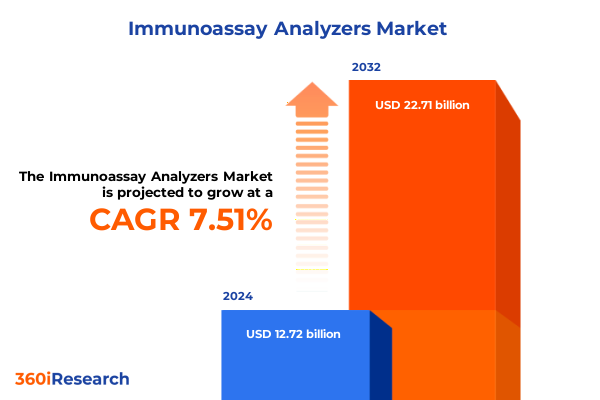

The Immunoassay Analyzers Market size was estimated at USD 13.69 billion in 2025 and expected to reach USD 14.73 billion in 2026, at a CAGR of 7.49% to reach USD 22.71 billion by 2032.

Unlocking the Critical Role of Immunoassay Analyzers as Cornerstones of Modern Clinical Diagnostics, Patient Precision, and Healthcare Efficiency

In an era where precision medicine and rapid diagnostics define clinical success, immunoassay analyzers have emerged as foundational instruments across hospital, laboratory, and point-of-care settings. These platforms leverage antigen–antibody binding reactions to detect and quantify biomarkers associated with a range of conditions, from infections to autoimmune disorders. The high sensitivity and specificity inherent in enzyme-linked immunosorbent assays, chemiluminescence tests, fluorescence-based methods, and radioimmunoassays enable clinicians to make timely, evidence-based decisions. Their automated workflows reduce operator variability, while robust reagent formulations ensure consistent performance, establishing immunoassay analyzers as cornerstones of modern diagnostic pathways.

Rapid Automation, AI Integration, and Digital Connectivity Are Redefining the Future of Immunoassay Analyzers in Diagnostic Laboratories Worldwide

Technological innovation has accelerated the evolution of immunoassay analyzers into sophisticated ecosystems that extend far beyond standalone instrumentation. Automation and high-throughput capabilities have redefined laboratory efficiency, allowing facilities to process hundreds of samples in parallel with minimal manual intervention. This shift not only elevates productivity but also enhances data integrity by reducing transcription errors and sample mishandling. Furthermore, integration with laboratory information systems (LIS) and electronic health records has created a seamless data flow, empowering multidisciplinary teams to access real-time results and integrate them into patient management platforms.

Concurrently, artificial intelligence and digital analytics have begun to permeate immunoassay workflows. Predictive algorithms assess quality control trends, flag anomalies, and optimize reagent usage, leading to more sustainable operations. Multiplexing technologies allow multiple analytes to be detected within a single sample run, thereby broadening clinical panels and conserving precious patient specimens. As a result, laboratories gain flexibility to tailor test menus for autoimmune and oncology panels while maintaining rapid turnaround times. Consequently, these transformative shifts are reshaping how immunoassay analyzers deliver precision, scalability, and actionable insights in contemporary diagnostics.

Assessing the Financial, Operational, and Strategic Impact of 2025 United States Tariffs on Immunoassay Analyzer Supply Chains and Costs

Recent trade policy changes have introduced a new dimension of complexity into the immunoassay analyzer market, particularly for imports of specialized instrumentation and consumables. The United States Trade Representative’s decision to reinstate Section 301 tariffs on certain Class I and II medical devices, a category encompassing immunoassay analyzers and key reagents, has imposed additional duties on products sourced from China. This policy measure aims to bolster domestic manufacturing but has simultaneously increased landed costs for end users, creating budgetary pressures in both public and private healthcare systems.

