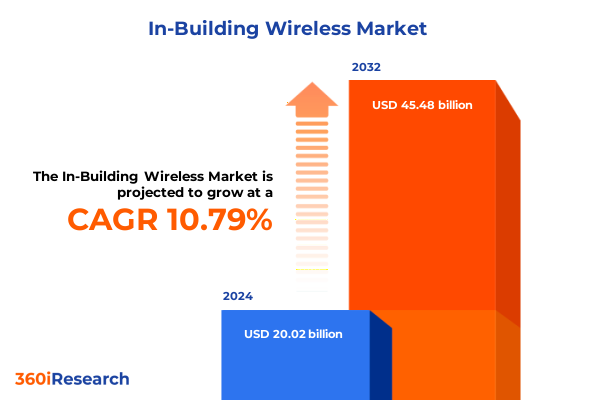

The In-Building Wireless Market size was estimated at USD 22.07 billion in 2025 and expected to reach USD 24.36 billion in 2026, at a CAGR of 10.88% to reach USD 45.48 billion by 2032.

A dynamic overview of the critical drivers shaping the evolution of in-building wireless and its impact on enterprise and public safety connectivity

In recent years, the demand for reliable, high-capacity wireless connectivity within buildings has surged as organizations seek to support an ever-growing array of mobile devices, mission-critical IoT applications, and unified communication platforms. This executive summary introduces key trends and considerations underpinning the evolution of in-building wireless, emphasizing its central role in enabling seamless user experiences across commercial, industrial, educational, and public safety environments. With enterprises expanding digital transformation initiatives and regulatory bodies mandating robust coverage standards, stakeholders are compelled to reimagine traditional network design to accommodate increased bandwidth requirements and stringent performance parameters.

Transitioning from legacy architectures to more agile, software-centric solutions is reshaping how businesses approach in-building wireless deployment. The integration of advanced analytics, network management platforms, and security capabilities is driving operational efficiencies while mitigating risks associated with unauthorized access and system vulnerabilities. Simultaneously, the proliferation of 5G and Wi-Fi 6 technologies is redefining performance benchmarks, unlocking new use cases that demand low-latency, high-throughput connections. Against this backdrop, a comprehensive understanding of market drivers, technological shifts, regional dynamics, and regulatory impacts becomes indispensable for executives seeking to make informed investment decisions. This section sets the stage for a deeper exploration of transformative forces, tariff influences, segmentation insights, and strategic imperatives that define the current in-building wireless landscape.

Examining pivotal transformative shifts in network architecture, analytics, and convergence that are reshaping in-building wireless deployment strategies

The in-building wireless market is undergoing transformative shifts driven by the convergence of emerging technologies, evolving user behaviors, and the imperative for data-driven decision-making. As 5G deployments accelerate, network architectures are becoming more distributed and software-defined, enabling adaptive resource allocation and real-time performance optimization. This transition from conventional passive systems to active, cloud-enabled solutions elevates the importance of integrated orchestration platforms that support network slicing, virtualization, and over-the-air updates.

Concurrent with architectural changes, the adoption of AI-driven analytics empowers facility managers and service providers to proactively monitor network health, predict capacity bottlenecks, and automate maintenance workflows. These capabilities not only enhance reliability but also reduce operational expenditures by minimizing manual interventions. Moreover, the intersection of in-building wireless with edge computing is unlocking new avenues for latency-sensitive applications such as augmented reality in manufacturing, autonomous robotics, and mission-critical public safety communications.

User expectations for uninterrupted connectivity have also catalyzed a shift towards heterogeneous network models that seamlessly blend cellular, Wi-Fi, and private LTE/5G infrastructures. This convergence demands cohesive security frameworks capable of enforcing consistent policies across multiple access technologies. Taken together, these transformative shifts underscore a landscape where agility, intelligence, and interoperability converge to drive the next wave of in-building wireless innovation.

