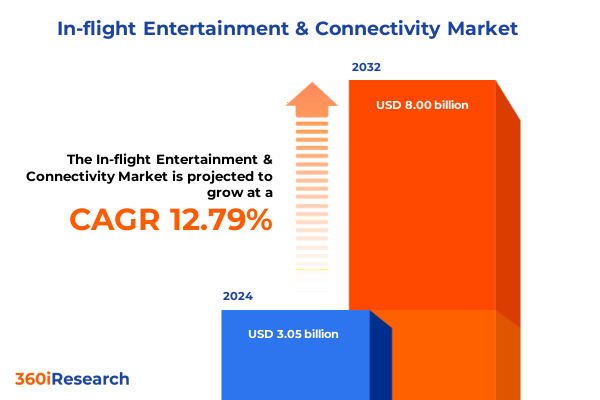

The In-flight Entertainment & Connectivity Market size was estimated at USD 3.45 billion in 2025 and expected to reach USD 3.76 billion in 2026, at a CAGR of 12.75% to reach USD 8.00 billion by 2032.

Harnessing the Skyward Digital Transformation to Elevate Passenger Experiences and Drive Revenue Growth

The aviation industry is undergoing an unprecedented evolution driven by passenger demand for seamless connectivity, immersive entertainment, and personalized services. Rising expectations no longer revolve solely around safety and punctuality but extend to the digital experiences available at 35,000 feet. As travelers increasingly view flight time as productive or leisure opportunities, airlines and in-flight service providers must equip cabins with robust hardware, versatile software, and comprehensive services that collectively redefine the journey. Furthermore, operators are challenged to balance these innovations with regulatory compliance, cost pressures, and the imperative to future-proof investments against rapid technological disruptions.

Amid these dynamics, in-flight entertainment and connectivity (IFEC) solutions are emerging as pivotal differentiators that enhance brand loyalty, unlock ancillary revenue streams, and deliver operational efficiencies. By integrating advanced seatback and personal screen interfaces with broadband internet access, real-time data services, and immersive media content, carriers can cater to diverse passenger segments-ranging from business travelers seeking productivity tools to leisure passengers craving premium entertainment options. Moreover, the scope of IFEC extends beyond passenger-facing offerings: airlines leverage data analytics platforms to optimize route planning, predictive maintenance, and targeted marketing campaigns. Consequently, strategic alignment across hardware manufacturers, software developers, and service integrators has become critical to delivering end-to-end IFEC ecosystems that respond to evolving stakeholder expectations without sacrificing reliability or security.

Unveiling the Technological Convergence and Passenger Expectations That Are Redefining the In-Flight Ecosystem

Over the past few years, transformative shifts in digital infrastructure, content delivery mechanisms, and passenger behavior have converged to reshape the IFEC landscape. First, the proliferation of high-capacity satellite constellations and next-generation air-to-ground networks has significantly expanded bandwidth availability, enabling real-time streaming services and cloud-based applications previously constrained to terrestrial environments. These infrastructure advancements have catalyzed partnerships between satellite operators, network equipment vendors, and content aggregators to co-develop unified platforms capable of seamless handoff between satellite and ground stations, thereby reducing latency and enhancing network resilience.

Simultaneously, passenger expectations have risen in parallel with everyday experiences on the ground. In an era where mobile broadband and over-the-top streaming define personal entertainment, air travelers anticipate uninterrupted connectivity and personalized media curation. This shift has prompted airlines to adopt modular software frameworks and media player middleware that support dynamic content updates, targeted advertising, and user authentication across multiple device types. Additionally, the emerging Internet of Things (IoT) in cabin environments is driving the integration of sensor networks for passenger comfort management, real-time aircraft monitoring, and cabin health analytics, thereby fusing entertainment, connectivity, and operational data into cohesive digital ecosystems.

In concert with these opportunities, the industry is grappling with heightened cybersecurity imperatives and sustainability mandates. The interconnectivity of hardware components, third-party applications, and passenger devices expands the attack surface, necessitating rigorous encryption standards, centralized management platforms, and continuous threat monitoring. Meanwhile, the pursuit of greener aviation compels stakeholders to innovate with lightweight materials, energy-efficient wireless access points, and software-optimized power management protocols. These convergent factors underscore the imperative for a holistic, adaptive approach to IFEC deployment that anticipates future technological inflections while delivering immediate value.

