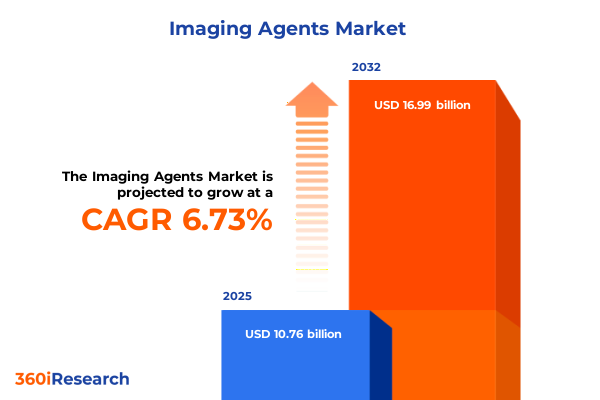

The Imaging Agents Market size was estimated at USD 10.76 billion in 2025 and expected to reach USD 11.40 billion in 2026, at a CAGR of 6.73% to reach USD 16.99 billion by 2032.

Delving into the Transformative Impact of Advanced Diagnostic Imaging Agents on Precision Medicine and Clinical Decision-Making in Modern Healthcare

Diagnostic imaging agents have emerged as essential enablers of modern healthcare delivery, providing clinicians with unparalleled visual clarity across a wide spectrum of clinical scenarios. From gadolinium-based contrast agents enhancing magnetic resonance procedures to iodinated compounds elevating computed tomography accuracy, these specialized substances serve as critical adjuncts in diagnosing and monitoring diseases. In parallel, microbubble agents are redefining vascular and perfusion imaging in ultrasound, while radiopharmaceuticals are unlocking the potential of nuclear modalities to deliver molecular-level insights in both PET and SPECT applications. This diverse array of agent types underpins precision medicine approaches, supports early detection efforts in oncology, and informs tailored treatment pathways in cardiology and neurology.

Looking beyond traditional boundaries, the imaging agent ecosystem is increasingly shaped by the integration of multimodal diagnostics, with hybrid PET/MRI platforms and advanced ultrasound techniques converging to offer richer, more actionable data. Regulatory frameworks continue to evolve, balancing rigorous safety standards-especially following the scrutiny of gadolinium retention concerns-with expedited pathways for agents addressing high unmet medical needs. Meanwhile, sustainability considerations are driving new conversations around lifecycle management, recycling of rare earth elements, and greener manufacturing processes. As stakeholders across hospitals, academic research institutes, ambulatory surgical centers, and diagnostic laboratories grapple with these developments, a clear understanding of the foundational role that these agents play in driving better patient outcomes is paramount.

Exploring Revolutionary Advances in Imaging Agent Technology and Integration of Artificial Intelligence That Are Redefining Diagnostic Capabilities Globally

The imaging agent landscape is undergoing a profound transformation fueled by technological breakthroughs and shifts in clinical practice. Artificial intelligence algorithms are now being applied to automate contrast enhancement quantification, reducing operator variability and accelerating diagnostic workflows. Equally, the emergence of theranostic radiopharmaceuticals is forging new frontiers in oncology by coupling diagnostic imaging with targeted therapeutic payloads, creating closed-loop treatment paradigms that were previously unimaginable. In ultrasound imaging, the refinement of microbubble formulations has catalyzed the adoption of three-dimensional contrast-enhanced studies, offering volumetric insights into microvascular perfusion that inform surgical planning and interventional guidance.

Beyond modality innovations, the convergence of imaging data with genomic and biomarker profiles heralds a more personalized approach to agent selection. Clinicians are beginning to leverage predictive modeling to determine whether a patient may derive greater benefit from PET imaging agents versus traditional SPECT tracers, thereby optimizing diagnostic yield while managing resource utilization. Moreover, strategic collaborations between global imaging companies, pharmaceutical firms, and academic consortia are accelerating pipeline development through shared access to advanced radiochemistry platforms. As digital health initiatives expand, cloud-based image analysis and remote interpretation services are democratizing access to specialty expertise, ensuring that transformative insights derived from advanced agents can reach community and rural healthcare settings.

Analyzing the Far-Reaching Consequences of the 2025 United States Tariff Regime on Supply Chains and Cost Structures Within the Imaging Agent Industry

The implementation of new tariffs by the United States in 2025 has introduced a complex array of cost pressures and supply chain challenges across the imaging agent industry. Import duties targeting precursor chemicals for gadolinium chelates and specialized radioisotopes have led manufacturers to contend with elevated raw material expenses, which have, in turn, reverberated through direct sales networks and distributor partnerships. Simultaneously, extended customs clearance procedures have introduced lead-time uncertainties, prompting several stakeholders to prioritize near-shoring of chemical synthesis and local assembly of radiopharmaceutical kits to mitigate disruptions.

