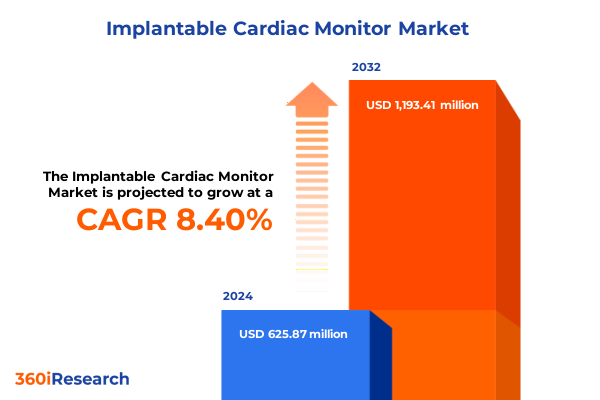

The Implantable Cardiac Monitor Market size was estimated at USD 1.20 billion in 2025 and expected to reach USD 1.30 billion in 2026, at a CAGR of 7.98% to reach USD 2.07 billion by 2032.

Understanding the Growing Importance of Implantable Cardiac Monitors in Revolutionizing Heart Rhythm Management and Patient Outcomes

The landscape of cardiovascular care is witnessing a fundamental transformation as chronic heart conditions continue to rise in prevalence. Implantable cardiac monitoring devices have emerged as indispensable tools for clinicians seeking to bridge gaps in early detection and long-term management of arrhythmias, syncope, and atrial fibrillation. By enabling continuous real-time data collection, these monitors empower healthcare professionals to make more informed therapeutic decisions, reduce hospital readmissions, and improve patient adherence through remote follow-up. As the technology evolves, clinicians and system leaders are increasingly relying on device-generated insights to tailor personalized treatment pathways and enhance overall quality of care.

Against this backdrop of dynamic clinical demand and rapid technological innovation, this executive summary distills critical observations across market drivers, regulatory headwinds, and strategic imperatives. The following sections explore transformative industry shifts, the ramifications of recent U.S. tariff implementations, deep-dive segmentation themes, and geographic nuances shaping uptake. Furthermore, competitive positioning of leading players is analyzed, culminating in actionable recommendations to guide industry leadership. This introduction sets the stage for a comprehensive assessment intended to support decision-makers in navigating the implantable cardiac monitoring arena with confidence and clarity.

Examining the Transformative Shifts Shaping the Future of Cardiac Monitoring Through Technological Advances and Data-Driven Patient Care

The convergence of digital connectivity, miniaturization, and advanced analytics has triggered a far-reaching metamorphosis in cardiac monitoring. Once confined to episodic clinic visits and external Holter recordings, arrhythmia surveillance now capitalizes on continuous subcutaneous sensors and wearable patch modalities that integrate seamlessly into patients' daily routines. This shift towards unobtrusive, long-duration monitoring has unlocked the potential to detect elusive events and asymptomatic episodes, empowering clinicians with a more holistic view of cardiac health.

Simultaneously, the rise of cloud-based platforms and wireless communication protocols has enabled instantaneous data transmission and remote patient management. Artificial intelligence and machine learning algorithms are progressively woven into monitoring ecosystems to triage alerts, predict arrhythmic trends, and optimize resource utilization for high-acuity patients. As wearable band-based systems, cellular-enabled patches, and subcutaneous implants become more interoperable with electronic health records, the workflow transformation extends from device manufacturers to ambulatory surgery centers, cardiology clinics, and tertiary hospitals. Stakeholders are now tasked with harnessing these technological advances to craft integrated care pathways that amplify clinical efficacy while controlling operational costs.

Assessing the Cumulative Impact of 2025 United States Tariffs on the Implantable Cardiac Monitor Landscape and Associated Supply Chains

In early 2025, the United States implemented a series of elevated import tariffs targeting medical device components and finished products, prompting a ripple effect across the implantable cardiac monitor supply chain. Manufacturers reliant on precision sensors, microelectronics, and specialized alloys encountered higher landed costs, which in turn pressured pricing strategies and margins. To mitigate these headwinds, several players have pursued nearshoring of assembly operations and strategic alliances with domestic component suppliers, fostering greater resilience against future trade fluctuations.

Beyond cost management, regulatory agencies have taken note of tariff-induced supply vulnerabilities and are exploring expedited pathways for in-country requalification of critical parts. This regulatory responsiveness is instrumental in safeguarding device availability, particularly for community hospitals and ambulatory surgical centers that depend on timely product restocking. Although tariff adjustments have necessitated short-term product repricing and inventory optimization, the industry’s proactive pivot towards diversified sourcing and collaborative vendor partnerships has laid the groundwork for more robust, vertically integrated manufacturing ecosystems.

