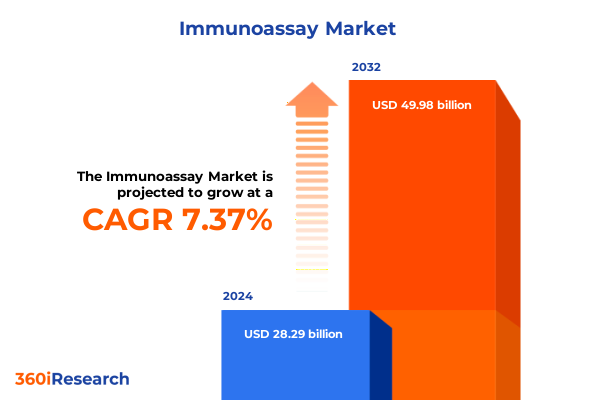

The Immunoassay Market size was estimated at USD 30.38 billion in 2025 and expected to reach USD 32.61 billion in 2026, at a CAGR of 7.36% to reach USD 49.98 billion by 2032.

Pioneering the Future of Diagnostic Science by Unraveling the Core Principles and Significance of Immunoassays in Modern Healthcare

Immunoassays lie at the heart of modern diagnostic science, leveraging the exquisite specificity of antigen-antibody interactions to detect and quantify a vast array of biomarkers. Through the selective binding of targeted molecules and subsequent signal generation, these assays have enabled clinicians and researchers to identify diseases at their earliest stages, monitor therapeutic interventions, and ensure the safety of biological products. As a foundational tool across clinical chemistry, point-of-care platforms, and research laboratories, immunoassays continue to drive precision medicine and public health initiatives worldwide.

Over the past decade, the integration of advanced detection chemistries and miniaturized platforms has elevated immunoassay performance by enhancing sensitivity, reducing sample volumes, and accelerating turnaround times. These capabilities have expanded the role of immunoassays beyond central laboratories into decentralized settings, empowering rapid decision-making in emergency departments, outpatient clinics, and field diagnostics. Consequently, healthcare providers and researchers alike now depend on immunoassays for everything from allergy panels and cardiac markers to environmental toxin screening and infectious disease surveillance.

Moreover, the versatility of immunoassay formats accommodates both qualitative assessments and quantitative measurements, supporting robust clinical workflows and high-throughput screening applications. By uniting traditional enzyme-linked immunosorbent assay principles with cutting-edge detection modes-such as chemiluminescence, fluorescence, and lateral flow technologies-immunoassays have demonstrated unparalleled adaptability to evolving healthcare needs. This executive summary lays out the critical shifts in the immunoassay landscape, examines trade policy impacts, and distills actionable insights across segmentation, regions, and leading players.

Examining Pivotal Technological Innovations and Strategic Alliances That Have Redefined the Global Immunoassay Ecosystem in Recent Years

In recent years, the immunoassay landscape has undergone transformative shifts driven by technological convergence and strategic collaborations. Artificial intelligence and machine learning algorithms now optimize assay design, predict reagent performance, and streamline result interpretation, reducing human error and expediting validation cycles. Simultaneously, partnerships between diagnostic firms and software developers have given rise to integrated platforms capable of end-to-end data management, from instrument control to cloud-based analytics.

The proliferation of point-of-care immunoassays marks another pivotal change, as novel lateral flow devices and microfluidic chips deliver rapid diagnostic results at the patient’s bedside. Innovations in biosensor technologies and microplate automation have redefined throughput expectations, enabling drug screening assays and clinical trials to achieve unprecedented scale. Strategic alliances with contract research organizations and hospitals have also facilitated accelerated assay calibration and regulatory approval, fostering a collaborative ecosystem that bridges early-phase research with commercial deployment.

Furthermore, the adoption of multiplexed immunoassays continues to expand, allowing simultaneous detection of multiple biomarkers within a single sample. This trend addresses the rising demand for comprehensive diagnostic panels in oncology, cardiology, and autoimmune disease monitoring. Collectively, these shifts underscore a new era in the immunoassay market-one where agility, digital integration, and cross-industry collaboration dictate competitive advantage.

Assessing the Far-Reaching Effects of Newly Imposed United States Tariffs on Immunoassay Components and Their Downstream Market Dynamics

The implementation of new United States tariffs in 2025 targeting imported immunoassay reagents and instruments has imposed significant cost pressures across the supply chain. Manufacturers reliant on international suppliers have observed increased landed costs for enzymes, substrates, and specialized antibodies. As a result, development timelines have been recalibrated, with product roadmaps adjusted to account for extended lead times and higher procurement budgets.

