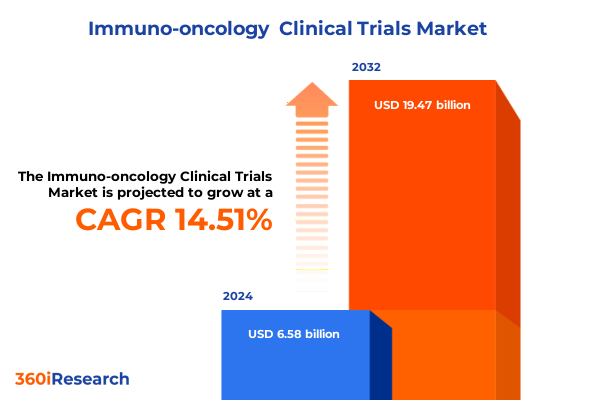

The Immuno-oncology Clinical Trials Market size was estimated at USD 7.40 billion in 2025 and expected to reach USD 8.32 billion in 2026, at a CAGR of 14.81% to reach USD 19.47 billion by 2032.

Unveiling the transformational era of immuno-oncology clinical trials as science converges with patient-centric innovation to redefine cancer treatment paradigms

The field of immuno-oncology has undergone a remarkable metamorphosis over the past decade, moving from proof-of-concept endeavors to established clinical paradigms that harness the body’s own defenses to combat cancer. Breakthrough therapies that engage T cells, natural killer cells, and cytokine networks have challenged conventional treatment modalities, infusing new optimism into oncological research. This report initiates with a panoramic view of the immuno-oncology landscape, detailing how scientific breakthroughs, regulatory evolutions, and patient demands have converged to create an environment ripe for innovation.

Building on foundational immunological principles, current clinical trials extend far beyond monotherapies to explore synergistic combinations, personalized approaches, and next-generation modalities. Aided by advanced biomarker profiling, adaptive trial designs, and real-time data analytics, research teams are optimizing patient selection, minimizing adverse events, and accelerating developmental timelines. As a result, the trajectory of immuno-oncology trials has shifted toward more agile, patient-centric frameworks, paving the way for rapid-cycle learning and iterative refinement.

This introduction lays the groundwork for the sections that follow, offering a roadmap of pivotal shifts, financial dynamics, segmentation nuances, regional variations, competitive landscapes, and recommendations that together shape the future of immuno-oncology clinical investigations.

Identifying pivotal breakthroughs and emerging modalities that have reshaped the immuno-oncology arena through cross-disciplinary research driving innovation

As immuno-oncology has matured, several transformative shifts have fundamentally reshaped its clinical trial landscape. Checkpoint inhibitors emerged as the vanguard, illuminating the potential of PD-1, PD-L1, and CTLA-4 blockade to unleash endogenous antitumor responses. Rapid regulatory approvals and breathtaking efficacy in multiple solid tumors solidified their status, prompting exploration of combination regimens to deepen and broaden patient benefit.

Parallel to these advances, adoptive cell therapies have progressed from autologous CAR-T cell constructs in hematological malignancies to next-generation TCR-T and NK cell platforms in both blood and solid tumor settings. These modalities have underscored the importance of cellular engineering, potency assays, and scalable manufacturing, ushering in a new era of personalized medicine. Meanwhile, oncolytic viruses and cytokine therapies, including interferon alpha, interferon gamma, and interleukin-2 variants, are reemerging with optimized delivery systems to activate innate and adaptive immune components.

Driving these therapeutic innovations is a growing commitment to translational science, exemplified by the integration of genomic profiling, digital biomarkers, and artificial intelligence–driven patient stratification. Adaptive trial designs and seamless phase transitions are now commonplace, enabling real-time adjustments to dosing schedules, combination partners, and eligibility criteria. Collectively, these shifts have accelerated time to proof of concept and bolstered the competitiveness of immuno-oncology trials in an increasingly crowded space.