Uncovering Key Market Segmentation Insights That Illuminate Diverse Product End User Indication Technology and Distribution Dynamics

Analyses reveal that product variations span a spectrum from insertable cardiac monitors, which include both subcutaneous and submuscular configurations, to wearable devices encompassing band-based systems and adhesive patches. These distinctions influence clinical workflow integration, patient comfort, and long-term adherence, underscoring the importance of tailored device selection for specific care settings. In turn, end-user segmentation reflects adoption across ambulatory surgical centers, specialized cardiology clinics, and broader general clinics, as well as community hospitals and tertiary care facilities, each presenting unique procurement cycles, budgetary constraints, and technical support requirements.

Another critical dimension of differentiation lies in clinical indication. Implantable monitors designed for arrhythmia monitoring can be further optimized for supraventricular or ventricular tachyarrhythmias, while atrial fibrillation detection platforms address both paroxysmal and persistent forms of the condition. Separate models calibrated for syncope management distinguish between cardiac syncope and vasovagal events. From a technological standpoint, Bluetooth-enabled monitors-whether leveraging BLE or classic Bluetooth stacks-coexist alongside wireless solutions operating on cellular or non-cellular networks, as well as cloud-based systems hosted on private or public infrastructures. Distribution channels add a final layer of complexity: some manufacturers engage directly with health systems or original equipment manufacturers, whereas others depend on authorized distributors and e-commerce platforms to extend market reach.

This comprehensive research report categorizes the Implantable Cardiac Monitor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Clinical Indication

- Offering

- Technology

- End User

- Distribution Channel

Highlighting Critical Regional Variations in Demand and Adoption Trends Across the Americas Europe Middle East and Africa and Asia-Pacific Markets

Regional demand patterns underscore striking contrasts in adoption rates and reimbursement environments. In the Americas, robust private and public payer frameworks have accelerated uptake, particularly in the United States and Canada, where telehealth initiatives and remote patient monitoring reimbursement codes support broader device utilization. Latin American markets are characterized by selective deployment in urban centers and leading cardiac care institutions, with gradual expansion into tier-two cities driven by public–private partnerships.

In Europe Middle East and Africa, heterogeneous regulatory landscapes have shaped divergent adoption curves. Western European countries demonstrate strong penetration of advanced subcutaneous implants, facilitated by centralized procurement and favorable health technology assessments. By contrast, emerging markets in the Middle East and Africa exhibit slower uptake, constrained by fragmented payer systems and limited infrastructure for secure data exchange. Nevertheless, government-led digital health programs are laying the groundwork for future growth. Across Asia-Pacific, a dual-track dynamic prevails: established markets such as Japan and Australia maintain high levels of patient access and clinical adoption, while rapidly developing economies in Southeast Asia prioritize lower-cost patch-based wearables and cellular-enabled devices to address burgeoning arrhythmia burdens at scale.

This comprehensive research report examines key regions that drive the evolution of the Implantable Cardiac Monitor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Company Positions and Competitive Dynamics Driving Innovation and Collaboration in the Implantable Cardiac Monitoring Sector

Leading device manufacturers have solidified their positions through a blend of product innovation, strategic acquisitions, and service ecosystem development. Some companies have introduced next-generation submuscular monitors with extended battery life and remote firmware update capabilities, establishing high entry barriers for new competitors. Others have fortified their portfolios by securing partnerships with digital health platforms and third-party analytics providers to deliver integrated patient management solutions.

Concurrent research collaborations with academic institutions and cardiology consortia have produced clinical evidence supporting early intervention protocols, thereby enhancing product value propositions. Mergers with complementary medtech firms have not only broadened geographic distribution but also unlocked cross-selling opportunities within existing client bases. The convergence of device-based diagnostics with software-as-a-medical-device offerings has created new revenue streams around subscription analytics and virtual patient engagement tools. This shift toward hybrid hardware–software models is reshaping competitive dynamics, compelling industry leaders to reevaluate go-to-market strategies and channel partnerships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Implantable Cardiac Monitor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Medtronic plc

- Abbott Laboratories

- Boston Scientific Corporation

- Biotronik SE & Co. KG

- GE HealthCare Technologies Inc.

- Koninklijke Philips N.V.

- Bardy Diagnostics, Inc. by Baxter International Inc.

- Nihon Kohden Corporation

- Cook Group Incorporated

- Zoll Medical Corporation

- MicroPort Scientific Corporation

- Integer Holdings Corporation

- Medico S.p.A.

- Avertix Medical Inc.

- CARDION s.r.o.

- Edwards Lifesciences Corporation

- iRhythm Technologies, Inc.

- Lepu Medical Technology (Beijing) Co., Ltd.