Tariffs on semiconductors, permanent magnets, and certain electronic components have risen to as high as 50%, intensifying the cost of goods sold for analyzer manufacturers. In most cases, these additional fees are passed downstream, translating into higher capital expenditure requirements for laboratory directors and procurement teams. Amid these headwinds, replacement of legacy immunoassay platforms becomes a more protracted decision, potentially delaying access to the latest automation and sensitivity improvements. Supply chain disruptions have compounded the effect, as companies scramble to identify alternative suppliers, manage regulatory approvals for new vendors, and absorb lead-time variability.

To mitigate these challenges, major original equipment manufacturers have accelerated investments in domestic production sites. Boston Scientific has expanded its U.S. footprint with a new facility in Georgia, while Abbott Laboratories has increased manufacturing and R&D capacity in Illinois and Texas to support its immunoassay portfolio. Siemens Healthineers committed over $150 million to upgrade American production operations, and Roche Diagnostics unveiled a $550 million expansion in Indianapolis. Although these efforts enhance local resilience, they require significant capital and time, underscoring the need for strategic planning and adaptive procurement practices in the coming years.

In-Depth Market Segmentation Insights Reveal How Technology, Product Types, Applications, Throughput, Samples, and End-Users Shape the Immunoassay Analyzer Ecosystem

The immunoassay analyzer market can be understood through a multifaceted segmentation framework that illuminates the interplay between technology, product form factor, clinical application, user environment, throughput demands, and sample diversity. From a technology standpoint, platforms range from label-free enzyme-linked immunosorbent assays to advanced chemiluminescence, fluorescence, and radioimmunoassay systems, each offering distinct trade-offs in terms of sensitivity, turnaround time, and reagent complexity. These technological variants drive the development of benchtop instruments-available in compact single-module and multiplex configurations-as well as floorstanding and tabletop implementations within fully automated workflows, complemented by semi-automated solutions that optimize cost-effectiveness.

Application depth further differentiates the market. Immunoassay analyzers support autoimmune diagnostics, cardiology markers, hormone panels, infectious disease detection, oncology biomarkers, and thyroid function assays, among others. This breadth of clinical utility necessitates versatile assay menus and adaptable hardware. End users span diagnostic laboratories-encompassing clinical, reference, and specialty labs-institutional settings such as ambulatory care centers, private and public hospitals, pharmacies, physician offices, and research institutes, including academic, government, and private centers. Each environment imposes unique operational requirements that inform system design.

Additionally, throughput classification separates high, medium, and low capacity platforms, aligning instrument selection with sample volume and urgency. Complementing this is sample compatibility: modern immunoassay analyzers must handle plasma, serum, whole blood, urine, and saliva in varying workflows. Collectively, these segmentation dimensions reveal how distinct user needs and clinical demands shape the competitive landscape and guide product innovation in immunoassay diagnostics.

This comprehensive research report categorizes the Immunoassay Analyzers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Product Type

- Throughput

- Sample Type

- Application

- End User

Regional Market Dynamics Uncovered: How the Americas, EMEA, and Asia-Pacific Regions Drive Unique Opportunities and Challenges for Immunoassay Analyzers

In the Americas, a robust regulatory framework and advanced reimbursement structures underpin high adoption rates of immunoassay analyzers. Over 11,000 U.S. laboratories, nearly half of which are part of integrated delivery networks, leverage fully automated platforms to support high patient volumes and diverse test menus. Recent FDA 510(k) clearances, such as the DxC 500i integrated clinical chemistry and immunoassay analyzer, underscore ongoing innovation and networked laboratory strategies that enhance operational efficiency and scalability.

Europe, the Middle East, and Africa present a heterogeneous landscape shaped by the implementation of the In Vitro Diagnostic Regulation (IVDR). Since May 2022, new IVD products have faced stricter clinical and analytical performance requirements, with existing assays expected to comply by 2025–2027. This regulatory overhaul has prompted manufacturers and laboratories to strengthen technical documentation, pursue notified body certifications, and standardize post-market surveillance, raising the bar for quality and safety across member states. Meanwhile, public healthcare systems in the Gulf Cooperation Council and North Africa are increasingly investing in diagnostic infrastructure to support preventive health initiatives.

