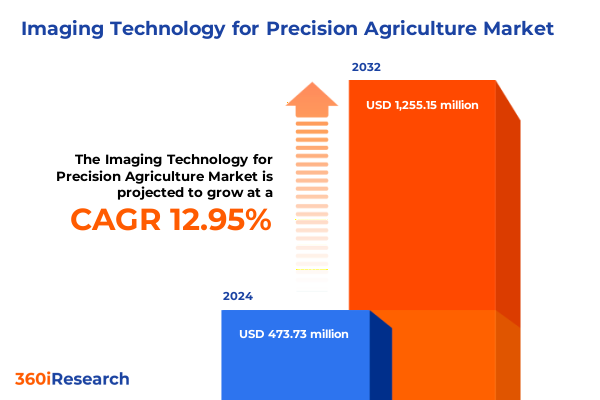

The Imaging Technology for Precision Agriculture Market size was estimated at USD 534.64 million in 2025 and expected to reach USD 596.61 million in 2026, at a CAGR of 12.96% to reach USD 1,255.15 million by 2032.

Discover How Cutting-Edge Imaging Technologies Are Driving a New Era of Data-Driven Agriculture and Sustainable Crop Management

Precision agriculture stands at the forefront of a transformative revolution, where high-resolution imaging technologies are redefining how stakeholders monitor crop health, manage resources, and enhance sustainability. As global food demand intensifies amid environmental constraints, the adoption of hyperspectral, multispectral, LiDAR, and thermal imaging systems has emerged as a critical innovation. These technologies enable growers to identify stress indicators, nutrient deficiencies, and water anomalies at the plant level, fostering proactive interventions that optimize yields and conserve inputs. Concurrently, ground-based platforms-whether handheld or tractor-mounted-complement aerial sensors on drones, manned aircraft, and satellites, creating a multi-layered data ecosystem. By marrying these platforms with sophisticated image processing software and advanced sensors such as CCD and CMOS detectors, agribusinesses and research institutions can transform raw imagery into actionable intelligence. This report offers a panoramic view of these technologies, detailing their applications in crop health monitoring, irrigation management, nutrient optimization, pest and disease detection, soil analysis, and yield prediction. By illuminating the current state of imaging tools for precision agriculture, this introduction sets the stage for an in-depth exploration of the market’s evolving drivers, opportunities, and challenges.

Uncovering the Major Technological Shifts Reshaping Precision Farming Through Advanced Imaging, AI Integration, and Platform Diversification

Over the past few years, precision agriculture has transitioned from niche pilot projects to mainstream adoption, propelled by rapid advancements in imaging sensors and analytic frameworks. Artificial intelligence and machine learning are now deeply embedded within imaging platforms, automating the interpretation of near-infrared and shortwave infrared data captured by multispectral and hyperspectral cameras. These AI-driven solutions can detect subtle variations in crop reflectance and thermal signatures, enabling early identification of nutrient stress or pathogen onset before symptoms become visible to the naked eye. Moreover, AI models continuously refine their predictive accuracy by assimilating historical data and real-time imagery, thereby delivering increasingly precise agronomic recommendations over successive growing seasons.

Simultaneously, the democratization of drone-based monitoring has fundamentally expanded the accessibility of aerial imaging. Small and mid-sized farms can now deploy rotary and fixed-wing UAVs equipped with high-resolution thermal and multispectral sensors, achieving sub-inch ground sample distance imagery at a fraction of traditional costs. This shift has encouraged wider integration of Internet of Things (IoT) networks, where data from soil moisture probes and weather stations are synergized with aerial imagery to create comprehensive farm management dashboards. The convergence of satellite constellations, manned aircraft, and UAV platforms supports scalable monitoring across both localized test plots and expansive commercial estates.

Furthermore, breakthroughs in LiDAR instrumentation are revolutionizing three-dimensional terrain modeling under dense crop canopies. By emitting laser pulses that penetrate vegetation, LiDAR-equipped drones and satellites generate precise digital elevation models that inform drainage optimization and tractor pathway planning. These cumulative shifts underscore a new era of precision farming, where imaging technologies are not merely diagnostic tools but integral components of autonomous decision-making systems structured around sustainability and efficiency.

