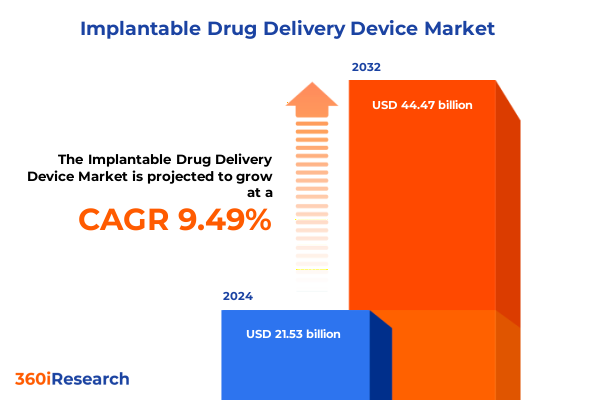

The Implantable Drug Delivery Device Market size was estimated at USD 23.29 billion in 2025 and expected to reach USD 25.20 billion in 2026, at a CAGR of 9.67% to reach USD 44.47 billion by 2032.

Unveiling the transformative potential embedded in implantable drug delivery solutions that redefine therapeutic efficacy and patient-centric care outcomes

The advent of implantable drug delivery systems has catalyzed a profound transformation in therapeutic modalities, offering sustained release profiles, targeted administration, and enhanced patient compliance. By circumventing the limitations of traditional dosing regimens, these technologies deliver rigorous pharmacokinetic control, thereby reducing systemic toxicity and improving clinical outcomes. Against a backdrop of rising chronic disease prevalence and a heightened focus on minimally invasive interventions, the momentum behind implantable devices continues to accelerate.

This executive summary encapsulates the critical trends, regulatory developments, and strategic imperatives shaping the implantable drug delivery arena. Through in-depth analysis of the technological landscape, barrier dynamics, and actionable insights, the report furnishes stakeholders with a holistic understanding of emerging opportunities and risks. It serves as a navigational compass for executives seeking to harness innovation, optimize investment portfolios, and reinforce competitive positioning in a market defined by rapid evolution.

Exploring the paradigm shift driven by technological breakthroughs regulatory evolutions and patient empowerment reshaping the implantable drug delivery landscape

Over the past decade, groundbreaking material science and digital integration have converged to redefine the boundaries of implantable drug delivery, ushering in a new era of precision medicine. Biodegradable polymers enable tailor-made degradation kinetics, while MEMS-based microchips and electromechanical systems deliver programmable dosing regimens that adapt to individual pharmacodynamic responses. Concurrently, regulatory frameworks have evolved to accommodate these hybrid devices, balancing rigorous safety requirements with accelerated pathways for breakthrough therapies.

Moreover, the rise of patient empowerment and value-based care models has amplified demand for devices that demonstrate measurable improvements in adherence and quality-of-life metrics. As a result, manufacturers are investing heavily in real-world evidence generation and digital health integration, creating ecosystems that capture longitudinal data streams and feed predictive analytics platforms. Consequently, this shift fosters a collaborative innovation environment where partnerships across medtech, biotech, and software sectors illuminate novel therapeutic frontiers.

Analyzing the cumulative repercussions of 2025 United States tariffs on component sourcing manufacturing logistics and global supply chain resilience

In early 2025, a new set of United States tariffs targeting critical components such as microelectronic sensors, specialty polymers, and precision pump mechanisms was implemented, sending ripples across global supply chains. The cumulative effect elevated input costs, prompting manufacturers to reassess sourcing strategies and accelerate localization efforts. Suppliers in Asia faced mounting pressure to renegotiate long-term contracts, while domestic producers scrambled to scale capacity and secure key feedstock materials.

As trade barriers intensified, companies responded by diversifying their procurement portfolios and investing in nearshore manufacturing hubs to mitigate geopolitical risks. Furthermore, strategic alliances emerged to pool development costs and share regulatory know-how, thereby preserving margins and ensuring continuity of supply. Ultimately, these adaptive maneuvers underscored the industry’s resilience, demonstrating that proactive tariff mitigation and agile operational frameworks are indispensable in safeguarding innovation pipelines and sustaining market growth.