Across the Asia-Pacific region, demographic shifts and policy reforms are fueling rapid growth. Japan’s share of the population aged 65 and above reached 29.8% in 2021, driving demand for chronic disease monitoring and immunoassay testing in clinical and home care settings. Concurrently, rising incidences of diabetes and infectious diseases in China and India, combined with government initiatives to expand domestic manufacturing, have broadened market access. National programs promoting point-of-care testing and local production incentives are enabling a new generation of compact, cost-effective immunoassay platforms to enter emerging markets, further diversifying regional dynamics.

This comprehensive research report examines key regions that drive the evolution of the Immunoassay Analyzers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Portfolios and Transformative Investments by Top Companies Steering the Competitive Immunoassay Analyzer Industry Landscape

The competitive landscape of immunoassay analyzers is dominated by established industry leaders pursuing technology differentiation and geographic expansion. Roche Diagnostics, for example, has invested $550 million in an Indianapolis manufacturing site to enhance domestic production of continuous glucose monitors, demonstrating its commitment to capacity building and supply chain resilience. Abbott Laboratories has bolstered its presence in the transfusion and point-of-care segments through expanded facilities in Illinois and Texas, mitigating tariff impacts and accelerating product availability.

Siemens Healthineers allocated over $150 million to U.S. infrastructure upgrades, relocating Varian manufacturing to California and scaling automated immunoassay production to meet integrated network demands. Beckman Coulter Diagnostics secured FDA 510(k) clearance for the DxC 500i integrated analyzer, reinforcing its strategy to deliver scalable solutions suited to both core and satellite laboratories. Thermo Fisher Scientific has announced a $2 billion U.S. investment plan to enhance manufacturing capacity and innovation in specialty diagnostics, further cementing its leadership in analytical instruments and reagents.

Midsize players such as Ortho Clinical Diagnostics and Bio-Rad Laboratories are carving out niche positions through strategic alliances and product portfolio enhancements. Ortho’s collaboration with emerging immunoassay developers accelerates assay menu diversity, while Bio-Rad’s expanded multiplexing platforms cater to research and high-complexity laboratories seeking comprehensive biomarker profiling.

This comprehensive research report delivers an in-depth overview of the principal market players in the Immunoassay Analyzers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Arlington Scientific, Inc.

- Becton Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Biobase Biodusty(Shandong), Co., Ltd.

- bioMérieux SA

- Carolina Liquid Chemistries Corp.

- Chengdu Vacure Biotechnology Co., Ltd.

- Danaher Corporation

- DiaSorin S.p.A.

- F. Hoffmann-La Roche AG

- Getein Biotech, Inc.

- Hipro Biotechnology Co., Ltd.

- Hitachi, Ltd.

- Illumina, Inc.

- Medline Industries, LP

- Meril Life Sciences Pvt. Ltd.

- Mindray Medical International Limited

- Ortho Clinical Diagnostics, Inc.

- PerkinElmer, Inc.

- PHC Europe B.V.

- Qiagen N.V.

- Randox Laboratories

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Strategic Roadmap for Industry Leaders: Harnessing Innovation, Supply Chain Resilience, and Market Expansion in the Immunoassay Analyzer Sector

As the immunoassay analyzer sector navigates evolving regulatory, economic, and technological pressures, industry leaders must adopt a proactive, multidimensional strategy. First, investing in modular automation and lab-connected analytics will ensure laboratories can scale operations while maintaining data integrity and cost efficiency. By prioritizing flexible platforms that accommodate both high-throughput and point-of-care scenarios, companies can capture diverse revenue streams across clinical and decentralized settings.

Second, strengthening supply chain resilience is critical. Diversifying component sourcing, forging strategic alliances with domestic suppliers, and enhancing in-country production capacity will mitigate the risk of sudden tariff escalations or logistics disruptions. Concurrently, leveraging digital procurement and predictive inventory management can reduce lead times and optimize working capital.