Analyzing the Cumulative Effects of Recent U.S. Trade Measures on Precision Agriculture Imaging Components and Equipment Costs in 2025

In 2025, U.S. trade policies have imposed a new set of financial pressures on precision agriculture imaging equipment through cumulative tariffs under multiple legal provisions. Section 232 investigations initiated by the U.S. Commerce Department are examining imports of unmanned aircraft systems and polysilicon-a core material for semiconductor-based sensors-and could result in fresh levies on drones and imaging components. Concurrently, the presidential proclamation issued on June 3, 2025, doubled the Section 232 steel and aluminum tariffs from 25% to 50%, directly affecting the cost of sensor housings, mounting hardware, and structural elements of imaging platforms.

Beyond these investigations, longstanding Section 301 tariffs on Chinese imports continue to levy a 25% ad valorem duty on a broad array of imaging-related modules and raw materials. Given China’s dominance in hyperspectral camera assemblies and multispectral sensor chips, precision agriculture suppliers reliant on these imports face sustained input cost escalations. The generalized 50% duties on solar wafer polysilicon instituted earlier this year under the same statute further underscore the vulnerability of imaging technology manufacturers to geopolitical trade disputes.

Moreover, the expanded metals tariffs announced in March targeted derivative steel and aluminum products necessary for agricultural machinery, including drone frames and ground-based sensor units. These measures have produced a ripple effect across supply chains, compelling original equipment manufacturers to reevaluate sourcing strategies and potentially absorb higher material costs or pass them on to end users in the field. Collectively, these trade actions have injected uncertainty into procurement timelines and budget forecasts, challenging stakeholders to implement mitigation strategies such as component localization and strategic inventory management.

In-Depth Insights into Key Market Segments Spanning Technology, Platform, Application, Spectral Range, and Component Categories

The imaging technology market for precision agriculture is defined by distinct segmentation pillars that collectively capture the full spectrum of user requirements and technical capabilities. Technology type segmentation highlights the critical roles of hyperspectral systems for detailed pigment and quality analysis, LiDAR platforms that generate three-dimensional biomass and terrain maps, multispectral tools for rapid vegetation indexing, and thermal imaging solutions tailored to water stress detection. From a platform perspective, data acquisition methods span ground-based configurations-ranging from handheld analyzers to tractor-mounted sensor arrays-through to aerial platforms on manned aircraft, which include both fixed-wing and helicopter operations, and satellite services delivered via constellation networks and single-satellite deployments; UAV ecosystems further subdivide into fixed-wing drones optimized for extended range and rotary-wing models engineered for maneuverability.

Application segmentation emphasizes operational utility, with core use cases in crop health monitoring-encompassing disease identification, nutrient deficiency detection, and water stress analytics-irrigation management through drip optimization and return-on-investment assessments, nutrient management via fertilizer recommendation and foliar analysis, pest and disease detection targeting both fungal outbreaks and insect infestations, soil analysis focused on moisture content assessment and textural profiling, and yield prediction supported by biomass estimation and harvest-planning algorithms. Spectral range delineations define the utilization of visible light for color and growth stage assessment, near-infrared bands for vegetative vigor indices, shortwave infrared to evaluate moisture and chemical composition, and thermal infrared for precise heat mapping. Component segmentation outlines the integration of specialized cameras-such as hyperspectral imaging units, multispectral cameras, and thermal sensors-with detector technologies including CCD and CMOS variants, supported by services for consulting, installation and maintenance, and training, and underpinned by software modules for advanced data analysis and image processing.

This comprehensive research report categorizes the Imaging Technology for Precision Agriculture market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Platform

- Spectral Range

- Component

- Application

Examining Regional Dynamics and Adoption Patterns Across the Americas, Europe Middle East Africa, and Asia-Pacific Precision Agriculture Markets

Regional dynamics exert a profound influence on precision agriculture imaging technology adoption, reflecting divergent regulatory frameworks, capital availability, and agronomic priorities across the globe. In the Americas, the United States and Canada lead the way through substantial investments in drone-based monitoring, variable-rate irrigation controls, and on-farm analytics platforms; North American producers leverage favorable research infrastructure and government programs to deploy advanced sensors and software solutions, while a growing base of service providers is extending coverage to Latin American producers seeking to enhance commodity crop yields and meet export quality standards.