Analyzing the compounding effects of United States tariff policies in 2025 on immuno-oncology clinical research supply chains and collaborations

The introduction of new United States tariffs in early 2025 has introduced a new layer of complexity to immuno-oncology clinical research, with ripple effects spanning procurement, budgeting, and cross-border collaboration. Tariff adjustments on laboratory reagents, specialized equipment, and cell culture materials have elevated operational costs and imposed delays on essential supply chains. As sponsors work to secure consistent access to critical inputs, many are revisiting procurement strategies, exploring local sourcing options, and negotiating long-term contracts to mitigate price volatility.

Beyond tangible goods, the tariff environment has influenced collaborative research agreements and joint development initiatives. International partnerships, particularly those involving academic institutions and biotechnology companies, have encountered unexpected cost-sharing challenges. These financial pressures are compounding existing demands on grant funding and venture capital, shaping the evaluative criteria that crossover therapeutic candidates must meet to justify continued investment.

In response, stakeholders are adopting innovative approaches to preserve trial momentum. Virtual coordination hubs, digital inventory tracking, and pre-emptive inventory stocking have become integral to trial planning. Furthermore, some sponsors are leveraging regional supply hubs and strategic alliances with consortiums to distribute risk and maintain streamlined operations. Looking ahead, the tariff landscape will likely continue to influence trial budgets and collaboration frameworks, underscoring the need for adaptive strategies in a dynamic policy environment.

Uncovering how trial segmentations across therapy classes, phases, disease indications, sponsor types, trial formats, and enrollment scales drive innovation

Insight into clinical trial segmentation provides clarity on how research efforts align with biological mechanisms, regulatory milestones, therapeutic indications, stakeholder objectives, study designs, and patient volumes. Within the realm of therapy type, trials encompass adoptive cell therapies-encompassing CAR-T, NK cell therapy, and TCR-T constructs-alongside cancer vaccines, which range from dendritic cell vaccines to DNA and peptide formulations. Checkpoint inhibitor studies span CTLA-4, PD-1, and PD-L1 inhibitors, while cytokine therapy protocols investigate interferon alpha, interferon gamma, and interleukin-2 approaches. Oncolytic virus trials complement these pathways, reflecting a diverse therapeutic toolkit.

The distribution across trial phases underscores the full scope of clinical validation, with Phase I safety evaluations, Phase II efficacy assessments, Phase III registration trials, and Phase IV post-marketing surveillance studies each playing critical roles. Indication segmentation differentiates hematological malignancies-comprising leukemia, lymphoma, and myeloma-from solid tumors such as breast, colorectal, lung, and melanoma, highlighting distinct mechanistic and operational considerations for each disease area.

Sponsor type influences trial priorities and execution models, with academic institutions driving exploratory studies, biotechnology companies pursuing niche innovations, consortiums fostering multi-center collaboration, and pharmaceutical companies shepherding late-stage development. Trial type varies between interventional designs that test predefined regimens and observational studies that monitor outcomes in real-world practice. Finally, patient enrollment scales range from small exploratory cohorts to medium-scale validations and large-scale pivotal trials, reflecting the progression of candidate therapies from discovery to broad clinical adoption.

This comprehensive research report categorizes the Immuno-oncology Clinical Trials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapy Type

- Trial Phase

- Indication

- Trial Type

- Sponsor Type

- Patient Enrollment

Exploring regional distinctions in the Americas, EMEA, and Asia-Pacific that are shaping immuno-oncology trial strategies and patient engagement approaches

Regional dynamics exert a profound influence on immuno-oncology trial design, regulatory strategy, and patient recruitment. In the Americas, well-established regulatory frameworks, coupled with robust funding ecosystems, facilitate swift trial initiation and high patient diversity. Centers of excellence in North America are leading complex combination studies, while Latin American sites are increasingly contributing to multi-regional development plans, leveraging cost efficiencies and emerging patient populations.

