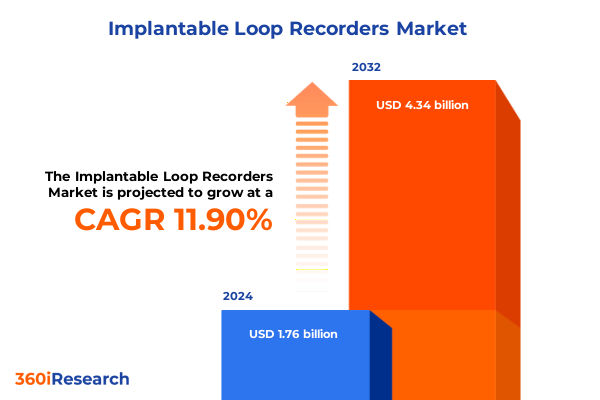

The Implantable Loop Recorders Market size was estimated at USD 1.95 billion in 2025 and expected to reach USD 2.17 billion in 2026, at a CAGR of 12.04% to reach USD 4.34 billion by 2032.

Unveiling the Future of Long-Term Cardiac Surveillance Through Advanced Implantable Loop Recorders Addressing Critical Arrhythmia Challenges

Implantable loop recorders have emerged as a pivotal innovation in long-term cardiac monitoring, offering an unparalleled window into arrhythmic events that often elude traditional diagnostic modalities. By continuously capturing heart rhythms for up to several years, these miniaturized devices empower clinicians to identify transient or asymptomatic conditions that might otherwise remain undetected. With advances in biocompatible materials and energy-efficient electronics, today’s recorders deliver greater reliability and patient comfort, underpinning their growing adoption across cardiology practices and neurology clinics alike.

Historically, the impulse for extended monitoring arose from the need to trace elusive episodes of syncope and palpitations, which standard Holter monitors and event recorders frequently failed to capture. Modern implantable loop recorders now integrate wireless connectivity, enabling seamless data transmission to cloud-based platforms and real-time analysis by care teams. This shift not only enhances diagnostic yield but also streamlines workflow by reducing the frequency of in-person visits and manual data downloads.

Moreover, patient adherence has significantly improved as device miniaturization and minimally invasive insertion techniques mitigate procedural discomfort and visibility under the skin. This patient-centric evolution has, in turn, driven broader acceptance among both primary care physicians and specialty clinics. Consequently, healthcare providers can deliver more precise risk stratification, guide therapy decisions, and monitor responses to anticoagulant and antiarrhythmic regimens with unprecedented clarity.

In this executive summary, we delve into the technological breakthroughs, regulatory influences, and clinical adoption patterns shaping the implantable loop recorder landscape. Through systematic analysis of tariff impacts, segmentation nuances, regional dynamics, and competitive strategies, this report equips stakeholders with actionable intelligence to navigate the rapidly evolving market environment.

Identifying Paradigm-Altering Innovations and Regulatory Evolutions Reshaping the Implantable Loop Recorder Landscape Across Clinical Practice

The landscape of implantable loop recorders is undergoing transformative shifts driven by converging advancements in materials science, wireless communication, and data analytics. Recent breakthroughs in sensor miniaturization have enabled continuous, high-fidelity electrocardiographic monitoring without compromising battery life or device longevity. As a result, next-generation recorders capture more nuanced arrhythmic signatures, facilitating earlier and more accurate diagnoses of paroxysmal atrial fibrillation and complex bradyarrhythmias.

Furthermore, the integration of secure Bluetooth transmission and proprietary cloud-based platforms is revolutionizing clinician-to-patient connectivity. Real-time alerts, powered by artificial intelligence algorithms trained to detect aberrant rhythms, enable proactive interventions that may reduce emergency department visits and hospital readmissions. At the same time, evolving regulatory frameworks are beginning to accommodate software updates and remote device adjustments, fostering a more agile approach to post-approval enhancements.

In addition, partnerships between device manufacturers and health systems are catalyzing novel care pathways, where remote monitoring programs extend beyond hospitals into homecare settings and ambulatory surgical centers. These collaborations, in conjunction with emerging reimbursement models that reward value-based care, are incentivizing providers to integrate implantable recorders into comprehensive patient management strategies. Consequently, industry players are exploring bundled-service offerings that include device implantation, data interpretation, and longitudinal follow-up.

Collectively, these innovations and policy reforms are redefining expectations for cardiac surveillance. By harmonizing technological evolution with clinical workflows and payment structures, implantable loop recorders are poised to become indispensable instruments in personalized cardiovascular care.

