reconstruction and AR-enabled visualization. Regional insights highlight the mature ecosystems of North America and Europe, the growth engines in Asia Pacific, and the nascent yet promising telemedicine initiatives in Africa and the Middle East. Competitive benchmarking demonstrates that vendors who align comprehensive hardware-software-service portfolios with proactive clinician training and robust after-sales support are best positioned to lead.

As industry players navigate these complex variables, a strategic focus on innovation partnerships, flexible business models, and policy advocacy will be critical. Companies capable of anticipating regulatory shifts, diversifying supply networks, and tailoring solutions to localized requirements will unlock new growth pathways and drive sustainable market leadership in the dynamic image guided surgery space.

Contact Ketan Rohom to Secure Your Comprehensive Market Research Report on Image Guided Surgery Devices and Unlock Critical Strategic Insights to Drive Competitive Advantage

We invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to obtain an exclusive, comprehensive market research report on image guided surgery devices. Engaging with this detailed study will provide your organization with strategic intelligence tailored to the unique demands of medical technology markets, from in-depth segmentation analyses to regional adoption dynamics and company benchmarking.

Securing this report ensures you gain timely insights into the disruptive innovations, emerging regulatory and tariff considerations, and competitive strategies shaping the image guided surgery landscape. Empower your decision-making with actionable data and expert perspectives that differentiate your offerings, optimize supply chains, and position your organization at the forefront of surgical technology.

Don’t miss this opportunity to harness critical strategic intelligence that will drive competitive advantage and support long-term growth. Reach out to Ketan Rohom today to explore customization options and expedite access to the full report.

- How big is the Image Guided Surgery Devices Market?

- What is the Image Guided Surgery Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?