Delivering Actionable Recommendations to Guide Industry Leadership in Enhancing Competitive Edge and Operational Excellence in Cardiac Monitoring

To capitalize on market opportunities, industry leaders should intensify investment in modular device architectures that can be rapidly reconfigured for emerging indications and connectivity standards. Strengthening partnerships with cloud infrastructure providers will enable the secure handling of escalating data volumes, while alliances with artificial intelligence innovators can augment diagnostic accuracy and streamline clinical workflows. Pricing strategies must also evolve to embrace outcome-based reimbursement models, shifting away from purely transactional engagements toward value-driven contracts tied to clinical endpoints.

Operationally, deploying regional manufacturing hubs and lean supply chain practices will mitigate the impact of geopolitical disruptions and tariff fluctuations. Engaging payers early in the product development lifecycle can align evidence generation with reimbursement criteria, accelerating market access. Finally, enhancing customer support through virtual training platforms and 24/7 remote monitoring services will foster loyalty among cardiology practitioners and healthcare executives. By embracing these measures, stakeholders can secure lasting differentiation and sustainable growth in an increasingly competitive arena.

Detailing Robust Research Methodologies That Ensure Data Integrity Reliability and Comprehensive Insight into Cardiac Monitoring Market Dynamics

This analysis integrates primary insights from in-depth interviews with cardiologists, electrophysiologists, healthcare administrators, and procurement leads, combined with secondary research into regulatory filings, patent databases, and public policy frameworks. Data triangulation methods were employed to reconcile divergent sources, ensuring robust validation of device adoption trends and tariff impacts. Care was taken to anonymize proprietary input while preserving the richness of expert perspectives across diverse care settings.

Quantitative modeling was supplemented by scenario planning to assess supply chain resilience under varying tariff regimes, while qualitative thematic analysis illuminated emerging innovation clusters and partnership ecosystems. Cross-functional workshops were conducted to stress-test recommendations against real-world operational constraints. Throughout, a structured data governance protocol maintained the integrity and reproducibility of findings, providing stakeholders with a transparent roadmap from raw observation to strategic insight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Implantable Cardiac Monitor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Implantable Cardiac Monitor Market, by Clinical Indication

- Implantable Cardiac Monitor Market, by Offering

- Implantable Cardiac Monitor Market, by Technology

- Implantable Cardiac Monitor Market, by End User

- Implantable Cardiac Monitor Market, by Distribution Channel

- Implantable Cardiac Monitor Market, by Region

- Implantable Cardiac Monitor Market, by Group

- Implantable Cardiac Monitor Market, by Country

- United States Implantable Cardiac Monitor Market

- China Implantable Cardiac Monitor Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Synthesis of Critical Findings Illustrating the Strategic Imperatives for Stakeholders in Implantable Cardiac Monitoring

In aggregate, the evolution of implantable cardiac monitoring reflects a confluence of clinical necessity, technological ingenuity, and market complexities. Stakeholders must navigate shifting tariff regimes and supply chain recalibrations while harnessing segmentation nuances to tailor devices and services to specific care loci. Regional disparities in payer support and infrastructure readiness demand differentiated market entry approaches, and competitive advantages will hinge on the integration of hardware innovation with data analytics capabilities.

Looking ahead, the most successful organizations will be those that proactively manage regulatory uncertainties, fortify strategic partnerships across the value chain, and pioneer outcome-based engagement models that align stakeholder incentives. By synthesizing the insights presented herein, decision-makers are equipped to chart a clear path toward enhanced patient outcomes, operational resilience, and sustainable growth within the dynamic ecosystem of implantable cardiac monitoring.

Take Action Today to Secure Exclusive Insights and Partner Directly with Ketan Rohom for Unparalleled Market Intelligence in Cardiac Monitoring

Engaging directly with Ketan Rohom presents a unique opportunity to access tailored market research that crystallizes the strategic pathways for competitive advantage in implantable cardiac monitoring. His deep understanding of sales and marketing dynamics empowers stakeholders to align product strategies with evolving clinical needs, regulatory frameworks, and emerging reimbursement models. By securing a detailed consultation, decision-makers gain clarity on innovation roadmaps, partnership opportunities, and value propositions that resonate with payers, providers, and patients alike. Partnering with Mr. Rohom ensures priority access to in-depth analysis, executive briefings, and interactive Q&A sessions that translate complex data into actionable intelligence. Prospective clients will benefit from customized deliverables that hone in on growth catalysts, risk mitigation tactics, and market entry scenarios with unprecedented precision. Take the next decisive step toward optimizing your product portfolio, enhancing stakeholder engagement, and driving sustainable revenue growth by connecting with Ketan Rohom today.

- How big is the Implantable Cardiac Monitor Market?

- What is the Implantable Cardiac Monitor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?