Europe, the Middle East, and Africa encompass a varied landscape, where stringent environmental directives and sustainability incentives drive uptake of low-emission imaging platforms and precision nutrient management tools. The European Union’s support mechanisms under the Common Agricultural Policy have accelerated deployment of satellite-derived monitoring and ground-based sensor networks, while agricultural stakeholders in the Middle East and North Africa focus predominantly on optimizing water use through thermal and multispectral analytics to adapt to resource-constrained environments.

In the Asia-Pacific region, rapid urbanization and population growth have spurred government-led digital agriculture initiatives in China, India, Japan, and Australia. Subsidized programs enable smallholder farmers to access smartphone-compatible imaging apps and low-cost drone services, and major agribusinesses invest heavily in integrated platforms that combine remote sensing, cloud-based processing, and predictive modeling to secure food production amid climatic variability.

This comprehensive research report examines key regions that drive the evolution of the Imaging Technology for Precision Agriculture market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Industry Players Driving Innovation and Competitive Strategies in the Precision Agriculture Imaging Technology Sector

The competitive landscape of precision agriculture imaging technologies features a blend of established industrial conglomerates and agile specialists. Global leaders such as Trimble and Topcon leverage broad portfolios encompassing GPS-guided equipment, LiDAR scanners, and integrated analytics platforms, enabling seamless interoperability across hardware and software layers. In parallel, drone-centric innovators like DJI and Parrot continue to refine multispectral payload capabilities and expand service ecosystems for commercial farming applications. Emerging players such as Sentera and MicaSense differentiate through niche sensor developments-particularly in hyperspectral miniaturization-and strategic alliances with research institutions to push the boundaries of spectral resolution and data throughput.

Moreover, sensor and camera component providers such as Headwall Photonics and FLIR Systems are advancing thermal and shortwave infrared solutions for high-precision irrigation management and pest detection, while software specialists including Hexagon and Pix4D develop machine-learning-backed image-processing suites that transform raw datasets into predictive agronomic insights. The convergence of these capabilities underlines a broader industry emphasis on platform agnosticism, enabling end users to integrate legacy agricultural equipment with state-of-the-art imaging modules and data processing engines. As competition intensifies, collaborative partnerships and modular architectures are emerging as key strategies for sustaining innovation and expanding addressable markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Imaging Technology for Precision Agriculture market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ag Leader Technology, Inc.

- AGCO Corporation

- AgJunction Inc.

- Agremo

- AGRIVI d.o.o.

- BharatAgri

- Ceres Imaging, Inc.

- Cropin Technology Solutions Pvt. Ltd.

- CropMetrics LLC

- Deere & Company

- Farmers Edge Inc.

- FarmQA, Inc.

- FieldX, Inc.

- Grownetics, Inc.

- Intello Labs Pvt. Ltd.

- Proagrica Ltd.

- Raven Industries, Inc.

- The Climate Corporation

- Topcon Corporation

- Trimble Inc.

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Market Challenges

Industry leaders seeking to capture value in the dynamic precision agriculture imaging market should prioritize several strategic initiatives. First, investing in localized manufacturing and supply chain partnerships can mitigate exposure to tariff fluctuations, ensuring stable component availability and cost optimization. Next, fostering cross-industry collaborations with agronomic research centers and extension services will accelerate technology validation, build trust among end users, and facilitate seamless integration of imaging insights into traditional farming workflows.

Additionally, developing scalable subscription-based service models-bundling hardware, software, and advisory support-can lower adoption barriers for smallholder and mid-market producers by transforming capital expenditures into predictable operational costs. Concurrently, expanding interoperability frameworks through open application programming interfaces and data standards will unlock synergies across IoT devices, farm management platforms, and remote sensing networks, delivering more holistic decision-support ecosystems.