Throughout this period, many companies responded by diversifying their sourcing strategies and negotiating volume-based agreements with domestic producers. In addition, research institutions and diagnostic laboratories have evaluated alternative detection modes and modular platform upgrades to mitigate disruptions. Some reagent manufacturers have accelerated local production of critical components-such as blocking reagents, buffers, and standards-to stabilize inventories and insulate against price fluctuations. Consequently, the tariff-induced reshuffling of supply networks has catalyzed a wave of nearshoring initiatives within the immunoassay community.

Despite initial headwinds, the industry has found avenues for resilience by fostering collaborative bulk-purchasing consortia and leveraging software-based reagent tracking systems. These measures have optimized inventory management and reduced waste associated with perishable bioproducts. Looking forward, stakeholders anticipate that ongoing tariff negotiations and bilateral trade agreements may reshape cost structures again, underscoring the importance of agile sourcing frameworks and continuous monitoring of trade policies.

Illuminating Critical Market Segmentation Dimensions That Reveal Unique Opportunities Across Immunoassay Types, Technologies, Instruments, and Applications

Analyzing the immunoassay market through the lens of type segmentation reveals that qualitative immunoassays continue to serve as vital tools for rapid diagnostics and initial screening, while quantitative immunoassays underpin precise biomarker measurement in clinical trials and patient monitoring applications. Technological segmentation underscores the dominance of enzyme immunoassays and enzyme-linked immunosorbent assays in high-volume laboratories, with fluorescent immunoassays and lateral flow assays gaining momentum in point-of-care contexts due to their speed and simplicity.

Instrument-based segmentation illuminates a diversified landscape where analyzers and kits form the backbone of established workflows, biosensors drive innovation in real-time monitoring, and microfluidic devices challenge conventional throughput paradigms. Within this realm, reagents bifurcate into antibodies, antigens, and specialized reagents such as blocking solutions and enzyme substrates, each playing a distinct role in assay performance. The inclusion of software and services further complements hardware investments by offering digital assay design, remote support, and data analytics.

Sample type segmentation underscores the versatility of immunoassays in handling blood, saliva, tissue, and urine matrices, each presenting unique challenges and opportunities for assay developers. Detection mode insights highlight how chemiluminescent systems deliver high sensitivity, colorimetric approaches balance cost and accessibility, and radioisotopic assays-though more specialized-remain critical for certain research applications. Application area segmentation demonstrates the broad reach of immunoassays across allergy testing, autoimmune disease panels, and oncology profiling, with niche segments like drug screening under toxicology fueling targeted innovation.

Finally, end-user and deployment type segmentation reflect the varied demands of contract research organizations, diagnostic laboratories, hospitals, and life science companies. Laboratory-based tests maintain their stronghold in central facilities, while point-of-care tests extend diagnostic capabilities to decentralized environments. These segmentation insights reveal a multifaceted market where product strategies must align with diverse user needs and evolving workflow models.

This comprehensive research report categorizes the Immunoassay market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Instruments

- Sample Types

- Detection Modes

- Application Areas

- End Users

- Deployment Types

Deciphering Regional Market Variations and Uncovering Strategic Imperatives Across the Americas, Europe, Middle East & Africa, and Asia-Pacific

Regional analysis of the immunoassay sector reveals distinct market dynamics within the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, a robust healthcare infrastructure and high adoption of advanced diagnostic platforms drive continuous demand for both qualitative and quantitative assays. The United States remains a hub for assay innovation, bolstered by substantial research funding and strategic collaborations between academia and industry.

In Europe, Middle East & Africa, regulatory harmonization and cross-border partnerships have facilitated broader access to novel immunoassays, especially in oncology and infectious disease diagnostics. Local manufacturers in EMEA continue to strengthen their footprint through targeted product portfolios designed for regional healthcare needs and reimbursement landscapes. Meanwhile, emerging markets within the region are rapidly scaling up point-of-care testing capacities to address public health priorities.

The Asia-Pacific region stands out for its accelerating investments in biotechnology and increasing manufacturing capabilities. Countries such as China, Japan, and South Korea lead in reagent production and assay automation technology. Growing healthcare expenditures and rising prevalence of chronic diseases are catalyzing expansion of immunoassay workflows into community hospitals and rural clinics. Additionally, government initiatives supporting domestic R&D have positioned Asia-Pacific as a focal point for next-generation immunoassay innovation.

