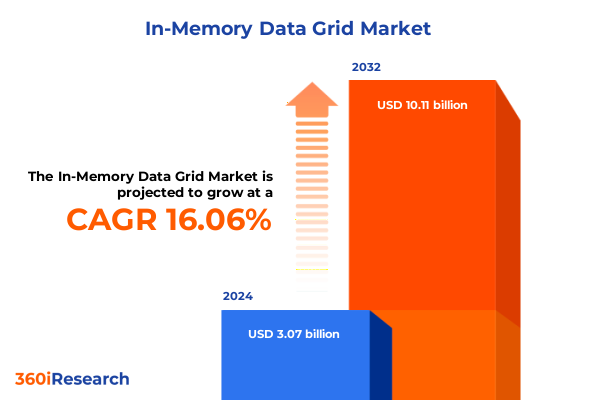

The In-Memory Data Grid Market size was estimated at USD 3.55 billion in 2025 and expected to reach USD 4.07 billion in 2026, at a CAGR of 16.10% to reach USD 10.11 billion by 2032.

Unlocking the Power of In-Memory Data Grids to Accelerate Real-Time Analytics and Revolutionize Data-Driven Decision Making in Modern Enterprises

In-memory data grids have emerged as a cornerstone for organizations seeking to process vast volumes of data with minimal latency. By storing data across distributed nodes in main memory rather than on traditional disks, these platforms enable sub-millisecond access speeds that drive real-time analytics and rapid transactional processing. As enterprises grapple with growing data velocity, complexity, and the demand for instantaneous insights, in-memory data grids deliver a high-throughput backbone for modern applications ranging from fraud detection to personalized digital experiences.

Moreover, the convergence of cloud computing, microservices architectures, and event-driven design patterns has elevated the importance of solutions that can elastically scale while maintaining consistent performance. In this environment, in-memory data grids function not only as high-speed caches but also as primary data stores, stream processing engines, and distributed compute fabrics. Consequently, leaders in banking, telecommunications, retail, and emerging industries are embarking on digital transformation initiatives underpinned by the agility, resilience, and simplified data handling capabilities that in-memory data grids provide.

Identifying the Strategic Shifts Driving In-Memory Data Grid Adoption from Traditional Architectures to Agile High-Performance Digital Ecosystems Across Industries

The in-memory data grid landscape has undergone transformative shifts as organizations pivot from monolithic legacy systems toward cloud-native, event-driven ecosystems. Adoption has accelerated particularly as businesses seek to decouple storage from compute and embrace distributed, horizontally scalable frameworks. Furthermore, the rise of containerization and orchestration platforms has fostered seamless integration of in-memory data grids within microservices-based applications, enabling developers to achieve consistency, availability, and fault tolerance without sacrificing agility.

In addition, artificial intelligence and machine learning workloads are increasingly harnessing in-memory architectures to train models and serve predictions at speed. This fusion has catalyzed a new paradigm in which data grids double as execution environments for in-situ analytics and real-time scoring. Consequently, enterprises are restructuring their data estates to co-locate streaming ingestion pipelines, feature stores, and in-memory compute layers, thereby reducing data movement and accelerating decision cycles. As a result, those who leverage these transformative shifts are positioned to lead in customer experience, operational efficiency, and new revenue generation.

Assessing the Compounded Effects of 2025 United States Tariff Policies on In-Memory Data Grid Supply Chains Pricing Dynamics and Global Competitive Positioning

In 2025, the United States implemented revised tariff schedules that have reverberated through global hardware supply chains, directly impacting the cost foundations of in-memory data grid deployments. Higher levies on memory modules, multicore processor boards, and server chassis have translated into increased capital expenditure requirements for on-premise infrastructures. Furthermore, extended customs clearances and compliance checks have introduced delivery delays, prompting vendors and end users to reevaluate inventory buffers and sourcing strategies.

Amid these pressures, leading providers have adapted by expanding local production partnerships, qualifying alternative component suppliers in tariff-exempt regions, and offering tiered licensing models that shift more compute workloads into cloud services. Such measures mitigate upfront hardware cost spikes and preserve budget predictability, yet they also underscore the growing appeal of hybrid and cloud-only deployment modes. As enterprises navigate this evolving tariff environment, those that strategically diversify procurement channels and embrace flexible consumption options will minimize operational disruption and maintain competitive total cost of ownership.

