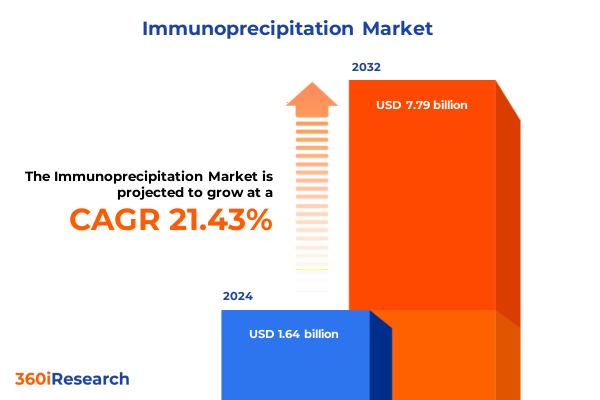

The Immunoprecipitation Market size was estimated at USD 2.00 billion in 2025 and expected to reach USD 2.38 billion in 2026, at a CAGR of 21.40% to reach USD 7.79 billion by 2032.

Unlocking the Power of Immunoprecipitation Techniques to Drive Breakthroughs in Protein Interaction Analysis and Molecular Research

Immunoprecipitation is a cornerstone technique in protein biology that enables the selective isolation of target antigens or protein complexes from complex biological mixtures. During this process, a specific antibody is immobilized on a solid support, such as magnetic beads or agarose resin, and incubated with a cell or tissue lysate. As the antibody binds its antigen, the resulting immune complex can be separated from the supernatant, washed to remove nonspecific interactors, and eluted for downstream analysis by methods such as western blotting or mass spectrometry. This affinity-based approach not only provides high specificity but also preserves protein-protein interactions, making it indispensable for probing cellular signaling pathways and identifying novel binding partners.

Over the decades, immunoprecipitation has evolved from manual column-based protocols to versatile formats including co-immunoprecipitation, chromatin immunoprecipitation, and RNA immunoprecipitation. These adaptations extend its utility beyond single protein isolation to mapping transcription factor binding sites and uncovering ribonucleoprotein assemblies in their native context. By capturing dynamic interactions, researchers can dissect post-translational modifications, epigenetic markers, and transient complexes that drive cellular processes. As research questions become more complex, the ability of immunoprecipitation to deliver clean, reliable data continues to cement its role as a foundational tool in molecular biology and drug discovery.

Transformative Technological Shifts Propel Immunoprecipitation from Manual Protocols to High-Throughput, Integrative, and Single-Cell Applications

The immunoprecipitation landscape is undergoing a profound transformation driven by technological innovations and methodological refinements. One of the most significant shifts has been the adoption of automation and high-throughput platforms, which enable laboratories to process large sample sets with minimal hands-on time and greater reproducibility. Magnetic bead processors, for example, streamline wash and separation steps in microplate formats, reducing variability and accelerating project timelines. This transition from manual agarose-based protocols to automated systems has democratized complex assays, allowing smaller research teams to access advanced workflows without extensive training.

Meanwhile, the intersection of immunoprecipitation with multi-omics approaches has fostered integrative analyses that offer holistic insights into cellular regulation. Chromatin immunoprecipitation coupled with next-generation sequencing (ChIP-seq) now routinely charts genome-wide protein-DNA interactions, elucidating transcriptional networks with unprecedented resolution. Similarly, proximity-dependent labeling strategies such as BioID and TurboID have expanded the scope of affinity purification by tagging neighboring proteins in living cells. These methods capture transient and low-abundance interactors that traditional pull-down assays may miss, shedding light on dynamic signaling events and subcellular microenvironments.

An emerging frontier in the field is single-cell immunoprecipitation, which seeks to resolve protein complexes and post-translational modifications at the level of individual cells. By integrating microfluidic platforms and sensitive detection chemistries, researchers can now benefit from spatially resolved protein interaction maps that reveal cellular heterogeneity in development, disease, and therapeutic response. As these methodological shifts converge, immunoprecipitation is poised to deliver richer biological insights while aligning with the demands of precision medicine and high-content screening.

Cumulative Impact of Newly Imposed United States Tariffs on Imported Immunoprecipitation Reagents and Consumables in 2025

In April 2025, the United States implemented a universal 10% tariff on most imported laboratory goods, followed by country-specific increases that have reshaped procurement strategies for immunoprecipitation reagents and consumables. Notably, imports from China now face a cumulative duty of 145%, while materials sourced from Canada and Mexico are exempt under USMCA for many goods but subject to a 25% rate on non-compliant items. These measures have elevated landed costs for antibodies, magnetic beads, agarose matrices, and related buffers, exerting budgetary pressures on academic institutions, contract research organizations, and biotechnology companies alike.

To mitigate these headwinds, industry stakeholders have pursued localization efforts for critical components, shifting portions of reagent manufacturing to domestic facilities. While this strategy curtails tariff exposure and shortens lead times, it also entails capital investments in infrastructure and compliance. Simultaneously, procurement teams are embracing miniaturized assay formats and reuse protocols, such as bead recycling and buffer optimization, to stretch reagent inventories without sacrificing data integrity. These cumulative adaptations underscore a broader drive toward cost-efficient workflows that preserve the high specificity and sensitivity required in immunoprecipitation experiments.