Analyzing the multifaceted impact of new U.S. tariffs on in-building wireless supply chains, cost structures, and strategic procurement approaches

In 2025, the United States enacted a series of tariffs targeting critical electronic components, from semiconductors to specialized RF amplifiers and antenna elements. These measures have exerted upward pressure on component costs, prompting equipment manufacturers and system integrators to re-evaluate sourcing strategies and reequip domestic production capabilities. As a result, lead times for amplifiers, cabling assemblies, and headend modules have lengthened, impacting project schedules and capital deployment for large-scale in-building wireless rollouts.

The ripple effects of these tariffs extend beyond hardware procurement. Service providers are recalibrating pricing models to offset increased installation expenses and maintenance overheads, while end users are reassessing upgrade cycles to balance performance objectives against budgetary constraints. Furthermore, the need to comply with evolving trade regulations has introduced additional administrative complexity, requiring dedicated legal and supply chain teams to ensure import-export compliance and mitigate the risk of potential fines.

Despite these challenges, the tariff environment has also catalyzed innovation within the domestic manufacturing sector. Several suppliers have announced plans to expand U.S.-based production facilities for antennas, repeaters, and small cell components, aiming to reduce dependency on imported goods. This re-shoring trend, supported by government incentives for strategic industries, promises to enhance supply chain resilience over the medium term, though near-term cost pressures will likely persist. Overall, the 2025 tariffs represent a crucial inflection point that is reshaping procurement strategies, cost structures, and long-term investment decisions across the in-building wireless ecosystem.

Unveiling in-depth segmentation analysis across components, system types, technologies, and applications to illuminate market dynamics and solution architectures

Insight into the in-building wireless ecosystem reveals a multifaceted market structured around components, system types, technologies, and applications. When examining components, the market encompasses hardware including amplifiers, antennas, cabling, and headend equipment; services such as consulting, installation, and maintenance & support; and software covering analytics, network management, and security. This tripartite division highlights the interplay between physical infrastructure, expert services, and digital platforms required to deliver consistent coverage and performance.

System type segmentation further dissects market offerings into distributed antenna systems, repeaters, and small cells. Distributed antenna systems branch into active configurations that incorporate amplification and signal processing, as well as passive variants that rely on coaxial cabling to distribute coverage. Repeaters divide into bidirectional amplifiers that enhance weak signals and passive repeaters that reflect signals without electronic gain. Small cells represent a compact, cell-site alternative, differentiated into femtocells designed for residential or small office environments, microcells for medium-density areas, and picocells that serve targeted coverage zones within larger facilities.

Technology-driven segmentation underscores the co-existence of 4G, 5G, and Wi-Fi networks, each offering distinct performance attributes and deployment considerations. Alongside connectivity standards, application segmentation illustrates the market’s breadth-spanning commercial settings such as healthcare, hospitality, offices, retail, and transportation, as well as education, industrial complexes, and public safety domains. Together, these layers of segmentation provide a comprehensive framework for understanding tailored solutions and investment priorities across diverse use cases.

This comprehensive research report categorizes the In-Building Wireless market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- System Type

- Technology

- Application

Illuminating market disparities across Americas, Europe Middle East Africa, and Asia-Pacific driven by regulatory, investment, and adoption trends

Regional dynamics in the in-building wireless market are influenced by a confluence of regulatory mandates, infrastructure investment levels, and the pace of technological adoption. In the Americas, federal and state governments have reinforced signal reliability standards for public safety, while private enterprises are driving 5G campus network deployments to support IoT-driven logistics and smart building initiatives. This has spurred heightened interest in converged architectures that align cellular and Wi-Fi coverage without sacrificing quality of service.

Across Europe, the Middle East, and Africa, regulatory frameworks vary widely; Western European nations emphasize spectrum re-farming and coordinated indoor coverage policies, whereas emerging markets in the Middle East and Africa prioritize foundational network expansion and cost-effective repeater solutions. Multinational corporations operating across these regions seek unified management platforms to ensure consistent performance and security across disparate regulatory regimes. Collaborative efforts between telecom operators and system integrators are also advancing public safety implementations, particularly in government and infrastructure projects.

