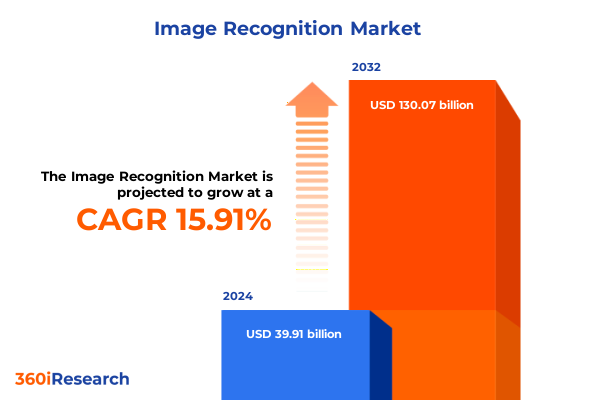

The Image Recognition Market size was estimated at USD 46.34 billion in 2025 and expected to reach USD 53.81 billion in 2026, at a CAGR of 16.99% to reach USD 139.07 billion by 2032.

Exploring the Evolution and Strategic Importance of Image Recognition in Modern Industries and Its Transformative Impact Across Diverse Application Verticals

The journey of image recognition began with simple feature extraction algorithms but has evolved into high-precision deep learning systems capable of interpreting complex visual data in real time. Initially adopted in niche research environments where computational resources were scarce, contemporary implementations leverage convolutional neural networks, transformer architectures, and self-supervised learning techniques to deliver accuracy levels previously unattainable. These advances coincide with exponential growth in computing power and the advent of dedicated hardware accelerators, ensuring inference latency meets the exacting requirements of mission-critical applications.

Furthermore, the strategic importance of image recognition transcends traditional machine vision by enabling organizations to convert raw pixels into actionable intelligence that drives operational efficiencies. In manufacturing, automated inspection systems identify defects with unprecedented consistency; in retail, real-time customer behavior analysis informs inventory management and in-store experiences; and in healthcare, diagnostic imaging solutions support clinicians in detecting anomalies with enhanced precision. As regulatory frameworks around data privacy and ethics mature, the industry’s focus has shifted towards algorithmic transparency and robustness, creating opportunities for solution providers to differentiate through explainability and rigorous validation protocols.

The democratization of artificial intelligence through open-source frameworks and cloud-centric development platforms has further accelerated adoption by lowering barriers to entry. Edge computing modules equipped with optimized vision models enable real-time processing at the point of capture, mitigating latency and bandwidth constraints. As ecosystem partnerships flourish-uniting semiconductor designers, software engineers, and systems integrators-the pace of innovation intensifies, cementing image recognition as a cornerstone of digital transformation strategies across sectors.

Unveiling the Technological Catalysts and Operational Shifts Driving Next Generation Image Recognition Solutions to New Heights

Breakthroughs in deep learning architectures have fundamentally reshaped the capabilities of image recognition, enabling models such as Vision Transformers and hybrid convolutional networks to parse visual data with unprecedented depth. These architectures, supported by innovations in parallel processing and neural network pruning, achieve higher accuracy without proportional increases in compute requirements. Moreover, multimodal approaches that fuse visual data with contextual signals-text, audio, sensor outputs-unlock new use cases that extend beyond static analysis to dynamic decision support systems.

Integration of edge AI platforms with centralized cloud services has introduced a hybrid deployment paradigm that balances latency, privacy, and scalability considerations. With 5G networks reaching maturity, the bandwidth constraints that once hindered distributed inference are evaporating, paving the way for real-time analytics in remote locations. Concurrently, sensor technology has surged forward, delivering higher resolution imaging and specialized modalities such as thermal and hyperspectral cameras, thus expanding the operational envelope for vision-based systems.

Data annotation methodologies have also undergone a metamorphosis. Synthetic data generation, combined with active learning strategies, significantly reduces the time and cost associated with labeling large image datasets. At the same time, privacy-preserving machine learning techniques such as federated learning and differential privacy ensure that sensitive or proprietary data remains secure. In this evolving landscape, ethics and accountability are gaining prominence, driving demand for explainable AI and compliance-ready solutions that can adapt to diverse regulatory requirements.

Assessing the Comprehensive Repercussions of 2025 US Trade Tariffs on Image Recognition Supply Chains Pricing Models and Adoption Dynamics

In 2025, sustained trade tensions resulted in the continuation of Section 301 tariffs on certain imports from key manufacturing hubs, impacting critical components used in image recognition hardware. Components such as camera modules, specialized sensors, and graphics processing units have carried an additional levy of 25 percent, directly influencing bill-of-materials costs for original equipment manufacturers and systems integrators. This shift has prompted businesses to reevaluate supplier relationships and explore alternative sourcing strategies to preserve profitability.

The immediate effect on hardware pricing has been palpable, leading some end users to defer capital expenditures or seek cost-sharing arrangements with solution vendors. Simultaneously, software and service providers have reported increased demand for integration and optimization projects aimed at extracting more value from existing installations rather than committing to new deployments. Consequently, vendors are reallocating resources toward service-based revenue models that mitigate pricing pressure and foster long-term customer engagement.