Third, targeted market expansion in emerging economies should align with local reimbursement frameworks and regulatory requirements. Establishing regional partnerships, tailoring pricing models for high-volume but cost-sensitive markets, and securing early approvals under frameworks such as IVDR or NMPA will accelerate adoption while fostering long-term customer engagement. Lastly, continuous collaboration with clinical end users to co-develop assays for niche applications-such as multiplexed oncology panels or specialized autoimmune markers-will differentiate offerings and enhance clinical value propositions, driving sustained growth in a competitive environment.

Comprehensive Research Methodology Combining Secondary Intelligence, Expert Interviews, and Analytical Rigor to Deliver Actionable Immunoassay Analyzer Market Insights

This analysis was developed through a rigorous, multi-layered research methodology combining secondary and primary data collection with advanced analytical techniques. Secondary research involved comprehensive reviews of peer-reviewed literature, regulatory filings, company press releases, and industry news to capture recent developments, technology advances, and policy shifts. Publicly available regulatory databases, including FDA 510(k) clearances and European IVDR updates, were systematically examined to validate product pipelines and approval timelines.

Primary research entailed in-depth interviews with senior executives, product managers, laboratory directors, and procurement specialists across major healthcare networks and diagnostic laboratories. These discussions provided qualitative insights into market drivers, adoption barriers, and unmet clinical needs. Data triangulation was employed to reconcile information from multiple sources, ensuring consistency and reliability.

Quantitative validation used statistical techniques to analyze adoption rates, technology penetration, and regional demand indicators. Segmentation models were constructed to align technology types, product form factors, and application domains, facilitating targeted insights. Finally, peer validation workshops were conducted with subject-matter experts to refine assumptions and confirm strategic implications, yielding an authoritative perspective on the immunoassay analyzer landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Immunoassay Analyzers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Immunoassay Analyzers Market, by Technology

- Immunoassay Analyzers Market, by Product Type

- Immunoassay Analyzers Market, by Throughput

- Immunoassay Analyzers Market, by Sample Type

- Immunoassay Analyzers Market, by Application

- Immunoassay Analyzers Market, by End User

- Immunoassay Analyzers Market, by Region

- Immunoassay Analyzers Market, by Group

- Immunoassay Analyzers Market, by Country

- United States Immunoassay Analyzers Market

- China Immunoassay Analyzers Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Strategic Synthesis and Critical Takeaways Framing the Future Trajectory of Immunoassay Analyzers for Stakeholders and Decision-Makers

Through exploring technological transformations, tariff impacts, granular segmentation, regional dynamics, and competitive strategies, this analysis highlights the multifaceted forces shaping the immunoassay analyzer market. Stakeholders must balance the imperative for innovation with pragmatic supply chain management, regulatory compliance, and customer-centric assay development.

A clear takeaway is that automation, digital integration, and data analytics will serve as key differentiators, enabling laboratories to meet increasing test volumes without compromising quality. Equally, the ramifications of U.S. tariffs underscore the importance of diversified manufacturing footprints and agile procurement frameworks. Insights into market segmentation emphasize that one-size-fits-all solutions no longer suffice; tailored platforms for specific applications, throughput needs, and end-user environments are essential.

Looking ahead, proactive engagement with regulatory reforms-particularly IVDR in Europe and evolving approval pathways in Asia-Pacific-will unlock new opportunities. By aligning product road maps with patient-centric outcomes and fostering strategic partnerships across geographies, industry leaders can secure competitive advantage and deliver superior diagnostic value for healthcare systems worldwide.

Take the Next Step in Diagnostics Intelligence by Engaging Ketan Rohom for Your In-Depth Immunoassay Analyzer Market Report Purchase

For further engagement with this comprehensive analysis, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure access to the full suite of market intelligence, detailed data sets, and customized insights that will empower your strategic planning and drive measurable results. Ketan brings deep expertise in diagnostic market dynamics and can tailor the report’s delivery to your organization’s requirements, ensuring you extract maximum value from every section. Don’t miss the opportunity to transform your decision-making with this authoritative resource-contact Ketan today to obtain your copy and embark on a data-driven path to competitive advantage.

- How big is the Immunoassay Analyzers Market?

- What is the Immunoassay Analyzers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?