Key segmentation revelations uncovering product type application end user and technology-driven dynamics powering device adoption patterns

A nuanced view of market segmentation reveals that Contraceptive Implants, Drug Eluting Stents, Infusion Pumps, Microchip Implants, and Osmotic Pumps each exhibit unique adoption drivers and technology lifecycles. Within the drug-eluting stent category, coronary applications command a distinct clinical trajectory compared to peripheral vascular interventions, influencing product differentiation strategies. Likewise, infusion pumps deployed in chemotherapy, insulin management, and pain control present divergent regulatory pathways and reimbursement landscapes that shape commercial roadmaps.

Simultaneously, applications spanning cardiology, contraception, diabetes, neurology, oncology, and pain management underscore the therapeutic breadth of implantable platforms, necessitating tailored value propositions for each clinical segment. From the home care setting to hospitals and specialty clinics, end-user preferences dictate form factor innovations and service delivery models. Layered on top of these dimensions, technology variants such as biodegradable polymers, mechanical pumps, microchip-based electromechanical systems, and osmotic devices each offer distinct performance attributes. Together, these segmentation insights inform prioritization of R&D investments and channel optimization approaches.

This comprehensive research report categorizes the Implantable Drug Delivery Device market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

Comprehensive regional intelligence highlighting distinctive trends challenges and opportunities across the Americas EMEA and Asia-Pacific markets

The Americas region exhibits robust adoption kinetics driven by favorable reimbursement schemes and a mature medical infrastructure, with leading device manufacturers capitalizing on strategic partnerships to penetrate underserved markets. Latin American markets, in particular, are experiencing a surge in demand for cost-efficient platforms that balance performance with affordability, prompting tiered product strategies.

In Europe, Middle East & Africa, evolving regulatory harmonization efforts, notably within the European Medical Device Regulation framework, have elevated entry requirements while simultaneously unlocking pan-regional opportunities. Middle Eastern health systems demonstrate growing interest in next-generation drug delivery implants to address prevalent lifestyle illnesses. Meanwhile, Asia-Pacific markets present a dual narrative: rapid urbanization and expanding healthcare access drive exponential demand growth, even as regulatory variance and reimbursement gaps necessitate region-specific go-to-market tactics. Continuously, these geographic insights inform resource allocation and partnership blueprints.

This comprehensive research report examines key regions that drive the evolution of the Implantable Drug Delivery Device market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

In-depth competitive overview illuminating leading innovators strategic alliances and pipeline advancements within the implantable drug delivery arena

Leading medtech firms are intensifying investments in next-generation implantable systems, forging alliances with semiconductor specialists and polymer scientists to broaden their innovation pipelines. Incumbents differentiate through proprietary delivery mechanisms and value-added digital monitoring services that augment patient engagement. Simultaneously, emerging players forged strategic collaborations with academic institutions, leveraging open innovation models to expedite proof-of-concept validation and clinical translation.

Moreover, the competitive landscape is marked by selective mergers and acquisitions targeting niche capabilities, such as MEMS fabrication expertise and osmotic reservoir miniaturization. As a result, organizations are recalibrating their portfolios to emphasize platform scalability and lifecycle management, recognizing that sustainable differentiation arises from seamless integration of device, data, and services. This evolving dynamic underscores the importance of anticipatory competitive intelligence and proactive ecosystem orchestration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Implantable Drug Delivery Device market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Becton, Dickinson and Company

- Boston Scientific Corporation

- CeQur SA

- Debiotech S.A.

- Enable Injections, Inc.

- Insulet Corporation

- Intarcia Therapeutics, Inc.

- Medtronic plc

- MicroCHIPS Biotechnology, Inc.

- Roche Holding AG

- Sensile Medical AG

- SteadyMed Ltd.

- Tandem Diabetes Care, Inc.