Evaluating the Far-Reaching Consequences of 2025 United States Tariff Adjustments on Supply Chains, Device Costs, and Adoption Dynamics in Cardiac Monitoring

The implementation of new United States tariffs in 2025 marks a watershed moment for the implantable loop recorder market, introducing fresh complexities in component sourcing and device manufacturing economics. Many manufacturers rely on specialized sensors and semiconductor components sourced globally; with increased duties on imported materials, supply chain managers are grappling with cost pressures that may ripple through final pricing structures. Consequently, strategic procurement and regional diversification have gained prominence as companies seek to shield their production pipelines from recurring tariff fluctuations.

In response to these headwinds, several device developers have accelerated efforts to localize key manufacturing stages or forge alliances with domestic suppliers. While reshoring certain assembly processes can mitigate tariff liabilities, it also demands capital investment and stringent quality control measures to maintain biocompatibility and electrical safety standards. This dual imperative has prompted device companies to assess the trade-offs between near-term cost increases and long-term resilience against geopolitical volatility.

Moreover, healthcare providers and group purchasing organizations are increasingly scrutinizing total cost of ownership for implantable recorders. As procurement cycles align more closely with value-based care metrics, the incremental expense stemming from tariff-induced component cost hikes may intensify negotiations over reimbursement rates. Payers, eager to contain overall cardiac care expenditures, could impose more rigorous pre-authorization protocols or adjust coverage guidelines, potentially affecting adoption timelines for new recorders.

Despite these challenges, the industry is adapting by refining product portfolios and exploring novel pricing frameworks. Device manufacturers are piloting subscription-based service models and bundled offerings that distribute up-front costs across remote monitoring, device implantation, and post-procedural analysis. This strategic recalibration underscores the sector’s ability to innovate around regulatory shifts, ensuring continued advancement of diagnostic capabilities in the face of evolving trade policies.

Unraveling Patient Profiles, Device Variations, and Care Settings to Illuminate Critical Segmentation Insights Within the Implantable Loop Recorder Market

In dissecting critical segmentation insights, it becomes clear that diverse clinical indications and device characteristics shape the implantable loop recorder market in nuanced ways. Patients with atrial fibrillation-whether paroxysmal, persistent, or permanent-represent one of the largest cohorts benefiting from continuous arrhythmia detection, while individuals experiencing unexplained syncope, palpitations, or cryptogenic stroke form important subgroups that demand tailored diagnostic strategies. Additionally, bradyarrhythmia patients, whose heart rates dip below normal thresholds, rely on recorders capable of capturing prolonged pauses and symptomatic correlations.

Equally significant is the range of product offerings that cater to varying clinical use cases and physician preferences. Devices such as Biomonitor III provide extended battery life and automated event detection, whereas platforms like Confirm Rx leverage smartphone connectivity for seamless data uploads. Lux Dx recorders enhance signal acquisition with multi-lead sensing capabilities, and Reveal Linq continues to be a workhorse solution noted for its compact profile and proven reliability. Each product’s feature set informs clinician selection, impacting procedural workflows and post-implantation follow-up.

Procedure location further stratifies market dynamics, as inpatient insertions often coincide with acute care evaluations, whereas outpatient settings-from ambulatory surgical centers to specialized cardiology clinics-offer streamlined pathways for elective monitoring. End users range from high-volume hospitals, including community and tertiary care facilities, to homecare environments that facilitate remote management and patient-led symptom reporting. This distribution model underscores the importance of aligning device design with intended clinical settings and resource availability.

Finally, the spectrum of applications extends from comprehensive arrhythmia management-encompassing both bradyarrhythmia and tachyarrhythmia detection-to cryptogenic stroke monitoring, diagnostic evaluation for unexplained chest discomfort, and general cardiac surveillance. Each application niche imposes distinct performance and data-interpretation requirements, shaping not only the technological roadmap but also the training and support structures needed to maximize diagnostic yield.

This comprehensive research report categorizes the Implantable Loop Recorders market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Indication

- Product

- Procedure Location

- End User

- Application

Dissecting Regional Variances Across Americas, EMEA, and Asia-Pacific to Decipher Growth Patterns, Access Dynamics, and Reimbursement Environments

Regional landscapes exert a profound influence on the adoption and integration of implantable loop recorders, with distinct drivers emerging across the Americas, Europe-Middle East-Africa, and Asia-Pacific markets. In North America, advanced healthcare infrastructure and value-based reimbursement schemes have accelerated the uptake of continuous monitoring solutions. Reimbursement authorities increasingly recognize the preventive impact of early arrhythmia detection on stroke mitigation, shaping coverage policies that favor broad device deployment in both inpatient and outpatient contexts.

Conversely, within Europe-Middle East-Africa, heterogeneous regulatory frameworks and variable payer structures create a mosaic of opportunity and challenge. While economies such as Germany and France boast established guidelines for implantable recorder reimbursement, emerging markets in the Middle East and select African nations grapple with constrained budgets and limited specialty care access. In these regions, partnerships with public health agencies and philanthropic organizations often underpin pilot programs that demonstrate clinical utility and foster stakeholder buy-in.