Uncovering the Multifaceted Segmentation of In-Memory Data Grids Across Data Types Components Organization Sizes Deployment Modes and Diverse Industry Applications

The in-memory data grid market can be explored through multiple dimensions, each revealing distinct value drivers and adoption patterns. Based on data type, applications demanding rapid processing of structured records enjoy consistent performance gains, while unstructured data scenarios leverage grid caching to accelerate search and indexing. Turning to components, enterprises balancing development agility and operational complexity gravitate toward managed services for turnkey integration and support, whereas professional services engagements are leveraged to tailor configurations. Software offerings diverge between commercial distributions that provide enterprise-grade SLAs and open source variants embraced by organizations prioritizing extensibility and community innovation.

Organization size further influences deployment strategies, with large enterprises typically negotiating custom licensing and hybrid architectures that bridge private clouds and on-premise data centers. In contrast, small and medium entities often adopt public cloud–based grids to reduce resource overhead and speed time to insight. Deployment modes span cloud and on-premise use cases, with hybrid cloud gaining traction as it harmonizes elasticity, security, and regulatory compliance. Within a public cloud context, enterprises choose between shared multitenant services for cost efficiency and dedicated private cloud instances for performance isolation. Lastly, application-specific segmentation highlights vertical distinctions: financial institutions rely on in-memory platforms for risk modeling, energy and utilities providers optimize grid operations, government and defense agencies implement federal, state, and local initiatives for secure data sharing, healthcare firms manage patient data streams, retail organizations enhance e-commerce and in-store personalization, and telecom and IT companies deliver mission-critical services through IT services firms and telecom service providers.

This comprehensive research report categorizes the In-Memory Data Grid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Data Type

- Component

- Organization Size

- Deployment Mode

- Application

Analyzing Distinct Regional Adoption Patterns of In-Memory Data Grids Across the Americas Europe Middle East & Africa and Asia-Pacific Markets

Regional dynamics reveal differentiated adoption curves for in-memory data grid technologies across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, early innovation hubs have witnessed rapid uptake, complemented by mature cloud infrastructures and strong venture capital support. North American financial services and technology enterprises lead the charge, advancing real-time use cases such as algorithmic trading and dynamic pricing.

Meanwhile, the Europe Middle East & Africa region balances robust regulatory mandates on data privacy with growing digital transformation initiatives. Financial centers in Western Europe prioritize secure in-memory solutions for compliance-driven analytics, while governments across the Middle East invest in smart city and defense programs that rely on deterministic performance. In Africa, telecommunications providers explore caching strategies to bridge connectivity gaps.

Shifting to Asia-Pacific, nations such as Singapore, Australia, China, and India are driving expansive rollouts of intelligent infrastructure. Government-sponsored digital economy policies and 5G network expansions are accelerating demand for low-latency data processing. Additionally, local partnerships and open source communities are playing a pivotal role in establishing in-memory data grids as foundational components of next-generation applications across banking, manufacturing, and retail landscapes.

This comprehensive research report examines key regions that drive the evolution of the In-Memory Data Grid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading In-Memory Data Grid Providers and Their Strategic Differentiators Shaping Performance Support and Ecosystem Integration Strategies

Key players in the in-memory data grid ecosystem differentiate themselves through technology maturity, support services, and ecosystem integrations. One provider leads with a unified platform combining grid caching, stream processing, and distributed computing, enabling complex transactions and analytics on a single node fabric. Another vendor focuses on fully managed cloud offerings, alleviating operational overhead and providing seamless scaling for enterprises migrating workloads off-premise.

Open source community projects continue to underpin the technology stack, with contributors driving feature enhancements in distributed consistency, memory management, and container orchestration. Commercial distributions build upon these foundations by integrating enterprise-grade security, comprehensive monitoring, and premium support. Notably, strategic alliances with hyperscalers and systems integrators amplify go-to-market reach, while certifications for key cloud marketplaces ensure frictionless deployment. As interoperability between grid engines and complementary data fabrics becomes paramount, vendors investing in open standards and API compatibility are securing a leadership edge.

This comprehensive research report delivers an in-depth overview of the principal market players in the In-Memory Data Grid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alachisoft

- Amazon Web Services, Inc.

- GigaSpaces Technologies Inc.

- Google LLC

- GridGain Systems

- Hazelcast, Inc.

- Infinispan

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Oracle Corporation

- Pivotal Software, Inc.

- Red Hat, Inc.

- SAP SE

- ScaleOut Software, Inc.

