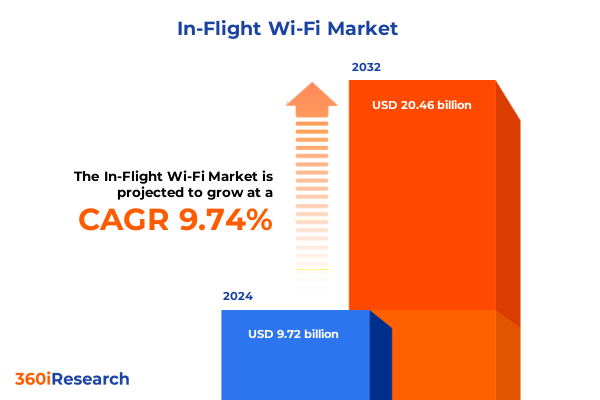

The In-Flight Wi-Fi Market size was estimated at USD 10.47 billion in 2025 and expected to reach USD 11.29 billion in 2026, at a CAGR of 10.03% to reach USD 20.46 billion by 2032.

Exploration of the Evolutionary Journey of In-Flight Wi-Fi and Its Critical Role in Shaping Modern Passenger Connectivity Expectations and Operational Efficiencies

Over the past decade, the aviation industry has witnessed a rapid acceleration in passenger expectations for uninterrupted digital access at 30,000 feet. No longer satisfied with basic messaging capabilities, travelers today demand seamless streaming, high-definition video conferencing, and real-time access to cloud services as part of their onboard experience. This shift has transformed in-flight Wi-Fi from a value-added optional feature to a strategic differentiator among airlines worldwide. As a result, airlines, service providers, and equipment manufacturers are investing heavily in next-generation connectivity solutions to meet these evolving demands.

At the core of this evolution lies the convergence of satellite and air-to-ground platforms, coupled with advancements in antenna design and network management software. Emerging technologies such as low earth orbit (LEO) satellite constellations and 5G-enabled airborne nodes are poised to redefine performance benchmarks for bandwidth, latency, and coverage. Meanwhile, regulatory bodies have begun to update spectrum allocations and safety guidelines to accommodate this new era of in-flight connectivity, setting the stage for accelerated deployment and broader service adoption.

This introduction will establish the fundamental context for understanding why in-flight Wi-Fi has emerged as a critical enabler of passenger satisfaction, ancillary revenue generation, and operational efficiency. It will serve as a launching point for an in-depth exploration of the major shifts, segmentation insights, regional dynamics, and actionable strategies that follow in the subsequent sections.

How Rapid Technological Advances Regulatory Revisions and Market Entrants Are Driving a New Era of In-Flight Wi-Fi Connectivity Innovation

The last several years have been marked by a series of transformative shifts that have reshaped the in-flight connectivity landscape. Technological innovation has led the charge, with the advent of high-throughput satellites offering multi-gigabit capacity and the introduction of advanced beamforming antennas that optimize link reliability. Meanwhile, airlines have embraced digital transformation strategies that integrate connectivity data streams into predictive maintenance, flight operations, and passenger personalization initiatives.

Simultaneously, the rise of new market entrants-such as space-based internet consortia and agile airborne network integrators-has intensified competition, driving down costs and accelerating feature roadmaps. Against this backdrop, legacy providers have been compelled to forge strategic partnerships with platform specialists and software developers to deliver turnkey connectivity packages that balance performance with lifecycle economics.

In addition, escalating cybersecurity threats have forced industry stakeholders to implement robust encryption protocols, intrusion detection systems, and zero-trust network architectures tailored for airborne environments. Regulatory updates, including harmonized spectrum policies and safety certifications for airborne 5G deployments, have further catalyzed the adoption of next-generation solutions. Taken together, these shifts underscore a dynamic marketplace defined by relentless innovation, converging ecosystems, and an unwavering focus on passenger-centric service delivery.