Assessing the Ripple Effects of New U.S. Tariff Policies on Supply Chains Installation Costs and Local Manufacturing Strategies

In 2025, the United States implemented revised tariff schedules targeting a broad range of imported aerospace components, digital electronics, and satellite communication equipment integral to IFEC systems. These measures, introduced under broader trade policy realignments, have elevated duties on key hardware elements such as content servers, wireless access points, and specialized semiconductors. Consequently, manufacturers and integrators face increased landed costs that challenge traditional procurement models. As raw material and module prices ascend, tier-one suppliers are compelled to reexamine supplier relationships and adopt cost-containment strategies without compromising system performance.

Although some carriers have absorbed marginal cost increases through incremental fare adjustments, the cumulative impact extends beyond ticket pricing. Service contracts for installation, integration, maintenance, and software licensing have all been recalibrated to reflect higher operational expenses. This has precipitated negotiations for localized assembly and value-added services within the United States, as vendors seek to circumvent tariffs via domestic production. In parallel, carriers and OEMs are exploring tariff engineering-modifying component designs to qualify for lower-duty classifications-and leveraging trade compliance expertise to maximize prevailing duty drawback programs.

Despite these headwinds, the industry’s response has been characterized by strategic agility. Through collaborative demand forecasting, long-term supply agreements, and process automation, stakeholders are mitigating cost inflation and preserving project timelines. Moreover, the search for alternative high-performance suppliers and expanded regional distribution hubs underscores a broader shift toward supply chain resilience. In essence, while the United States tariffs have introduced new complexity into the IFEC value chain, they have also accelerated efforts to localize, optimize, and diversify sourcing strategies that will wield long-term benefits.

Decoding the Complex Multidimensional Segmentation Framework That Drives Focused Strategies and Tailored IFEC Solutions

A nuanced understanding of market segmentation is essential for stakeholders seeking to tailor IFEC solutions that resonate with diverse airline portfolios and passenger expectations. From the hardware vantage point, the ecosystem comprises content servers, seatback units, and wireless access points, each serving distinct roles in content distribution and network connectivity. Beyond hardware, the services dimension encompasses installation and integration as well as maintenance and support, which together ensure system uptime and seamless upgrades. Meanwhile, software segmentation spans management platforms and media player middleware, offering the orchestration layers that unify content delivery, user interfaces, and backend analytics.

Turning to technology, industry offerings are demarcated by air-to-ground networks, satellite architectures, and the emergent Air-Fi model. Satellite connectivity is further refined into Ka-band, Ku-band, and L-band services, each delivering specific trade-offs between bandwidth, coverage, and licensing complexity. In terms of application, IFEC features range from connectivity services-comprising internet access, real-time data feeds, and VoIP channels-to e-commerce platforms facilitating duty-free shopping and food and beverage ordering, as well as an expanding portfolio of entertainment services that includes games, movies, music, and television programming.

Passenger class segmentation highlights differentiated expectations, with business and first-class travelers prioritizing high-definition seatback screens, personalized content recommendations, and low-latency connectivity for video conferencing, while economy class benefits from cost-effective streaming solutions and curated content bundles. Aircraft type segmentation reveals that widebody and regional jets often require scalable multiservice solutions to cater to long-haul and short-haul mission profiles respectively, whereas business jets demand highly customizable, secure connectivity suites. Distribution channels range from aftermarket upgrades for retrofit opportunities to original equipment manufacturer offerings at the point of production, each reflecting unique procurement cycles and certification requirements. Lastly, payment models in the IFEC space encompass advertising sponsorships, subscription bundles, and transaction-based structures, allowing airlines to monetize services through targeted ad placements, premium content tiers, or per-use charges.

This comprehensive research report categorizes the In-flight Entertainment & Connectivity market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Passenger Class

- Aircraft Type

- Payment Model

- Application

- Distribution Channel

Unraveling Regional Divergences in Spectrum Policies Infrastructure Maturity and Passenger Preferences Impacting IFEC Adoption

Regional dynamics exert a powerful influence on the adoption, regulatory environment, and infrastructure readiness of IFEC solutions across the Americas, Europe, Middle East and Africa, and Asia-Pacific. In the Americas, carriers in North and South America benefit from established satellite gateways, liberalized spectrum policies, and robust aftermarket ecosystems, facilitating rapid deployment of connectivity and entertainment services. Local preferences emphasize live television streaming, social media integration, and loyalty program tie-ins, prompting airlines to forge partnerships with regional content providers and mobile network operators.

Across Europe, the Middle East, and Africa, regulatory frameworks governing spectrum allocation and equipment certification vary significantly, necessitating bespoke approaches for each subregion. Gulf carriers leverage government-led satellite investments to offer ultra-high-bandwidth connectivity on ultra-long-haul routes, while European low-cost airlines focus on lean hardware configurations to drive ancillary revenues through subscription-based entertainment portals. In Africa, infrastructure constraints and emerging mobile markets have inspired hybrid models that blend terrestrial backhaul with satellite fallback capabilities, ensuring basic connectivity even in low-coverage zones.