Within Europe, Middle East, and Africa, the landscape is characterized by heterogeneous regulatory pathways, variable reimbursement environments, and evolving ethical oversight. European Union harmonization efforts have streamlined multinational trials, yet individual member states maintain country-specific requirements that demand meticulous planning. In the Middle East and Africa, growing investment in healthcare infrastructure and nascent clinical research capabilities are opening new avenues for patient enrollment, particularly in regions with high unmet need and limited therapeutic options.

The Asia-Pacific region stands out for its rapidly expanding clinical trial capacity, accelerating regulatory reforms, and competitive operational cost structures. Key markets in China, Japan, South Korea, and Australia offer advanced trial networks and specialized expertise in oncology research. Moreover, the region’s large patient pools, rising prevalence of specific tumor subtypes, and emerging philanthropic initiatives support both early-stage and late-stage development, positioning Asia-Pacific as a pivotal contributor to global immuno-oncology advancements.

This comprehensive research report examines key regions that drive the evolution of the Immuno-oncology Clinical Trials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining how pioneering biopharmaceutical leaders are driving immuno-oncology innovation with strategic alliances, portfolio expansions, and clinical trials

The immuno-oncology arena is advancing under the stewardship of leading biopharmaceutical organizations and innovative biotechnology firms. Classic checkpoint pioneers continue to refine their portfolios, while cell therapy specialists scale manufacturing capacity to meet growing demand. Strategic alliances-whether between global pharmaceutical giants and nimble biotech innovators or among cross-sector consortiums-are facilitating knowledge transfer, resource sharing, and the co-development of next-generation therapies.

Major pharmaceutical companies are augmenting their pipelines through targeted acquisitions and in-licensing agreements, expanding their reach into novel modalities such as bispecific antibodies, engineered cell therapies, and oncolytic vectors. Meanwhile, biotechnology companies are leveraging venture funding to propel first-in-class candidates through early clinical evaluation, often in collaboration with leading academic institutions. This confluence of capital, creativity, and clinical expertise is accelerating the translation of promising discoveries into tangible patient benefits.

Beyond individual programs, quality-of-life considerations, digital health integrations, and biomarker-driven patient selection are emerging as key differentiators in company strategies. Organizations that integrate real-world evidence platforms, decentralized trial elements, and advanced analytics are achieving greater operational efficiency and deeper insights into therapeutic performance. As a result, company competitiveness increasingly depends on agile cross-functional teams that can navigate regulatory complexities, optimize trial execution, and deliver meaningful outcomes for stakeholders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Immuno-oncology Clinical Trials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Charles River Laboratory

- Clinipace Company

- Eli Lilly and Company

- ICON PLC

- IQVIA

- Novo Nordisk A/S

- PAREXEL International Corporation

- Pfizer Inc.

- PRA Health Sciences

- SGS SA

- Syneos Health

- Wuxi AppTec Inc.

Charting pathways for industry leaders to optimize immuno-oncology trials through strategic collaborations, regulatory alignment, and patient-centric frameworks

To maintain a competitive edge and drive meaningful clinical outcomes, industry leaders must adopt an integrated approach that aligns therapeutics development with regulatory, operational, and patient-centric imperatives. Establishing cross-functional cells dedicated to trial design, regulatory strategy, and data science can accelerate decision-making and promote rapid iteration of protocols. These teams should engage with regulatory authorities early, utilizing accelerated approval pathways and adaptive design frameworks to streamline development timelines and mitigate risk.

In parallel, forging strategic collaborations-ranging from technology partnerships for manufacturing scale-up to joint development agreements that share financial burden-will optimize resource allocation and unlock access to novel platforms. Engaging patient advocacy groups and community stakeholders throughout trial planning ensures that study endpoints, logistics, and communication strategies resonate with patient needs, driving enrollment and retention. Embedding patient-reported outcomes and real-world evidence into trial architectures can also enrich data quality and support broader reimbursement discussions.

Operational agility is equally critical in the face of supply chain uncertainties and evolving geopolitical dynamics. Sponsors should diversify supplier networks, implement digital inventory tracking, and leverage regional distribution hubs to minimize delays. Finally, investing in digital and data science capabilities-such as AI-driven site selection, electronic data capture enhancements, and predictive analytics-will empower teams to anticipate challenges and continuously optimize trial performance. By embracing these actionable strategies, organizations can propel immuno-oncology research toward sustainable success and transformative patient impact.