In the Asia-Pacific region, aggressive digital transformation agendas and state-funded 5G trials have accelerated the adoption of small cell networks and distributed antenna systems. Industrial hubs in East Asia are particularly focused on integrating private LTE and Wi-Fi 6 solutions in factory automation, while educational institutions in Southeast Asia are investing in high-density coverage to support remote learning and campus-wide connectivity. Collectively, these regional insights underscore the necessity for solutions that can adapt to regulatory diversity and local investment climates.

This comprehensive research report examines key regions that drive the evolution of the In-Building Wireless market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling how top industry players are driving innovation through partnerships, cloud-native solutions, and integrated service offerings

Leading participants in the in-building wireless sphere are distinguished by their ability to integrate end-to-end solutions that marry advanced hardware, software intelligence, and specialized services. Established infrastructure providers have differentiated themselves by forging strategic partnerships with chipset manufacturers, enabling accelerated development cycles for 5G-ready small cells and active distributed antenna systems that can be deployed in mission-critical environments.

Innovators specializing in network management platforms are gaining traction by offering cloud-native analytics and security features that simplify multi-technology orchestration. These firms have invested heavily in machine learning algorithms to predict signal degradation points and optimize power distribution across large, complex indoor venues. Concurrently, service-focused entities with deep systems integration expertise are carving out a niche by delivering turnkey deployments and managed support models that relieve enterprises of operational burdens.

Strategic collaborations between telecom operators and technology vendors are also redefining competitive dynamics. Joint ventures targeting smart city and public safety initiatives are pooling resources to develop interoperable solutions that meet stringent coverage and resilience benchmarks. Moreover, a wave of mergers and acquisitions is consolidating capabilities, as larger players seek to absorb specialized R&D talent and expand their global footprint. These competitive maneuvers underscore the importance of agility and innovation in maintaining market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the In-Building Wireless market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Accelleran NV

- Acuity Brands, Inc.

- Advanced RF Technologies, Inc.

- American Tower Corporation

- ANS Advanced Network Services, LLC

- AT&T Inc.

- Casa Systems, Inc.

- Cisco Systems, Inc.

- Comba Telecom Systems Holdings Limited

- Comba Telecom Systems Holdings Ltd.

- CommScope Holding Company, Inc.

- Corning Incorporated

- Crown Castle Inc.

- Diamond Communications LLC

- Fujitsu Limited

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- Huber+Suhner AG

- iBwave Solutions Inc.

- In-Building Cellular, Inc.

- JMA Wireless, Inc.

- MORCOM International, Inc.

- NEC Corporation

- Nokia Corporation

- Powertec Telecommunications Pty Ltd.

- Samsung Electronics Co., Ltd.

- Schneider Electric SE

- Siemens AG

- Signals Defense LLC

- SOLiD Distributed Antenna Systems, Inc.

- TE Connectivity Ltd.

- Telefonaktiebolaget LM Ericsson (publ.)

- Verizon Communications Inc.

- WESCO International, Inc.

- Westell Technologies, Inc.

- ZTE Corporation

Delivering a comprehensive set of strategic and operational recommendations to optimize investments, enhance connectivity, and future-proof networks

To navigate the complex in-building wireless environment, industry leaders must adopt a holistic strategy that balances short-term operational needs with long-term innovation goals. Initial steps include conducting comprehensive network audits to pinpoint signal dead zones and capacity constraints, thereby informing targeted infrastructure enhancements. By leveraging AI-assisted analytics, organizations can prioritize investments in areas that yield the highest improvement in user experience and operational efficiency.

Further, leaders should explore hybrid sourcing models that combine domestic production of critical components with selective imports, thereby mitigating tariff-induced cost pressures without compromising on performance. Establishing strategic alliances with local manufacturers can also unlock preferential access to emerging hardware innovations, while reinforcing supply chain agility. On the technology front, integrating private LTE or 5G networks with Wi-Fi 6 deployments via unified orchestration platforms will ensure seamless handovers and consistent security policies across access technologies.