In Asia-Pacific, the confluence of high passenger volumes, ambitious fleet expansion plans, and receptive regulatory trends has catalyzed rapid innovation in IFEC. Airlines and business jet operators in this region prioritize multi-band satellite services and Air-Fi solutions to address dense traffic in congested airspaces and support digital services for next-generation aircraft platforms. Additionally, joint ventures between local aerospace manufacturers and global connectivity providers are gaining traction, underscoring a collaborative ethos that accelerates technology transfer and regional skill development.

This comprehensive research report examines key regions that drive the evolution of the In-flight Entertainment & Connectivity market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Diverse Competitive Ecosystem of Hardware Innovators Software Pioneers and Satellite Operators Shaping IFEC Offerings

The competitive landscape of the IFEC market features a diverse mix of hardware manufacturers, service integrators, software developers, and satellite operators, each competing to deliver end-to-end solutions that satisfy evolving airline requirements. Prominent hardware vendors have expanded beyond traditional seatback units to offer modular wireless access points and integrated content servers, while leading service providers emphasize turnkey installation, predictive maintenance, and remote support capabilities that minimize aircraft downtime.

Software companies have sharpened their focus on scalable management platforms that centralize device control, content rights management, and system health monitoring, enabling airlines to orchestrate multi-fleet deployments through a single dashboard. Concurrently, middleware developers are optimizing user interfaces for cross-device compatibility and embedding advanced features such as dynamic content recommendations, real-time flight data overlays, and integrated loyalty program touchpoints. Satellite operators are investing in next-generation high-throughput satellites and ground station infrastructure to deliver consistent global coverage and reduced latency, while niche players are exploring emerging technologies such as high-altitude platform systems (HAPS) to address coverage gaps.

Strategic alliances and joint ventures have become commonplace as stakeholders seek to integrate complementary capabilities. Airline groups frequently partner with technology providers to co-develop branded entertainment portals and bespoke connectivity packages, while consortiums with government entities and spectrum regulators enable the acceleration of certification and frequency licensing. The result is a mosaic of collaborations that drive innovation, unlock new monetization avenues, and reinforce the importance of cross-sector partnerships in delivering future-ready IFEC ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the In-flight Entertainment & Connectivity market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AirFi International BV

- Anuvu Operations LLC

- Astronics Corporation

- B/E Aerospace Inc.

- Bluebox Aviation Systems Ltd.

- Burrana Pty Ltd

- Collins Aerospace

- Digecor Inc.

- Flight Display Systems LLC

- Global Eagle Entertainment Inc.

- Gogo Business Aviation LLC

- Honeywell International Inc.

- Inmarsat Aviation

- KID-Systeme GmbH

- Kontron AG

- Lufthansa Systems GmbH & Co. KG

- Lumexis Corporation

- Panasonic Avionics Corporation

- Rockwell Collins Inc.

- Satcom1 A/S

- Spafax Holdings Inc.

- Stellar Entertainment Inc.

- Thales Group

- Viasat Inc.

- Zodiac Aerospace

Implementing Collaborative Technology Roadmaps and Resilient Supply Chain Approaches to Drive IFEC Innovation and Profitability

To capitalize on the accelerating transformation of IFEC, industry leaders must adopt a multifaceted strategy that aligns technological innovation with operational efficiency and customer-centricity. First, cultivating agile partnerships across the hardware, software, and service dimensions will enable rapid prototyping and co-creation of tailored solutions, ensuring that offerings align with airline route structures, passenger demographics, and regulatory contexts. Moreover, leveraging modular, open-architecture frameworks can reduce integration complexity and support incremental upgrades without necessitating complete system overhauls.

In parallel, prioritizing cybersecurity and data privacy is essential. Implementing end-to-end encryption, robust authentication protocols, and continuous vulnerability assessments will protect both corporate assets and passenger data, thereby bolstering trust and regulatory compliance. Additionally, embedding analytics engines and AI-driven algorithms within management platforms will facilitate predictive maintenance, usage-based pricing models, and personalized content recommendations, translating data insights into new revenue streams and optimized asset utilization.

Furthermore, industry participants should pursue regional manufacturing and localized support hubs to mitigate the impact of trade policies and expedite service rollouts. By establishing strategic assembly centers and forging alliances with local system integrators, companies can navigate tariff challenges while enhancing supply chain resilience. Finally, developing flexible payment schemas-including advertising sponsorships, subscription tiers, and microtransactions-will enable airlines to adapt monetization strategies to varying passenger willingness to pay, demographic preferences, and route profiles. Through a concerted focus on collaboration, security, localization, and flexible economics, the IFEC ecosystem can thrive in today’s dynamic aviation environment.

