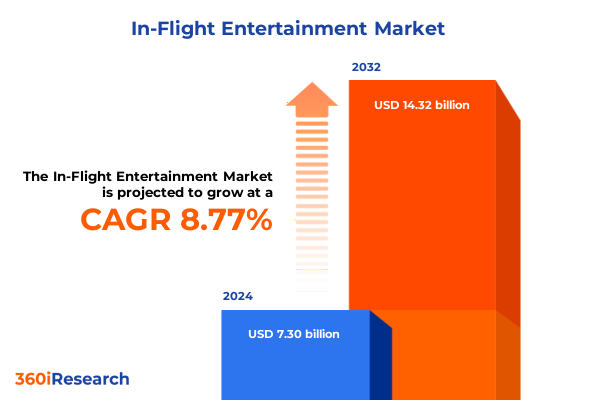

The In-Flight Entertainment Market size was estimated at USD 7.93 billion in 2025 and expected to reach USD 8.61 billion in 2026, at a CAGR of 8.80% to reach USD 14.32 billion by 2032.

Setting the Stage for a New Era of Passenger Delight Through Immersive In-Flight Entertainment Innovations and Industry Dynamics

As air travel continues its post-pandemic resurgence, passenger expectations for engaging, personalized in-flight entertainment experiences have never been higher. Travelers now view airlines not merely as carriers but as providers of premium content ecosystems that rival their ground-based streaming subscriptions. In response, carriers are investing heavily in digital infrastructures that support advanced content delivery, seamless device connectivity, and immersive screen technologies. These strategic priorities underscore the crucial role of in-flight entertainment (IFE) systems as a key differentiator in a fiercely competitive industry.

Uncovering Major Technological and Strategic Transformations Reshaping the Global In-Flight Entertainment Landscape for Enhanced Passenger Experiences

The in-flight entertainment landscape is undergoing a seismic shift driven by breakthroughs in display technology, connectivity, and user personalization. Airlines are partnering with leading electronics suppliers to introduce ultra-high-definition seat-back screens that deliver 4K HDR visuals, promising travelers an unprecedented cinematic experience at 30,000 feet. Concurrently, the rapid rollout of high-speed satellite networks and next-generation wireless protocols is enabling live TV, real-time gaming, and on-demand streaming on personal devices without the need for onboard media servers. Artificial intelligence and advanced analytics are powering dynamic recommendation engines that tailor content to individual viewing patterns, while biometric authentication streamlines user access and enhances data security. Meanwhile, the emergence of virtual and augmented reality applications offers passengers immersive excursions and interactive safety briefings, signaling a future where flights become fully integrated, multimedia journeys.

Analyzing the Far-Reaching Consequences of United States Tariffs on In-Flight Entertainment Hardware and Connectivity Components

The reimposition of steep U.S. tariffs on electronics and aerospace components in early 2025 has introduced significant cost pressures for manufacturers and airlines alike. Display panels, embedded computing modules, and satellite antennas imported from key production hubs face duties ranging from 25% to over 100%, forcing OEMs to reconsider global supply chains. Aircraft manufacturers warn that these levies could add millions of dollars in per-plane costs, potentially slowing retrofit programs and dampening airline investments in new IFE hardware. In reaction, carriers are increasingly pivoting to bring-your-own-device (BYOD) streaming models and cloud-based content platforms that minimize dependence on tariff-affected hardware.

Revealing Deep Insights into Passenger Preferences Across Diverse Hardware, Content, Connectivity, Aircraft, and Cabin Class Segments

Across the hardware spectrum, entrenched seat-back monitors are giving way to more flexible approaches that allow passengers to stream content directly to handheld tablets or smartphones. At the same time, dedicated wireless personal device solutions are gaining traction through in-flight Wi-Fi hotspots that leverage both 4G and emerging 5G air-to-ground networks. Content preferences span live television broadcasts to immersive games, blockbuster movies to curated music playlists, prompting providers to curate libraries that accommodate diverse demographics. Fleet characteristics also play a role: narrow-body jets often favor cost-effective tablet mounts and central streaming servers, regional jets balance weight and power considerations with lightweight seat-back screens, and wide-body aircraft justify full-scale theatrical installations for premium cabins. Finally, cabin segmentation drives tailored experiences, with business and first-class passengers expecting multi-screen interaction and premium content bundles, while economy and premium economy travelers appreciate user-friendly streaming apps and ad-supported content models.

This comprehensive research report categorizes the In-Flight Entertainment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- System Type

- Platform Ownership

- Class Of Service

- Deployment Mode

- Distribution Channel

- Aircraft Category

Navigating Key Regional Dynamics and Adoption Patterns Across Americas, EMEA, and Asia-Pacific In-Flight Entertainment Markets

In North America, carriers are leading the charge on streaming integration, deploying cloud-based platforms alongside domestic Wi-Fi partnerships that deliver consistent connectivity from coast to coast. European and Middle Eastern airlines are pioneering satellite-based high-bandwidth services, equipping ultra-efficient wide-body fleets with Starlink or Ku-band solutions that allow passengers to browse global streaming services even at polar latitudes. In Asia-Pacific, rapid fleet expansion and state-backed technology initiatives are fueling the growth of homegrown IFE systems, while 6G trials promise sub-50-millisecond latencies for telepresence and cloud gaming in the near future. Each region’s regulatory environment, infrastructure investments, and passenger demographics shape distinct adoption patterns.

