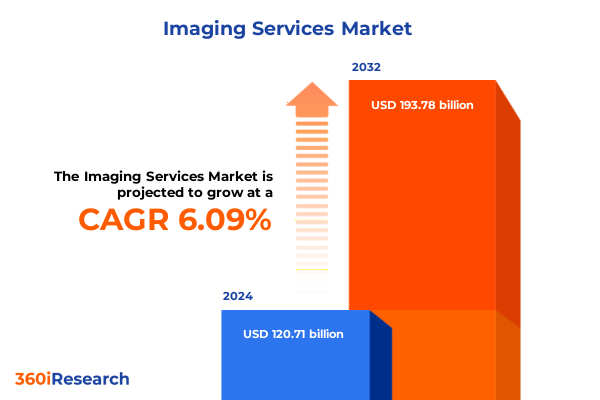

The Imaging Services Market size was estimated at USD 127.63 billion in 2025 and expected to reach USD 134.94 billion in 2026, at a CAGR of 6.14% to reach USD 193.78 billion by 2032.

Unveiling the Growth Story and Strategic Imperatives in Medical Imaging to Illuminate Market Dynamics and Opportunities with Clarity and Context

The medical imaging sector stands at the cusp of an era defined by rapid technological progress and shifting care delivery models. Advances in artificial intelligence, machine learning, and cloud-based diagnostics are converging to enable previously unattainable levels of image analysis accuracy and efficiency. These breakthroughs are not only enhancing diagnostic precision but also empowering clinicians to make faster, more informed decisions. Beyond pure technology, evolving reimbursement policies and value-based care imperatives are reshaping how imaging services integrate into patient care pathways, leading to closer collaboration between radiologists, referring physicians, and multidisciplinary teams.

Moreover, the ongoing digitization of health records and the proliferation of interoperable platforms facilitate seamless data sharing and longitudinal patient monitoring. This interoperability fosters a more holistic understanding of disease progression, translating into tailored treatment plans and improved outcomes. As the sector moves towards decentralized care, point-of-care imaging is gaining traction in clinics, outpatient centers, and even remote environments. Consequently, market participants must adapt to a landscape where agility in service delivery and the ability to integrate advanced analytics are key differentiators.

In this context, understanding the interplay between technological innovation, regulatory evolution, and shifting clinical practices becomes critical. This introduction outlines the foundational trends and strategic considerations that inform subsequent analysis, setting the stage for a comprehensive exploration of market dynamics and future opportunities.

Charting the Evolution of Imaging Technology and Clinical Practices That Are Redefining Diagnosis and Patient Care Delivery Models Worldwide

Imaging technology has undergone transformative shifts that extend well beyond incremental improvements. Cutting-edge modalities such as functional MRI are moving from research laboratories into routine clinical workflows, enabling more precise mapping of physiological processes. Simultaneously, open MRI systems are carving out new niches by addressing patient comfort and accessibility concerns. Hybrid imaging platforms that combine positron emission tomography with CT or MRI have redefined diagnostic standards in oncology and neurology, creating integrated solutions that deliver both anatomical and molecular insights in a single session.

In parallel, the rise of portable imaging systems is revolutionizing point-of-care diagnostics. These compact devices are increasingly being deployed in ambulatory surgical centers and emergency response settings, where rapid imaging can be a critical determinant in patient triage and treatment paths. Such mobility is complemented by the broader adoption of cloud-based image storage and AI-driven interpretation tools, which together enable healthcare providers to extend specialist expertise into remote and underserved regions.

Furthermore, regulatory frameworks have evolved to accommodate these innovations, balancing the imperative for patient safety with the need for accelerated pathways to market. This progress has incentivized manufacturers to pursue agile development and iterative enhancements, bridging the gap between pilot studies and full-scale clinical adoption. As a result, competitive landscapes have shifted, with startups and established corporations alike racing to secure key partnerships and intellectual property in high-impact application areas. These transformative shifts underscore the urgency for stakeholders to realign strategies in anticipation of the sector’s next phase of growth.