Despite geographic variations, a common theme emerges: stakeholders across all regions are prioritizing digital integration, supply chain resilience, and regulatory agility to navigate evolving market conditions. Understanding these regional nuances is essential for companies seeking to tailor their strategies and capture growth opportunities in the global immunoassay market.

This comprehensive research report examines key regions that drive the evolution of the Immunoassay market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Emerging Challengers Shaping Competitive Dynamics and Technological Leadership in the Immunoassay Industry

The competitive landscape of immunoassays is characterized by established players that leverage expansive portfolios and global distribution networks alongside emerging challengers focused on niche innovations. Global diagnostics leaders have consolidated their positions through sustained investments in R&D, strategic acquisitions of biosensor and microfluidics ventures, and partnerships with digital health firms. These initiatives have enabled incumbents to expand their assay menus and enrich value-added services such as remote diagnostic support and cloud-based data analytics.

Emerging biotechnology companies and specialized reagent suppliers are carving out new growth pathways by offering proprietary antibody technologies, novel detection chemistries, and customizable kit formats. Their nimble structures allow for rapid iteration and close collaboration with end users to address specific assay performance gaps. Additionally, several contract research organizations are vertically integrating immunoassay capabilities to enhance service offerings and reduce customer turnaround times.

Mid-tier players and regional manufacturers are also strengthening their competitive positioning by tailoring assay platforms for localized needs, such as tropical disease testing in Asia-Pacific or cost-effective automated immunoassay systems for emerging economies in EMEA. Meanwhile, software developers and digital platforms continue to disrupt traditional workflows by embedding artificial intelligence into assay design, interpretive algorithms, and predictive maintenance for instruments.

Collectively, these dynamics reveal a market in which leadership is determined not only by technological prowess and catalog breadth but also by the ability to deliver end-to-end solutions that integrate hardware, reagents, and data analytics. Companies that excel in forging cross-functional partnerships and aligning product strategies with evolving user workflows are poised to capture the largest share of emerging opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Immunoassay market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies Inc.

- Almac Group Limited

- ANP Technologies, Inc.

- Autobio Diagnostics Co., Ltd.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- BioLegend, Inc.

- bioMérieux S.A.

- Biosurfit SA

- Boditech Med Inc.

- Charles River Laboratories International, Inc.

- Danaher Corporation

- Diasorin S.p.A.

- Dynex Technologies, Inc.

- Epitope Diagnostics Inc.

- F. Hoffmann-La Roche Ltd.

- Fapon Biotech Inc.

- Gyros Protein Technologies AB by Mesa Laboratories, Inc.

- H.U. Group Holdings Inc.

- J. Mitra & Co. Pvt. Ltd.

- Kamiya Biomedical Company

- Koninklijke Philips N.V.

- Merck KGaA

- MiCo BioMed, Inc.

- NanoEntek

- Nanōmix, Inc.

- OPKO Health, Inc.

- Promega Corporation

- QIAGEN N.V.

- Quanterix Corporation

- QuidelOrtho Corporation

- Randox Laboratories Ltd.

- Revvity, Inc. (Formarly PerkinElmer, Inc.)

- Sekisui Diagnostics, LLC

- Shenzhen Micropoint Biotechnologies Co., Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Siemens Healthineers AG

- Sysmex Corporation

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

- Tosoh Corporation

- WAK-Chemie Medical GmbH

- Zoetis Inc.

- Zybio Inc.

Crafting Strategic Roadmaps and Actionable Initiatives to Propel Market Growth and Foster Sustainable Innovation in Immunoassay Development

To thrive in the rapidly evolving immunoassay market, industry leaders should prioritize the development of integrated platforms that combine high-performance detection capabilities with intuitive data management tools. Investing in modular systems that can accommodate diverse detection modes-from fluorometric to chemiluminescent-will enable flexible deployment across laboratory and point-of-care environments.

In addition, fostering strategic alliances with domestic reagent manufacturers and software developers can mitigate supply chain risks and accelerate time to market. Collaborative research initiatives and co-development agreements should focus on multiplexed assay formats and miniaturized device architectures to address growing demands for rapid, multiplexed testing in diverse healthcare settings.

Furthermore, aligning product roadmaps with emerging application areas-such as oncology biomarker panels, endocrine disorder diagnostics, and environmental toxin screening-will foster market differentiation. Companies should also enhance customer support ecosystems by offering remote training, digital troubleshooting, and real-time reagent tracking to improve user experiences and drive workflow efficiency.