Assessment of the 2025 U.S. Tariff Regime on In-Flight Connectivity Components and Its Compounding Effects on Supply Chains and Service Economics

In 2025, a series of tariff adjustments by the United States government introduced new duties on critical electronic components, impacting the global supply chain for in-flight Wi-Fi hardware. These measures, aimed at protecting domestic manufacturing sectors, have had ripple effects across manufacturers of high-gain antennas, modems, and network management equipment. Consequently, equipment suppliers have been compelled to restructure their procurement strategies, either by sourcing alternative components domestically or by navigating complex import compliance procedures.

At the same time, service providers have faced upward pressure on installation and maintenance costs, prompting them to reevaluate pricing models and contractual terms with airline partners. While some operators have opted to absorb incremental expenses through bundled service agreements, others have explored hybrid pricing structures that balance upfront costs with usage-based fees to maintain affordability for end customers.

Despite these headwinds, the industry has demonstrated resilience through collaborative mitigation initiatives. Suppliers and airlines have formed consortiums to share logistics infrastructure, negotiate collective tariff exemptions, and invest in localized manufacturing facilities within free-trade zones. Additionally, software-driven solutions-such as remote diagnostics and predictive maintenance platforms-have been adopted more widely to reduce the need for on-site technical interventions that incur higher tariff-related charges. This section unpacks the cumulative impact of the 2025 tariff measures on supply chain resilience, cost structures, and strategic partnerships across the in-flight connectivity ecosystem.

Deep Dive into Market Dynamics Across Component Platform Technology Application Installation Pricing and End-User Dimensions to Reveal Adoption Drivers and Commercial Nuances

A comprehensive examination of the market reveals distinct insights when analyzed across multiple segmentation dimensions. By component, the distinctions between hardware, services, and software become apparent in how airlines prioritize investments-some opting for turnkey service packages while others invest heavily in proprietary network management platforms. When considering platform, the bifurcation between air-to-ground and satellite solutions highlights differing coverage footprints and performance trade-offs, and within satellite options, Ka-Band’s high throughput contrasts with the broader coverage of Ku-Band and the reliability of L-Band.

Analyses based on connectivity technology further illuminate competitive dynamics, as the integration of 4G/5G cellular links complements Ka-Band and Ku-Band satellite feeds, whereas L-Band remains the go-to choice for critical backup communications. From an application standpoint, connectivity offerings can be tailored for passenger entertainment services, operational use cases such as real-time flight data transmission, or essential cockpit communication, each with unique quality-of-service requirements. Installation approaches, whether linefit as a factory-installed solution or retrofit for existing fleets, significantly influence deployment timelines and certification pathways.

The pricing model segmentation, ranging from subscription-based plans to pay-per-use schemes and hybrid structures, underscores the ongoing debate between predictable recurring revenues and usage-driven flexibility. Lastly, the diverse end-user landscape-encompassing business jet operators, commercial airlines, and military platforms-drives varied service level agreements, regulatory compliance standards, and aftermarket support requirements. By weaving together these perspectives, this section illuminates the nuanced decision criteria shaping technology adoption and commercial strategies across the in-flight Wi-Fi domain.

This comprehensive research report categorizes the In-Flight Wi-Fi market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Platform

- Connectivity Technology

- Installation

- Pricing Model

- Application

- End User

Comparative Analysis of Americas EMEA and Asia-Pacific In-Flight Connectivity Landscapes Driven by Regulatory Regimes Infrastructure Maturity and Passenger Demand

Regional dynamics play a pivotal role in the deployment and evolution of in-flight Wi-Fi services, influenced by varying regulatory frameworks, infrastructure readiness, and passenger demographics. In the Americas, where aviation traffic is heavily concentrated across North and South America, airlines have embraced high-throughput satellite partnerships to meet passenger expectations for consistent connectivity on long-haul routes. Regulatory bodies have streamlined certification processes, fostering a collaborative environment that encourages innovation and rapid network expansions. Meanwhile, terrestrial network backhauls in major hubs have enabled lower-latency air-to-ground solutions in select corridors, supporting real-time operational applications.

Across Europe, the Middle East, and Africa, the landscape is characterized by a mosaic of regulatory jurisdictions and spectrum allocation policies. European carriers have advanced satellite-based in-flight entertainment and connectivity packages in partnership with multinational satellite operators, while carriers in the Middle East leverage state-of-the-art ground infrastructure to deliver hybrid connectivity models. In Africa, emerging markets present both challenges and opportunities: limited ground networks drive demand for satellite-exclusive offerings, but regulatory complexity can delay certification timelines for new platforms.