Detailing the rigorous research methodology combining extensive data collection, expert interviews, systematic analysis to ensure robust immuno-oncology insights

The methodology underpinning this report combines rigorous data acquisition, expert validation, and systematic analysis to deliver reliable insights. Secondary research encompassed an extensive review of scientific literature, regulatory filings, clinical trial registries, and financial disclosures, ensuring a comprehensive understanding of market dynamics and therapeutic trends. Publicly available databases were supplemented by proprietary repositories to capture nuanced information on trial design, patient populations, and geographic distribution.

Primary research included in-depth interviews with leading oncology investigators, regulatory specialists, biopharmaceutical executives, and patient advocates. These discussions provided firsthand perspectives on emerging challenges, operational best practices, and strategic priorities. Insights gleaned from one-on-one conversations were triangulated with secondary data to validate hypotheses and refine segmentation frameworks.

Quantitative and qualitative data were synthesized through a multi-step validation process, applying statistical checks, outlier analysis, and cross-source comparisons. Segment definitions were developed collaboratively with domain experts to ensure clarity and applicability. The final report underwent multiple rounds of quality review, guaranteeing methodological consistency, factual accuracy, and alignment with industry best practices. This structured approach provides stakeholders with a robust foundation for informed decision-making in the evolving immuno-oncology landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Immuno-oncology Clinical Trials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Immuno-oncology Clinical Trials Market, by Therapy Type

- Immuno-oncology Clinical Trials Market, by Trial Phase

- Immuno-oncology Clinical Trials Market, by Indication

- Immuno-oncology Clinical Trials Market, by Trial Type

- Immuno-oncology Clinical Trials Market, by Sponsor Type

- Immuno-oncology Clinical Trials Market, by Patient Enrollment

- Immuno-oncology Clinical Trials Market, by Region

- Immuno-oncology Clinical Trials Market, by Group

- Immuno-oncology Clinical Trials Market, by Country

- United States Immuno-oncology Clinical Trials Market

- China Immuno-oncology Clinical Trials Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Drawing strategic conclusions on the evolving immuno-oncology trial landscape to inform decision-making and guide future research priorities

The evolving immuno-oncology clinical trial environment reflects a confluence of scientific innovation, operational ingenuity, and stakeholder collaboration. Breakthroughs in cellular engineering, checkpoint inhibition, and biomarker stratification have unlocked new therapeutic possibilities, while adaptive trial frameworks and digital enhancements accelerate progress. At the same time, geopolitical forces and tariff policies underscore the need for flexible sourcing and strategic alliances.

Segmentation analysis reveals how therapy types, trial phases, indications, sponsor models, study designs, and patient enrollment scales collectively shape clinical investigation. Regional insights demonstrate that trial success hinges on understanding local regulatory requirements, patient demographics, and infrastructure capabilities. Company strategies emphasize the importance of partnerships, pipeline diversification, and advanced analytics to sustain momentum in a competitive landscape.

By synthesizing these findings, decision-makers are equipped to navigate the complexities of immuno-oncology research. The culmination of rigorous methodology and actionable insights supports strategic planning and operational excellence. As the field continues to advance, stakeholders who embrace collaborative innovation, patient-centric design, and agile execution will be best positioned to deliver transformative outcomes for patients worldwide.

Engage with Ketan Rohom to access the definitive immuno-oncology clinical trials report and empower your strategic planning and market insights

The complexities of immuno-oncology clinical research demand access to the most authoritative and comprehensive insights available. Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the full immuno-oncology clinical trials market research report. His expertise will guide you through advanced report features and customization options, ensuring you acquire the precise data and analysis your organization needs. Take the next step toward informed decision-making and strategic advantage by connecting with Ketan Rohom today.

- How big is the Immuno-oncology Clinical Trials Market?

- What is the Immuno-oncology Clinical Trials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?