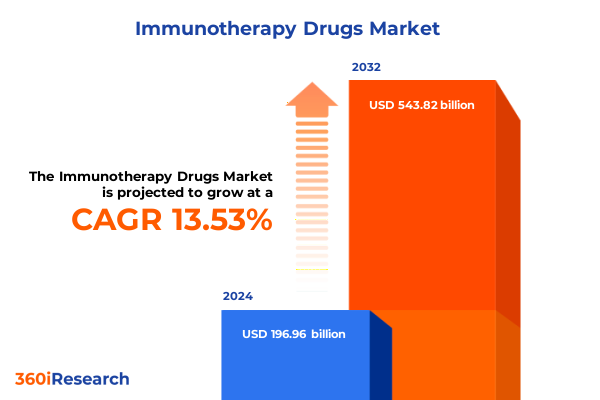

The Immunotherapy Drugs Market size was estimated at USD 222.59 billion in 2025 and expected to reach USD 251.56 billion in 2026, at a CAGR of 13.61% to reach USD 543.82 billion by 2032.

Immunotherapy Drugs Catalyzing a New Era in Oncology Care through Personalized Treatment Approaches and Advanced Therapeutic Innovations

Immunotherapy drugs have emerged as one of the most significant therapeutic advances in oncology over the past decade, fundamentally transforming how clinicians and researchers approach cancer treatment. By harnessing the body’s own immune system to identify and destroy malignant cells, these therapies transcend the limitations of conventional modalities, offering renewed hope for patients facing previously intractable malignancies. As the field continues to evolve, the integration of novel biologics with cutting-edge technologies, such as gene editing and artificial intelligence–driven biomarker discovery, is driving a relentless push toward more personalized and precision-based interventions that align with each patient’s unique tumor profile.

Breakthrough Modalities and Next-Generation Immunotherapies Reshaping Cancer Treatment Paradigms with Diverse Mechanisms and Combination Strategies

The immunotherapy landscape is undergoing a fundamental reshaping as next-generation modalities move from experimental settings into routine clinical practice. Immune checkpoint inhibitors, which initially defined the field, now share the spotlight with adoptive cell therapies, cancer vaccines, cytokine agonists, and oncolytic virus platforms that collectively extend the boundaries of what immunomodulation can achieve. This therapeutic diversification is complemented by a growing emphasis on combination regimens that leverage synergistic mechanisms of action-melding cell therapies with checkpoint blockade or cytokine modulation to overcome resistance pathways and enhance durable responses.

Assessing the Cumulative Impact of United States Tariffs in 2025 on Immunotherapy Drug Supply Chains Investments and Innovation Ecosystem Dynamics

In 2025, the introduction of multiple layers of tariffs on pharmaceutical components and equipment by the United States has generated significant ripple effects throughout the immunotherapy ecosystem. Tariffs of up to 25% on active pharmaceutical ingredients sourced from Asia, combined with duties on medical packaging and large-scale manufacturing machinery, have elevated production costs for critical biologics and cell therapy reagents. Simultaneously, a global 10% tariff on healthcare imports has pressed companies to reexamine procurement strategies and supply chains, prompting a surge in domestic manufacturing investments to safeguard continuity of research and clinical supply.

Comprehensive Segmentation Analysis Reveals Critical Insights into Therapy Types Indications Administration Routes End Users and Mechanisms of Immunotherapy

A nuanced segmentation of the immunotherapy market reveals key drivers and opportunities across multiple dimensions, beginning with therapy type. Adoptive cell therapy encompasses breakthrough approaches such as CAR-T, NK cell, and TCR-engineered constructs, each tailored to exploit distinct immune effector functions. Parallel progress in cancer vaccines spans dendritic cell–based formulations, DNA-encoded immunogens, and peptide vaccines designed to engage tumor-specific antigens with high precision. Checkpoint inhibitors targeting CTLA-4, PD-1, and PD-L1 pathways continue to anchor many treatment protocols, while cytokine-driven therapies leverage colony-stimulating factors, interferons, and interleukins to amplify immune activation. Oncolytic virus platforms, underpinned by adenovirus, herpesvirus, and reovirus backbones, are also gaining traction as vectors that induce both direct oncolysis and potent immunogenic cell death.