Finally, embedding sustainability benchmarks into product roadmaps-such as quantifiable reductions in water usage, fertilizer application rates, and greenhouse gas emissions-will resonate with both regulatory mandates and corporate environmental goals, positioning imaging solutions as essential tools for meeting evolving eco-compliance and corporate social responsibility objectives.

Comprehensive Overview of the Research Methodology Employed to Ensure Accuracy, Depth, and Reliability of Market Insights

This market research report integrates a multi-tiered research methodology designed to ensure rigorous accuracy and comprehensive coverage. Secondary research involved a thorough review of industry publications, government trade records, academic journals, and reputable news outlets to establish a foundational understanding of technological advancements, regulatory changes, and trade dynamics. Primary research was conducted through in-depth interviews with key stakeholders-including equipment manufacturers, sensor developers, agronomic consultants, and end users-to validate secondary findings and gather nuanced perspectives on adoption drivers and deployment challenges.

Quantitative data was triangulated by cross-referencing inputs from industry surveys, public financial disclosures, and tariff documentation to verify cost structures and supply chain impacts. Qualitative insights were synthesized using thematic analysis frameworks to identify emergent market segments and strategic imperatives. Geographic and firmographic disaggregation was applied to stratify findings across regional markets and company types. This methodological approach delivers robust, actionable insights by combining empirical trade data with expert testimony, ensuring that conclusions reflect real-world market conditions and technological trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Imaging Technology for Precision Agriculture market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Imaging Technology for Precision Agriculture Market, by Technology Type

- Imaging Technology for Precision Agriculture Market, by Platform

- Imaging Technology for Precision Agriculture Market, by Spectral Range

- Imaging Technology for Precision Agriculture Market, by Component

- Imaging Technology for Precision Agriculture Market, by Application

- Imaging Technology for Precision Agriculture Market, by Region

- Imaging Technology for Precision Agriculture Market, by Group

- Imaging Technology for Precision Agriculture Market, by Country

- United States Imaging Technology for Precision Agriculture Market

- China Imaging Technology for Precision Agriculture Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Synthesis of Key Findings Highlighting the Future Outlook and Strategic Imperatives for Imaging Technology in Precision Agriculture

Imaging technology continues to redefine precision agriculture by offering granular, data-rich perspectives on crop performance and resource utilization. The confluence of advanced sensor modalities, AI-driven analytics, and versatile deployment platforms underpins a new standard in agricultural decision-making-one that balances productivity gains with environmental stewardship. While U.S. trade policies have introduced cost headwinds, they also spur domestic innovation and encourage strategic supply chain diversification. Regional markets exhibit diverse growth trajectories driven by policy support, infrastructure capacity, and environmental imperatives, highlighting the importance of tailored market entry and expansion tactics.

Key players in the ecosystem are forging partnerships and modular product architectures, facilitating seamless integrations across legacy and emerging platforms. At the same time, actionable recommendations emphasize the value of subscription models, interoperability, and sustainability alignment to accelerate adoption and deliver measurable agronomic outcomes. As the sector evolves, continuous investment in sensor miniaturization, data standards, and cross-sector collaboration will be critical. This report’s comprehensive insights equip stakeholders to navigate the complex convergence of technology, policy, and agronomy, empowering them to harness imaging technologies for sustainable, profitable, and resilient farming systems.

Take the Next Step by Contacting Ketan Rohom to Secure Exclusive Access to a Comprehensive Market Research Report on Precision Agriculture Imaging Technologies

For readers poised to navigate the dynamic landscape of precision agriculture imaging technologies, obtaining comprehensive, data-driven insights is essential. Engage with Ketan Rohom to gain privileged access to a meticulously crafted research report encompassing market drivers, segmentation analysis, regional trends, tariff impacts, and strategic recommendations. This report equips decision-makers with the critical intelligence needed to optimize investment strategies, drive innovation, and maintain a competitive advantage in an increasingly complex environment. Reach out today to secure your copy and embark on a journey toward informed leadership in precision agriculture imaging.

- How big is the Imaging Technology for Precision Agriculture Market?

- What is the Imaging Technology for Precision Agriculture Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?