Finally, adopting a proactive stance toward regulatory changes and trade policy developments will be critical. Establishing dedicated teams to monitor tariff negotiations, compliance requirements, and regional reimbursement landscapes will ensure agility in pricing strategies and market entry decisions. By executing these strategic imperatives, immunoassay companies can unlock sustainable growth and maintain technological leadership.

Detailing Rigorous Research Frameworks and Analytical Techniques Employed to Deliver Unparalleled Precision and Depth in Immunoassay Market Insights

Our research methodology integrates a rigorous blend of primary and secondary data sources to ensure unparalleled depth and accuracy in immunoassay market insights. Primary research comprises structured interviews with senior executives, laboratory directors, and procurement specialists from leading healthcare institutions, diagnostic laboratories, and pharmaceutical organizations. These interviews provide qualitative perspectives on workflow challenges, assay performance expectations, and purchasing criteria.

Secondary research encompasses an exhaustive review of scientific literature, patent filings, regulatory submissions, and public company disclosures. Technical papers and clinical trial reports offer granular details on assay sensitivity, specificity, and platform interoperability, while trade publications and white papers illuminate emerging application areas and competitive strategies.

Data triangulation techniques are employed to reconcile information from diverse sources, ensuring consistency and reliability in our analytical framework. Quantitative survey data validate qualitative findings, and cross-referencing with industry association statistics and government regulatory databases adds further rigor. Advanced analytical tools, including market trend modeling and scenario planning, enhance our ability to interpret multifaceted dynamics and stress-test strategic hypotheses.

This comprehensive methodology underpins the credibility of our insights, empowering stakeholders with actionable intelligence to navigate technological shifts, regulatory landscapes, and competitive challenges in the immunoassay market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Immunoassay market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Immunoassay Market, by Type

- Immunoassay Market, by Technology

- Immunoassay Market, by Instruments

- Immunoassay Market, by Sample Types

- Immunoassay Market, by Detection Modes

- Immunoassay Market, by Application Areas

- Immunoassay Market, by End Users

- Immunoassay Market, by Deployment Types

- Immunoassay Market, by Region

- Immunoassay Market, by Group

- Immunoassay Market, by Country

- United States Immunoassay Market

- China Immunoassay Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1749 ]

Synthesizing Critical Findings and Forward-Looking Perspectives to Guide Decision-Making and Strategic Planning in the Evolving Immunoassay Landscape

In synthesizing the findings of this executive summary, it is evident that technological innovation, strategic collaboration, and regulatory adaptation serve as the cornerstones of competitive advantage in the immunoassay market. The interplay of advanced detection modes, digital integration, and nearshoring initiatives has reshaped supply chains and product offerings alike. Meanwhile, segmentation analysis highlights opportunities across assay types, instrument platforms, and niche applications, underscoring the importance of tailored product strategies.

Regional variations in market maturity and healthcare infrastructure further emphasize the need for localized approaches, whereas the competitive landscape demands a balance between portfolio breadth and specialized niche capabilities. Industry leaders that effectively blend hardware, reagents, and data analytics, while maintaining agility in response to trade policies and regulatory shifts, will secure long-term growth and market share.

Ultimately, the evolving immunoassay ecosystem rewards those who embrace cross-sector partnerships, invest in scalable technologies, and anticipate end-user needs across laboratory and point-of-care settings. By applying the insights and recommendations outlined herein, decision-makers can forge resilient business models and drive meaningful advancements in diagnostics and life sciences research.

As the immunoassay market continues to evolve, maintaining a forward-looking perspective and fostering continuous innovation will be essential for sustained success and industry leadership.

Accelerate Market Success with Personalized Immunoassay Insights and Exclusive Research Access Offered by Ketan Rohom, Associate Director of Sales & Marketing

To access tailored insights and stay ahead of the competition, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He will guide you through the full breadth of the immunoassay market research report, ensuring you receive the precise data and analysis required to inform your strategic roadmap. Engaging directly with an expert allows you to clarify specific queries, explore customized licensing options, and expedite your path to actionable market intelligence.

Don’t miss the opportunity to leverage in-depth analysis on emerging technologies, regulatory shifts, and competitive dynamics. Contact Ketan to schedule a personalized briefing and unlock exclusive access to proprietary market insights that can drive your innovation pipeline, investment decisions, and go-to-market strategies.

- How big is the Immunoassay Market?

- What is the Immunoassay Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?