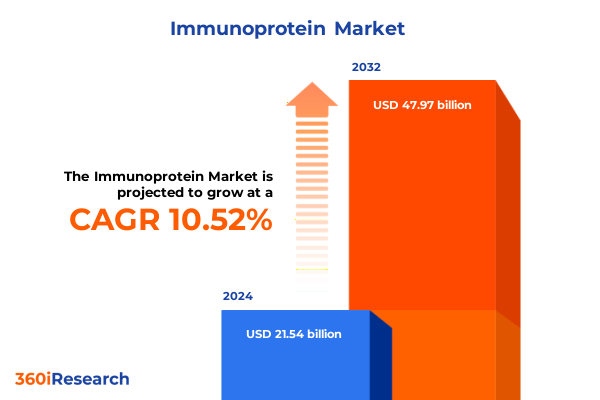

The Immunoprotein Market size was estimated at USD 23.61 billion in 2025 and expected to reach USD 25.89 billion in 2026, at a CAGR of 10.65% to reach USD 47.97 billion by 2032.

Discover the Critical Role of Immunoproteins in Modern Healthcare Settings and Their Expanding Influence on Cutting-edge Diagnostic and Therapeutic Practices Around the Globe

Immunoproteins, integral components within the broader field of immunology, have emerged as critical agents in both diagnostic and therapeutic applications across modern healthcare. These specialized proteins are harnessed to identify disease markers, modulate immune responses, and treat a spectrum of conditions from autoimmune disorders to immunodeficiency syndromes. The versatility of immunoproteins has catalyzed a growing interest among clinicians, researchers, and pharmaceutical developers, underscoring their transformative potential in precision medicine.

Over the past decade, advancements in molecular biology and bioprocessing have amplified the purity, potency, and specificity of immunoprotein therapies. Innovations in recombinant technology and improved purification methods now enable more targeted interventions with reduced adverse effects. Concurrently, diagnostic laboratories leverage refined immunoprotein assays to deliver rapid, reliable insights into patient health, driving more informed clinical decisions. As healthcare systems worldwide grapple with rising chronic disease prevalence and emerging pathogens, immunoproteins stand at the forefront of innovative solutions.

Looking ahead, the confluence of personalized therapeutics, real-time diagnostics, and digital health platforms promises to elevate the role of immunoproteins even further. Stakeholders ranging from pharmaceutical manufacturers to hospital administrators are actively collaborating to integrate these biomolecules into holistic care pathways. This introduction sets the stage for an in-depth exploration of the factors reshaping the immunoprotein landscape, ensuring readers grasp the foundational significance of these remarkable agents in contemporary medicine.

Explore How Groundbreaking Technological Innovations and Shifting Clinical Paradigms Are Reshaping the Immunoprotein Market and Patient Care Trajectories in 2025

The immunoprotein arena is experiencing a wave of transformative shifts driven by technological breakthroughs and evolving clinical paradigms. First, the advent of high-throughput platforms has revolutionized assay development, enabling simultaneous analysis of multiple biomarkers and accelerating time to result. Techniques such as next-gen sequencing juxtaposed with novel mass spectrometry protocols are redefining how researchers profile immunoproteins, facilitating unprecedented depth and precision.

In parallel, regulatory bodies are pioneering adaptive approval frameworks to expedite patient access to critical immunoprotein therapies without compromising safety. These frameworks support conditional authorizations and rolling reviews, prompting manufacturers to adopt more agile development strategies. Moreover, the rise of personalized medicine is encouraging collaboration between diagnostics and therapeutics, leading to companion immunoprotein assays that optimize treatment selection and dosage regimens tailored to individual immune profiles.

Supply chain optimization has also undergone a paradigm shift. The integration of advanced analytics and blockchain technologies enhances traceability from raw material procurement through final formulation, mitigating risks associated with contamination or shortage. Digital health initiatives, including tele-immunology consultation services and remote monitoring of immunoprotein therapy outcomes, further underscore the sector’s commitment to patient-centric innovation. Taken together, these transformative shifts are redefining the immunoprotein landscape, unlocking new opportunities for stakeholders across the value chain.