This comprehensive research report examines key regions that drive the evolution of the In-Flight Entertainment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players’ Strategies, Competitive Advantages, and Collaborative Initiatives in In-Flight Entertainment

Major IFE suppliers are refining their competitive plays to capture emerging opportunities. Panasonic Avionics is scaling modular QLED seat-back displays that integrate AI-driven recommendation engines and offer customizable cabin-class profiles. Thales Group is focusing on security-hardened media servers and real-time analytics dashboards that optimize content caching across fleet networks. Collins Aerospace (now part of Viasat) champions hybrid connectivity systems that combine geostationary satellites with air-to-ground cells for seamless coverage. Gogo is leveraging its 5G ground-station network to offer managed entertainment services aimed at low-cost carriers, while Inmarsat’s GX Aviation continues to expand global Ka-band capacity, partnering with airlines to deliver premium broadband for both leisure and corporate travelers. Emerging startups are also making inroads with niche offerings, including VR-based destination previews and blockchain-secured content rights management.

This comprehensive research report delivers an in-depth overview of the principal market players in the In-Flight Entertainment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Astronics Corporation

- Bluebox Aviation Systems

- Digiserve

- Global Eagle Entertainment Inc.

- Gogo Inc.

- Immfly

- Inmarsat plc

- Intelsat S.A.

- Lufthansa Systems GmbH & Co. KG

- Novair

- Panasonic Avionics Corporation

- Raytheon Technologies

- Safran S.A.

- Thales Group

- Viasat, Inc.

- Zodiac Inflight Innovations

Providing Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends, Mitigate Risks, and Drive Passenger Engagement

To thrive in this rapidly evolving environment, airlines and equipment suppliers should pursue a multi-pronged strategy. First, diversifying supply chains and localizing critical IFE component production will mitigate the impact of tariff fluctuations. Second, expanding BYOD-friendly ecosystems and partnering with major content platforms can reduce hardware capital expenditure while meeting passenger expectations. Third, adopting modular and software-defined architectures ensures IFE systems remain future-proof, allowing seamless upgrades as new codecs, network standards, and UX innovations emerge. Fourth, harnessing AI and advanced analytics will unlock personalized content recommendations, targeted advertising, and operational efficiencies such as predictive hardware maintenance. Finally, developing regional partnerships for satellite capacity and ground-station access will guarantee uninterrupted service across key routes.

Explaining the Rigorous Research Methodology Behind the In-Flight Entertainment Industry Analysis Report to Ensure Reliability

This analysis draws on a robust, multi-method research framework. Primary interviews were conducted with senior technology and cabin experience executives from global airlines, IFE equipment manufacturers, and content aggregators to capture firsthand perspectives. Secondary data sources include leading industry surveys, public company disclosures, and sector-specific white papers, ensuring comprehensive coverage of technological, regulatory, and economic factors. Data triangulation techniques were applied to reconcile divergent viewpoints and validate key themes. Quantitative data on connectivity deployments, cabin retrofits, and content partnerships were systematically mapped to identify patterns, while expert workshops facilitated scenario planning for technology adoption roadmaps. Rigorous peer review throughout the research process upheld analytical integrity and credibility.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our In-Flight Entertainment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- In-Flight Entertainment Market, by Component

- In-Flight Entertainment Market, by System Type

- In-Flight Entertainment Market, by Platform Ownership

- In-Flight Entertainment Market, by Class Of Service

- In-Flight Entertainment Market, by Deployment Mode

- In-Flight Entertainment Market, by Distribution Channel

- In-Flight Entertainment Market, by Aircraft Category

- In-Flight Entertainment Market, by Region

- In-Flight Entertainment Market, by Group

- In-Flight Entertainment Market, by Country

- United States In-Flight Entertainment Market

- China In-Flight Entertainment Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3021 ]

Summarizing Core Findings and Strategic Takeaways to Guide Decision-Makers in Advancing In-Flight Entertainment Excellence

The convergence of 4K HDR displays, next-generation connectivity, personalized AI-driven content, and immersive VR/AR applications represents a pivotal moment for in-flight entertainment. Airlines that proactively adjust their service models-shifting toward BYOD, modular hardware, and cloud-native platforms-will achieve cost efficiencies while delighting passengers with tailored, high-quality experiences. Regional market nuances underscore the importance of strategic partnerships, whether with satellite providers in the Middle East or low-latency ground-networks in North America. Moreover, resilient supply-chain strategies must account for evolving tariff landscapes, ensuring uninterrupted access to critical components. By synthesizing these insights, industry leaders can chart clear, actionable paths that align technology roadmaps with passenger expectations, regulatory requirements, and competitive dynamics.

Ensuring You Take the Next Step by Engaging with Our Associate Director to Secure Comprehensive In-Flight Entertainment Market Insights

To explore the full scope of these in-depth insights and tailor them to your specific strategic priorities, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) today. Ketan will guide you through the report’s comprehensive findings and ensure you have the right data to power your next competitive move in the evolving in-flight entertainment market.

- How big is the In-Flight Entertainment Market?

- What is the In-Flight Entertainment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?