- Terumo Corporation

- Valeritas Holdings, Inc.

- West Pharmaceutical Services, Inc.

- Ypsomed Holding AG

Strategic recommendations designed to empower industry leaders to capitalize on emerging opportunities navigate uncertainties and foster sustainable growth

To thrive in this evolving environment, industry leaders should prioritize strategic investments in microchip-enabled delivery platforms that facilitate real-time dosing optimization and remote therapy management. In addition, cultivating collaborative relationships with regulatory agencies can expedite approval timelines while shaping policies that accommodate emerging hybrid devices.

Furthermore, diversifying manufacturing footprints through joint ventures in nearshore facilities can alleviate tariff exposures and reinforce supply chain resilience. Concurrently, embedding advanced analytics into post-market surveillance frameworks will enable predictive maintenance, reduce adverse event rates, and strengthen payer and provider partnerships. Collectively, these recommendations equip organizations to capitalize on innovation waves, mitigate operational risks, and sustain competitive advantage.

Rigorous research framework combining primary expert engagements secondary data analysis and advanced validation techniques to ensure robustness

This research integrates primary engagements with key industry stakeholders, including clinical investigators, regulatory specialists, and supply chain executives, to capture firsthand perspectives on technological, policy, and market dynamics. Complementing these interviews, secondary data sources such as peer-reviewed journals, patent databases, and regulatory filings provide a robust knowledge base, ensuring that findings reflect the latest advancements and compliance frameworks.

Data triangulation methodologies are employed to reconcile divergent insights, while advanced validation workshops bring together cross-functional experts to stress-test hypotheses. Quality controls, including systematic audit trails and metadata governance, underpin the study’s rigor. As a result, the research outputs deliver both depth and reliability, furnishing decision-makers with an evidence-driven foundation for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Implantable Drug Delivery Device market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Implantable Drug Delivery Device Market, by Product Type

- Implantable Drug Delivery Device Market, by Technology

- Implantable Drug Delivery Device Market, by Application

- Implantable Drug Delivery Device Market, by End User

- Implantable Drug Delivery Device Market, by Region

- Implantable Drug Delivery Device Market, by Group

- Implantable Drug Delivery Device Market, by Country

- United States Implantable Drug Delivery Device Market

- China Implantable Drug Delivery Device Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding insights synthesizing critical takeaways and outlining future outlook trajectories for the implantable drug delivery sphere

The trajectory of implantable drug delivery systems is defined by an intersection of innovation, regulatory evolution, and shifting stakeholder expectations. By harnessing the unique advantages of polymer science, microelectronics, and digital connectivity, the industry is poised to elevate therapeutic precision and enhance longitudinal patient engagement.

As tariffs reshape supply chain architectures and regional disparities clarify market entry strategies, organizations that adopt agile operational models and collaborative innovation approaches will emerge as frontrunners. Ultimately, success will hinge on the ability to integrate devices, data, and services into unified care ecosystems, thereby unlocking the full potential of implantable drug delivery.

Compelling call to action urging decision-makers to engage with Associate Director Ketan Rohom for acquiring comprehensive insights and unlocking strategic advantage

To secure an authoritative strategic guide on evolving trends and deep market intelligence in the implantable drug delivery domain, we encourage direct engagement with Ketan Rohom, whose leadership in sales and marketing expertise can facilitate a tailored acquisition process. He will outline how the comprehensive research report aligns with your organizational priorities and investment strategy, ensuring you obtain actionable intelligence that supports informed decision-making and competitive differentiation.

Reach out to Ketan Rohom to explore bespoke data deliverables, custom analytics modules, and priority insights, establishing a partnership that accelerates your market entry or expansion initiatives. By taking this step, you will position your organization at the vanguard of innovation, equipped with the clarity to anticipate shifts, optimize resource allocation, and drive sustainable growth within the rapidly evolving implantable drug delivery landscape

- How big is the Implantable Drug Delivery Device Market?

- What is the Implantable Drug Delivery Device Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?