Examine the Far-reaching Consequences of Recent U.S. Tariff Adjustments on Immunoprotein Supply Chains, Manufacturing Costs, and Patient Access Throughout 2025

Recent tariff adjustments imposed by the United States on imported raw materials and finished immunoprotein products have introduced a complex array of challenges and strategic considerations for manufacturers, distributors, and healthcare providers. Heightened duties on critical plasma-derived components have elevated production costs, prompting downstream price adjustments that reverberate across procurement budgets at hospitals and specialty clinics.

These increased trade barriers have also underscored vulnerabilities in global supply chains, compelling several industry leaders to diversify their sourcing strategies. Companies have accelerated efforts to establish regional manufacturing hubs and secure long-term contracts with domestic suppliers to mitigate import dependency. Concurrently, stakeholders are exploring strategic partnerships with contract development and manufacturing organizations to optimize capacity utilization and cost efficiency.

From a patient access standpoint, the ripple effects of tariff-driven price volatility risk delaying the adoption of advanced immunoprotein therapies in both public and private healthcare systems. In response, industry associations and advocacy groups are engaging with policymakers to negotiate tariff relief and safeguard critical immunoglobulin supplies. As a consequence, the 2025 tariff landscape has become a catalyst for industry-wide dialogue on sustainable sourcing, regulatory advocacy, and innovative financing models aimed at preserving uninterrupted patient access to life-saving immunoproteins.

Uncover Detailed Segmentation Perspectives that Highlight Product Variations, Technological Approaches, Clinical Applications, and End User Integration Strategies

A multifaceted segmentation analysis illuminates the immunoprotein market through the lens of product, technology, application, and end user integration. In terms of product segmentation, the market is delineated by intramuscular immunoglobulin, intravenous immunoglobulin, and subcutaneous immunoglobulin. Within intramuscular immunoglobulin, the analysis focuses exclusively on standard formulations, whereas intravenous immunoglobulin is further divided into branded, generic, hypoimmune, and next-generation variants. Subcutaneous immunoglobulin offerings are classified into conventional and facilitated delivery methods, each addressing distinct patient compliance and pharmacokinetic requirements.

Technological segmentation reveals a diverse toolkit driving immunoprotein development and application. Capillary electrophoresis stands out for its high resolution in protein fractionation, complemented by enzyme-linked immunosorbent assay platforms that maintain their status as diagnostic workhorses. Meanwhile, liquid chromatography–mass spectrometry has gained traction for its unparalleled sensitivity, and protein microarray arrays facilitate multiplexed detection of immune signatures. Surface plasmon resonance further enhances real-time interaction analysis, supporting both research and quality control.

From an application standpoint, immunoproteins are essential in diagnostics and therapeutics. Diagnostic uses encompass disease marker detection, immune response assessment, and pharmacokinetic studies, each critical to refining patient diagnosis and treatment monitoring. Therapeutic applications address a spectrum of conditions, including autoimmune disorders, hematological disorders, immunodeficiency diseases, infectious diseases, and neurological disorders, reflecting the broad impact of immunoproteins on patient care.

Finally, end user segmentation spans diagnostic centers, home healthcare settings, hospitals, research laboratories, and specialty clinics. This cross-sectional perspective underscores how diverse care environments adopt immunoprotein solutions tailored to their operational needs, ranging from point-of-care testing in remote settings to large-scale infusion protocols in tertiary care centers.

This comprehensive research report categorizes the Immunoprotein market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Application

- End User

Illuminate Regional Variations in Immunoprotein Demand and Adoption Trends Across the Americas, Europe Middle East & Africa, and the Asia-Pacific for Strategic Planning

Regional dynamics play a pivotal role in shaping immunoprotein demand and adoption patterns. In the Americas, advanced healthcare infrastructure and robust reimbursement frameworks have facilitated rapid uptake of both diagnostic and therapeutic immunoprotein products. Leading institutions are investing in state-of-the-art analytical platforms, while strategic alliances between domestic plasma centers and biotech firms are driving innovation in next-generation immunoglobulins.