Key Segmentation Insights Highlight How Antibody Types, Bead Formats, End Users, and Applications Drive Diverse Immunoprecipitation Needs

Detailed segmentation of the immunoprecipitation market underscores the nuanced needs of research end users and informs product development strategies. Antibody classifications anchor the first dimension, distinguishing between monoclonal and polyclonal reagents. Monoclonal antibodies, prized for their uniform specificity, are subdivided into mouse- and rabbit-derived formats, enabling precise targeting across diverse protein targets. In contrast, polyclonal antibodies, sourced from goat and rabbit hosts, offer broader epitope recognition that can enhance capture efficiency for certain antigens. Balancing these attributes is critical when optimizing protocols for affinity and yield within complex lysates.

The choice of solid support further differentiates product offerings. Agarose beads provide a cost-effective matrix for small-scale immunoprecipitation but often require centrifugation and longer incubation periods. Magnetic bead systems, on the other hand, streamline separation steps and support automated, high-throughput formats. Paramagnetic beads deliver robust recovery under gentle conditions, while superparamagnetic variants facilitate rapid processing in microplate workflows, catering to laboratories that prioritize speed and reproducibility.

From an end-user perspective, academic and research institutes drive foundational discovery, leveraging immunoprecipitation for mechanistic studies and biomarker identification. Contract research organizations focus on scalable, service-oriented workflows that demand standardized kits and reagents. Pharmaceutical and biotechnology companies, meanwhile, integrate immunoprecipitation into drug discovery pipelines, where assay robustness and regulatory compliance are paramount.

Finally, application areas shape reagent specifications and protocol complexity. Epigenetic studies rely on chromatin immunoprecipitation to map histone modifications, while post-translational modification analyses demand specialized antibodies and buffers optimized for phosphorylation or acetylation detection. Protein analysis applications, including co-immunoprecipitation, probe interaction networks and complex assembly, requiring high-affinity antibodies and supports that preserve native conformations.

This comprehensive research report categorizes the Immunoprecipitation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Antibody

- Product Type

- End User

- Application

Key Regional Insights Reveal Differing Adoption Dynamics and Strategic Priorities for Immunoprecipitation Across the Americas, EMEA, and Asia-Pacific

Regional dynamics play a pivotal role in shaping immunoprecipitation adoption rates and supply chain strategies. In the Americas, strong research funding from government agencies and private foundations underpins growth in both academic and industrial laboratories. Leading biotechnology clusters in the United States and Canada foster strategic partnerships between reagent manufacturers and life science hubs, while tariff pressures have accelerated the development of domestic production capabilities to maintain reliable access to critical consumables.

Across Europe, the Middle East, and Africa, collaborative research initiatives and regulatory harmonization efforts bolster market expansion. European academic centers and pharmaceutical companies alike benefit from pooled procurement approaches and regional distribution networks that minimize shipping times and ensure compliance with stringent quality standards. In the Middle East and Africa, emerging research programs are driving demand for cost-effective kits and reagents, prompting suppliers to tailor offerings that balance performance with affordability.

Asia-Pacific stands out for its rapid increase in R&D investments and expanding biotechnology infrastructure. Countries such as China, India, South Korea, and Japan are investing heavily in proteomics and cell biology, creating large-scale demand for immunoprecipitation solutions. Local manufacturing capacities, coupled with government incentives for domestic innovation, are driving competition on price and delivery speed, while global suppliers form regional partnerships to navigate import regulations and support bespoke applications.

This comprehensive research report examines key regions that drive the evolution of the Immunoprecipitation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Company Insights Spotlight Major Life Science Innovators Shaping the Immunoprecipitation Market Through Strategic Acquisitions and Product Development

The competitive landscape of the immunoprecipitation market features a mix of global leaders and specialized innovators advancing their positions through targeted acquisitions, product enhancements, and strategic collaborations. Thermo Fisher Scientific, a pioneer in magnetic bead technologies, continues to expand its automation portfolio, partnering with benchtop robotic platforms to streamline immunoprecipitation workflows and support high-throughput demands.

Danaher Corporation’s acquisition of a leading antibody supplier has broadened its life sciences segment, integrating an extensive library of validated antibodies with enterprise-level distribution networks. This move enhances its ability to serve a global customer base with both custom and off-the-shelf immunoprecipitation solutions.

Meanwhile, Merck KGaA’s strategic investments in multiplexed bead chemistries have yielded customizable immunoprecipitation kits tailored for epigenetic and protein complex studies. Smaller players are differentiating through niche offerings, such as specialized antibody immobilization chemistries and next-generation proximity labeling reagents, collaborating with academic groups to validate performance in cutting-edge applications.

Together, these companies shape market trends by prioritizing reagent specificity, ease of use, and integration with downstream analytical platforms, driving continuous innovation while addressing evolving research needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Immunoprecipitation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abcam plc

- Active Motif, Inc.

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Cell Signaling Technology, Inc.