Meanwhile, the Asia-Pacific region represents a dynamic frontier characterized by rapid infrastructural investments and escalating demand for remote patient monitoring. China’s domestic device manufacturers are increasingly competitive on price and features, stimulating innovation and expanding options for local hospitals and diagnostic centers. In parallel, health authorities in Japan and South Korea are refining coverage pathways to support digital health technologies, which bodes well for the integration of wireless data platforms and AI-enabled alerting systems across high-throughput cardiology services.

Despite divergent market maturities and regulatory environments, a common theme emerges: stakeholders across all regions are seeking to optimize care pathways by embedding implantable loop recorders into multidisciplinary management programs. By navigating complex reimbursement landscapes and forging strategic alliances, manufacturers and providers can cultivate sustainable growth trajectories in each geographic market.

This comprehensive research report examines key regions that drive the evolution of the Implantable Loop Recorders market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Steering the Implantable Loop Recorder Market Through Technological Advancement and Partnerships

Leading companies in the implantable loop recorder domain are distinguished by their ability to innovate rapidly while forging strategic alliances across the healthcare ecosystem. Several market frontrunners have demonstrated this through continuous enhancements to device miniaturization and battery longevity. By investing in proprietary sensor technologies, these firms are delivering incremental performance gains that strengthen clinical confidence in long-term monitoring outcomes.

In addition to organic product development, many organizations are pursuing acquisitions and joint ventures to augment their digital health portfolios. Collaborative efforts with electronic health record providers and telemedicine platforms have yielded integrated solutions that present clinicians with a unified dashboard for rhythm analysis and patient management. These partnerships exemplify a shift toward holistic service delivery, where data interpretation, patient engagement, and follow-up protocols converge under a single vendor umbrella.

Moreover, several competitors have instituted specialized training and certification programs for electrophysiologists and allied healthcare professionals. By establishing dedicated centers of excellence, they ensure that technical proficiency and best practice guidelines permeate clinical communities, thereby reducing adoption barriers and enhancing patient outcomes. Such programs frequently involve ongoing clinical research collaborations, yielding real-world evidence that bolsters reimbursement negotiations and regulatory submissions.

Finally, forward-thinking companies are exploring cross-industry alliances with software developers and academic institutions to harness machine learning algorithms for advanced rhythm classification. This emphasis on predictive analytics underscores the broader trend toward precision cardiology, where personalized risk stratification and automated alerting systems refine decision-making. Collectively, these strategic moves illustrate how corporate leadership, technological foresight, and collaborative ecosystems coalesce to shape the future of implantable loop recorder innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Implantable Loop Recorders market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AliveCor Inc.

- Angel Medical Systems Inc.

- Bardy Diagnostics Inc.

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- GE HealthCare Technologies Inc.

- Hill-Rom Holdings Inc.

- iRhythm Technologies Inc.

- Koninklijke Philips N.V.

- Medtronic plc

- Nihon Kohden Corporation

- Preventice Solutions Inc.

- Siemens Healthineers AG

- Zoll Medical Corporation

Transformative Strategies and Tactical Roadmaps for Industry Leaders to Capitalize on Emerging Opportunities in Implantable Loop Recorder Development and Adoption

Industry leaders seeking to capitalize on the promise of implantable loop recorders should adopt a multipronged strategy that addresses technological innovation, stakeholder engagement, and supply chain robustness. First, ongoing investment in miniaturization and energy-efficient circuit design will differentiate next-generation devices by offering extended monitoring horizons with minimal patient burden. Companies should prioritize modular architectures that facilitate future software enhancements and sensor upgrades.

Concurrently, device manufacturers must deepen engagement with payers and regulatory bodies to articulate the value proposition of early arrhythmia detection. Crafting compelling real-world evidence portfolios-supported by post-market surveillance studies in partnership with academic centers-will strengthen coverage agreements and streamline reimbursement processes. Moreover, embedding device services within value-based care models can align incentives across providers, payers, and patients.

On the operational front, supply chain diversification is paramount in mitigating the impact of tariff volatility and component shortages. Collaborations with regional manufacturing hubs, supplemented by dual-sourcing strategies for critical modules, will enhance resilience against geopolitical risks. In parallel, companies should implement advanced analytics to forecast demand patterns and optimize inventory buffers.

Finally, strategic alliances with digital health and telemedicine platforms can unlock new revenue streams and promote continuity of care. By integrating remote monitoring dashboards with electronic health record systems, device makers enable seamless data exchange and foster clinician adoption. Embedding AI-driven insights within these platforms not only enhances diagnostic accuracy but also positions stakeholders at the forefront of personalized cardiovascular care.