Within the Europe, Middle East, and Africa region, regulatory harmonization efforts under multinational coalitions have streamlined cross-border clinical trials and market approvals. Established pharmaceutical hubs in Western Europe remain hotspots for immunoprotein R&D, whereas emerging markets in the Middle East and Africa are witnessing growing interest in localized manufacturing and technology transfer partnerships that reduce reliance on imports.

In the Asia-Pacific, rapid economic expansion and increasing healthcare expenditures have fueled strong demand for cost-effective immunoprotein therapies. Local producers are scaling capacity to meet domestic needs, often leveraging public-private collaborations to bolster plasma collection networks and strengthen supply security. Meanwhile, market entrants are tailoring product portfolios to align with regional treatment guidelines and address distinct epidemiological profiles, underscoring the importance of regional customization for sustained growth.

This comprehensive research report examines key regions that drive the evolution of the Immunoprotein market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyze Prominent Industry Players’ Strategic Positioning, Collaborative Alliances, and Innovative Portfolios Influencing the Competitive Immunoprotein Landscape

The immunoprotein sector is defined by the strategic moves of a handful of leading organizations that maintain significant influence over market dynamics. One prominent entity has focused on enhancing its pipeline through targeted acquisitions and in-licensing agreements that broaden its repertoire of antibody therapies. Another global leader has channeled investments into advanced fractionation technologies and continuous processing, aiming to boost manufacturing efficiency and address quality consistency challenges.

Strategic alliances between biopharma innovators and academic research institutions have become increasingly common, enabling accelerated translation of preclinical immunoprotein candidates into clinical development. Collaborative ventures have also emerged between contract development and manufacturing organizations and immunoprotein developers, optimizing scale-up processes and ensuring robust supply under variable demand conditions.

Innovation in formulation technologies and delivery modalities remains a key differentiator. Industry frontrunners are piloting facilitated subcutaneous platforms designed to enable self-administration and improve patient adherence. Concurrently, investment in digital therapeutics and patient monitoring systems is gaining momentum, as companies seek to complement immunoprotein treatments with data-driven support services. These strategic initiatives underscore the competitive landscape’s emphasis on integrated solutions that span the continuum from research through patient care.

This comprehensive research report delivers an in-depth overview of the principal market players in the Immunoprotein market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- CSL Behring LLC

- Danaher Corporation

- DiaSorin S.p.A.

- Fujirebio Inc.

- Grifols, S.A.

- Hologic, Inc.

- Octapharma AG

- Ortho Clinical Diagnostics Holdings plc

- QuidelOrtho Corporation

- Roche Holding AG

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

- Werfen, S.A.

Identify Actionable Strategic Initiatives for Industry Leaders to Enhance Innovation, Optimize Supply Chains, and Strengthen Market Adaptability in the Immunoprotein Sector

To navigate the evolving immunoprotein landscape, industry leaders should prioritize targeted investment in next-generation modalities that promise improved specificity and reduced infusion cycles. By embracing continuous bioprocessing and single-use technologies, organizations can enhance manufacturing agility and rapidly adapt to shifts in demand or regulatory requirements.

Diversification of supply chains is critical. Establishing regional centers of excellence and securing strategic raw material partnerships will mitigate risks associated with tariff fluctuations and raw material scarcity. Simultaneously, companies should engage proactively with policymakers and industry associations to advocate for favorable trade policies and streamlined regulatory pathways.

Deepening collaboration with end users will yield actionable insights that drive product development. By integrating real-world data platforms and patient feedback mechanisms, manufacturers can refine formulations and delivery systems to optimize clinical outcomes. Investing in digital ecosystems that support tele-immunology and remote monitoring will further differentiate offerings and enhance patient engagement.