In the Asia-Pacific region, the rapid growth of domestic air travel has spurred investments in air-to-ground coverage, particularly in densely populated corridors. Simultaneously, large-scale LEO constellation deployments are catalyzing a shift toward satellite-first connectivity, with regional carriers piloting broadband services that target both passenger engagement and enhanced cockpit communications. Collectively, these three regions illustrate how local conditions-from regulatory agility to infrastructure maturity-shape the strategic priorities of airlines and service providers alike.

This comprehensive research report examines key regions that drive the evolution of the In-Flight Wi-Fi market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insight into Leading Market Participants Leveraging Technological Expertise and Strategic Alliances to Elevate In-Flight Connectivity Service Differentiation

Within the competitive arena of in-flight Wi-Fi, a handful of leading companies have emerged by leveraging distinct strengths in technology, partnerships, and service delivery. Equipment manufacturers specializing in high-frequency phased-array antennas have set the benchmark for throughput and reliability, while satellite operators have differentiated their value propositions through vast coverage footprints and managed service offerings. Connectivity aggregators and system integrators have staked their market positions on end-to-end managed solutions that bundle hardware, network operations centers, and passenger engagement platforms.

Strategic alliances have also played a critical role in shaping the vendor landscape. Joint ventures between satellite constellations and airline consortiums have unlocked preferential capacity arrangements, enabling tiered service levels and flexible bandwidth scaling. Similarly, collaborations between software developers and avionics manufacturers have produced integrated network management tools that streamline certification and reduce time-to-service. These partnerships underscore a growing emphasis on interoperability, data analytics, and user experience as key differentiators in a crowded market.

Meanwhile, a cadre of nimble disruptors has begun to challenge incumbents by offering modular connectivity suites that can be rapidly deployed across retrofit fleets. By exploiting emerging 5G platforms and leveraging cloud-native orchestration frameworks, these newcomers are demonstrating that lower total lifecycle costs and agile feature roadmaps can capture share even against entrenched legacy contracts. Ultimately, the interplay between established players and agile entrants will continue to drive innovation, pricing dynamics, and service quality improvements throughout the ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the In-Flight Wi-Fi market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Anuvu, Inc.

- Astronics Corporation

- Collins Aerospace

- Deutsche Telekom AG

- EchoStar Corporation

- Eutelsat Communications S.A.

- Global Eagle Entertainment, Inc.

- Gogo Inc.

- Honeywell International Inc.

- Inflight Media Digital Ltd.

- Inmarsat plc

- Intelsat S.A.

- Iridium Communications Inc.

- Kymeta Corporation

- L3Harris Technologies, Inc.

- OneWeb Ltd.

- Panasonic Avionics Corporation

- SES S.A.

- SITAONAIR

- SmartSky Networks, LLC

- Thales Group

- ThinKom Solutions, Inc.

- Viasat, Inc.

Strategic Imperatives for Industry Leaders to Accelerate Deployment Enhance Passenger Engagement and Secure Competitive Advantage in the In-Flight Wi-Fi Ecosystem

To capitalize on burgeoning opportunities within the in-flight Wi-Fi market, industry leaders must adopt a multi-faceted strategic approach. First, investing in modular, software-defined network architectures will enable rapid feature rollouts-such as augmented reality entertainment and enhanced crew communication tools-while minimizing hardware obsolescence risks. Equally important is the establishment of cross-industry consortiums to standardize interoperability protocols and collectively negotiate spectrum allocations, thereby reducing regulatory friction and accelerating global deployments.

Second, forging integrated partnerships between satellite network operators, antenna suppliers, and airline IT teams can streamline certification pathways and reduce time-to-market. Such collaborations should extend to co-developing data analytics platforms that synthesize passenger usage patterns, network performance metrics, and operational KPIs in real time, empowering airlines to optimize service tiers and ancillary revenue streams dynamically.