Comprehensive Mixed-Methods Framework Combining Primary Interviews, Secondary Sources, and Rigorous Data Validation Techniques Underpinning Market Insights

The research methodology underpinning this report combines rigorous primary data collection with exhaustive secondary analysis to ensure both depth and validity of insights. Primary research consisted of in-depth interviews with key opinion leaders, including electrophysiologists, cardiac device specialists, and healthcare administrators across North America, Europe-Middle East-Africa, and Asia-Pacific. These qualitative engagements provided nuanced perspectives on clinical workflows, patient experience, and procurement criteria, which were then subjected to thematic coding and triangulation.

Secondary research entailed a comprehensive review of peer-reviewed journals, regulatory filings, white papers, and conference proceedings published within the past three years. This desk research enabled cross-verification of primary findings, identification of emerging technology trends, and contextualization of tariff and reimbursement developments. Furthermore, proprietary patent analyses and technical specifications were evaluated to map the competitive landscape and intellectual property trajectories.

To reinforce data integrity, quantitative inputs-such as device shipment trends and installer activity-were validated through multiple sources, including industry associations and semi-annual financial disclosures. A structured data validation protocol was applied, incorporating error-checking routines and consistency assessments to eliminate anomalies. Additionally, expert advisory panels convened at critical milestones to review preliminary findings and refine analytical frameworks.

Finally, insights were synthesized through an iterative process that balanced exploratory research with hypothesis-driven analysis. This phased approach ensured that the final report delivers actionable intelligence grounded in empirical evidence and stakeholder consensus, equipping decision-makers with a robust foundation for strategic planning and competitive differentiation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Implantable Loop Recorders market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Implantable Loop Recorders Market, by Indication

- Implantable Loop Recorders Market, by Product

- Implantable Loop Recorders Market, by Procedure Location

- Implantable Loop Recorders Market, by End User

- Implantable Loop Recorders Market, by Application

- Implantable Loop Recorders Market, by Region

- Implantable Loop Recorders Market, by Group

- Implantable Loop Recorders Market, by Country

- United States Implantable Loop Recorders Market

- China Implantable Loop Recorders Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesis of Key Findings and Implications Emphasizing the Pivotal Role of Implantable Loop Recorders in Shaping Future Cardiac Care Paradigms

In synthesizing key findings, it is evident that implantable loop recorders occupy a central role in advancing personalized cardiac care by enabling continuous, high-resolution rhythm monitoring. Technological progress in sensor design, energy efficiency, and wireless connectivity has heightened device reliability and patient acceptance, transforming diagnostic pathways for arrhythmia management and cryptogenic stroke monitoring. Moreover, the confluence of value-based reimbursement models and remote data analytics is reshaping care delivery, fostering collaboration between device makers, healthcare providers, and payers.

The introduction of 2025 United States tariffs has underscored the imperative for supply chain agility, prompting manufacturers to reevaluate sourcing strategies and pursue regional manufacturing partnerships. Simultaneously, segmentation analysis reveals diverse clinical use cases-ranging from atrial fibrillation subtypes to syncope evaluation-that necessitate tailored device features and support services. Regional insights highlight the importance of navigating heterogeneous regulatory and reimbursement landscapes in the Americas, EMEA, and Asia-Pacific, where localized collaborations and pilot initiatives drive market entry.

Key industry players have distinguished themselves through a blend of organic innovation and strategic alliances, leveraging training programs and predictive analytics to enhance clinician proficiency and diagnostic yield. For industry leaders, actionable recommendations include investing in modular device platforms, reinforcing value articulation with payers, and forging collaborations with digital health ecosystems to streamline data integration. Such approaches will not only mitigate geopolitical and regulatory risks but also unlock new avenues for growth.

Ultimately, this multifaceted landscape demonstrates that the future of implantable loop recorders hinges on harmonizing technological ingenuity with stakeholder alignment. By adopting holistic, evidence-based strategies, manufacturers and care providers can accelerate the transition to predictive, precision-focused cardiac surveillance.

Connect Directly With Ketan Rohom to Unlock In-Depth Market Intelligence and Propel Strategic Decision-Making in Implantable Cardiac Monitoring

We at the forefront of specialized market research recognize that discerning decision-makers require deep, tailored insights to guide product development and strategic positioning in the implantable cardiac monitoring space. To gain comprehensive access to rich datasets, granular segmentation analysis, and forward-looking perspectives, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this detailed research report can support your organization’s goals. Engaging with an experienced industry leader will ensure personalized guidance on integrating these findings into your corporate strategy, accelerating time to market, and enhancing competitive advantage. Reach out to Ketan Rohom to arrange a private briefing, discuss bespoke consulting support, and secure your copy of the full market research report. Transform your understanding of the implantable loop recorder landscape and propel your strategic decision-making with authoritative insights at your fingertips

- How big is the Implantable Loop Recorders Market?

- What is the Implantable Loop Recorders Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?