Assessing the Cumulative Consequences of United States Tariff Policies in 2025 on Supply Chains Pricing Structures and Equipment Accessibility

United States tariff policies introduced in 2025 have imposed notable pressures on the supply chains of medical imaging equipment, particularly for components sourced from international manufacturing hubs. These tariffs have elevated the cost of critical hardware elements such as high-field magnets for MRI systems and advanced detectors for CT scanners. Consequently, equipment manufacturers have faced the challenge of recalibrating procurement strategies, either by sourcing domestically produced alternatives or by absorbing incremental costs, which can impact pricing structures downstream.

Moreover, the impact has extended to service providers who rely on imported parts for routine maintenance and calibration. Higher import duties on specialized calibration tools and replacement parts have led to elongated service cycles and elevated operational expenditures. In some cases, diagnostic centers have deferred nonurgent upgrades, resulting in an extended lifecycle for aging systems. This trend has underscored the importance of agile supply chain management and the diversification of supplier portfolios to mitigate exposure to future tariff escalations.

In response, leading manufacturers have pursued strategic partnerships with domestic component producers, investing in localized manufacturing capabilities to offset tariff-related cost burdens. Concurrently, providers are exploring long-term service agreements that bundle maintenance with extended warranties, spreading financial impact over multi-year horizons. These developments illustrate how tariff policies in 2025 have served as catalysts for strategic realignments, prompting increased collaboration across the value chain and a renewed focus on resilient sourcing and cost containment strategies.

Uncovering Critical Insights Across Service Type Modality Application and End User Segments to Inform Strategic Positioning and Portfolio Decisions

Segmentation insights reveal nuanced dynamics that are essential for crafting targeted strategies in the imaging services sector. Within the service type segment, demand varies significantly between computed tomography and magnetic resonance imaging, with MRI subsegments such as functional and open configurations catering to distinct clinical priorities. Computed radiography and digital radiography each present unique value propositions, influencing how providers invest in X-ray infrastructure. Nuclear imaging continues to serve specialized diagnostic contexts, while ultrasound’s versatility ensures its prevalence across diverse medical disciplines.

When considering modality, standalone systems remain core assets for high-throughput centers, whereas hybrid combinations address the growing need for comprehensive diagnostic information in a single workflow. Portable units, in contrast, unlock new use cases by extending advanced imaging capabilities into ambulatory surgical centers and community clinics. These modality distinctions shape purchasing decisions, service agreements, and training requirements for technical personnel.

Application-driven segmentation further refines the market outlook, as cardiology centers, neurologists, and oncologists exhibit specific preferences based on image resolution, throughput, and contrast mechanisms. Gastrointestinal and urology imaging demand specialized probes and software, while orthopedic and musculoskeletal assessments benefit from high-resolution X-ray and ultrasound modalities for dynamic examinations. Finally, end-user profiles highlight varying adoption curves: research labs and academic institutions prioritize cutting-edge features for experimental protocols, diagnostic centers focus on cost-efficiency and uptime, and hospitals and clinics balance a spectrum of service offerings to meet inpatient and outpatient needs.

This comprehensive research report categorizes the Imaging Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Modality

- Application

- End-User

Examining Regional Dynamics in the Americas Europe Middle East & Africa and Asia Pacific to Highlight Growth Drivers Challenges and Collaborative Opportunities

Regional insights uncover contrasting growth trajectories and strategic imperatives across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In North America, robust healthcare infrastructure and well-established reimbursement frameworks support rapid uptake of advanced modalities, particularly in metro-centric medical hubs. Conversely, Latin American markets are characterized by budgetary constraints that drive demand for cost-effective portable and standalone systems, often financed through public-private partnerships.

In Europe, Middle East & Africa, regulatory harmonization under initiatives such as the European Medical Device Regulation has heightened standards for safety and efficacy, prompting manufacturers to streamline compliance processes. Meanwhile, Gulf Cooperation Council countries are making targeted investments in oncology and cardiology centers, fueling demand for hybrid imaging platforms. In sub-Saharan Africa, infrastructure limitations create opportunities for lightweight ultrasound units that can operate in low-resource settings.