In response to these fiscal headwinds, some developers have accelerated their investment in alternative agent chemistries that rely on domestically sourced reagents, thereby reducing exposure to imported tariff liabilities. Others are negotiating long-term supply agreements with international distributors to lock in stable pricing, even as local distributors are exploring consolidated shipping solutions to offset duty costs. Regulatory bodies have also recognized the urgency of the situation, issuing guidance to streamline import inspections for life-saving diagnostic materials. While short-term fluctuations in pricing and availability are being managed through strategic inventory buffers, the cumulative impact of these tariffs underscores the importance of robust risk management strategies and the value of supply chain diversification.

Uncovering Key Insights from Segmentation by Agent Type, Modality, Application, End User, and Distribution Channel Perspectives

A deep dive into market segmentation reveals nuanced dynamics that are reshaping competitive positioning and product development priorities. When viewed through the lens of agent type, the market encompasses a spectrum ranging from traditional gadolinium-based agents and iodinated contrast compounds to innovative microbubble formulations and a burgeoning radiopharmaceutical segment that spans both PET imaging agents and SPECT imaging agents. Each of these classes carries distinct regulatory and formulation considerations, influencing the timeline for market entry and the level of clinical adoption.

Assessing modality segmentation, computed tomography continues to rely heavily on iodinated agents for high-resolution anatomical imaging, while magnetic resonance imaging is buoyed by next-generation gadolinium constructs that offer enhanced relaxivity. Nuclear imaging’s demand profile is increasingly driven by novel PET imaging agents for oncology and neurology, even as SPECT tracers maintain a role in cardiac diagnostics. Ultrasound imaging is bifurcated into two-dimensional studies using conventional microbubble products and advanced three-dimensional imaging agents designed for complex volumetric assessments.

Application segmentation underscores oncology as a principal growth driver, supported by specialized molecular tracers, while cardiology and neurology represent significant use cases for both contrast and radiopharmaceutical agents. End users range from academic research institutes that pioneer novel indications to ambulatory surgical centers and diagnostic laboratories focused on workflow efficiency, as well as hospitals and imaging centers that balance clinical throughput with patient safety. Finally, distribution channel segmentation spans direct sales models, distributor networks differentiated between international distributors and local distributors, and an online retail presence that is steadily gaining traction for lower-volume specialty products.

This comprehensive research report categorizes the Imaging Agents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Agent Type

- Modality

- Application

- End User

- Distribution Channel

Revealing Strategic Regional Nuances and Growth Drivers Shaping Imaging Agent Adoption Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics are exerting a pronounced influence on deployment strategies and investment priorities. In the Americas, the United States dominates demand with its expansive hospital and imaging center network, a robust ambulatory surgical center sector, and leading academic research institutes that drive early adoption of novel agents. Latin American markets are following suit, though adoption curves vary based on local regulatory harmonization and infrastructure readiness.

Across Europe, Middle East, and Africa, mature markets in Western Europe benefit from established reimbursement frameworks and a growing emphasis on value-based diagnostics, while emerging economies in the Middle East are investing heavily in imaging capacity. Regulatory alignment within the European Union has smoothed cross-border approvals for innovative contrast agents, whereas some African regions face infrastructure bottlenecks that slow the pace of new modality rollouts. In Asia-Pacific, an extensive build-out of diagnostic laboratories and private imaging centers in markets such as China, India, and Southeast Asia is creating fertile conditions for both iodinated and radiopharmaceutical agent expansion. Government incentives aimed at enhancing early cancer detection programs are particularly catalyzing growth in oncology-focused tracers, positioning the region as a hotbed for long-term strategic partnerships.

This comprehensive research report examines key regions that drive the evolution of the Imaging Agents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Strategies, Innovation Portfolios, and Partnerships of Leading Imaging Agent Developers Shaping the Industry

Leading players in the imaging agent arena are deploying a variety of strategic approaches to differentiate their offerings and solidify market leadership. One major supplier has introduced an AI-enabled platform that optimizes dosing regimens for gadolinium-based products, leveraging real-world data analytics to improve safety margins and reduce gadolinium retention concerns. Another key competitor has forged partnerships with nuclear medicine research centers to expedite the clinical validation of next-generation PET imaging agents, thereby accelerating time-to-market for molecular diagnostics in oncology.

Collaborations between established pharmaceutical companies and emerging biotechs are also reshaping the competitive landscape, with joint ventures focused on theranostic agent development and radiolabelling innovations. Several developers have expanded their distribution networks through acquisitions of regional distributor groups, enhancing local support and supply chain resilience. Sustainability initiatives are increasingly front and center, with efforts to implement closed-loop recovery systems for rare earth elements used in contrast formulations and to adopt greener manufacturing processes across global production facilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Imaging Agents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bayer AG

- Bracco Imaging S.p.A.

- Cardinal Health, Inc.

- Fujifilm Holdings Corporation

- GE Healthcare

- Guerbet S.A.

- J. B. Chemicals & Pharmaceuticals Limited

- Lantheus Holdings, Inc.

- Livealth Biopharma

- Mallinckrodt plc

- Sagent Pharmaceuticals, Inc.

- Scintica Instrumentation, Inc.