- Software AG

- Starburst Data, Inc.

- Terracotta, Inc.

- TIBCO Software Inc.

- VMware, Inc.

Delivering Targeted Strategic Recommendations to Guide Industry Leaders in Maximizing In-Memory Data Grid Value Through Innovation Collaboration and Best Practices

Industry leaders seeking to harness the full potential of in-memory data grids should adopt a series of strategic measures. First, evaluating infrastructure architecture through proof-of-concept pilots helps validate key workload characteristics under real-world conditions. In tandem, establishing partnerships with both cloud providers and hardware vendors ensures diversified procurement options and cost resilience. This multifaceted approach not only mitigates tariff-driven price volatility but also unlocks rapid elasticity when demand spikes.

Moreover, fostering cross-functional collaboration between data engineering, DevOps, and business stakeholders accelerates adoption curves and aligns performance objectives with strategic goals. Organizations should consider contributing to open source communities to influence roadmaps and gain early access to innovations. Finally, implementing robust governance frameworks around data placement, access controls, and compliance policies will safeguard sensitive information while maintaining the speed benefits of in-memory architectures. By executing on these recommendations, enterprises can drive sustainable performance enhancements and cultivate a culture of continuous data-driven innovation.

Detailing the Comprehensive Primary and Secondary Research Methodology Data Collection Techniques and Analytical Framework Underpinning This In-Memory Data Grid Study

This study integrates both primary and secondary research methodologies to ensure a rigorous and balanced analysis. Primary research involved in-depth interviews with senior architects, IT directors, and solution engineers across key industries, complemented by detailed vendor briefings that illuminated product roadmaps and go-to-market strategies. Secondary research encompassed a comprehensive review of published white papers, technical benchmarks, regulatory filings, and thought leadership articles.

Data triangulation was employed to reconcile divergent perspectives, cross-validating insights against real-world case studies and implementation success stories. Analytical frameworks utilized include technology adoption lifecycles, total cost of ownership assessments, and qualitative risk matrices focused on performance, security, and compliance. Geographical trial deployments and controlled performance tests provided empirical benchmarks, while thematic analysis of interview transcripts unearthed prevailing adoption drivers, challenges, and emerging use cases. This methodological rigor underpins the reliability and depth of the findings presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our In-Memory Data Grid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- In-Memory Data Grid Market, by Data Type

- In-Memory Data Grid Market, by Component

- In-Memory Data Grid Market, by Organization Size

- In-Memory Data Grid Market, by Deployment Mode

- In-Memory Data Grid Market, by Application

- In-Memory Data Grid Market, by Region

- In-Memory Data Grid Market, by Group

- In-Memory Data Grid Market, by Country

- United States In-Memory Data Grid Market

- China In-Memory Data Grid Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Drawing Conclusive Insights on How In-Memory Data Grids Will Continue to Redefine Data Processing Operational Agility and Digital Transformation Outcomes

In conclusion, in-memory data grids have transitioned from niche acceleration caches to mission-critical platforms shaping modern IT architectures. Their capacity for rapid data access, distributed compute, and real-time processing positions organizations to innovate at warp speed. As technological and geopolitical factors evolve-from cloud proliferation and AI-driven demands to tariff regimes and regulatory landscapes-the strategic value of these grids only intensifies.

Moving forward, enterprises that proactively integrate in-memory data grids into both edge and core environments will unlock new efficiencies, revenue streams, and customer experiences. Forward-looking leaders will continue to invest in hybrid and cloud-native deployments, cultivate open source collaboration, and refine governance practices to balance performance imperatives with security and compliance obligations. Ultimately, those who master in-memory data grid capabilities will redefine industry benchmarks and secure a decisive competitive advantage in the digital age.

Connect with Ketan Rohom to Secure Exclusive Access to the In-Memory Data Grid Market Study and Empower Your Enterprise with Actionable Intelligence

To explore tailored insights and gain a competitive edge through our comprehensive In-Memory Data Grid market research, connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings extensive experience guiding global enterprises to make data-driven decisions leveraging high-performance data grids. Engaging with Ketan will enable you to access executive summaries, deep-dive analyses, and bespoke advisory support crafted to align with your strategic objectives. Reach out today to secure your organization’s copy of the full report, tap into actionable intelligence, and accelerate your journey toward real-time data mastery.

- How big is the In-Memory Data Grid Market?

- What is the In-Memory Data Grid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?