Asia-Pacific exhibits a bifurcated landscape, where advanced economies like Japan and South Korea pursue next-generation technologies such as photon-counting detectors, while emerging markets in Southeast Asia emphasize accessible models that can scale across diverse clinical settings. Government-led health campaigns in India and China have accelerated imaging adoption in rural areas, aided by teleradiology networks that bridge geographical gaps. These regional nuances underscore the importance of tailored strategies that align product portfolios with local healthcare priorities and procurement mechanisms.

This comprehensive research report examines key regions that drive the evolution of the Imaging Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players Strategic Initiatives and Competitive Landscapes to Illuminate Innovation Trends Partnerships and Market Positioning

A focused look at leading industry players reveals divergent approaches to innovation, market expansion, and partnership formation. Several long-standing corporations continue to invest heavily in next-generation platform development, leveraging their extensive clinical trial networks to validate performance claims and secure key reference accounts. These organizations often form alliances with academic centers and technology vendors to co-develop proprietary software modules that enhance image clarity and workflow efficiency.

In contrast, emerging challengers have adopted agile business models, deploying modular systems that can be rapidly customized to meet niche clinical needs. Their lean structures enable swift iteration cycles and targeted entry into underpenetrated markets. These newcomers frequently engage in venture-backed collaborations, securing capital to scale production and expand distribution channels. At the same time, hybrid entities-formed through strategic M&A between established players and innovative startups-are gaining traction by combining market reach with cutting-edge capabilities.

Competitive differentiation also stems from comprehensive service ecosystems. Top-tier companies offer integrated solutions spanning equipment financing, training programs, and software-as-a-service analytics, thereby fostering long-term customer engagement. By contrast, more specialized vendors focus on single modalities or applications, cultivating deep expertise that appeals to centers of excellence. This diversity in corporate strategies underscores a dynamic competitive environment, where alliances and acquisitions play as critical a role as product innovation in shaping market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Imaging Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alliance HealthCare Services, Inc. by Akumin Inc.

- Analogic Corporation

- Apex Radiology

- Banner Health

- Bruker Corporation

- Butterfly Network

- Capitol Imaging Services

- Carestream Health, Inc

- Esaote S.p.A.

- Fujifilm Holdings Corporation

- GE Healthcare

- Global Diagnostics Imaging

- Healius Limited

- I-MED Radiology Network

- iCAD, Inc.

- MXR Imaging Inc.

- PerkinElmer, Inc.

- Radnet, Inc.

- RAYUS Radiology

- Siemens AG

- Simonmed Imaging

- Sonic Healthcare Limited

- Unilabs AB

- Ziehm Imaging GmbH

Defining Strategic Roadmaps and Best Practices for Industry Leaders to Navigate Emerging Trends Regulatory Shifts and Technological Innovations with Confidence

Industry leaders should prioritize a strategy that balances technological innovation with operational resilience. To begin, strengthening supplier diversification by establishing partnerships with domestic component manufacturers can mitigate exposure to external policy shifts, such as tariffs and trade restrictions. In parallel, investing in modular, upgradeable system architectures allows providers to adapt quickly to clinical demand fluctuations without committing to full-scale capital expenditures.

Next, organizations should embrace digital transformation by integrating AI-driven diagnostic tools and cloud-based platforms into their service offerings. By doing so, they enhance diagnostic throughput and unlock new revenue streams through remote interpretation services. Equally important is the cultivation of cross-disciplinary collaborations with clinicians, data scientists, and regulatory experts to ensure that emerging solutions align with real-world workflow requirements and compliance standards.

Furthermore, market players must adopt a customer-centric approach that tailors service agreements to the unique needs of ambulatory centers, research institutions, and large hospital networks. Flexible financing models and outcome-based contracts can facilitate broader adoption, especially in resource-constrained environments. Finally, maintaining agility through iterative product development and frequent stakeholder feedback loops will enable firms to refine value propositions and stay ahead of competitive pressures. These recommendations provide a practical blueprint for navigating a complex and evolving imaging services landscape.