Detailing the Integrated Hybrid Research Approach Combining Secondary Intelligence and Primary Stakeholder Interactions to Ensure Robust Findings

Our research methodology combined rigorous secondary analysis with targeted primary engagements to capture a comprehensive view of the IFEC landscape. Initially, we conducted an exhaustive review of publicly available technical white papers, regulatory filings, industry association reports, and patent databases to map evolving technology standards, certification requirements, and spectrum allocation trends. This secondary phase laid the groundwork for quantitative analyses of technology adoption patterns, component cost drivers, and service model evolution.

Following the secondary research, we engaged in structured interviews and workshops with key stakeholders representing airlines, hardware suppliers, software developers, satellite operators, and regulatory authorities. These interactive sessions provided firsthand insights into procurement cycles, pain points in installation and maintenance processes, and evolving passenger experience objectives. In addition, we surveyed airline route planners, inflight operations managers, and passenger experience specialists to validate segmentation frameworks and refine regional adoption assumptions.

To ensure analytical rigor, data triangulation techniques were employed, cross-verifying interview findings with financial disclosures, certification timetables, and technology deployment case studies. Forecasting models were stress-tested under multiple tariff, capacity, and regulatory scenarios to assess supply chain risks and revenue sensitivities. Finally, expert validation with external advisors and industry consultants ensured that conclusions and recommendations were grounded in current best practices and anticipatory of emerging inflection points.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our In-flight Entertainment & Connectivity market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- In-flight Entertainment & Connectivity Market, by Component

- In-flight Entertainment & Connectivity Market, by Technology

- In-flight Entertainment & Connectivity Market, by Passenger Class

- In-flight Entertainment & Connectivity Market, by Aircraft Type

- In-flight Entertainment & Connectivity Market, by Payment Model

- In-flight Entertainment & Connectivity Market, by Application

- In-flight Entertainment & Connectivity Market, by Distribution Channel

- In-flight Entertainment & Connectivity Market, by Region

- In-flight Entertainment & Connectivity Market, by Group

- In-flight Entertainment & Connectivity Market, by Country

- United States In-flight Entertainment & Connectivity Market

- China In-flight Entertainment & Connectivity Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Summarizing the Strategic Imperatives and Collaborative Pathways That Will Propel the Next Generation of In-Flight Digital Experiences

The in-flight entertainment and connectivity sector stands at the intersection of rapid technological progress and shifting regulatory environments, creating a landscape rich with both opportunity and complexity. The convergence of advanced satellite networks, IoT cabin architectures, and passenger-centric software platforms promises to deliver a new era of immersive, personalized travel experiences. However, stakeholders must remain vigilant in addressing cybersecurity vulnerabilities, supply chain disruptions, and evolving trade policies to maintain momentum.

By embracing modular, open-architecture solutions and forging strategic partnerships, industry participants can accelerate time-to-market while preserving the flexibility to adapt to future innovations. Regional insights underscore the importance of tailored approaches to spectrum management, content localization, and infrastructure investments, while segmentation analysis highlights the necessity of aligning offerings with specific hardware, technology, application, passenger class, aircraft type, distribution channel, and payment model requirements.

Ultimately, the future of IFEC will be shaped by the ability of airlines, manufacturers, and service providers to act in concert, leveraging shared data analytics, scalable content ecosystems, and resilient supply chain frameworks. The strategic recommendations outlined herein provide a roadmap for navigating near-term regulatory challenges and seizing long-term growth opportunities. With a clear understanding of market dynamics, stakeholders are well positioned to deliver next-generation in-flight experiences that drive loyalty, unlock ancillary revenues, and reinforce competitive advantage.

Transform Your In-Flight Entertainment Strategy with a Personalized Consultation to Secure the Definitive Market Intelligence Report

To acquire the comprehensive market research report and unlock the strategic insights that will drive your in-flight entertainment and connectivity initiatives forward, please connect with Ketan Rohom, Associate Director, Sales & Marketing. Ketan’s expertise in translating data-driven findings into actionable business strategies ensures you will have the detailed guidance needed to navigate complex regulatory environments, harness emerging technologies, and outperform competitors. Reach out today to explore customized licensing options that align with your organizational objectives and gain instant access to the extensive analysis, proprietary frameworks, and industry benchmarks contained within the report. Elevate your decision-making with unparalleled market intelligence and secure your competitive edge in the evolving aviation ecosystem by partnering with Ketan Rohom for this essential research asset.

- How big is the In-flight Entertainment & Connectivity Market?

- What is the In-flight Entertainment & Connectivity Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?