Finally, fostering cross-sector partnerships-from academic consortia to tech startups-will accelerate innovation. Collaborative frameworks that align R&D objectives with healthcare system needs are essential for translating scientific breakthroughs into accessible, cost-effective immunoprotein solutions.

Understand the Rigorous Research Methodology Employed to Gather Comprehensive Insights on Immunoprotein Dynamics, Ensuring Data Integrity and Analytical Precision

This study employs a rigorous, multi-phased research methodology designed to ensure the integrity, comprehensiveness, and relevance of insights presented. The process began with an extensive literature review of peer-reviewed journals, regulatory guidelines, and white papers to establish a foundational understanding of immunoprotein science and market dynamics.

Primary research comprised in-depth interviews with key opinion leaders, including immunologists, bioprocess engineers, and healthcare procurement specialists. These conversations provided firsthand perspectives on emerging trends, clinical challenges, and technological hurdles. Simultaneously, a structured survey was distributed to a representative sample of diagnostic laboratories, hospitals, and specialty clinics to quantify adoption patterns and procurement priorities.

Secondary data sources encompassed manufacturer filings, patents, clinical trial registries, and government trade statistics. Data triangulation across these sources enabled validation of critical findings and identification of discrepancies. Analytical techniques such as SWOT analysis and Porter’s Five Forces were employed to decipher competitive intensity and market attractiveness across segments.

Ethical considerations and data confidentiality protocols were strictly adhered to throughout the research process. All primary respondents consented to anonymized data usage, and proprietary information was handled under non-disclosure agreements. This methodological framework guarantees that the insights delivered are robust, actionable, and reflective of the current immunoprotein ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Immunoprotein market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Immunoprotein Market, by Product

- Immunoprotein Market, by Technology

- Immunoprotein Market, by Application

- Immunoprotein Market, by End User

- Immunoprotein Market, by Region

- Immunoprotein Market, by Group

- Immunoprotein Market, by Country

- United States Immunoprotein Market

- China Immunoprotein Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesize Key Takeaways on Immunoprotein Developments, Market Dynamics, and Strategic Imperatives That Will Drive Stakeholder Decisions in the Evolving Healthcare Ecosystem

In conclusion, immunoproteins stand as transformative agents within modern healthcare, offering both diagnostic clarity and therapeutic efficacy across a wide spectrum of diseases. The convergence of advanced analytical technologies, personalized medicine initiatives, and digital health integration has catalyzed unprecedented innovation, positioning immunoproteins at the vanguard of patient-centric care.

Tariff adjustments in the United States have underscored the critical interdependence of global supply chains and the necessity for strategic sourcing diversification. Stakeholders must balance cost imperatives with the imperative to maintain uninterrupted access to essential immunoglobulin therapies. Segmentation insights reveal a complex tapestry of product, technological, application, and end user factors that collectively shape market dynamics, while regional analyses highlight the nuanced demands of the Americas, Europe, Middle East & Africa, and Asia-Pacific.

Leading companies continue to differentiate through strategic alliances, continuous processing investments, and integrated digital offerings. Moving forward, industry leaders should focus on next-generation modalities, robust advocacy initiatives, and collaborative R&D frameworks to deliver cost-effective, high-quality immunoprotein solutions. The interplay of these strategic imperatives will define the immunoprotein sector’s trajectory and its ability to meet evolving clinical needs.

Engage with Associate Director of Sales & Marketing Ketan Rohom to Secure Cutting-edge Immunoprotein Market Intelligence and Drive Strategic Decisions

To acquire the comprehensive immunoprotein market research report and gain actionable intelligence tailored to your organization’s strategic needs, we invite you to engage with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise will guide you through the report’s detailed findings, answer your specific queries, and ensure you receive the insights necessary to stay ahead in this rapidly evolving sector. Connect with Ketan to customize the research package, explore extended data modules, and secure the knowledge required to drive confident, data-led decisions that bolster innovation, optimize supply chains, and enhance patient outcomes.

- How big is the Immunoprotein Market?

- What is the Immunoprotein Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?