Detailing a Robust Multi-Source Research Framework Integrating Primary Expert Interviews Secondary Data Analysis and Rigorous Validation Protocols

This research draws on a multi-tiered methodology designed to ensure comprehensive coverage and robust validation. Primary data collection comprised in-depth interviews with clinicians, radiology department heads, and purchasing executives across diverse healthcare settings. These interviews, conducted under structured protocols, provided nuanced perspectives on emerging needs and procurement drivers. Secondary research included a systematic review of peer-reviewed journals, regulatory filings, and industry white papers to map technological advancements and policy developments.

Quantitative and qualitative analyses were integrated through a triangulation approach. Market segmentation variables were defined based on service type, modality, application, and end-user categories, ensuring alignment with clinical and operational realities. Data was normalized across diverse sources to mitigate inconsistencies, and key assumptions were stress-tested under varying scenarios, including shifts in tariff regimes and reimbursement changes. Advanced analytics techniques, such as conjoint analysis and scenario modeling, were employed to assess the relative influence of different factors on purchasing decisions.

Finally, an expert advisory panel comprising academic researchers, industry veterans, and regulatory consultants reviewed preliminary findings and provided critical feedback. This iterative validation step strengthened the objectivity and applicability of insights. Throughout the research process, rigorous protocols for data integrity, confidentiality, and ethical compliance were strictly upheld to deliver a credible and actionable framework.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Imaging Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Imaging Services Market, by Service Type

- Imaging Services Market, by Modality

- Imaging Services Market, by Application

- Imaging Services Market, by End-User

- Imaging Services Market, by Region

- Imaging Services Market, by Group

- Imaging Services Market, by Country

- United States Imaging Services Market

- China Imaging Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings and Strategic Implications to Provide a Cohesive Perspective on the Future Trajectory of the Imaging Services Sector

The convergence of technological innovation, policy shifts, and evolving care paradigms has created a dynamic environment for imaging services. Key themes emerge around the critical importance of agility-both in technology adoption and operational strategy-as a determinant of success. Companies and providers that demonstrate resilience through diversified supply chains, modular system designs, and adaptive service models will be best positioned to capture emerging opportunities.

Moreover, the fragmentation of demand across service types, modalities, applications, and end-user segments underscores the value of targeted approaches. Stakeholders must develop nuanced product portfolios and go-to-market strategies that reflect the distinct needs of cost-sensitive outpatient clinics, high-throughput hospital networks, and specialized research institutions. This segmentation lens enables more precise resource allocation and enhances competitive positioning.

Finally, regional distinctions highlight the necessity of localized strategies, with different regulatory, economic, and infrastructural factors shaping market entry and expansion. The interplay between global technological trends and regional healthcare priorities suggests that successful players will combine global R&D capabilities with tailored market execution. Overall, this conclusion synthesizes the report’s core insights, charting a cohesive path for stakeholders to navigate the rapidly evolving imaging services sector with clarity and confidence.

Take the Next Step Toward Informed Decision Making by Connecting with Ketan Rohom to Access Comprehensive Market Research Insights

Engaging with Ketan Rohom opens the door to a deeper understanding of current market dynamics and future trajectories in imaging services. By reaching out, stakeholders gain access to specialized insights derived from rigorous research grounded in primary interviews with seasoned experts and comprehensive secondary analysis. This dialogue empowers decision-makers to tailor strategies that resonate with evolving regulatory landscapes and capitalize on technological breakthroughs. Prospective partners and clients will benefit from personalized consultations that translate complex data into actionable plans, ensuring resource optimization and competitive differentiation. With a focus on translating intelligence into influence, connecting with Ketan provides a direct channel to bespoke market intelligence and strategic guidance. Take this opportunity to elevate decision-making processes and align investments with validated growth opportunities across service types, modalities, applications, and end-user segments. Forge a partnership that transforms information into impact and positions your organization at the forefront of innovation within the imaging services domain

- How big is the Imaging Services Market?

- What is the Imaging Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?