- Diagenode S.A.

- GenScript Biotech Corporation

- Merck KGaA

- Miltenyi Biotec B.V. & Co. KG

- QIAGEN N.V.

- R&D Systems, Inc.

- Santa Cruz Biotechnology, Inc.

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

Actionable Recommendations to Enhance Immunoprecipitation Efficiency, Navigate Tariff Pressures, and Drive Innovation Through Strategic Investments

To navigate the evolving immunoprecipitation landscape and capitalize on emerging opportunities, industry leaders should adopt a multifaceted strategy that balances innovation with operational efficiency. Prioritizing the integration of automation in sample processing and detection will not only enhance throughput but also elevate reproducibility and data quality. Investing in high-capacity magnetic bead platforms and robotic liquid handlers can reduce manual intervention and accelerate project timelines.

In light of tariff pressures, forging partnerships with regional manufacturers and exploring co-development agreements will mitigate supply chain risks and diversify sourcing options. Encouraging domestic production of high-value antibodies and reagents can buffer against fluctuating duties, while collaboration with academic and government consortia may unlock incentives for local fabrication.

Furthermore, incorporating proximity-dependent labeling techniques and single-cell immunoprecipitation workflows will position organizations at the forefront of precision proteomics. Allocating resources to validate and implement these advanced methodologies will uncover novel interactomes and transient complexes, strengthening pipeline discovery efforts. Lastly, optimizing reagent utilization through miniaturized assays and reuse protocols will reconcile cost containment with the rigorous performance standards demanded by life science research.

Comprehensive Research Methodology Employed to Gather and Validate Critical Data on Immunoprecipitation Technologies and Market Dynamics

This report employs a robust research methodology combining primary and secondary data sources to ensure comprehensive and validated insights. Primary research included structured interviews with industry experts, procurement managers, and academic researchers to capture firsthand perspectives on protocol preferences, procurement challenges, and emerging applications. These discussions provided qualitative depth and identified key innovation drivers.

Secondary research comprised an extensive review of peer-reviewed journals, patent filings, industry whitepapers, and publicly available tariff schedules. By analyzing harmonized tariff schedules and trade policy updates, the impact of 2025 import duties on reagent costs and supply chain dynamics was quantified. Technology trends were cross-referenced against recent publications in proteomics and next-generation sequencing to map the evolution of integrative IP techniques.

Market segmentation was defined through classification frameworks covering antibody type, solid support formats, end-user categories, and application domains. Regional market intelligence drew on government funding reports, regional trade data, and supplier distribution networks. Competitive profiling leveraged press releases, regulatory filings, and financial disclosures to chart strategic moves and product portfolios. The combined approach ensured that the findings reflect the latest developments and actionable insights for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Immunoprecipitation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Immunoprecipitation Market, by Antibody

- Immunoprecipitation Market, by Product Type

- Immunoprecipitation Market, by End User

- Immunoprecipitation Market, by Application

- Immunoprecipitation Market, by Region

- Immunoprecipitation Market, by Group

- Immunoprecipitation Market, by Country

- United States Immunoprecipitation Market

- China Immunoprecipitation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Conclusion Emphasizing the Crucial Role of Immunoprecipitation in Advancing Protein Research and Driving Future Innovation in Life Sciences

Immunoprecipitation remains an essential technique for unraveling protein interactions, post-translational modifications, and chromatin dynamics across basic and translational research. Technological advances in automation, high-throughput platforms, and proximity labeling have significantly enhanced its versatility, enabling researchers to capture transient and context-specific interactomes with greater precision.

The imposition of new U.S. tariffs in 2025 has prompted strategic shifts in sourcing, assay miniaturization, and domestic production, underscoring the need for resilient supply chain models. Regionally, varied funding landscapes and regulatory frameworks shape adoption patterns, from the well-funded hubs of the Americas to the emerging markets in Asia-Pacific and collaborative networks in EMEA.

Leading companies continue to differentiate through acquisitions, product innovation, and partnerships, expanding reagent ecosystems and automation capabilities. By embracing advanced methodologies and optimizing operational efficiencies, organizations can harness the full potential of immunoprecipitation to drive discovery and support precision medicine initiatives. These collective insights lay the groundwork for informed decision-making and strategic planning in a dynamic research environment.

Call to Action Connect with Ketan Rohom to Secure Your Comprehensive Immunoprecipitation Market Research Report Today

To take the next step toward unlocking deep strategic insights and optimizing your immunoprecipitation workflows, connect directly with Ketan Rohom, Associate Director of Sales & Marketing at our firm. Ketan can guide you through the comprehensive features of the full market research report, tailoring the information to your organization’s unique priorities.

Reach out today to discuss how this report will equip you with actionable intelligence on emerging technologies, tariff impacts, regional dynamics, and competitive strategies. Secure your access to in-depth analyses, expert interviews, and validated data that will empower your team to make informed decisions and stay ahead in the evolving immunoprecipitation landscape.

Act now to partner with Ketan and transform your immunoprecipitation strategy into a sustainable competitive advantage.

- How big is the Immunoprecipitation Market?

- What is the Immunoprecipitation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?