Meanwhile, domestic policy initiatives such as the CHIPS and Science Act and incentives under recent infrastructure legislation are spurring onshore manufacturing investments. These programs, designed to underwrite capital expenditures for semiconductor fabrication and advanced packaging facilities, offer a pathway to attenuate the impact of tariffs over the medium term. Enterprises that proactively align their supply chain strategies with these incentives stand to benefit from enhanced resiliency and reduced exposure to geopolitical volatility.

Decoding Critical Market Segments Through Offering Deployment Application End Users Channels and Emerging Technology Perspectives

An examination of market offerings reveals a trifurcated landscape encompassing hardware, services, and software solutions. Hardware installations range from embedded vision modules integrated into edge-computing devices to standalone camera arrays for high-throughput inspection. Service offerings span consulting engagements that define vision-based use cases, systems integration projects that ensure interoperability with existing IT infrastructure, and ongoing support contracts for model retraining and maintenance. Software portfolios comprise bespoke custom implementations tailored to unique workflows alongside off-the-shelf packaged suites optimized for standard industry requirements.

Deployment footprints oscillate between cloud-native and on-premises environments, reflecting a nuanced balance between scalability and data sovereignty. Hybrid cloud architectures are gaining traction as organizations seek to combine the elasticity of public cloud instances with the control of private cloud resources. Conversely, mission-critical workloads persist in data center environments or at the network edge, where deterministic performance and minimal latency are paramount.

Vertical applications span aerospace programs that employ vision systems for both civil air traffic monitoring and defense threat detection, automotive use cases encompassing commercial vehicle fleet telematics and passenger safety systems, consumer electronics applications such as smart TVs and wearables, and healthcare deployments across diagnostic imaging labs, homecare monitoring setups, and hospital-grade surgical assistance. End users range from large enterprises in banking, financial services and insurance to retail chains and telecom operators, while small and medium enterprises predominantly in healthcare and discrete manufacturing gravitate toward turnkey solutions. Market channels include direct engagement models and indirect distribution through networks of distributors, online retailers, and resellers.

Emerging technology vectors further enrich the ecosystem. Next-generation networks-both non-standalone and standalone 5G-provide the connectivity backbone, while artificial intelligence algorithms span computer vision, machine learning, and natural language processing domains. Blockchain frameworks in public, private, and consortium formats underpin data integrity, and IoT protocols such as LoRa, LPWAN, and NB-IoT enable seamless sensor integration across sprawling industrial landscapes.

This comprehensive research report categorizes the Image Recognition market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Channel

- Technology

- Deployment

- Application

- End User

Unraveling Regional Dynamics Shaping Image Recognition Adoption Patterns Market Maturity and Innovation Across Americas EMEA and Asia Pacific

Within the Americas, robust R&D investments and advanced manufacturing capabilities have accelerated the integration of image recognition across industries. North America, in particular, has emerged as a hub for pilot programs in autonomous vehicles and precision agriculture, underpinned by collaborative initiatives between technology providers and academic institutions. Regulatory harmonization efforts are facilitating cross-border data flows, enabling seamless deployment of vision-based analytics in sectors ranging from retail loss prevention to public safety monitoring.

In Europe, Middle East & Africa, strict data privacy regimes have compelled solution architects to embed privacy-by-design principles into their systems. The region’s defense and aerospace sectors continue to drive demand for high-performance vision solutions, while retail and financial services adopt advanced authentication and fraud detection measures. Government mandates around smart city deployments in the Middle East are fostering large-scale projects that integrate urban surveillance cameras with AI analytics platforms.

Asia-Pacific remains the fastest adopter of image recognition technologies, fueled by large-scale smart manufacturing initiatives in China, industrial automation programs in South Korea and Japan, and digital identity schemes in India. Southeast Asian nations are investing in telemedicine and remote diagnostics to address healthcare access challenges, while Australia and New Zealand prioritize environmental monitoring applications to support sustainability goals. This diverse tapestry of use cases underscores the region’s role as both an innovation incubator and a critical market for global technology vendors.

This comprehensive research report examines key regions that drive the evolution of the Image Recognition market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Competitive Positions Partnerships Technological Strengths and Strategic Moves Among Leading Image Recognition Providers Worldwide

Competitive dynamics in the image recognition arena are defined by the interplay of semiconductor innovators, cloud service titans, and specialized software vendors. Companies with proprietary AI accelerators and high-density sensor arrays are positioning themselves as preferred hardware partners, leveraging co-design approaches to optimize model inference at the chip level. Meanwhile, hyperscale cloud platforms are bundling vision AI APIs with broader ML toolkits to streamline developer adoption and shorten time to proof of concept.