Indication-based segmentation underscores the diverse therapeutic horizons across hematologic and solid tumors. Blood cancers such as acute lymphoblastic leukemia, acute myeloid leukemia, chronic lymphocytic leukemia, and lymphomas benefit from the targeting precision of CAR-T and bispecific antibody constructs. In breast cancer, distinct subpopulations of hormone receptor–positive and triple-negative disease drive the exploration of subcutaneous checkpoint formulations and novel antibody-drug conjugates. Lung cancer subtypes, from non-small cell to small cell variants, are witnessing bespoke vaccine and adoptive cell trials, while the heterogeneity of cutaneous and uveal melanoma encourages advanced TIL and TCR cell therapy strategies.

Route of administration segmentation highlights the impact of intratumoral injections in fostering localized immune activation, complemented by systemic intravenous infusions that ensure broader effector cell trafficking. Subcutaneous formats, particularly for checkpoint inhibitors, are emerging as patient-centric alternatives that reduce infusion burden and expand access in outpatient or resource-limited settings. End-user segmentation further refines the landscape: high-volume hospitals anchor early adoption of complex cell therapies, oncology clinics promote broad dissemination of checkpoint agents, and specialized centers serve as innovation hubs for cutting-edge vaccine and viral platforms.

Examining mechanism of action classification reveals synergies between active immunotherapies-such as antigen-directed vaccines and replicating viral vectors-and passive modalities, including adoptive cell transfers, immune checkpoint blockade, and monoclonal antibodies. These complementary strategies inform combination regimens that aim to prime, expand, and sustain antitumor immunity within dynamic tumor microenvironments.

This comprehensive research report categorizes the Immunotherapy Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapy Type

- Route Of Administration

- Mechanism Of Action

- End User

- Indication

Divergent Regional Dynamics Highlight Varied Adoption Reimbursement and Infrastructure Trends Across Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics in immunotherapy adoption and infrastructure reveal distinct opportunities and challenges across the globe. In the Americas, robust clinical trial pipelines and favorable reimbursement frameworks have positioned the United States and Canada as epicenters of innovation, where public-private partnerships and venture funding underpin rapid pipeline maturation. Meanwhile, Europe, the Middle East, and Africa exhibit wide variance: Western European nations leverage progressive regulatory pathways to expedite product approvals, while Middle Eastern hubs channel capital into oncology centers of excellence, and African nations gradually build foundational capacity through targeted collaborations with global research institutions. In the Asia-Pacific region, government-led initiatives in Japan, China, South Korea, and Australia are accelerating approvals and driving large-scale manufacturing investments. Growing middle-class demand and healthcare access reforms further propel the uptake of immunotherapies, making this region one of the fastest-expanding in terms of clinical trial activity and commercialization potential.

This comprehensive research report examines key regions that drive the evolution of the Immunotherapy Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles Highlight Leading Innovators Driving Immunotherapy Advancements through Collaborations Pipeline Diversification and Market Leadership

The immunotherapy domain is characterized by fierce competition and strategic maneuvers among leading biopharmaceutical innovators. Industry stalwarts such as Merck & Co. and Bristol-Myers Squibb solidify their dominance in checkpoint inhibition through fortified portfolios that expand indications and explore next-generation, subcutaneous delivery. Novartis and Gilead Sciences, buoyed by their pioneering CAR-T constructs, engage in broad alliance networks to co-develop off-the-shelf cell therapies and novel vector systems. Roche, through its Genentech arm, augments its capabilities in bispecific antibodies and next-gen antibody-drug conjugates, while Iovance and Adaptimmune push the frontiers of TIL and TCR-engineered therapies for solid tumors. Emerging biotech firms leverage nimble R&D frameworks to target niche antigens and develop bispecific formats, setting the stage for strategic partnerships and potential acquisitions that could reshape the competitive topography.

This comprehensive research report delivers an in-depth overview of the principal market players in the Immunotherapy Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amgen Inc.