Third, adopting a hybrid pricing model that blends subscription fees with usage-based components will balance predictable revenue forecasting with the flexibility demanded by airlines and passengers alike. Finally, dedicating resources to cybersecurity and compliance-particularly for emerging threats targeting airborne networks-will be paramount in safeguarding passenger data and operational integrity. By executing on these actionable recommendations, industry leaders can secure sustainable competitive advantages and drive the next wave of in-flight connectivity innovation.

Detailed Overview of a Multi-Tiered Research Framework Combining Secondary Analysis Primary Interviews Surveys and Data Triangulation to Ensure Rigor

This market research report is underpinned by a rigorous multi-stage methodology that integrates both primary and secondary data sources. Initial secondary research included a comprehensive review of regulatory filings, technical white papers, industry trade publications, and public financial disclosures to establish a foundational understanding of market drivers and technological trajectories. Proprietary databases were queried to gather historical adoption trends, vendor profiles, and platform performance benchmarks.

Primary research efforts involved in-depth interviews with over 100 senior executives across airlines, satellite operators, equipment suppliers, and regulatory agencies. These conversations were designed to validate secondary insights, uncover emerging use cases, and gauge the strategic priorities of key stakeholders. Concurrently, a survey of end users-including corporate flight departments, commercial airline IT managers, and military communications officers-provided quantifiable perspectives on service quality, pricing model preferences, and feature demand.

Data triangulation techniques were applied to reconcile discrepancies between secondary reports and primary feedback, ensuring that final insights reflect both macro-level industry trends and ground-level operational realities. All quantitative and qualitative inputs underwent rigorous cross-validation, with iterative reviews conducted by an internal panel of subject matter experts. This comprehensive approach ensures that the findings and recommendations presented in this report are both empirically robust and pragmatically actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our In-Flight Wi-Fi market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- In-Flight Wi-Fi Market, by Component

- In-Flight Wi-Fi Market, by Platform

- In-Flight Wi-Fi Market, by Connectivity Technology

- In-Flight Wi-Fi Market, by Installation

- In-Flight Wi-Fi Market, by Pricing Model

- In-Flight Wi-Fi Market, by Application

- In-Flight Wi-Fi Market, by End User

- In-Flight Wi-Fi Market, by Region

- In-Flight Wi-Fi Market, by Group

- In-Flight Wi-Fi Market, by Country

- United States In-Flight Wi-Fi Market

- China In-Flight Wi-Fi Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Synthesis of Key Findings Highlighting Market Transformation Drivers Competitive Landscapes and Strategic Pathways for Future In-Flight Wi-Fi Success

In summary, the in-flight Wi-Fi market stands at a pivotal juncture defined by converging technological breakthroughs, shifting regulatory landscapes, and evolving passenger expectations. The maturation of high-throughput satellites, the expansion of air-to-ground networks, and the integration of 5G capabilities are collectively raising the bar for service performance and reliability. Concurrently, tariff-induced supply chain adjustments and regional regulatory variances underscore the importance of strategic agility and collaborative mitigation strategies.

Key segmentation insights reveal that nuanced adoption patterns-spanning hardware, services, software, platform types, and pricing models-will continue to shape competitive dynamics. Regional analyses further emphasize how local conditions in the Americas, EMEA, and Asia-Pacific drive differentiated market approaches. Leading companies that excel in technological integration, strategic alliances, and customer-centric service design are best positioned to capture growth opportunities, while emerging disruptors are setting the stage for further innovation.

Moving forward, industry stakeholders must adopt modular network architectures, hybrid pricing frameworks, and robust cybersecurity measures to maintain momentum and deliver on passenger expectations. With a clear understanding of the current landscape and strategic pathways illuminated, decision-makers are equipped to navigate complexity and secure meaningful value from their in-flight connectivity initiatives.

Unlock Exclusive In-Depth Market Intelligence on In-Flight Wi-Fi Innovations and Strategic Opportunities by Connecting Directly with Our Senior Sales Leader

If you are eager to gain a comprehensive understanding of the in-flight connectivity market and how recent industry developments can influence your strategic decisions, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) today to purchase the full market research report and secure the insights that will drive your next wave of innovation and competitive advantage

- How big is the In-Flight Wi-Fi Market?

- What is the In-Flight Wi-Fi Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?