Strategic alliances and mergers have become a hallmark of market consolidation, as incumbents seek to shore up capabilities across the vision pipeline. Partnerships between systems integrators and boutique AI specialists are proliferating, enabling the rapid assembly of vertical-specific solutions. Meanwhile, established players are augmenting their portfolios through targeted acquisitions of startups with niche expertise in areas such as anomaly detection, thermal imaging, and sensor fusion. These moves not only bolster technical roadmaps but also expand global go-to-market footprints through cross-selling opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Image Recognition market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allied Vision Technologies GmbH

- Amazon Web Services, Inc.

- Basler AG

- Baumer Holding AG

- Cognex Corporation

- FLIR Systems, Inc.

- Google LLC

- Hikvision Digital Technology Co., Ltd.

- IBM Corporation

- IDS Imaging Development Systems GmbH

- Keyence Corporation

- Microsoft Corporation

- NVIDIA Corporation

- OMRON Corporation

- Teledyne Technologies Incorporated

Implementing Forward Thinking Strategies to Leverage Image Recognition Capabilities Enhance Operational Efficiency and Maximize Stakeholder Value

Industry leaders should prioritize investments in edge inference capabilities that leverage the latest neural network optimization techniques. By deploying lightweight vision models on locally managed devices, organizations can reduce latency, lower bandwidth consumption, and maintain control over sensitive data streams. Moreover, adopting a modular architecture that decouples sensing hardware from core analytics logic enables rapid upgrades as both sensor fidelity and model accuracy improve concurrently.

Supply chain diversification is equally critical; enterprises must cultivate relationships with multiple hardware vendors across geographic regions to mitigate the impact of tariff regimes and geopolitical uncertainties. Additionally, forging collaborative alliances with academic research labs and standards bodies can accelerate validation cycles for new use cases and enhance interoperability across platforms. Finally, embedding privacy-enhancing technologies into every layer of the stack-from data capture to model deployment-not only ensures compliance with evolving regulations but also fosters customer trust, which is an increasingly valuable form of competitive differentiation.

Detailing Rigorous Research Protocols Methodical Data Collection and Analytical Frameworks Utilized to Derive Actionable Insights in Image Recognition Studies

This analysis is anchored in a rigorous multi-stage research approach that blends primary interviews with secondary data synthesis. Stakeholder interviews were conducted across a cross-section of ecosystem participants, including solution architects, IT decision makers, hardware manufacturers, and regulatory experts. These insights were then triangulated against publicly available filings, patent databases, and industry association white papers to validate technical trends and commercial dynamics.

Quantitative data was harmonized using a bottom-up methodology that maps product revenues, deployment metrics, and user adoption rates to underlying technology drivers. Qualitative assessments were informed by scenario analysis and expert workshops that stress-tested emerging risk factors such as regulatory changes, supply chain disruptions, and alternative technology paradigms. Throughout, data integrity protocols were applied to ensure consistency, while peer review processes vetted assumptions and conclusions to deliver a reliable evidence base for decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Image Recognition market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Image Recognition Market, by Offering

- Image Recognition Market, by Channel

- Image Recognition Market, by Technology

- Image Recognition Market, by Deployment

- Image Recognition Market, by Application

- Image Recognition Market, by End User

- Image Recognition Market, by Region

- Image Recognition Market, by Group

- Image Recognition Market, by Country

- United States Image Recognition Market

- China Image Recognition Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3498 ]

Concluding Comprehensive Findings by Emphasizing Core Trends Opportunities and Imperatives Shaping the Future Trajectory of Image Recognition Technologies

The landscape of image recognition technology is characterized by rapid innovation, shifting regulatory landscapes, and dynamic competitive alignments. Core trends such as the migration to edge AI, the proliferation of multimodal sensor arrays, and the fusion of vision data with contextual signals are redefining the boundaries of what vision systems can achieve. Meanwhile, geopolitical factors and policy incentives are reshaping supply chains and influencing investment priorities across regions.

Organizations that embrace a strategic roadmap-one that balances short-term efficiency gains with long-term platform scalability-will be best positioned to capitalize on the full spectrum of image recognition opportunities. Prioritizing flexible architectures, cultivating diverse vendor ecosystems, and embedding ethical considerations into system design are imperatives that drive sustainable value creation. As this technology continues to permeate industries, decision makers who act decisively and leverage tailored insights will maintain a competitive advantage in an increasingly visual world.

Seize the Competitive Edge Today by Connecting with Ketan Rohom for Exclusive Access to Comprehensive Image Recognition Market Insights and Strategic Guidance

Gaining a competitive edge in the rapidly evolving image recognition domain requires decisive action and the right intelligence to guide strategic investments. Partnering with an expert in market dynamics ensures that your organization can prioritize the most impactful technologies and anticipate shifts before they reach critical mass. By engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, you secure personalized guidance tailored to your organizational objectives and resource constraints.

Reach out today to explore how bespoke insights can sharpen your strategic roadmap and accelerate the realization of measurable outcomes. Let this be the catalyst that transforms raw data into sustainable competitive advantage through informed decision-making and proactive initiatives.

- How big is the Image Recognition Market?

- What is the Image Recognition Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?