Finally, proactive engagement with regulatory bodies and participation in industry consortia will enable enterprises to anticipate compliance requirements and influence emerging standards. By aligning corporate networks with public safety mandates, organizations can not only safeguard personnel but also contribute to broader community resilience. Collectively, these recommendations provide a roadmap for decision makers to optimize in-building wireless investments and position their organizations for sustained competitive advantage.

Outlining a rigorous mixed-method research approach combining primary interviews, secondary analyses, and structured frameworks to underpin market insights

This research employs a robust, multi-tiered methodology to ensure the validity and reliability of insights presented. Primary data collection involved structured interviews with network engineers, facility managers, system integrators, and C-level executives to capture firsthand perspectives on deployment challenges, performance expectations, and technology preferences. These qualitative inputs were complemented by site visits to commercial campuses, healthcare facilities, and industrial zones to directly observe in-building wireless implementations and identify real-world pain points.

Secondary research sources included publicly available regulatory guidelines, technical white papers, academic journals, and corporate filings, which provided context on tariff developments, spectrum allocations, and standardization initiatives. Proprietary databases were also utilized to track patent filings and product releases, offering an advanced view of innovation trajectories. Data triangulation techniques were applied throughout, cross-referencing disparate information sets to minimize bias and validate critical assumptions.

Analytical frameworks such as SWOT and Porter’s Five Forces were adapted to the in-building wireless domain, enabling structured evaluation of competitive landscapes, supplier dynamics, and technology adoption risks. Financial analysis was excluded to maintain focus on strategic and operational dimensions, consistent with the executive summary’s scope. Finally, all findings were subjected to peer review by industry subject matter experts to ensure technical accuracy and relevance to current market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our In-Building Wireless market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- In-Building Wireless Market, by Component

- In-Building Wireless Market, by System Type

- In-Building Wireless Market, by Technology

- In-Building Wireless Market, by Application

- In-Building Wireless Market, by Region

- In-Building Wireless Market, by Group

- In-Building Wireless Market, by Country

- United States In-Building Wireless Market

- China In-Building Wireless Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Summarizing the critical interplay of technology, regulation, and competitive dynamics that defines the modern in-building wireless landscape

In-building wireless has emerged as a cornerstone technology for supporting the digital ambitions of organizations across diverse sectors. The confluence of 5G expansion, AI-driven network management, and evolving user expectations is redefining how coverage and capacity strategies are conceived and deployed. At the same time, external factors such as tariff realignments and regulatory mandates are reshaping supply chain dynamics and operational priorities.

A clear understanding of market segmentation-from hardware components and system architectures to technology standards and application use cases-empowers stakeholders to tailor investments to specific performance requirements and regulatory landscapes. Regional disparities underscore the need for adaptive solutions that can navigate varying policy frameworks, infrastructure maturity levels, and investment appetites. Meanwhile, competitive pressures are driving collaborations and consolidations that accelerate innovation while expanding service portfolios.

As the in-building wireless ecosystem continues to mature, organizations that embrace a strategic balance between technology adoption, supply chain resilience, and regulatory engagement will be best positioned to deliver seamless connectivity experiences. By integrating advanced analytics, converged network architectures, and proactive vendor partnerships, stakeholders can transform connectivity from a cost center into a strategic asset that drives operational efficiency and long-term growth.

Engage directly with Ketan Rohom for an exclusive in-building wireless market intelligence report that empowers your organization’s strategic leadership

For tailored guidance on leveraging in-building wireless technologies to achieve seamless connectivity, enhanced operational efficiency, and strategic growth, connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His deep expertise in guiding enterprises and service providers through complex market dynamics ensures you receive personalized insights that align with your organization’s objectives. Reach out to secure your comprehensive in-building wireless market research report and transform strategic planning into actionable outcomes that drive competitive advantage and long-term success.

- How big is the In-Building Wireless Market?

- What is the In-Building Wireless Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?