- Siemens Healthineers AG

Actionable Recommendations for Industry Leaders to Navigate Challenges and Capitalize on Opportunities in Imaging Agent Markets

Industry leaders can take decisive steps to fortify their competitive positioning and navigate the evolving market landscape. Prioritizing the establishment of localized manufacturing capabilities for critical precursors and finished imaging agents can mitigate exposure to international tariff fluctuations and enhance supply reliability. Equally, investing in next-generation formulation platforms-such as biodegradable microbubbles and nanocarrier-based contrast systems-can drive differentiation in high-growth clinical segments like oncology and neurology.

Furthermore, cultivating strategic alliances with artificial intelligence providers and imaging hardware manufacturers will be essential for delivering integrated solutions that streamline clinical workflows and support data-driven decision-making. Engaging proactively with global and regional regulatory bodies to accelerate review pathways for breakthrough agents can reduce time-to-market and unlock early adoption incentives. Finally, embedding sustainability practices-from green chemistry initiatives to rare earth recovery programs-will enhance corporate social responsibility profiles and resonate with stakeholders across the healthcare ecosystem.

Outlining Research Methodology Including Primary Interviews, Secondary Data Analysis, and Rigorous Validation for Reliable Industry Insights

This research leverages a rigorous, multi-tiered methodology to ensure the depth and accuracy of its insights. Primary data collection included in-depth interviews with key opinion leaders in radiology and nuclear medicine, as well as discussions with supply chain executives and regulatory specialists. These conversations provided firsthand perspectives on clinical requirements, adoption barriers, and strategic imperatives shaping the future of imaging agents.

Complementing primary research, a comprehensive secondary analysis was conducted, drawing on peer-reviewed publications, regulatory filings, patent databases, and third-party databases to map technology trends and competitive activity. Data triangulation techniques were applied to reconcile differing viewpoints and validate critical assumptions. Finally, an expert validation process involved convening a panel of industry advisors to review preliminary findings and refine the narrative arc of the report. This systematic approach ensures that the resulting intelligence is both credible and directly relevant to decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Imaging Agents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Imaging Agents Market, by Agent Type

- Imaging Agents Market, by Modality

- Imaging Agents Market, by Application

- Imaging Agents Market, by End User

- Imaging Agents Market, by Distribution Channel

- Imaging Agents Market, by Region

- Imaging Agents Market, by Group

- Imaging Agents Market, by Country

- United States Imaging Agents Market

- China Imaging Agents Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarizing Main Findings and Forward Looking Perspectives on Imaging Agent Evolution to Inform Impactful Decision Making Across Healthcare Systems

The analysis presented herein underscores the critical role that advanced imaging agents play in driving diagnostic precision and improving patient care across multiple therapeutic areas. Key trends-such as the integration of artificial intelligence, the rise of theranostic radiopharmaceuticals, and the diversification of modality-specific formulations-are converging to reshape the competitive and regulatory environment. Additionally, the imposition of new tariff structures in the United States highlights the strategic importance of supply chain resilience and localized production capabilities.

Segmentation insights reveal varied growth trajectories based on agent type, modality, application, end user, and distribution channel, while regional nuances point to distinct adoption dynamics and investment priorities in the Americas, EMEA, and Asia-Pacific. Leading companies are responding through innovation portfolios, strategic partnerships, and sustainability initiatives, demonstrating the multifaceted nature of competition in this sector. As healthcare systems contend with evolving patient needs and economic pressures, the synthesis of these findings provides a clear framework for making informed, future-proof decisions.

Looking ahead, industry stakeholders should remain vigilant to emerging breakthroughs in imaging agent chemistry, regulatory adaptations, and digital health integrations. By aligning strategic initiatives with these forward-looking perspectives, organizations can capitalize on the evolving landscape to deliver enhanced clinical value and long-term growth.

Connect with Ketan Rohom to Access the Full Market Research Report and Empower Your Strategic Initiatives in the Imaging Agent Sector

Engaging directly with Ketan Rohom unlocks immediate access to the full breadth of our imaging agent market research report and positions your organization to leverage critical strategic insights. As Associate Director of Sales & Marketing, Ketan brings a deep understanding of the nuanced dynamics shaping the contrast media and radiopharmaceutical landscape, ensuring that every recommendation is grounded in actionable intelligence. By reaching out, you gain not only the comprehensive analysis contained within the report but also the opportunity to discuss bespoke research extensions tailored to your specific competitive challenges and investment priorities.

This collaborative engagement guarantees that decision-makers receive a customized briefing that distills the most relevant trends-from shifting regulatory frameworks to emerging modality preferences-into clear, executable strategies. Whether you are seeking to refine your product portfolio, expand into underserved regions, or optimize your supply chain resilience in light of recent tariff developments, Ketan will guide you through the report’s insights and facilitate a seamless purchasing process. Take the next step toward fortifying your market position by contacting Ketan Rohom and securing the intelligence that will inform your high-impact strategic initiatives.

- How big is the Imaging Agents Market?

- What is the Imaging Agents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?