- AstraZeneca PLC

- Bristol-Myers Squibb Company

- F. Hoffmann-La Roche Ltd

- Genscript Biotech Corporation

- Gilead Sciences, Inc.

- HD Biosciences Co., Ltd.

- Horizon Discovery Group PLC

- ImmunXperts SA

- Johnson & Johnson

- Jubilant Life Sciences Limited

- Labcorp

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

Actionable Strategic Recommendations Empower Industry Leaders to Navigate Regulatory Tariffs Supply Chain Challenges and Accelerate Immunotherapy Innovation and Adoption

Industry leaders should proactively diversify supply chains to mitigate tariff-driven disruptions by securing multi-regional sourcing partnerships and investing in local fill-finish capacity. Prioritizing dual-mechanism combination trials-linking checkpoint blockade with oncolytic viruses or cytokine agonists-can unlock synergistic efficacy and address resistance patterns documented in emerging clinical data. Strengthening translational research collaborations with academic and clinical centers will accelerate the validation of predictive biomarkers and refine patient selection algorithms. In parallel, stakeholder engagement with regulatory agencies to streamline review pathways, especially for innovative administration routes and novel cell therapy platforms, can expedite time-to-market while ensuring rigorous safety oversight. Finally, aligning R&D investments with real-world evidence initiatives will underscore long-term value, bolstering reimbursement negotiations and expanding patient access across diverse healthcare systems.

Robust Research Methodology Combines Primary Interviews Secondary Data Clinical Trial Analysis and Industry Intelligence for Comprehensive Immunotherapy Insights

This analysis is underpinned by a robust research methodology that triangulates insights from primary interviews, secondary data sources, and comprehensive clinical trial registries. Primary research included in-depth discussions with oncologists, cell therapy manufacturing experts, regulatory specialists, and supply chain leaders, providing qualitative context and real-time perspectives. Secondary research leveraged peer-reviewed literature, industry publications, company financial releases, and government policy statements to validate emerging trends. Clinical trial databases, such as ClinicalTrials.gov, were systematically examined to map the trajectory of investigational agents, while intellectual property landscapes were surveyed to highlight patent activity. Data quality and relevance were rigorously assessed through cross-validation, ensuring that the findings reflect the latest advances and real-world developments in immunotherapy.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Immunotherapy Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Immunotherapy Drugs Market, by Therapy Type

- Immunotherapy Drugs Market, by Route Of Administration

- Immunotherapy Drugs Market, by Mechanism Of Action

- Immunotherapy Drugs Market, by End User

- Immunotherapy Drugs Market, by Indication

- Immunotherapy Drugs Market, by Region

- Immunotherapy Drugs Market, by Group

- Immunotherapy Drugs Market, by Country

- United States Immunotherapy Drugs Market

- China Immunotherapy Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Concluding Insights Emphasize the Transformative Potential of Integrative Immunotherapy Strategies and the Imperative of Policy Adaptation for Sustained Progress

The immunotherapy field stands at an inflection point where scientific breakthroughs converge with complex market forces and policy shifts. The broadening of therapeutic modalities-from checkpoint inhibitors to engineered cell therapies and beyond-underscores the field’s unprecedented momentum. Simultaneously, external pressures such as tariffs and supply chain reconfigurations demand agile strategies and sustained collaboration across stakeholders. Moving forward, the integration of mechanistic insights, patient-centric delivery innovations, and adaptive regulatory frameworks will determine how rapidly and equitably these life-saving treatments reach those in need. By embracing a holistic perspective that balances innovation with resilience, the industry can sustain progress and unlock the full potential of immunotherapy.

Engage with Ketan Rohom Associate Director Sales Marketing to Access the Comprehensive Immunotherapy Market Research Report and Unlock Strategic Growth Opportunities

Ready to elevate your strategic positioning and gain unparalleled insights into the evolving immunotherapy landscape? Engage with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure access to the comprehensive immunotherapy market research report. Connect directly to explore tailored recommendations, detailed segmentation analyses, and actionable intelligence designed to inform your next move in this dynamic industry ecosystem.

- How big is the Immunotherapy Drugs Market?

- What is the Immunotherapy Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?